Global Fermented Dairy Ingredients Market Size, Share, Growth Analysis Report - Forecast 2034

Fermented Dairy Ingredients Market By Product Type (Yogurt, Cheese, Kefir, Sour Cream, Buttermilk), By Application (Bakery, Dairy, Snacks, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.55 Billion | USD 18.98 Billion | 8.3% | 2024 |

Fermented Dairy Ingredients Market: Industry Perspective

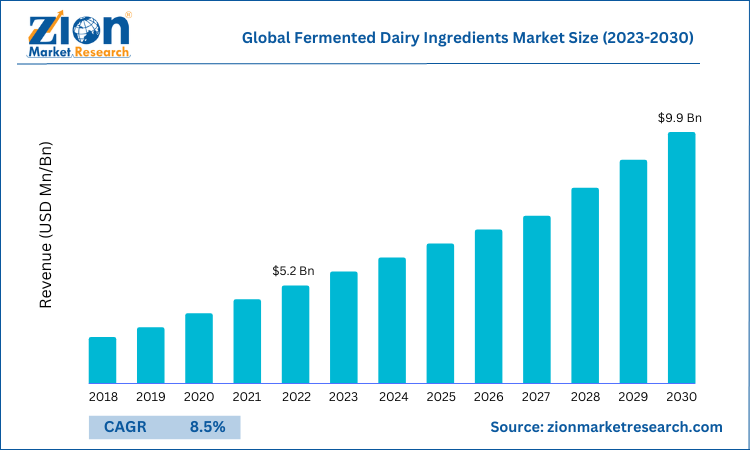

The global fermented dairy ingredients market size was worth around USD 8.55 Billion in 2024 and is predicted to grow to around USD 18.98 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.3% between 2025 and 2034. The report analyzes the global fermented dairy ingredients market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fermented dairy ingredients industry.

The report analyzes the global fermented dairy ingredients market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fermented dairy ingredients market.

Fermented Dairy Ingredients Market: Overview

Fermented milk or dairy products, also known as cultured dairy food products, are generally fermented with the help of lactic acid bacteria. This fermentation method increases the shelf life of food products while also improving important aspects such as digestibility, taste, and so on. Cheese is regarded as one of the most important ingredients in a variety of fast foods and bakery items. A wide variety of Lactobacilli strains are thought to be grown or developed in laboratories, allowing for the production of a diverse range of cultured milk products with varying tastes.

Key Insights

- As per the analysis shared by our research analyst, the global fermented dairy ingredients market is estimated to grow annually at a CAGR of around 8.3% over the forecast period (2025-2034).

- Regarding revenue, the global fermented dairy ingredients market size was valued at around USD 8.55 Billion in 2024 and is projected to reach USD 18.98 Billion by 2034.

- The fermented dairy ingredients market is projected to grow at a significant rate due to increasing consumer interest in gut health, clean-label dairy products, and growing demand for functional foods.

- Based on Product Type, the Yogurt segment is expected to lead the global market.

- On the basis of Application, the Bakery segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Fermented Dairy Ingredients Market: Dynamics

Key Growth Drivers:

The fermented dairy ingredients market is propelled by strong consumer demand for functional and health-promoting foods—particularly probiotics and protein-rich ingredients—driven by rising awareness of gut health, immunity, and overall wellness. Manufacturers are expanding applications of fermented dairy ingredients (yogurt powders, whey-derived concentrates, probiotic cultures, kefir powders) across bakery, beverages, infant nutrition, and sports nutrition, increasing volumes. Technological advances in fermentation, microencapsulation, and shelf-stable processing make it easier to incorporate live cultures and bioactive peptides into a wider range of products. Urbanization, higher disposable incomes in emerging markets, and interest in clean-label, “natural” fermentation processes further boost adoption.

Restraints:

Market growth is constrained by the inherent perishability and cold-chain needs of many fermented dairy inputs, which raise logistics and storage costs—particularly for live-culture products. Price volatility in raw milk and energy costs can squeeze margins for producers. Regulatory complexity around claims for probiotics and bioactives, plus varying country-level approvals for specific strains, complicates product launches and labeling. Additionally, a growing portion of consumers seeking lactose-free or plant-based alternatives can limit demand for traditional dairy-based fermented ingredients in some segments.

Opportunities:

Significant opportunities exist in product innovation and premiumization: stable, shelf-friendly probiotic powders and fermented whey concentrates for sports and clinical nutrition; infant formula applications where fermented components aid digestibility; and flavor-modulation using fermentation for clean-label taste solutions. Expansion into high-growth geographies (Asia-Pacific, Latin America) and co-development with food manufacturers to create hybrid dairy–plant products can open new revenue streams. Advances in strain selection, precision fermentation, and microencapsulation also enable tailored functionality (targeted gut strains, postbiotics, peptides) and longer shelf life—making fermented dairy ingredients attractive to R&D-driven brands.

Challenges:

The market faces quality-and-safety challenges: maintaining strain viability through processing, ensuring consistent functional activity in finished goods, and preventing contamination during large-scale fermentation. Stability of live cultures under varying processing and storage conditions remains a technical hurdle. Fragmented regulatory frameworks and an evolving scientific consensus on strain-specific health claims create commercial risk for marketers. Finally, sustainability pressures—water use, greenhouse gas emissions from dairy supply chains—and consumer scrutiny about animal-derived ingredients may force producers to invest in greener practices or risk losing market share to alternative solutions.

Fermented Dairy Ingredients Market: Segmentation

The global fermented dairy ingredients industry is segmented based on product type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on the product type, the global market is bifurcated into natural cheese, flavored milk, and yogurt. The natural cheese segment is expected to dominate the market during the forecast period. The segment growth is owing to its large concentration of riboflavin, zinc, phosphorous, and vitamins A and B-12. The use of cheese in numerous food sectors, including bakery goods, fast food, and as an ingredient in many Italian dishes, is also anticipated to drive growth in the market for fermented dairy ingredients from 2022 to 2030.

Additionally, because sour milk has such high nutritional value, more people are consuming it. In addition, sour cream, also known as crème fraiche, is made by fermenting normal cream with lactic acid. It has a creamy consistency and a distinct sour flavor. On the other hand, the yogurt segment is expected to hold a significant market share during the forecast period. Protein, calcium, vitamins, live cultures, or probiotics, which can improve the gut microbiota, can all be found in high concentrations in yogurt. These may safeguard teeth and bones and guard against digestive issues. On a diet to lose weight, low-fat yogurt can be a helpful supply of protein. Thus, the aforementioned benefits drive market growth.

Based on the application, the global fermented dairy ingredients industry is segmented into bakery, dairy, snacks, and others. The bakery segment accounted for the largest market share in 2022 and is expected to continue the same pattern during the forecast period. This is due to the widespread use of fermented dairy ingredients in baked foods like bread and pastries. Due to their acidity, these components are used to preserve food and are beneficial for gastrointestinal issues. As a result, they are frequently used by bakeries to extend the life of their products. Besides, the dairy segment is growing at the fastest rate over the forecast period. Probiotic bacteria and fermented dairy products decrease cholesterol absorption, which is aided by the consumption of fermented dairy foods.

Dairy products may benefit body mass and body fat, in part because of whey proteins, medium-chain fatty acids, calcium, and other nutrients. Most members of the health-conscious population, particularly members of generation Z and millennials, favor these. Consumer acceptance and subsequent consumption of functional dairy foods are influenced by several additional variables, including consumers' familiarity with innovative products and the functional ingredients used in their formulation, consumers' awareness of the factuality of health effects, and ultimately consumers' sensory evaluation of the developed functional dairy foods. Thus, driving segmental growth.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Fermented Dairy Ingredients Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Fermented Dairy Ingredients Market |

| Market Size in 2024 | USD 8.55 Billion |

| Market Forecast in 2034 | USD 18.98 Billion |

| Growth Rate | CAGR of 8.3% |

| Number of Pages | 196 |

| Key Companies Covered | E. I. du Pont de Nemours and Company, Koninklijke DSM, Cargill Incorporated, Chr. Hansen Holding, Novozymes, Kerry, Bioprox, Ingredion Incorporated, Archer Daniels Midland Company, Lake International Technologies, Arla Foods Ingredients Group, CSK Food Enrichment, DairyChem, Epi Ingredients, CP Ingredients, Socius Ingredients, Dairy Connection, The Tatua Cooperative Dairy Company, and Corbion among others., and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fermented Dairy Ingredients Market: Regional Analysis

The Fermented Dairy Ingredients market shows significant regional variation driven by diverse consumer preferences, industrial growth, and technological advancements. North America holds a strong position due to high demand for functional foods and growing awareness of gut health, supported by advanced dairy processing technologies. Europe is witnessing steady growth, driven by the increasing adoption of clean-label products and stringent food safety regulations, along with a strong focus on organic and natural dairy ingredients.

The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization, rising disposable incomes, and expanding dairy consumption in countries like China, India, and Japan. Latin America and the Middle East & Africa are also experiencing growth due to rising demand for flavored and probiotic dairy products, coupled with expanding dairy manufacturing capabilities. This regional diversity reflects the evolving trends and opportunities in the global fermented dairy ingredients market.

Fermented Dairy Ingredients Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the fermented dairy ingredients market on a global and regional basis.

The global fermented dairy ingredients market is dominated by players like:

- E. I. du Pont de Nemours and Company

- Koninklijke DSM

- Cargill Incorporated

- Chr. Hansen Holding

- Novozymes

- Kerry

- Bioprox

- Ingredion Incorporated

- Archer Daniels Midland Company

- Lake International Technologies

- Arla Foods Ingredients Group

- CSK Food Enrichment

- DairyChem

- Epi Ingredients

- CP Ingredients

- Socius Ingredients

- Dairy Connection

- The Tatua Cooperative Dairy Company

- and Corbion among others.

The global fermented dairy ingredients market is segmented as follows:

By Product Type

- Natural Cheese

- Flavored Milk

- Yoghurt

By Application

- Bakery

- Dairy

- Snacks

- Others

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fermented milk or dairy products, also called cultured dairy food products, are generally fermented with the help of lactic acid bacteria. This kind of fermentation method extends the shelf life of food products along with improving the products’ important aspects, such as digestibility, taste, etc.

The global fermented dairy ingredients market is expected to grow due to increasing consumer interest in gut health, clean-label dairy products, and growing demand for functional foods.

According to a study, the global fermented dairy ingredients market size was worth around USD 8.55 Billion in 2024 and is expected to reach USD 18.98 Billion by 2034.

The global fermented dairy ingredients market is expected to grow at a CAGR of 8.3% during the forecast period.

North America is expected to dominate the fermented dairy ingredients market over the forecast period.

Leading players in the global fermented dairy ingredients market include E. I. du Pont de Nemours and Company, Koninklijke DSM, Cargill Incorporated, Chr. Hansen Holding, Novozymes, Kerry, Bioprox, Ingredion Incorporated, Archer Daniels Midland Company, Lake International Technologies, Arla Foods Ingredients Group, CSK Food Enrichment, DairyChem, Epi Ingredients, CP Ingredients, Socius Ingredients, Dairy Connection, The Tatua Cooperative Dairy Company, and Corbion among others., among others.

The report explores crucial aspects of the fermented dairy ingredients market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed