Fortified Cereals Market Size, Growth, Global Trends, Forecast 2034

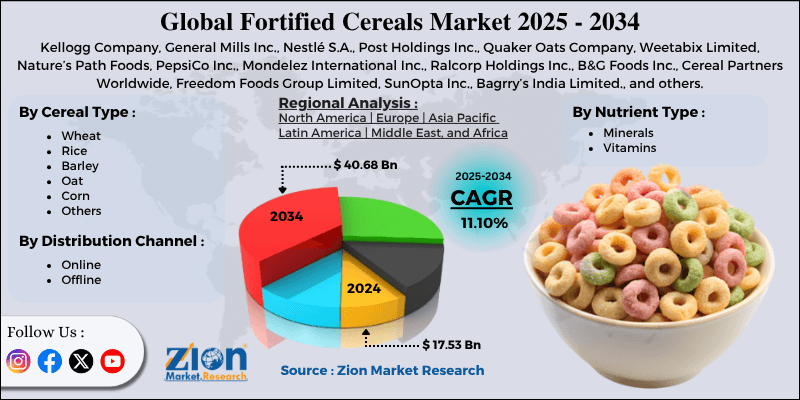

Fortified Cereals Market By Cereal Type (Wheat, Rice, Barley, Oat, Corn, and Others), By Nutrient Type (Minerals, Vitamins), By Distribution Channel (Online, Offline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

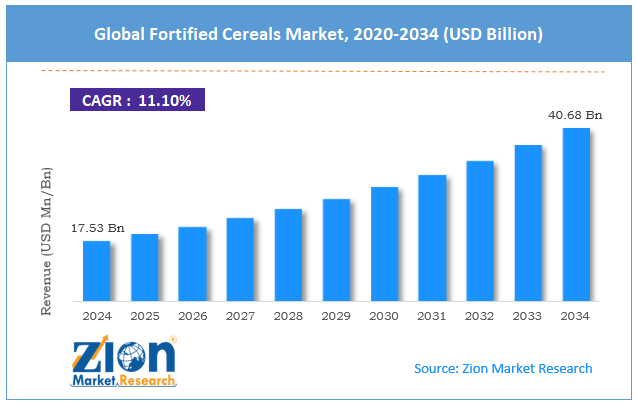

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.53 Billion | USD 40.68 Billion | 11.10% | 2024 |

Fortified Cereals Industry Perspective:

The global fortified cereals market size was approximately USD 17.53 billion in 2024 and is projected to reach around USD 40.68 billion by 2034, with a compound annual growth rate (CAGR) of roughly 11.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fortified cereals market is estimated to grow annually at a CAGR of around 11.10% over the forecast period (2025-2034)

- In terms of revenue, the global fortified cereals market size was valued at around USD 17.53 billion in 2024 and is projected to reach USD 40.68 billion by 2034.

- The fortified cereals market is projected to grow significantly due to the rising cases of micronutrient deficiencies, the growth of the breakfast cereals market, and the increasing disposable income in emerging economies.

- Based on cereal type, the wheat segment is expected to lead the market, while the corn segment is anticipated to experience significant growth.

- Based on nutrient type, the vitamins segment is the dominant segment, while the minerals segment is projected to witness sizable revenue growth over the forecast period.

- Based on the distribution channel, the offline segment is expected to lead the market compared to the online segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Fortified Cereals Market: Overview

Fortified cereals are snack or breakfast cereals enriched with essential minerals and vitamins to address dietary deficiencies and enhance overall nutrition. They are broadly consumed for their health benefits, long shelf life, and convenience, especially among adults with busy lifestyles, children, and populations at higher risk of nutrient deficiencies. The global fortified cereals market is projected to experience substantial growth, driven by increasing health awareness, rising cases of lifestyle diseases, and the growing popularity of ready-to-eat and convenience food options. Consumers are becoming more conscious of the role of nutrition in maintaining overall health. Fortified cereals, deepened with minerals and vitamins, are preferred to avoid deficiencies. This growing awareness is driving global demand.

Moreover, lifestyle-related conditions like obesity, diabetes, and cardiovascular diseases are mounting. Fortified cereals offer vital nutrients that help manage and prevent these diseases. This trend motivates consumers to adopt healthier breakfast options. Furthermore, modern lifestyles demand easy and quick meal solutions. Fortified cereals offer ready-to-eat convenience without compromising nutrition. This convenience factor majorly drives their prominence among the urban population.

Although drivers exist, the global market is challenged by factors such as the preference for traditional diets and health concerns related to added sugar. Several consumers in emerging nations prefer home-cooked and homemade meals. This cultural preference decreases dependency on processed fortified foods. Industry penetration stays restricted in these regions. Likewise, some fortified cereals contain added sugar to improve taste. Health-conscious consumers are concerned about diabetes, obesity, and other sugar-related issues. These concerns may restrict the industry's growth.

Even so, the global fortified cereals industry is well-positioned due to product diversification, the development of e-commerce, and a focus on nutrition for older adults and children. There is a growing demand for high-fiber, gluten-free, and low-sugar cereals. Manufacturers can innovate to meet the changing dietary preferences. Diversification raises consumer appeal and industry share. Digital platforms also streamline access to fortified cereals in regions. Online promotions and subscription models motivate repeat purchases. This channel backs higher sales volume and direct consumer engagement. Additionally, targeted products for seniors and children address specific nutritional needs. Growth-focused cereals and immune-boosting cereals for older people are gaining prominence. Age-focused offerings fuel differentiated industry demand.

Fortified Cereals Market Dynamics

Growth Drivers

How is the growing demand for ready-to-eat and convenient foods boosting the fortified cereals market?

A fast-paced lifestyle and urbanization have increased the demand for ready-to-eat and convenience breakfast solutions, which favor fortified cereals. A 2025 Euromonitor report stated that the ready-to-eat cereal sector grew by 6.5% in volume across Europe and North America combined.

Busy working professionals and school-going kids are the major consumer segments. This key factor drives demand, ultimately influencing the growth of the fortified cereals market. Companies like General Mills and Kellogg's are expanding their fortified cereal ranges, which require minimal preparation while delivering essential nutrients. The convenience factor, combined with health benefits, makes fortified cereals a key choice for the modern population.

Innovation in product formulation and fortification fuels the market growth

Advancements in product development and fortification are improving the appeal of fortified cereals. Companies are now integrating probiotics, omega-3 fatty acids, and plant-based options alongside conventional minerals and vitamins. For example, in 2024, Kellogg's introduced a new line of fortified cereals in Europe that contain whole grains, added micronutrients, and plant proteins, targeting digestive health.

Moreover, innovations in microencapsulation technology help preserve the stability of nutrients during storage and processing. Continuous advancement is essential for differentiating products in a highly competitive market and attracting a larger clientele among health-conscious buyers.

Restraints

How is the fortified cereals market adversely impacted by the competition from natural and organic alternatives?

The growth of organic and natural foods presents a significant challenge for fortified cereals. Consumers are increasingly preferring whole foods, homemade breakfast options, and fresh fruits, as they are perceived as more natural sources of minerals and vitamins. According to a 2024 report by Euromonitor, global organic cereal sales increased by 8%, surpassing the growth of fortified cereals in major regions.

Recent news highlights companies like General Mills and Nestlé diversifying their product ranges to include organic cereals, meeting this demand. This move towards natural alternatives restricts the industry share of fortified cereals among Gen Z and millennial consumers.

Opportunities

How does the development of functional and specialty cereals create promising avenues for the growth of the fortified cereals industry?

Advancements in functional ingredients, such as plant-based proteins, omega-3 fatty acids, fiber, and probiotics, create a lucrative opportunity in the fortified cereals industry. According to reports, the functional cereal segment is expected to grow at a CAGR of 8.3% worldwide by 2030. Recent news reports indicate that Kellogg's has introduced a protein- and fiber-fortified cereal line in Europe, targeting immune and digestive health. This differentiation enables companies to cater to niche consumer preferences, foster brand loyalty, and justify premium pricing. Functional cereals offer a strategic benefit in a competitive market.

Challenges

The risk of nutrient degradation during storage limits the market growth

Nutrient stability remains a significant challenge for fortified cereals. Vitamins such as A, C, and folic acid may degrade during storage, which can decrease product efficacy. The Journal of Food Science and Technology (2023) reports that some fortified cereals lost up to 15% of their vitamin content over 6 months. Manufacturers are actively investing in advanced packaging solutions; however, these solutions increase production costs. Nutrient degradation may erode consumer trust and negatively impact brand perception, particularly for premium fortified products.

Fortified Cereals Market: Segmentation

The global fortified cereals market is segmented based on cereal type, nutrient type, distribution channel, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on cereal type, the global fortified cereals industry is divided into wheat, rice, barley, oat, corn, and others. The wheat segment holds a leading share of the market since it is the most widely consumed cereal. It forms the base for numerous snack and breakfast products. Its versatility enables easy fortification with iron, vitamins, and minerals, improving its nutritional value. Fortified wheat-based cereals are a popular choice among adults and children seeking balanced diets. Strong consumer familiarity and developed supply chains make wheat the leading industry category.

Based on nutrient type, the global fortified cereals market is segmented into minerals and vitamins. The vitamins segment holds a dominant share of the market, as it is commonly added as nutrients in fortified cereals, comprising vitamin A, D, E, and B-complex. They play a key role in growth, immunity, and overall health, making cereals a highly preferred source. Manufacturers emphasize the fortification of vitamins to resolve common deficiencies in adults and children. High consumer awareness of vitamins' benefits fuels the segmental dominance worldwide.

Based on the distribution channel, the global market is segmented into online and offline. The offline segment holds leadership. The segment comprises convenience stores, hypermarkets, grocery shops, and supermarkets. Consumers prefer to physically inspect products, check labels, and compare rates before making a purchase. Well-developed retail networks and broader availability make offline the leading channel worldwide. Robust brand presence and in-store promotions also strengthen offline sales.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Fortified Cereals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fortified Cereals Market |

| Market Size in 2024 | USD 17.53 Billion |

| Market Forecast in 2034 | USD 40.68 Billion |

| Growth Rate | CAGR of 11.10% |

| Number of Pages | 215 |

| Key Companies Covered | Kellogg Company, General Mills Inc., Nestlé S.A., Post Holdings Inc., Quaker Oats Company, Weetabix Limited, Nature’s Path Foods, PepsiCo Inc., Mondelez International Inc., Ralcorp Holdings Inc., B&G Foods Inc., Cereal Partners Worldwide, Freedom Foods Group Limited, SunOpta Inc., Bagrry’s India Limited., and others. |

| Segments Covered | By Cereal Type, By Nutrient Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fortified Cereals Market: Regional Analysis

What factors will help North America experience significant growth in the fortified cereals market over the forecast period?

North America is likely to maintain its leadership in the fortified cereals market due to high health awareness and nutritional knowledge, a well-established breakfast cereal culture, and the presence of major global brands. Consumers in the region are highly aware of the importance of a balanced diet and proper nutrient intake. Fortified cereals are extensively recognized as a source of crucial minerals and vitamins.

According to surveys, more than 70% of U.S. adults actively prefer to consider the nutrient content when buying breakfast cereals. Breakfast cereals are staples in North American households, with high daily consumption among adults and children. This strong cultural preference for cereals facilitates acceptance of diverse fortified varieties. The United States cereal industry is estimated to be worth over USD 11 billion, with fortified cereals accounting for a leading market share, according to Statista.

Furthermore, North America is home to leading fortified cereal manufacturers, including General Mills, Post Holdings, and Kellogg’s. These companies continually advance with mineral- and vitamin-enriched products, thanks to their strong promotional strategies and brand recognition, which fuel broader adoption in the region.

Europe continues to hold the second-highest share in the fortified cereals industry, owing to strong health and nutrition awareness, high penetration of packaged and processed foods, and the presence of leading regional and global players. European consumers are highly aware of the importance of dietary health, with a focus on preventing chronic diseases and addressing nutritional deficiencies. Fortified cereals are believed to meet daily dietary needs. According to surveys, more than 65% of European users prefer cereals based on their nutrient content when choosing breakfast cereals.

Moreover, Europe holds a sophisticated processed food market, and cereals are a staple portion of daily consumption. Fortified cereals benefit from brand familiarity and developed consumption habits. According to Euromonitor, fortified cereals account for approximately 40% of the overall breakfast cereal market in major European nations, such as Germany and the UK.

Additionally, companies such as Weetabix, Kellogg's, and Nestlé have a strong presence in the region. These manufacturers continuously introduce mineral- and vitamin-enriched variants modified to local tastes. Their strong R&D and marketing activities help fuel product adoption and consumer trust.

Fortified Cereals Market: Competitive Analysis

The leading players in the global fortified cereals market are:

- Kellogg Company

- General Mills Inc.

- Nestlé S.A.

- Post Holdings Inc.

- Quaker Oats Company

- Weetabix Limited

- Nature’s Path Foods

- PepsiCo Inc.

- Mondelez International Inc.

- Ralcorp Holdings Inc.

- B&G Foods Inc.

- Cereal Partners Worldwide

- Freedom Foods Group Limited

- SunOpta Inc.

- Bagrry’s India Limited.

Fortified Cereals Market: Key Market Trends

Increased focus on high-protein and functional cereals:

Fortified cereals are now enriched with additional functional ingredients like probiotics, fiber, plant-based proteins, and antioxidants. These products target specific health benefits, including muscle building, overall well-being, and immune support. Functional cereals are appealing to both fitness-conscious consumers and adults.

Age-specific and personalized fortified cereals:

Manufacturers are developing cereals tailored to different age categories and dietary needs, such as growth-focused cereals for children and immune-boosting cereals for adults. Personalization helps to address nutritional gaps in the target population. This approach reinforces market differentiation and customer loyalty.

The global fortified cereals market is segmented as follows:

By Cereal Type

- Wheat

- Rice

- Barley

- Oat

- Corn

- Others

By Nutrient Type

- Minerals

- Vitamins

By Distribution Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fortified cereals are snack or breakfast cereals enriched with essential minerals and vitamins to address dietary deficiencies and enhance overall nutrition. They are broadly consumed for their health benefits, long shelf life, and convenience, especially among adults with busy lifestyles, children, and populations at higher risk of nutrient deficiencies.

The global fortified cereals market is projected to grow due to rising health consciousness among consumers, increasing urbanization and busy lifestyles, as well as innovations in fortified cereal products.

According to study, the global fortified cereals market size was worth around USD 17.53 billion in 2024 and is predicted to grow to around USD 40.68 billion by 2034.

The CAGR value of the fortified cereals market is expected to be approximately 11.10% from 2025 to 2034.

Macroeconomic factors, such as inflation, rising disposable incomes, and urbanization, will drive demand for nutrient-rich and convenient fortified cereals, while also influencing affordability and pricing.

North America is expected to lead the global fortified cereals market during the forecast period.

The United States is a significant contributor to the global fortified cereals market, owing to its established industry presence and high consumption levels.

The key players profiled in the global fortified cereals market include Kellogg Company, General Mills, Inc., Nestlé S.A., Post Holdings, Inc., Quaker Oats Company, Weetabix Limited, Nature’s Path Foods, PepsiCo, Inc., Mondelez International, Inc., Ralcorp Holdings, Inc., B&G Foods, Inc., Cereal Partners Worldwide, Freedom Foods Group Limited, SunOpta Inc., and Bagrry’s India Limited.

Stakeholders should focus on health-focused formulations, product innovation, expanding distribution channels, and digital marketing to stay competitive in the fortified cereals market.

The report examines key aspects of the fortified cereals market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed