Food Grade Calcium Chloride Market Size, Share, Trends, Growth & Forecast 2034

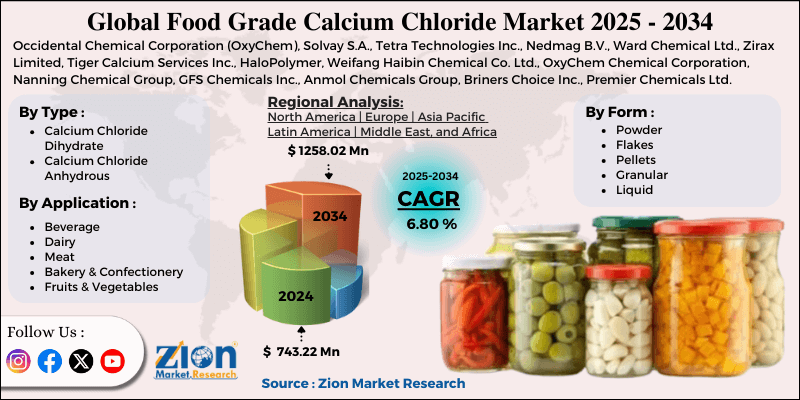

Food Grade Calcium Chloride Market By Type (Calcium Chloride Dihydrate, Calcium Chloride Anhydrous), By Form (Powder, Flakes, Pellets, Granular, Liquid), By Application (Beverage [Alcoholic, Non-alcoholic], Dairy, Meat, Bakery & Confectionery, Fruits & Vegetables, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

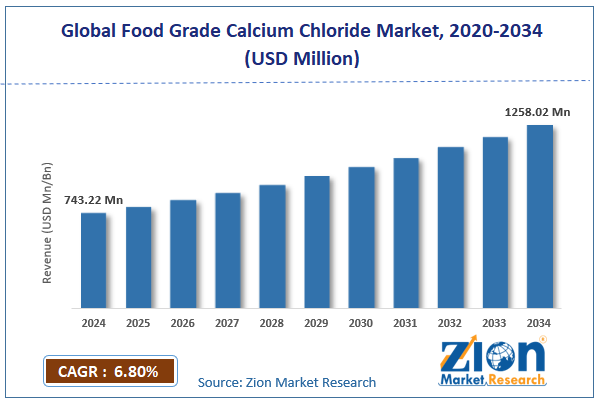

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 743.22 Million | USD 1258.02 Million | 6.80% | 2024 |

Food Grade Calcium Chloride Industry Perspective:

The global food grade calcium chloride market size was worth around USD 743.22 million in 2024 and is predicted to grow to around USD 1258.02 million by 2034, with a compound annual growth rate (CAGR) of roughly 6.80% between 2025 and 2034.

Food Grade Calcium Chloride Market: Overview

Food-grade calcium chloride is an inorganic, high-purity salt used mainly in the food industry as a preservative, firming agent, and stabilizer. It is commonly added to canned foods, cheese, and tofu to enhance shelf life and texture. It also holds applications in pickling, brewing, and as an electrolyte in sports beverages. The global food grade calcium chloride market is poised for notable growth owing to the flourishing processed food industry, rising demand in dairy applications, and the expansion of the beverage sector. The worldwide increase in demand for processed and packaged foods, which need additives for texture and preservation, is majorly driving the use of calcium chloride. According to the FAO, the consumption of processed food surged by 30% across the globe from 2020 to 2024.

Moreover, calcium chloride is widely used in cheese production to enhance calcium content and improve curd formation. With worldwide consumption of cheese surpassing 21 million metric tons as of 2024, dairy applications are a leading growth propeller. Furthermore, calcium chloride serves as an electrolyte in functional and sports drinks. The worldwide sports drink industry hit $32.5 billion in 2024, progressing at more than 5% CAGR, which drives the demand for calcium chloride.

Nevertheless, the global market faces limitations due to factors such as health issues resulting from excessive use and the availability of natural substitutes. Even though calcium chloride is regarded as safe, excessive intake may result in hypercalcemia or gastrointestinal discomfort, triggering regulatory scrutiny and prompting consumers.

Also, there is a growing preference for natural food preservatives like lemon juice and vinegar, which may hamper synthetic alternatives like calcium chloride. Still, the global food grade calcium chloride industry benefits from several favorable factors like expansion in functional foods, growing use in plant-based and vegan markets, and development of organic-compliant formulations.

Calcium chloride's role in boosting calcium levels offers potential for application in functional foods, mainly for sports nutrition and bone health. As plant-based foods need texture stabilizers, food-grade calcium chloride is highly used in meat substitutes and tofu. Moreover, creating clean-label variants and organic-certified calcium chloride offers new avenues for exploring health-conscious user segments.

Key Insights:

- As per the analysis shared by our research analyst, the global food grade calcium chloride market is estimated to grow annually at a CAGR of around 6.80% over the forecast period (2025-2034)

- In terms of revenue, the global food grade calcium chloride market size was valued at around USD 743.22 million in 2024 and is projected to reach USD 1258.02 million by 2034.

- The food grade calcium chloride market is projected to grow significantly owing to rising use in dairy products and cheese manufacturing, surging adoption in meat tenderization processes, and enhanced food safety standards and regulations.

- Based on type, the calcium chloride dihydrate segment is expected to lead the market, while the calcium chloride anhydrous segment is expected to grow considerably.

- Based on form, the liquid segment is the dominating segment, while the flakes segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the fruits & vegetables segment is expected to lead the market compared to the dairy segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Food Grade Calcium Chloride Market: Growth Drivers

Increasing use as a firming agent in vegetables and fruits to drive the market growth

Calcium chloride’s role as a firming agent in pickles, fresh-cut fruits, and canned vegetables has gained traction because of the worldwide progress in the fresh-cut produce market. Calcium chloride helps maintain texture and crispness during post-harvest storage and processing, reducing spoilage and wastage.

Recent innovations in food preservation have focused on non-thermal techniques, where calcium chloride is preferred for its least impact on nutritional value or taste. A joint research study from the USDA and Cornell University in January 2025 endorsed calcium chloride-based treatments to decrease microbial contamination in lettuce and fresh-cut apples.

How will rising adoption of vegan and plant-based food products remarkably fuel the food grade calcium chloride market growth

The worldwide plant-based food progress is offering opportunities for food-grade calcium chloride as a calcium supplement and firming agent. Calcium chloride is highly used in tofu, plant-based cheese, and meat substitutes to enhance calcium content and texture.

Beyond Dairy Co., a new entrant in Germany, introduced a calcium-fortified vegan mozzarella with food-grade calcium chloride in February 2025. It aimed to imitate the texture of customary cheese. This inclination is commonly seen in North America and Europe, where nutritional fortification and flexitarian diets are highly demanded. The intersection of sustainability, health, and advancements is fueling segmental growth, thus impacting the global food grade calcium chloride market.

Food Grade Calcium Chloride Market: Restraints

Availability of alternative substitutes and additives negatively impacts market progress

Many other food additives, such as calcium gluconate, potassium chloride, and calcium lactate, offer similar functionalities, including stabilizing, firming, and mineralization, and are widely used as substitutes. These substitutes usually offer better taste profiles, low corrosiveness, and enhanced solubility, increasing their preference in specific applications.

Food Grade Calcium Chloride Market: Opportunities

Will technological advancements in food preservation positively impact the food grade calcium chloride market growth?

Advancements in food preservation now incorporate calcium chloride to reduce dependency on artificial preservatives. Fresh methods like modified atmosphere packaging and non-thermal pasteurization blend well with calcium chloride to reduce microbial load and maintain firmness.

Companies in the U.S. and Europe are actively investing in 'green preservation' methods, where calcium extends shelf life without using synthetic chemicals. This inclination offers an opportunity for broader adoption in high-value products like pickles, fresh-cut fruit, and organic canned items, fueling the food grade calcium chloride industry.

Food Grade Calcium Chloride Market: Challenges

Does storage, handling, and hygroscopic nature restrict the growth of food grade calcium chloride market?

Calcium chloride’s extreme hygroscopicity means that it readily absorbs moisture from the air, compounding its transport, storage, and shelf-life. Improper storage could offer clumping, reduced efficiency, or contamination, mainly in humid climates.

Mid- and small-sized food processing units in Southeast Asia face logistical challenges in using calcium chloride due to limited infrastructure.

Food Grade Calcium Chloride Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Grade Calcium Chloride Market |

| Market Size in 2024 | USD 743.22 Million |

| Market Forecast in 2034 | USD 1258.02 Million |

| Growth Rate | CAGR of 6.80% |

| Number of Pages | 213 |

| Key Companies Covered | Occidental Chemical Corporation (OxyChem), Solvay S.A., Tetra Technologies Inc., Nedmag B.V., Ward Chemical Ltd., Zirax Limited, Tiger Calcium Services Inc., HaloPolymer, Weifang Haibin Chemical Co. Ltd., OxyChem Chemical Corporation, Nanning Chemical Group, GFS Chemicals Inc., Anmol Chemicals Group, Briners Choice Inc., Premier Chemicals Ltd., and others. |

| Segments Covered | By Type, By Form, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Food Grade Calcium Chloride Market: Segmentation

The global food grade calcium chloride market is segmented based on type, form, application, and region.

Based on type, the global food grade calcium chloride industry is divided into calcium chloride dehydrate and calcium chloride anhydrous. The calcium chloride dehydrate segment registered the maximum share of the market owing to its ease of use and high stability in food applications. It is broadly used in preserving canned vegetables, enhancing the texture of dairy products, and firming tofu. Its lower reactivity and better solubility increase its safety and practicality for the mass production of food. In addition, regulatory approvals and extensive acceptance in food processing strengthen its dominance.

Based on form, the global food grade calcium chloride market is segmented into powder, flakes, pellets, granular, and liquid. The liquid food grade segment holds leadership because of its broad use in cheese manufacturing, beverage production, and as a firming agent in canned vegetables. The liquid form promises precise dosing, reduced handling time in automated processing systems, and easy mixing. Its leadership is fueled by convenience, mainly in continuous production environments.

Based on application, the global market is segmented as beverage (alcoholic, non-alcoholic), dairy, meat, bakery & confectionery, fruits & vegetables, and others. The fruits & vegetables segment is leading in the global market due to the progressing trend of convenience foods and food export. It is broadly used as a firming agent in canned vegetables, cut fruit products, and pickles to maintain texture and extend shelf life. As global demand for ready-to-eat and processed produce surges, manufacturers are dependent on calcium chloride to retain crispness and avoid spoilage.

Food Grade Calcium Chloride Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Food Grade Calcium Chloride Market?

Asia Pacific is projected to maintain its dominant position in the global food grade calcium chloride market owing to the expanding processed food industry, high consumption of vegetables and fruits, and cost-efficient manufacturing and availability of raw materials. Asia Pacific is experiencing rapid growth in its processed food industry, driven by increasing urbanization, changing lifestyles, and rising disposable income. Nations like Indonesia, China, and India are heavily investing in the food processing ecosystem.

According to the Asian Development Bank, processed food sales in the APAC region surged by 35% from 2020 to 2024, driving the demand for food-grade additives like calcium chloride. The region also registers for the maximum global production of vegetables and fruits, with India and China being forerunners. Calcium chloride is extensively used to preserve shelf life and texture in packaged and canned produce.

Moreover, the region benefits from low-cost labor and plenty of limestone reserves, helping cost-efficient production of calcium chloride. The key producers in India and China supply both international and domestic markets. This manufacturing benefit boosts the region's dominance in export and consumption of food-grade calcium chloride.

North America maintains its position as the second-leading region in the global food grade calcium chloride industry due to a strong packaged and processed food industry, improved beverage industry, and high consumption of preserved and fresh-cut produce. North America boasts well-developed processed food industries, with leading demand for texture enhancers and preservatives such as calcium chloride. The United States processed food market alone was estimated at more than $1.1 trillion in 2024, making it a major propeller of additive consumption. The preference for canned, ready-to-eat, and frozen foods propels the persistent use of calcium chloride in manufacturing.

Moreover, the region boasts a thriving beverage sector, encompassing soft drinks, functional drinks, and alcoholic beverages, where calcium chloride serves as an electrolyte and pH control agent. The sports and energy drink market in the United States exceeded $38 billion in 2024, a domain that highly uses calcium chloride. The growth in health-conscious consumers is strengthening this growth.

Furthermore, consumers in Canada and the United States are increasing their demand for cut and pre-packaged vegetables and fruits, which require firming agents to maintain their freshness. Calcium chloride is primarily used to extend shelf life and preserve texture.

Food Grade Calcium Chloride Market: Competitive Analysis

The prominent players in the global food grade calcium chloride market are:

- Occidental Chemical Corporation (OxyChem)

- Solvay S.A.

- Tetra Technologies Inc.

- Nedmag B.V.

- Ward Chemical Ltd.

- Zirax Limited

- Tiger Calcium Services Inc.

- HaloPolymer

- Weifang Haibin Chemical Co. Ltd.

- OxyChem Chemical Corporation

- Nanning Chemical Group

- GFS Chemicals Inc.

- Anmol Chemicals Group

- Briners Choice Inc.

- Premier Chemicals Ltd.

Food Grade Calcium Chloride Market: Key Market Trends

Growth of functional and electrolyte beverages:

The rise in health-focused beverages, comprising functional waters and sports drinks, is driving the use of calcium chloride as an electrolyte. Owing to its vital role in mineral balance and hydration, calcium chloride is gaining major appeal.

Increased usage of vegan and plant-based products:

With the growth of plant-based food, calcium chloride is mainly used in products like meat substitutes, vegan cheese, and tofu. It plays a key role as a texture stabilizer and coagulant, mainly in soy-based applications.

The global food grade calcium chloride market is segmented as follows:

By Type

- Calcium Chloride Dihydrate

- Calcium Chloride Anhydrous

By Form

- Powder

- Flakes

- Pellets

- Granular

- Liquid

By Application

- Beverage (Alcoholic, Non-alcoholic)

- Dairy

- Meat

- Bakery & Confectionery

- Fruits & Vegetables

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Food-grade calcium chloride is an inorganic, high-purity salt used mainly in the food industry as a preservative, firming agent, and stabilizer. It is commonly added to canned foods, cheese, and tofu to enhance shelf life and texture. It also holds applications in pickling, brewing, and as an electrolyte in sports beverages.

The global food grade calcium chloride market is projected to grow due to growth in food consumption and global population, improvements in food additive formulation, and increasing consumption of packaged and processed foods.

According to study, the global food grade calcium chloride market size was worth around USD 743.22 million in 2024 and is predicted to grow to around USD 1258.02 million by 2034.

The CAGR value of the food grade calcium chloride market is expected to be around 6.80% during 2025-2034.

Asia Pacific is expected to lead the global food grade calcium chloride market during the forecast period.

The key players profiled in the global food grade calcium chloride market include Occidental Chemical Corporation (OxyChem), Solvay S.A., Tetra Technologies, Inc., Nedmag B.V., Ward Chemical Ltd., Zirax Limited, Tiger Calcium Services Inc., HaloPolymer, Weifang Haibin Chemical Co., Ltd., OxyChem Chemical Corporation, Nanning Chemical Group, GFS Chemicals, Inc., Anmol Chemicals Group, Briners Choice Inc., and Premier Chemicals Ltd.

Emerging trends in the food grade calcium chloride market include its increasing use in clean-label and fortified foods, especially in plant-based and functional beverages. Innovations focus on sustainable production methods and their integration in non-thermal food preservation technologies.

Stakeholders should invest in R&D for eco-friendly formulations and expand into emerging markets with rising processed food demand. Strengthening supply chain resilience and aligning with clean-label trends can enhance market competitiveness.

Regulatory challenges include region-specific food safety standards and labeling requirements that complicate global distribution. Environmental concerns over chloride discharge and storage-related risks are prompting stricter compliance and sustainability measures.

The report examines key aspects of the food grade calcium chloride market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed