Global Gear Hobbing Machine Market Size, Share, Growth Analysis Report - Forecast 2034

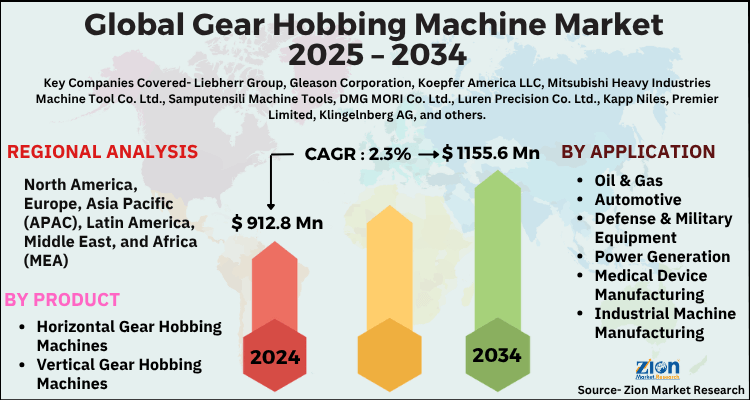

Gear Hobbing Machine Market By Product (Horizontal Gear Hobbing Machines, Vertical Gear Hobbing Machines), By Application (Oil & Gas, Automotive, Defense & Military Equipment, Power Generation, Medical Device Manufacturing, Industrial Machine Manufacturing, Consumer Electronics & Appliances, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 912.8 Million | USD 1155.6 Million | 2.3% | 2024 |

Global Gear Hobbing Machine Market: Industry Perspective

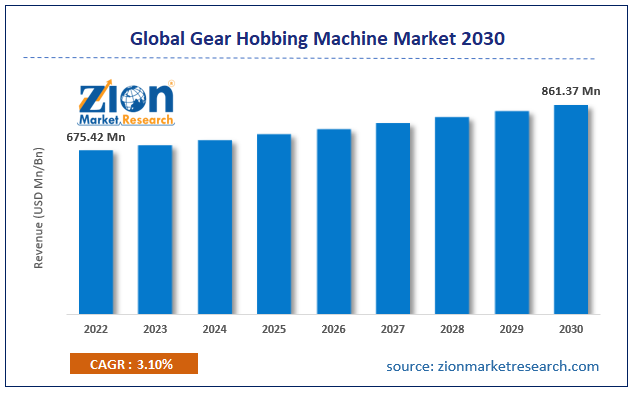

The global gear hobbing machine market size was worth around USD 912.8 Million in 2024 and is predicted to grow to around USD 1155.6 Million by 2034 with a compound annual growth rate (CAGR) of roughly 2.3% between 2025 and 2034. The report analyzes the global gear hobbing machine market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the gear hobbing machine industry.

Global Gear Hobbing Machine Market: Overview

A gear hobbing machine is used during gear manufacturing. These machines use a multi-tooth, rotating cutting tool which is also known as a hob to generate teeth on different types of gears including helical gears, spur gears, sprockets, and splines. As compared to any other method of cutting gears, the use of a hobbing machine is the most preferred due to the high rate of accuracy obtained using the tool. The process including the use of these machines includes setting up the gear in its blank format. It is done by placing it on the spindle of the machine.

Once the machine starts functioning, the hob comes in contact with the gear cutting it as it proceeds further. There are types of movement involved during the process called indexing and feeding. The axial movement of the hob along the line of the gear and the hob is known as indexing while moving the object toward the hob is called feeding. It is important to keep applying a lubricant or a coolant to the machine to ensure the machine does not overheat. The demand for gear hobbing machines will register considerable growth during the forecast period.

Global Gear Hobbing Machine Market: Growth Drivers

Growing demand for petroleum products to drive market growth

The global gear hobbing machine market is expected to be driven by the rising demand for petroleum products worldwide. Some of the most used products include everyday necessities such as kerosene, diesel, fuel oil, aviation turbine fuel, petrol, paraffin, and many more. As the global population continues to rise, the demand for petroleum products will continue to soar until the foreseeable future. This is because most of the modern tools run on petroleum-based fuel and although there is an increased rate of innovation to develop alternatives, petroleum cannot be easily replaced. Such trends are likely to push petroleum producers to seek new reservoirs and undertake extensive exploration activities, especially in deep waters causing the need to develop complex drilling systems and other accessories. In January 2023, the Indian government was reported to receive an investment of USD 58 billion in the same year that will be used for oil exploration projects. In July 2024, leading reports indicated that oil & gas corporations were reinvesting their profits earned from surging prices of fossil fuel toward exploring new deposits. The International Energy Agency has forecasted that global investments will reach a total of USD 528 billion in 2024.

Rise in power generation infrastructure to push the market revenue further

With the surge in demand for power supply across industrial, commercial, and residential units, governments and private companies have amped up their efforts to build a power generation infrastructure that can meet the growing demand from consumers. For instance, in August 2023, the Madhya Pradesh government of India and Coal India announced a partnership to install two thermal plants in the state at a cost of INR 5600 crore. In the same month, Germany announced its plans to provide hydrogen plants worth 8.8 gigawatts of power with an added supply of 15 GW, initially fueled by natural gas, and in 2035 it will switch to a hydrogen grid.

Restraints:

Limited application of the machine to restrict market growth

Gear hobbing machines, while considered ideal for generating teeth on gears, have limited application. It can be used to produce splines, grooves, and serrations. For instance, splines are teeth present on a drive shaft which ultimately matches with a mating unit. However, gear hobbing machines cannot be used to create these structures, and similar restrictions are observed in other gear forms. This could lead to consumers preferring alternate methods that may prove to have higher cost efficiency. For instance, laser cutting, a no-contact procedure is not only safer to use but also provides precise results even when dealing with complex designs. These factors are likely to prevent the gear hobbing machine industry size from reaching its true potential.

Opportunities:

Growing vehicle production worldwide to create growth possibilities

The global gear hobbing machine market may gain from the high growth rate observed in the automotive sector driven by the rise in vehicle production. Auto production trends are known to directly impact the demand for gear which subsequently affects the use of hobbing machines. The rise in world population, changing consumer buying patterns, growing middle-income groups, and the availability of vehicles across price ranges have helped the growth in commercial and passenger vehicles. Additionally, with the introduction of electric and hybrid vehicles is a major cause of the recent addition of new-age customers willing to spend more on environment-friendly amenities.

The Russia-Ukraine war has disrupted the supply and price of fuel leading to several countries witnessing a steep rise in fuel prices in 2022 and 2023 causing more people to incline toward electric substitutes. In 2022, more than 10 million electric cars were sold as per a new report by the International Energy Agency (IEA).

Challenges:

High initial investment likely to discourage new entrants

Gear hobbing machines are expensive and require a high initial investment. Moreover, operating such a piece of machinery demands skilled professionals and a complementing infrastructure further adding to the total associated expense. This can discourage smaller players and new entrants from investing resources as they may find other alternatives more viable in terms of cost and performance.

Global Gear Hobbing Machine Market: Segmentation

The global gear hobbing machine market is segmented based on product, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on product, the global market segments are horizontal gear hobbing machines and vertical gear hobbing machines. During 2022, the highest growth was observed in the horizontal hobbing machines segment since this variant has been used traditionally. They also offer excellent performance output while being highly versatile adding to the popularity of the machines. The productivity rate is directly related to reduced downtime and expansive application since they can be used on all types of gears thus justifying the associated cost. A gear hobbing machine may typically cost between INR 50000 to INR 500000.

Based on application, the gear hobbing machine industry is divided into oil & gas, automotive, defense & military equipment, power generation, medical device manufacturing, industrial machine manufacturing, consumer electronics & appliances, and others. The automotive industry led with the highest CAGR in 2024 due to the extensive use of machines in providing teeth structures to gears used in automotive vehicles. The rising sales in the electric vehicles industry which is currently over USD 390 billion will help the segmental expansion in the coming years.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Key Insights

- As per the analysis shared by our research analyst, the global gear hobbing machine market is estimated to grow annually at a CAGR of around 2.3% over the forecast period (2025-2034).

- Regarding revenue, the global gear hobbing machine market size was valued at around USD 912.8 Million in 2024 and is projected to reach USD 1155.6 Million by 2034.

- The gear hobbing machine market is projected to grow at a significant rate due to increasing demand for precision gears in the automotive and aerospace industries, rising adoption of automation and Industry 4.0 technologies, and growing technological advancements in gear manufacturing processes.

- Based on Product, the Horizontal Gear Hobbing Machines segment is expected to lead the global market.

- On the basis of Application, the Oil & Gas segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Global Gear Hobbing Machine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gear Hobbing Machine Market |

| Market Size in 2024 | USD 912.8 Million |

| Market Forecast in 2034 | USD 1155.6 Million |

| Growth Rate | CAGR of 2.3% |

| Number of Pages | 206 |

| Key Companies Covered | Liebherr Group, Gleason Corporation, Koepfer America LLC, Mitsubishi Heavy Industries Machine Tool Co. Ltd., Samputensili Machine Tools, DMG MORI Co. Ltd., Luren Precision Co. Ltd., Kapp Niles, Premier Limited, Klingelnberg AG, and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Gear Hobbing Machine Market: Regional Analysis

The gear hobbing machine market shows strong regional diversity, with Asia-Pacific leading due to the presence of major manufacturing hubs in countries like China, Japan, and India, where increasing industrialization and automotive production are key growth drivers. North America follows closely, driven by advanced technological adoption, strong demand in aerospace and defense sectors, and investments in precision engineering. Europe remains a mature market with consistent demand from automotive and heavy machinery industries, particularly in Germany and Italy. Meanwhile, regions such as Latin America and the Middle East & Africa are witnessing gradual growth, fueled by expanding industrial infrastructure, rising investments in machinery modernization, and the growing presence of manufacturing operations.

Global Gear Hobbing Machine Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the gear hobbing machine market on a global and regional basis.

The global gear hobbing machine market is dominated by players like:

- Liebherr Group

- Gleason Corporation

- Koepfer America LLC

- Mitsubishi Heavy Industries Machine Tool Co. Ltd.

- Samputensili Machine Tools

- DMG MORI Co. Ltd.

- Luren Precision Co. Ltd.

- Kapp Niles

- Premier Limited

- Klingelnberg AG

Global Gear Hobbing Machine Market: Segmentation Analysis

The global gear hobbing machine market is segmented as follows;

By Product

- Horizontal Gear Hobbing Machines

- Vertical Gear Hobbing Machines

By Application

- Oil & Gas

- Automotive

- Defense & Military Equipment

- Power Generation

- Medical Device Manufacturing

- Industrial Machine Manufacturing

- Consumer Electronics & Appliances

- Others

Global Gear Hobbing Machine Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

A gear hobbing machine is used during gear manufacturing. These machines use a multi-tooth, rotating cutting tool which is also known as a hob to generate teeth on different types of gears including helical gears, spur gears, sprockets, and splines. As compared to any other method of cutting gears, the use of a hobbing machine is the most preferred due to the high rate of accuracy obtained using the tool. The process including the use of these machines includes setting up the gear in its blank format. It is done by placing it on the spindle of the machine.

The global gear hobbing machine market is expected to grow due to rising demand in automotive and aerospace industries, increasing automation in manufacturing, growing need for high-precision gear production, and expanding investments in industrial machinery modernization.

According to a study, the global gear hobbing machine market size was worth around USD 912.8 Million in 2024 and is expected to reach USD 1155.6 Million by 2034.

The global gear hobbing machine market is expected to grow at a CAGR of 2.3% during the forecast period.

Asia-Pacific is expected to dominate the gear hobbing machine market over the forecast period.

Leading players in the global gear hobbing machine market include Liebherr Group, Gleason Corporation, Koepfer America LLC, Mitsubishi Heavy Industries Machine Tool Co. Ltd., Samputensili Machine Tools, DMG MORI Co. Ltd., Luren Precision Co. Ltd., Kapp Niles, Premier Limited, Klingelnberg AG, among others.

The report explores crucial aspects of the gear hobbing machine market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed