Flight Demonstrator Market Size, Share, Trends, Growth & Forecast 2034

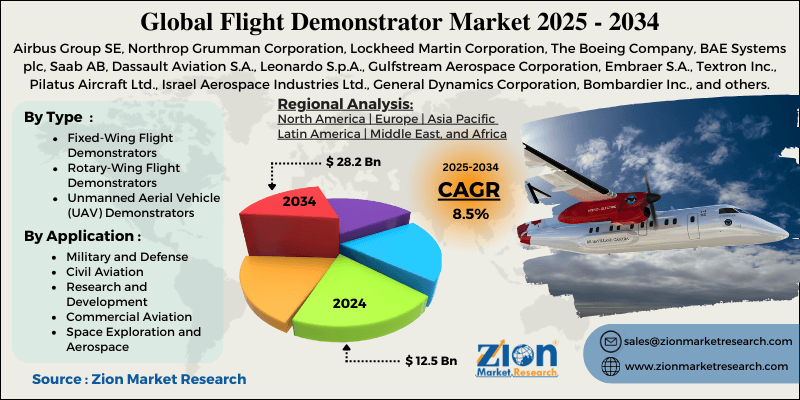

Flight Demonstrator Market By Type (Fixed-Wing Flight Demonstrators, Rotary-Wing Flight Demonstrators, and Unmanned Aerial Vehicle (UAV) Demonstrators), By Application (Military and Defense, Civil Aviation, Research and Development, Commercial Aviation, and Space Exploration and Aerospace), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

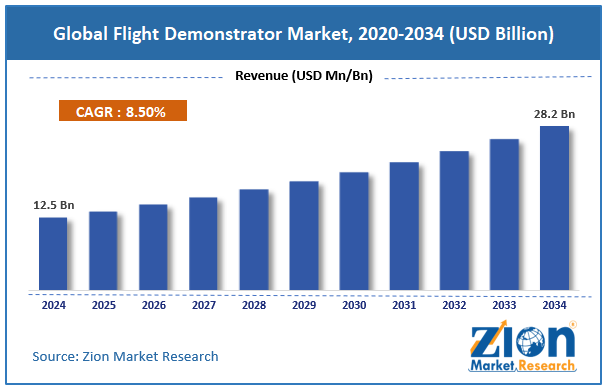

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.5 Billion | USD 28.2 Billion | 8.5% | 2024 |

Flight Demonstrator Industry Perspective:

The global flight demonstrator market size was worth around USD 12.5 billion in 2024 and is predicted to grow to around USD 28.2 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global flight demonstrator market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2025-2034).

- In terms of revenue, the global flight demonstrator market size was valued at around USD 12.5 billion in 2024 and is projected to reach USD 28.2 billion by 2034.

- The rising industry partnerships & innovation ecosystems are expected to drive the flight demonstrator market over the forecast period.

- Based on the type, the fixed-wing flight demonstrators segment is expected to capture the largest market share over the projected period.

- Based on the application, the military and defense segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Flight Demonstrator Market: Overview

A flight demonstration is a test or prototype aircraft used to evaluate new technologies, systems, designs, or ideas in real-world flight conditions before they are built or put to use. It gives one a chance to assess new technologies, including propulsion, avionics, structural integrity, control systems, and aerodynamic characteristics in a real-world setting. Flight demonstrators assist engineers in developing new technologies by providing insights and guidance through controlled test flights, thereby lowering risk. Flight demonstrations are pretty popular in the aerospace industry for new commercial aircraft designs, military aviation programs, and research and development. They enable researchers and designers to determine how well new materials, combinations, or technologies perform in the real world. For instance, they can test new aerodynamic surfaces, improved avionics, or more environmentally friendly fuels. The flight demonstration sector is growing because new aircraft and technologies require more robust testing platforms.

Strict safety rules, increased funding for the aviation and defense industries, and the need to test new aircraft designs and systems in real-world flight conditions all contribute to growth. Adding advanced technologies like AI and machine learning to flight demonstrations makes it easier to process and test data.

Flight Demonstrator Market Dynamics

Growth Drivers

How does the rising demand for low-emission and sustainable aviation technologies drive the flight demonstrator market growth?

The aviation industry is growing as demand for low-emission, environmentally friendly technology rises. These technologies significantly decrease the carbon footprint of air travel, which is good for the environment and meets regulatory requirements. Sustainable Aviation Fuels (SAFs) are a significant category of fuels, as they can cut carbon emissions by up to 80% compared to regular jet fuel. This makes them very important for airlines that need to meet strict emissions restrictions and carbon reduction goals. The desire of governments and major airlines to use SAFs and other green technologies is driving increased investment and the development of new ideas in manufacturing and feedstock diversification. This is what is driving growth in the flight demonstrator market.

Also, better alternative propulsion technologies, such as hybrid-electric and hydrogen-powered planes, help aviation find long-term solutions by attracting more financing and speeding up technological progress. This initiative not only allows airlines to meet new environmental standards but also gives companies a competitive edge in a market increasingly focused on sustainability.

Restraints

Extremely high development and testing costs impede market growth

The flight demonstrator market cannot expand due to the very high costs of research and testing, which make it hard for small businesses and startups to get started. Building meaningful flying demonstrators costs hundreds of millions of dollars because of the considerable design, fabrication, flight-test instrumentation, validation processes, and regulatory compliance required. Long and expensive certification and approval processes make it harder to enter the market and increase investment risks, slowing the pace of new technology demonstration and adoption.

Also, spending too much money can lead to budget overruns and project delays, which may negatively impact the profitability of flight demonstration programs and make it harder to secure the resources needed for technological innovation. These problems make it harder for the market to grow, as they limit the number of possible projects and the number of stakeholders willing to invest in expensive flight demonstration projects.

Opportunities

Will the rising number of projects offer an opportunity for the flight demonstrator industry growth?

The increasing number of projects offer a potential opportunity for the flight demonstrator market over the analysis period. For instance, in June 2025, Pratt & Whitney Canada has reached a significant milestone in the RTX Hybrid-Electric Flight Demonstrator project by testing the combined propulsion system and batteries at full power. While ground testing of the hybrid-electric propulsion system continues in Longueuil, Quebec, Pratt & Whitney Canada has selected AeroTEC to support future flight testing of the De Havilland Canada Dash 8-100 experimental aircraft. Pratt & Whitney is an RTX business.

The new end-to-end test marks the first battery-powered operation of the propulsion system, which combines a highly efficient Pratt & Whitney Canada thermal engine with a 1 megawatt (MW) electric motor developed by RTX business, Collins Aerospace. The 200-kilowatt-hour (kWh) batteries supplied by H55 S.A. were also successfully charged and discharged using the high-voltage Mobile Charging Unit, which was developed by Pratt & Whitney Canada, the National Research Council of Canada, and the Innovative Vehicle Institute. RTX Ventures, the venture funding arm of RTX, supports H55.

Challenges

Does the limited availability of specialized testing infrastructure pose a major challenge to the flight demonstrator market expansion?

The lack of specialized testing infrastructure makes it hard for the market to grow, as aerospace test facilities require significant capital to build and maintain, limiting their number and capacity. Many of the facilities already in operation are decades old and can't handle the more complex testing needs of modern flight demos, such as high-power propulsion systems, cryogenic fuel management, and heavy sensor data processing. Because there aren't enough labs, it's hard to set them up and get to them. This slows down development and raises prices, especially for small enterprises that rely on third-party labs.

The issue is significantly worse due to specialized tools and the need for highly trained staff. This makes it harder for the industry to quickly expand testing programs, slowing the process of getting new technology certified and to market. These infrastructure problems make it harder for new ideas to emerge, slow down time-to-market, and make the flight demonstrator business less competitive overall.

Flight Demonstrator Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flight Demonstrator Market |

| Market Size in 2024 | USD 12.5 Billion |

| Market Forecast in 2034 | USD 28.2 Billion |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 214 |

| Key Companies Covered | Airbus Group SE, Northrop Grumman Corporation, Lockheed Martin Corporation, The Boeing Company, BAE Systems plc, Saab AB, Dassault Aviation S.A., Leonardo S.p.A., Gulfstream Aerospace Corporation, Embraer S.A., Textron Inc., Pilatus Aircraft Ltd., Israel Aerospace Industries Ltd., General Dynamics Corporation, Bombardier Inc., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Flight Demonstrator Market: Segmentation

The global flight demonstrator industry is segmented based on type, application, and region.

Based on type, the global flight demonstrator market is bifurcated into fixed-wing flight demonstrators, rotary-wing flight demonstrators, and Unmanned Aerial Vehicle (UAV) demonstrators. The fixed-wing flight demonstrators’ segment is expected to capture the largest market share over the projected period. The growth is being driven by the aerospace industry, which includes enhancements to commercial airline fleets, the modernization of military aircraft, and the development of new aviation technologies. Fixed-wing demonstrations are very important for technical advancement because they help you test all of the aerodynamics, propulsion, control systems, and safety features without putting real planes at risk.

Based on the application, the global flight demonstrator industry is bifurcated into military and defense, civil aviation, research and development, commercial aviation, and space exploration & aerospace. The military and defense segment holds the major market share. The growing investment in this sector is the main reason for market development.

Flight Demonstrator Market: Regional Analysis

What factors will help North America dominate the flight demonstrator market over the projected period?

The North America region is expected to dominate the flight demonstrator market. The region's significant presence of key Original Equipment Manufacturers (OEMs), considerable aerospace research and development (R&D) capabilities, and high demand for new flight testing all help the industry flourish. Also, the increased use of advanced flight testing, automation, and next-generation aircraft development projects, such as electric and hybrid propulsion systems and technology for autonomous flight, is helping boost sales.

The United States has a high CAGR because it is one of the world's largest aviation markets. This is because flight demonstration programs are being developed for both the commercial and defense sectors, which helps the industry keep growing. North America's rules and contemporary testing infrastructure enable faster development and testing, attracting more investment and helping the industry flourish. In the North American flight demonstrator business, revenue is growing due to new technologies, strong market demand, and industry leadership.

Flight Demonstrator Market: Competitive Analysis

The global flight demonstrator market is dominated by players like:

- Airbus Group SE

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- The Boeing Company

- BAE Systems plc

- Saab AB

- Dassault Aviation S.A.

- Leonardo S.p.A.

- Gulfstream Aerospace Corporation

- Embraer S.A.

- Textron Inc.

- Pilatus Aircraft Ltd.

- Israel Aerospace Industries Ltd.

- General Dynamics Corporation

- Bombardier Inc.

The global flight demonstrator market is segmented as follows:

By Type

- Fixed-Wing Flight Demonstrators

- Rotary-Wing Flight Demonstrators

- Unmanned Aerial Vehicle (UAV) Demonstrators

By Application

- Military and Defense

- Civil Aviation

- Research and Development

- Commercial Aviation

- Space Exploration and Aerospace

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A flight demonstration is a test or prototype aircraft used to evaluate new technologies, systems, designs, or ideas in real-world flight conditions before they are built or put to use. It gives one a chance to assess new technologies, including propulsion, avionics, structural integrity, control systems, and aerodynamic characteristics in a real-world setting.

The flight demonstrator market is driven by several factors, including rising demand for low-emission and sustainable aviation technologies, growth in advanced Air Mobility (AAM) & Urban Air Mobility (UAM) concepts, need for faster innovation cycles in aerospace, government funding and national R&D programs, increasing focus on autonomous and AI-driven flight systems, and expansion of defense modernization programs.

Technical complexity and high risk of failure pose a major challenge to the flight demonstrator industry expansion.

Based on the type, the fixed-wing flight demonstrators segment is expected to dominate the flight demonstrator market growth during the projected period.

The growing investment in advanced technology and the growing aerospace and defense industry pose a major impact factor for the flight demonstrator industry's growth over the projected period.

According to the report, the global flight demonstrator market size was worth around USD 12.5 billion in 2024 and is predicted to grow to around USD 28.2 billion by 2034.

The global flight demonstrator market is expected to grow at a CAGR of 8.5% during the forecast period.

The global flight demonstrator industry growth is expected to be driven by the North America region. It is currently the world’s highest-revenue-generating market due to stringent government regulations.

The global flight demonstrator market is dominated by players like Airbus Group SE, Northrop Grumman Corporation, Lockheed Martin Corporation, The Boeing Company, BAE Systems plc, Saab AB, Dassault Aviation S.A., Leonardo S.p.A., Gulfstream Aerospace Corporation, Embraer S.A., Textron Inc., Pilatus Aircraft Ltd., Israel Aerospace Industries Ltd., General Dynamics Corporation, and Bombardier Inc., among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed