Drilling Fluids Market Size, Growth, Global Trends, Forecast 2034

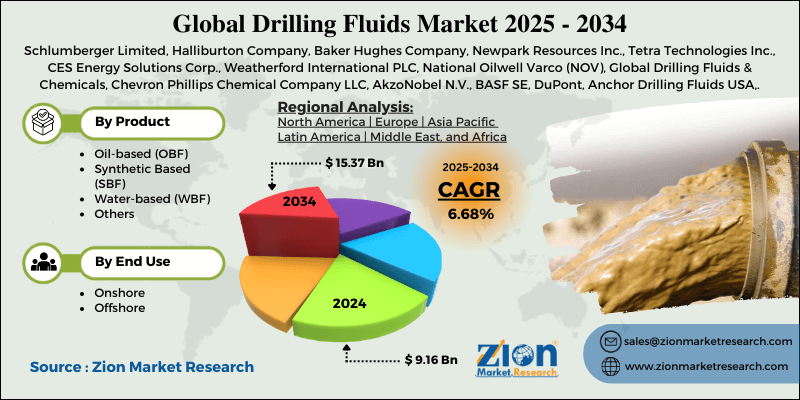

Drilling Fluids Market By Product Type (Oil-based [OBF], Synthetic-based [SBF], Water-based [WBF], and Others), By End-Use (Onshore, Offshore), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

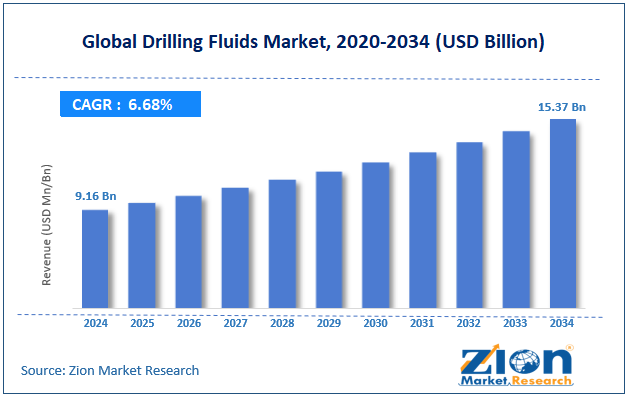

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.16 Billion | USD 15.37 Billion | 6.68% | 2024 |

Drilling Fluids Industry Perspective:

What will be the size of the global drilling fluids market during the forecast period?

The global drilling fluids market size was around USD 9.16 billion in 2024 and is projected to reach USD 15.37 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.68% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global drilling fluids market is estimated to grow annually at a CAGR of around 6.68% over the forecast period (2025-2034)

- In terms of revenue, the global drilling fluids market size was valued at around USD 9.16 billion in 2024 and is projected to reach USD 15.37 billion by 2034.

- The drilling fluids market is projected to grow significantly, driven by rising deepwater and unconventional drilling projects, increased demand for enhanced drilling efficiency, and expanding shale gas and tight oil extraction.

- Based on product, the Water-based (WBF) segment is expected to lead the market, while the Oil-based (OBF) segment is expected to grow considerably.

- Based on end use, the onshore segment is expected to lead the market, followed by the offshore segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by the Middle East & Africa.

Drilling Fluids Market: Overview

Drilling fluids, also known as drilling muds, are specially formulated liquids used during drilling operations to lubricate and cool the drilling bit, carry rock cuttings to the surface, and maintain wellbore stability. They precisely control formation pressures, avoid well collapse, and protect the reservoir from damage. The global drilling fluids market is projected to witness substantial growth driven by increasing worldwide energy demand, the growth of unconventional resources, and technological advancements in drilling fluids. Growing worldwide demand for oil and gas continues to fuel drilling and exploration activities. Developing economies and industrial growth need reliable power supplies. This ultimately augments the demand for drilling fluids in offshore and onshore projects.

Moreover, unconventional reservoirs such as tight gas, shale, and coal-bed methane require complex drilling operations. These wells require improved drilling fluids to maintain wellbore stability and pressure control. As unconventional drilling grows, fluid consumption increases remarkably. Furthermore, continuous advancements have enhanced fluid performance under pressure conditions and extreme temperatures. Advanced additives improve cuttings transport, lubrication, and formation protection. These advancements raise drilling efficiency and adoption rates.

Although drivers exist, the global market is challenged by factors such as volatility in crude oil prices, stringent environmental regulations, and high costs of advanced drilling fluids. Varying oil prices create uncertainty in drilling budgets. Operators usually cancel or delay drilling projects during price downturns. This directly reduces the demand for drilling fluids. Likewise, environmental restrictions lower the use of oil-based and specific synthetic fluids. Compliance raises operational costs and restricts fluid selection. These constraints affect industry growth in sensitive regions. High-performance drilling fluids comprise expensive additives and raw materials. Smaller operators may opt for low-cost alternatives, thereby limiting the adoption of premium fluid systems.

Even so, the global drilling fluids industry is well-positioned due to the development of environmentally friendly drilling fluids and the digitalization and real-time fluid monitoring. Demand for low-toxicity and biodegradable fluids is increasing. Green formulations help meet regulatory standards and sustainability objectives. This offers fresh growth opportunities for manufacturers. Additionally, advanced sensors and data analytics enhance fluid performance management. Real-time monitoring reduces risks and improves drilling efficacy, creating value-added service prospects.

Drilling Fluids Market: Dynamics

Growth Drivers

How is offshore and deepwater drilling boosting growth in the drilling fluids market?

Offshore, ultra-deepwater, and deepwater projects are increasing because of the depletion of onshore reserves. These wells require fluids that can withstand extreme pressure and temperature without compromising well integrity. Regions like West Africa, Brazil, and the Gulf of Mexico are leading in high-performance drilling activity. Advanced synthetic and specialty fluids are steadily adopted for complex subsurface conditions. The growth of deepwater operations creates continuous demand for advanced fluid solutions. This segment is becoming a major driver for the total drilling fluids market expansion.

How is the drilling fluids market driven by shale and unconventional resource development?

The development of gas, shale oil, and other unconventional resources continues to fuel fluid demand. Hydraulic fracturing and horizontal drilling need specialized fluids to promise cuttings transport and wellbore stability. Polymer-enhanced, water-based fluids dominate these applications. Variable geology and long laterals further increase fluid consumption and complexity. This trend is widespread in North America, with thousands of wells drilled each year using advanced fluid systems. Unconventional resource development remains a high-volume, consistent driver of the market.

Restraints

A limited-skilled workforce hinders market progress

The drilling fluids sector needs specialized expertise for deployment, formulation, and monitoring. The lack of skilled chemists and engineers may hamper field operations. Retaining talents and training adds operational costs for service providers. In offshore or remote regions, staffing challenges are higher. Lack of specialization may negatively impact the performance and efficiency of fluid systems. This limitation affects the overall scalability of improved drilling fluid solutions.

Opportunities

How does the demand for eco-friendly and biodegradable fluids create promising avenues for the drilling fluids industry growth?

Environmental sustainability offers an emerging sector for green drilling fluids. Corporate ESG commitments and regulations are augmenting the adoption of biodegradable water-based fluids. Companies can differentiate themselves by offering high-performance and low-toxicity solutions. Sensitive and offshore ecological regions mainly need eco-friendly products. This trend motivates investment in research and development for sustainable formulations. The market for environmentally responsible fluids is projected to grow, thereby propelling the drilling fluids industry.

Challenges

Competition from alternative technologies restricts the market growth

New drilling techniques or fluidless technologies may reduce dependency on conventional drilling fluids. Technologies like foam-based systems and underbalanced drilling offer alternatives. Fluid manufacturers should innovate to stay relevant. Adoption of substitutes may limit industry growth in some segments. Continuous investment in research and development is needed to maintain competitiveness. Emerging technologies pose a long- and medium-term challenge.

Drilling Fluids Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Drilling Fluids Market |

| Market Size in 2024 | USD 9.16 Billion |

| Market Forecast in 2034 | USD 15.37 Billion |

| Growth Rate | CAGR of 6.68% |

| Number of Pages | 215 |

| Key Companies Covered | Schlumberger Limited, Halliburton Company, Baker Hughes Company, Newpark Resources Inc., Tetra Technologies Inc., CES Energy Solutions Corp., Weatherford International PLC, National Oilwell Varco (NOV), Global Drilling Fluids & Chemicals, Chevron Phillips Chemical Company LLC, AkzoNobel N.V., BASF SE, DuPont, Anchor Drilling Fluids USA, Stellar Drilling Fluids LLC., and others. |

| Segments Covered | By Product, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Drilling Fluids Market: Segmentation

The global drilling fluids market is segmented based on product, end-use, and region.

Based on product, the global drilling fluids industry is divided into Oil-based (OBF), Synthetic-based (SBF), Water-based (WBF), and others. The water-based (WBF) segment accounts for nearly 59% of the market, driven by its wide applicability. They are widely used for offshore and onshore drilling operations because they are cost-effective, easier to dispose of than non-aqueous fluids, and environmentally acceptable. Their performance has also improved with additives that enhance wellbore stability and rheological control across different drilling environments.

On the other hand, the oil-based (OBF) segment captured nearly 30% of the total market share, owing to its superior performance in complex and deep wells. These fluids offer excellent thermal stability, lubrication, and shale inhibition, which are important for extended-reach and high-pressure/high-temperature drilling. Nonetheless, their use is moderated by higher costs and stricter environmental regulations than those for WBF systems.

Based on end-use, the global drilling fluids market is segmented into onshore and offshore. The onshore drilling segment holds a dominating share of the market, registering for 70% of the total market. Most oil and gas wells are drilled onshore, where water-based fluids are widely used due to simpler regulatory compliance and lower costs. The high volume of unconventional and conventional onshore wells promises sustained demand for drilling fluids.

Nonetheless, the offshore segment captures 35% of the total market. Despite less in number, offshore wells, mainly ultra-deepwater and deepwater, need high-performance fluids like oil-based and synthetic-based fluids to handle high pressures, complex well profiles, and temperatures.

Drilling Fluids Market: Regional Analysis

What gives North America a competitive edge in the global Drilling Fluids Market?

North America is likely to sustain its leadership in the drilling fluids market with a 5.2% CAGR, driven by the dominance of unconventional and shale drilling, advanced drilling technologies, robust rig infrastructure, and strong onshore and offshore exploration investment. North America dominates the global market, accounting for nearly 40% of the market share. This is backed by extensive shale and unconventional oil and gas production. Leading basins like the Permian and Bakken need high volumes of drilling fluids for hydraulic fracturing and horizontal drilling. This broader unconventional drilling activity promises sustained demand for advanced fluid systems.

Moreover, the region’s adoption of extended-reach wells, real-time fluid monitoring, and horizontal drilling increases the need for improved fluid performance. North America has the largest active rig fleet and a mature oilfield service network. These capabilities motivate investment in specialized drilling fluids and maintain industry dominance. Both offshore projects and onshore shale plays in the Canadian offshore and the Gulf of Mexico fields propel fluid consumption. Onshore drilling demands high volume, while offshore projects require high-performance, premium fluids. Combined exploration investments across different environments keep the region at the forefront of the market.

The Middle East & Africa continue to hold the second-highest share, with a 6.3% CAGR in the drilling fluids industry, owing to large conventional oil & gas reserves, active drilling, major offshore projects, deepwater exploration, and strategic investments and production expansion plans. The Middle East & Africa region holds the fastest-growing conventional oil and gas reserves, supporting year-round large-scale drilling activity. Economies like the UAE, Saudi Arabia, Kuwait, and Nigeria maintain large offshore and onshore drilling programs. This heavy drilling intensity fuels robust demand for specialized and basic drilling fluids in the region.

Moreover, offshore basins in West Africa and the Arabian Gulf account for a significant share of drilling fluid consumption. Deepwater and ultra-deepwater exploration in regions like the Gulf of Guinea requires high-performance fluid systems capable of managing complex well conditions. These offshore operations drive regional market share in advanced drilling fluids. Additionally, national oil companies and international operators in the region continue to invest in capacity expansion and long-term service contracts for drilling fluid providers. Hence, the Middle East & Africa remain a major growth market worldwide.

Drilling Fluids Market: Competitive Analysis

The leading players in the global drilling fluids market are:

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Newpark Resources Inc.

- Tetra Technologies Inc.

- CES Energy Solutions Corp.

- Weatherford International PLC

- National Oilwell Varco (NOV)

- Global Drilling Fluids & Chemicals

- Chevron Phillips Chemical Company LLC

- AkzoNobel N.V.

- BASF SE

- DuPont

- Anchor Drilling Fluids USA

- Stellar Drilling Fluids LLC.

Drilling Fluids Market: Key Market Trends

Growth of high‑performance and specialty fluids:

Demand for advanced drilling fluids capable of withstanding extreme conditions, such as deepwater drilling and high-pressure, high-temperature (HPHT) wells, is growing dramatically. Improved formulations with polymers, nanoparticles, and specialty additives enhance lubrication, wellbore stability, and thermal stability in complex environmental. This trend supports complex drilling programs and fuels innovation in performance-based and premium synthetic fluid systems.

Customized and recycled fluid practices:

Operators steadily seek customized fluid solutions tailored to specific well conditions, operational goals, and geology, leading to more tailored service models and formulations. Simultaneously, the reuse and recycling of drilling fluids through closed-loop systems and separation technologies are gaining prominence, lowering fluid procurement costs and reducing waste. These practices help enhance sustainability and cost-effectiveness in offshore and onshore drilling.

The global drilling fluids market is segmented as follows:

By Product

- Oil-based (OBF)

- Synthetic Based (SBF)

- Water-based (WBF)

- Others

By End-Use

- Onshore

- Offshore

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed