Ferrovanadium Alloy Market Size Report, Industry Share, Analysis, Growth, Forecasts 2025 - 2034

Ferrovanadium Alloy Market By Application (Steel Production, Vanadium Redox Batteries, Alloying Agent, and Other Industrial Uses ), By Grade (High Carbon Ferrovanadium, Medium Carbon Ferrovanadium, and Low Carbon Ferrovanadium), By End User (Automotive, Aerospace, Construction, and Other End Users), By Production Process (Aluminothermic Process, Electrolytic Process, and Other Production Processes), By Purity Level (90-95% Ferrovanadium, 96-99% Ferrovanadium, and Greater than 99% Ferrovanadium), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

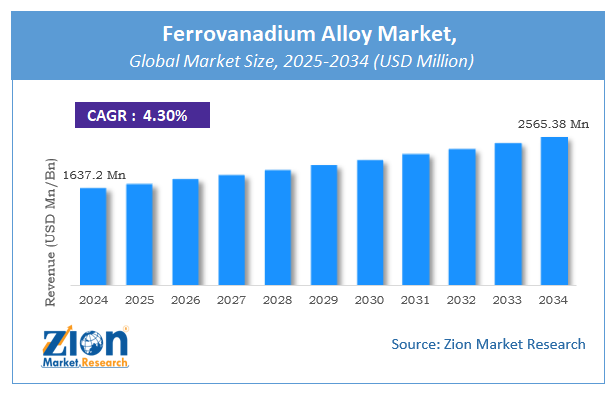

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1637.2 Million | USD 2565.38 Million | 4.3% | 2024 |

Ferrovanadium Alloy Market: Industry Perspective

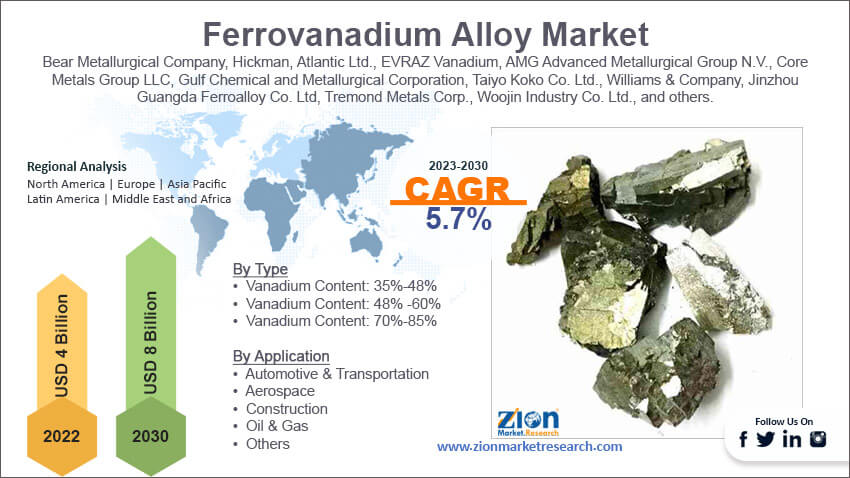

The global ferrovanadium alloy market size was worth around USD 1637.2 million in 2024 and is predicted to grow to around USD 2565.38 million by 2034 with a compound annual growth rate (CAGR) of roughly 4.3% between 2025 and 2034. The report analyzes the global ferrovanadium alloy market's drivers, restraints/challenges, and the effect they have on the demand during the projection period. In addition, the report explores emerging opportunities in the ferrovanadium alloy industry.

Ferrovanadium Alloy Market: Overview

Ferrovanadium is an alloy combining vanadium and iron with vanadium content ranging from 35% to 85%. The production of alloy can result in a grayish silver crystalline solid, which can be crushed into powdered for,m referred to as ferrovanadium dust. Reportedly, ferrovanadium is a hardener, anticorrosive, and strengthening additive used for steels such as tool sheets, ferrous-based items, and high-strength low–alloy steel. Moreover, ferrovanadium is utilized as an additive for improving the ferrous alloy qualities.

Key Insights

- As per the analysis shared by our research analyst, the global ferrovanadium alloy market is estimated to grow annually at a CAGR of around 4.3% over the forecast period (2025-2034).

- Regarding revenue, the global ferrovanadium alloy market size was valued at around USD 1637.2 Million in 2024 and is projected to reach USD 2565.38 Million by 2034.

- The ferrovanadium alloy market is projected to grow at a significant rate due to increasing demand for high-strength, low-alloy (HSLA) steel in construction, automotive, and energy infrastructure, where ferrovanadium enhances steel's strength, durability, and corrosion resistance.

- Based on Application, the Steel Production segment is expected to lead the global market.

- On the basis of Grade, the High Carbon Ferrovanadium segment is growing at a high rate and will continue to dominate the global market.

- Based on the End User, the Automotive segment is projected to swipe the largest market share.

- By Production Process, the Aluminothermic Process segment is expected to dominate the global market.

- In terms of Purity Level, the 90-95% Ferrovanadium segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Ferrovanadium Alloy Market: Growth Factors

Escalating product penetration in steel & automotive sectors to boost the global market trends

Surging corrosion resistance to alkaline reagents and hydrochloric & sulfuric acids has translated into huge demand for ferrovanadium alloy, thereby driving the global ferrovanadium alloy market trends. Furthermore, massive product use in enhancing the tensile strength-to-weight ratio of any substance will embellish the growth of the market across the globe. A prominent surge in the use of the product in hand tools such as ratchets, spanners, and screwdrivers will steer the expansion of the market globally.

The large-scale use of ferrovanadium alloy in chemical processing activities will create a huge scope of growth for the global market. In addition to this, escalating demand for processing, drilling, production, transportation, and storage of the oil & gas sector will scale the expansion of the global market. A rise in the demand for pipes for cross-country pipelines and a thriving city gas distribution sector will spearhead the growth of the global market. Product innovations and the establishment of new units are anticipated to contribute significantly to the size of the global market. Citing an instance, in March 2021, Vision Blue Resources, a battery metal investment firm, introduced a $300 million blank check firm in the U.S.

Ferrovanadium Alloy Market: Restraints

Rise in the costs of raw components to inhibit the global industry expansion over 2023-2030

The growing environmental concerns, along with fluctuations in the raw material costs are anticipated to hinder the growth of the global ferrovanadium alloy industry during the forecast timeline. According to the World Steel Association AISBL, in 2020, each ton of steel produced led to the emission of nearly 1.90 tons of carbon dioxide into the atmosphere. Furthermore, nearly 1,870 million tons of steel were produced, resulting in total direct emissions of 2.6 billion tons, containing about 8% to 10% of anthropogenic carbon dioxide emissions.

Ferrovanadium Alloy Market: Opportunities

High government focus on strengthening the infrastructure of roadways and highways to generate new growth avenues for the global market

The huge focus of the government on improving the infrastructure of highways, dams, and bridges is steering the demand for steel, which in turn, is predicted to propel the expansion of the global ferrovanadium alloy market. Ferrovanadium is a key alloy that is mainly used in steel production for enhancing the strength, abrasion resistance, hardness, and ductility of material. For the record, HRIDAY which is an abbreviation of Heritage City Development and Augmentation Yojana and Smart City Mission aiming to launch cutting-edge construction activities in India makes use of ferrovanadium for manufacturing high-strength steel. In addition to this, schemes such as the Boston Harbor Dredging venture and California High-Speed Rail project have helped in enhancing the steel demand, thereby increasing new growth avenues for the global market.

Ferrovanadium Alloy Market: Challenges

A surge in the import duties of steel products by the EU can pose a huge challenge to the global industry expansion by 2030

The European Union’s CABM (Carbon Border Adjustment Mechanism) has decided to levy nearly 25% to 35% tax on the import of high-carbon products such as iron ore, steel, and cement. Moreover, countries such as India export nearly 27% of iron ore pellets, aluminum products, and steel products to EU countries. Moreover, the tax imposition is likely to come into force for India from 1st January 2026. Hence, such moves can prove to be detrimental to the expansion of the global ferrovanadium alloy industry.

Ferrovanadium Alloy Market: Segmentation Analysis

The global ferrovanadium alloy market is segmented based on application, grade, end user, production process, purity level, and region.

Based on Application, the global ferrovanadium alloy market is divided into steel production, vanadium redox batteries, alloying agent, and other industrial uses.

On the basis of Grade, the global ferrovanadium alloy market is bifurcated into high carbon ferrovanadium, medium carbon ferrovanadium, and low carbon ferrovanadium.

By End User, the global ferrovanadium alloy market is split into automotive, aerospace, construction, and other end users. The automotive segment, which acquired a key share of the global industry in 2024, is predicted to lead the industry growth in the next eight years. The segmental expansion over 2025-2034 can be subject to the escalating demand for the product in hybrid and electric vehicles, along with a growing need for hard steel in axle construction. Apart from this, the thriving vehicle manufacturing sector in Germany, Italy, the UK, India, Malaysia, China, Japan, and Thailand will contribute significantly to the product demand in the coming years.

Furthermore, thriving construction activities have enhanced the penetration of ferrovanadium alloys in the construction segment, thereby assisting the latter in registering the fastest CAGR in 2024. Moreover, the product is used extensively in structural plates and concrete reinforcing bars. In addition to this, ferrovanadium alloy is used in columns and beams to provide structural support to constructions.

In terms of Production Process, the global ferrovanadium alloy market is categorized into aluminothermic process, electrolytic process, and other production processes.

By Purity Level, the global Ferrovanadium Alloy market is divided into 90-95% ferrovanadium, 96-99% ferrovanadium, and greater than 99% ferrovanadium.

Ferrovanadium Alloy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ferrovanadium Alloy Market |

| Market Size in 2024 | USD 1637.2 Million |

| Market Forecast in 2034 | USD 2565.38 Million |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | PagesNO |

| Key Companies Covered | Glencore, Evraz, Antaria Solutions Limited, ERAMET, JSC Chelyabinsk Electrometallurgical Plant, AMG Advanced Metallurgical Group, JSC RusVanadium, Wah Chang, Borusan Mannesman, Sibelco Belgium, Cititrade Resources Pte Ltd, Chromalloy, Zaklady Chemiczne Police SA, Vametco Inc., Globe Specialty Metals, and others. |

| Segments Covered | By Application, By Grade, By End User, By Production Process, By Purity Level, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ferrovanadium Alloy Market: Regional Analysis

Asia-Pacific is predicted to retain its leading position in the global ferrovanadium alloy market over the forecast timespan

Asia-Pacific, which contributed about 50% of the global ferrovanadium alloy market revenue in 2024, will be a leading region over the forecast timeline. Moreover, the regional market elevation over the coming eight years can be subject to thriving industrial growth and an increase in construction activities owing to a surging population of Asian countries such as India and China. Thriving residential activities in emerging economies are likely to proliferate the expansion of the market in the sub-continent. In addition to this, a rise in the crude steel production has translated into a huge demand for ferrovanadium alloy in the sub-continent.

According to the World Steel Association, in August 2023, the crude steel production in Asia & Oceania was 115.7 million tons and a cumulative of 944.8 million tons in the first eight months of 2023. Apart from this, China is a leading producer of crude steel across the globe and produced nearly 77.9 million metric tons of crude steel in December 2022. Furthermore, India, Japan, and Thailand follow China in the manufacture of crude steel as well as steel products.

The European ferrovanadium alloy industry is set to record the fastest CAGR in the next couple of years subject to the presence of giant players in countries such as Russia, the UK, Finland, Switzerland, Denmark, Sweden, Estonia, and France. Moreover, the establishment of new production units of steel manufacturing firms in the continent will contribute significantly towards the regional industry revenue in the forecasting years. For instance, in the first half of 2020, EVRAZ Vanadium, a Russia-based firm, launched an R&D unit in Zug, Switzerland, at group subsidiary East Metals AG. Such moves will contribute lucratively towards the growth of the industry in Europe.

Ferrovanadium Alloy Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the ferrovanadium alloy market on a global and regional basis.

The global ferrovanadium alloy market is dominated by players like:

- Glencore

- Evraz

- Antaria Solutions Limited

- ERAMET

- JSC Chelyabinsk Electrometallurgical Plant

- AMG Advanced Metallurgical Group

- JSC RusVanadium

- Wah Chang

- Borusan Mannesman

- Sibelco Belgium

- Cititrade Resources Pte Ltd

- Chromalloy

- Zaklady Chemiczne Police SA

- Vametco Inc.

- Globe Specialty Metals

The global ferrovanadium alloy market is segmented as follows;

By Application

- Steel Production

- Vanadium Redox Batteries

- Alloying Agent

- Other Industrial Uses

By Grade

- High Carbon Ferrovanadium

- Medium Carbon Ferrovanadium

- Low Carbon Ferrovanadium

By End User

- Automotive

- Aerospace

- Construction

- Other End Users

By Production Process

- Aluminothermic Process

- Electrolytic Process

- Other Production Processes

By Purity Level

- 90-95% Ferrovanadium

- 96-99% Ferrovanadium

- Greater than 99% Ferrovanadium

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Ferrovanadium is an alloy combining vanadium and iron with vanadium content ranging from 35% to 85%. The production of alloy can result in a grayish silver crystalline solid which can be crushed into powdered form referred to as ferrovanadium dust.

The global ferrovanadium alloy market is expected to grow due to rising demand in steel production, growth in construction and automotive industries, and increasing use in high-strength alloy applications.

According to a study, the global ferrovanadium alloy market size was worth around USD 1637.2 Million in 2024 and is expected to reach USD 2565.38 Million by 2034.

The global ferrovanadium alloy market is expected to grow at a CAGR of 4.3% during the forecast period.

Asia-Pacific is expected to dominate the ferrovanadium alloy market over the forecast period.

Leading players in the global ferrovanadium alloy market include Glencore, Evraz, Antaria Solutions Limited, ERAMET, JSC Chelyabinsk Electrometallurgical Plant, AMG Advanced Metallurgical Group, JSC RusVanadium, Wah Chang, Borusan Mannesman, Sibelco Belgium, Cititrade Resources Pte Ltd, Chromalloy, Zaklady Chemiczne Police SA, Vametco Inc., Globe Specialty Metals, among others.

The report explores crucial aspects of the ferrovanadium alloy market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed