Disposable Protective Clothing Market Size and Forecast 2034

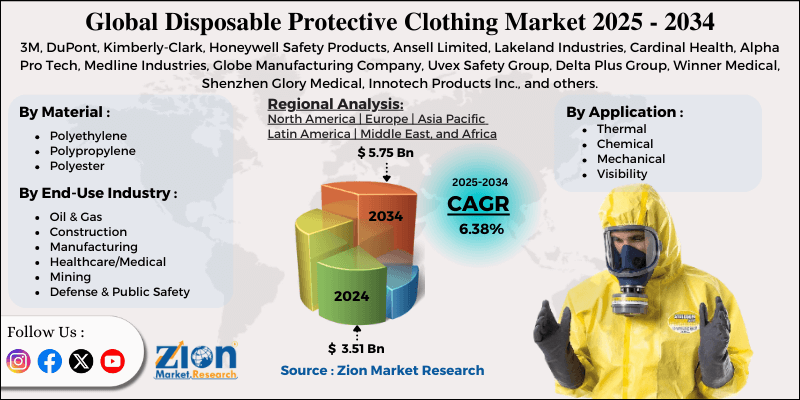

Disposable Protective Clothing Market By Material (Polyethylene, Polypropylene, Polyester, and Others), By Application (Thermal, Chemical, Mechanical, Biological/Radiation, Visibility, and Others), By End-Use Industry (Oil & Gas, Construction, Manufacturing, Healthcare/Medical, Mining, Defense & Public Safety, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

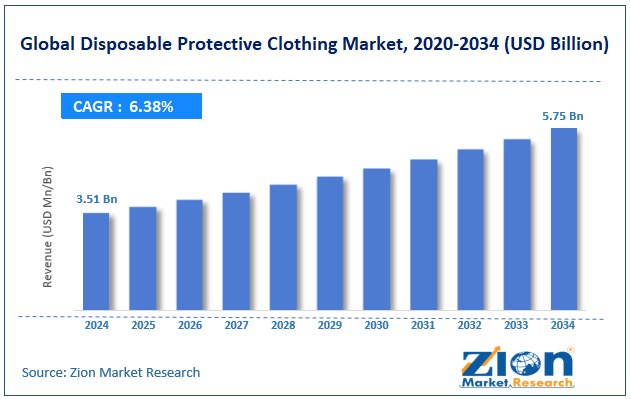

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.51 Billion | USD 5.75 Billion | 6.38% | 2024 |

Disposable Protective Clothing Industry Perspective:

What will be the size of the global disposable protective clothing market during the projected period?

The global disposable protective clothing market size was around USD 3.51 billion in 2024 and is projected to reach USD 5.75 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.38% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global disposable protective clothing market is estimated to grow annually at a CAGR of around 6.38% over the forecast period (2025-2034)

- In terms of revenue, the global disposable protective clothing market size was valued at around USD 3.51 billion in 2024 and is projected to reach USD 5.75 billion by 2034.

- The disposable protective clothing market is projected to grow significantly, driven by rising demand in the medical and healthcare sectors, increased awareness of infectious diseases, and expanding chemical manufacturing activities.

- Based on material, the polyethylene segment is expected to lead the market, while the polypropylene segment is expected to grow considerably.

- Based on application, the chemical segment is the dominating segment, while the thermal segment is projected to witness sizeable revenue over the forecast period.

- Based on end-use industry, the healthcare/medical segment is expected to lead the market, followed by the manufacturing segment.

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Disposable Protective Clothing Market: Overview

Disposable protective clothing is single-use apparel designed to protect workers and the environment from hazardous substances, biological agents, and contamination. Largely used in laboratories, healthcare, industrial, and food processing settings, these items include masks, gloves, shoe covers, gowns, and coveralls. The global disposable protective clothing market is poised for notable growth, driven by rising healthcare demand, stringent workplace safety regulations, and increasing infectious disease cases. The growth of clinics, hospitals, and diagnostic centers intensifies the need for disposable protective clothing. Infection prevention protocols need single-use garments to reduce cross-contamination. This impacts continuous demand from healthcare facilities worldwide.

Moreover, regulatory bodies and governments enforce stringent occupational safety standards in industries. Compliance with these regulations mandates the use of certified protective apparel. This drives sustained adoption in the manufacturing and industrial sectors. Furthermore, frequent pandemics and outbreaks increase the awareness of personal protection. Disposable clothing lowers transmission risks in high-exposure environments. Demand surges during public health emergencies and remains elevated afterward.

Nevertheless, the global market faces limitations due to factors such as the high cost of advanced products, environmental concerns, and fluctuations in raw material prices. Premium disposable clothing with greater protection levels is costly. Smaller businesses may find this cost challenging. This may restrict the adoption in cost-sensitive markets.

Moreover, single-use garments generate substantial industrial and medical waste. Environmental regulations and sustainability concerns create resistance. Pressure increases to lower disposable product use. Likewise, prices of non-woven fabrics and polymers are volatile. This impacts production costs and profit margins. Manufacturers experience pricing instability in competitive markets.

Still, the global disposable protective clothing industry benefits from several favorable factors, such as the development of eco-friendly materials, the adoption of smart protective clothing, and government emergency preparedness programs. Recyclable and biodegradable protective clothing addresses sustainability concerns. Advancement in green materials creates new product segments, attracting environmentally conscious buyers. The integration of sensors enables real-time monitoring of conditions and exposure. Smart features add value to disposable products, thus supporting premium industry segments. Additionally, governments are building strategic PPE stockpiles. Long-term contracts stabilize demand, ensuring steady revenue streams for manufacturers.

Disposable Protective Clothing Market: Dynamics

Growth Drivers

How is the disposable protective clothing market driven by the increased awareness of public health preparedness and emergency planning?

Worldwide health crises have raised awareness of the need to maintain a supply of disposable protective clothing for emergency readiness. Businesses now integrate PPE into contingency planning for industrial accidents, outbreaks, and biohazard events. Strategic stockpiling has intensified baseline demand as compared to pre-pandemic levels. Disposable gear is seen as important infrastructure for resilience. Preparedness initiatives promise a consistent, long-term demand for the disposable protective clothing market.

How are technological advancements and material innovation fueling the disposable protective clothing market?

Advancements in nonwovens, barrier laminates, and antimicrobial coatings have enhanced the protection, durability, and comfort of disposable clothing. New materials resist fluids, pathogens, and chemicals while being breathable and lightweight. Smart protective wear with sensors is developing in high-risk sectors, increasing performance benchmarks. Improved product features encourage broader adoption in industries. Technological improvements continue to differentiate products and drive replacement cycles.

Restraints

Competition from reusable protective clothing adversely impacts the market progress

Reusable protective garments offer long-term cost savings and low environmental impact, challenging disposable substitutes. Some businesses, mainly in non-critical applications, may prefer reusable PPE. This competition can slow the growth of disposable protective clothing in some industrial segments. Balancing performance with cost-effectiveness is vital. Industry players should innovate to retain preference for disposable options.

Opportunities

How does the integration of smart and functional technology present favorable prospects for the disposable protective clothing market?

The integration of temperature monitoring, sensors, and hazard detection into disposable protective clothing presents an urgent opportunity. Smart PPE can alert users to biological, thermal, or chemical threats, thereby increasing workplace safety. Industries such as oil and gas, chemical processing, and healthcare can benefit from real-time monitoring features. Technological advancement allows companies to command higher margins while improving product differentiation. Advanced functional PPE can become a growth propeller in high-risk applications, fueling the disposable protective clothing industry.

Challenges

Logistics and storage constraints restrict the market growth

Disposable protective clothing needs proper storage conditions to maintain functionality and sterility. Large-scale stockpiling can be challenging for businesses with restricted warehouse space. Transportation logistics, especially for bulk shipments, add operational challenges. Improper storage or delays may compromise product integrity, reducing confidence I adoption. Efficient logistics solutions are vital to overcome these operational challenges.

Disposable Protective Clothing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Disposable Protective Clothing Market |

| Market Size in 2024 | USD 3.51 Billion |

| Market Forecast in 2034 | USD 5.75 Billion |

| Growth Rate | CAGR of 6.38% |

| Number of Pages | 216 |

| Key Companies Covered | 3M, DuPont, Kimberly-Clark, Honeywell Safety Products, Ansell Limited, Lakeland Industries, Cardinal Health, Alpha Pro Tech, Medline Industries, Globe Manufacturing Company, Uvex Safety Group, Delta Plus Group, Winner Medical, Shenzhen Glory Medical, Innotech Products Inc., and others. |

| Segments Covered | By Material, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Disposable Protective Clothing Market: Segmentation

The global disposable protective clothing market is segmented based on material, application, end-use industry, and region.

Based on material, the global disposable protective clothing industry is divided into polyethylene, polypropylene, polyester, and others. The polyethylene segment accounts for nearly 45% of the total market share due to its broader use, strong chemical- and liquid-barrier properties, and cost-effectiveness in protective wear. Polyethylene usually registers the leading industry share among materials for disposable protective garments.

On the other hand, the polypropylene segment holds 35% of the market and is widely used for its breathable, lightweight, and cost-efficient features, primarily in nonwoven gowns, medical apparel, and coveralls, making it a significant material after polyethylene.

Based on application, the global disposable protective clothing market is segmented into thermal, chemical, mechanical, biological/radiation, visibility, and others. The chemical application accounts for 40% of the total market, as disposable garments are widely used to protect workers from hazardous chemicals and particulates in industries such as manufacturing, oil and gas, and healthcare. This elevated use, driven by strict safety requirements, makes chemical protective clothing the leading segment.

Conversely, the thermal protection segment leads with 25% of the market, majorly in markets where protection against flame, heat, and high temperatures is prioritized. Protective clothing for thermal hazards is vital in firefighting, metalworking, and heavy manufacturing industries.

Based on end-use industry, the global market is segmented into oil & gas, construction, manufacturing, healthcare/medical, mining, defense & public safety, and others. The healthcare/medical sector dominates with 45% market share, driven by stringent infection-control requirements across clinics, diagnostic labs, hospitals, and emergency services. Medical facilities and hospitals consistently need disposable gowns, masks, coveralls, and other garments to prevent cross-contamination and protect healthcare workers. This crucial and non-negotiable safety demand makes healthcare the leading end-use segment worldwide.

However, the manufacturing segment accounts for nearly 30% of the market, encompassing electronics, automotive, general manufacturing, and related sectors. Workers in this segment face particulate, mechanical, and chemical hazards, creating a strong demand for disposable protective clothing to promise workplace safety. Industrial expansion and increasing compliance with occupational safety regulations further drive adoption in manufacturing.

Disposable Protective Clothing Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Disposable Protective Clothing Market?

Asia Pacific is projected to maintain its dominant position with an 8-9% CAGR in the global disposable protective clothing market, driven by its leading regional market share, rapid industrialization and manufacturing growth, and expanding healthcare infrastructure. Asia Pacific registers the leading regional share in the market, outshining North America and Europe. This dominance is backed by significant adoption across the healthcare, industrial, and manufacturing sectors. The sheer scale of demand in India, China, and Southeast Asia sustains its leading rank.

The region’s fast-growing industrial base, including electronics, chemicals, food processing, and automotive fuels, has remarkable regional demand, indicating high factory and production line utilization. Moreover, Asia Pacific’s healthcare industry is growing, driven by rising hospital expenditure and infection control standards, resulting in increased use of disposable protective gowns and coveralls. Healthcare applications account for nearly 40% of demand in APAC.

North America maintains its position as the second-largest region, with a 6-7% CAGR in the global disposable protective clothing industry, driven by strong regional market share, well-developed healthcare infrastructure, and stringent safety regulations. North America captures a substantial share of the global market, accounting for 25-30% of industry revenue. This makes it the second-leading regional contributor after APAC. The region’s market size is substantial owing to broader adoption across the industrial and healthcare sectors.

Moreover, the region’s advanced healthcare systems fuel significant demand for disposable protective apparel in clinics, hospitals, and laboratories, backing infection control and safety. Approximately 90 percent of healthcare facilities adhere to stringent protective clothing protocols. This extensive compliance drives consistent consumption.

Additionally, regulatory bodies such as OSHA in the United States enforce stringent workplace safety standards that require the use of protective clothing in industries such as construction, chemical processing, and manufacturing. These regulations notably increase regional demand and promise substantial market penetration.

Disposable Protective Clothing Market: Competitive Analysis

The leading players in the global disposable protective clothing market are:

- 3M

- DuPont

- Kimberly-Clark

- Honeywell Safety Products

- Ansell Limited

- Lakeland Industries

- Cardinal Health

- Alpha Pro Tech

- Medline Industries

- Globe Manufacturing Company

- Uvex Safety Group

- Delta Plus Group

- Winner Medical

- Shenzhen Glory Medical

- Innotech Products Inc.

Disposable Protective Clothing Market: Key Market Trends

Technological innovation & advanced materials:

There is a significant inclination toward advanced fabrics, including lightweight nonwovens, breathable materials, multilayer laminates, and microporous films. These advancements enhance comfort, barrier performance, and durability, expanding use in industrial, healthcare, and cleanroom applications. Improved materials also support integration with smart features, such as sensors.

Broader adoption across non‑healthcare sectors:

Disposable protective clothing is no longer restricted to healthcare; cleanroom industries, manufacturing, food processing, and construction are also steadily adopting these products. Growing regulatory compliance and elevated awareness of worker safety are boosting the industry penetration. This diversification augments sustainable demand beyond traditional medical settings.

The global disposable protective clothing market is segmented as follows:

By Material

- Polyethylene

- Polypropylene

- Polyester

- Others

By Application

- Thermal

- Chemical

- Mechanical

- Biological/Radiation

- Visibility

- Others

By End-Use Industry

- Oil & Gas

- Construction

- Manufacturing

- Healthcare/Medical

- Mining

- Defense & Public Safety

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed