Dairy Ingredients Market Size, Share, Growth Report, 2034

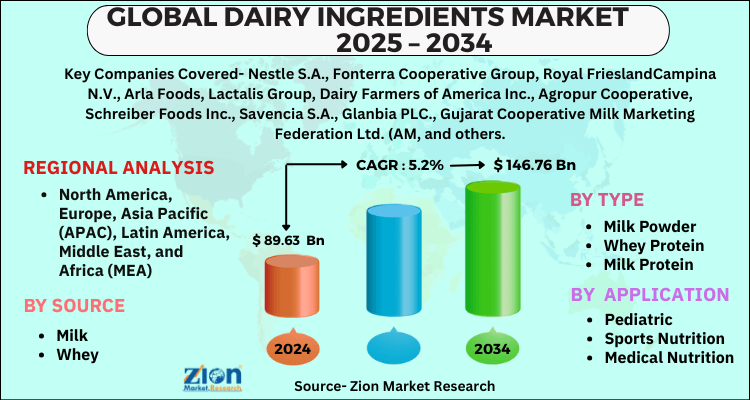

Dairy Ingredients Market - By Source (Milk and Whey), By Type (Milk Powder, Whey Protein, Milk Protein, Third-generation Ingredient, Casein, Buttermilk Powder, Whey Permeate, and Lactose), By Application (Pediatric, Sports Nutrition, Medical Nutrition, Functional Food, Bakery, Confectionery, Dairy, Animal Feed, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

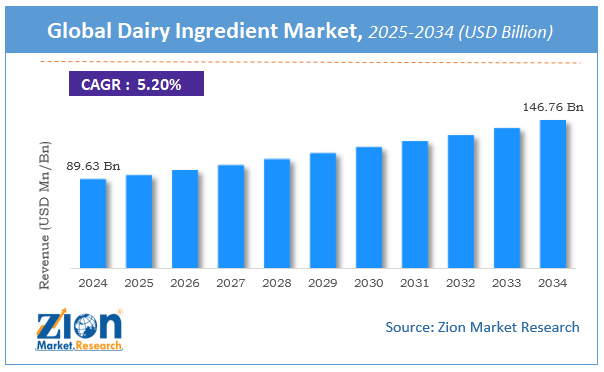

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 89.63 Billion | USD 146.76 Billion | 5.2% | 2024 |

Dairy Ingredient Market: Industry Perspective

The global dairy ingredient market size was worth around USD 89.63 Billion in 2024 and is predicted to grow to around USD 146.76 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.2% between 2025 and 2034.

The report analyzes the global dairy ingredient market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the dairy ingredient industry.

Dairy Ingredient Market: Overview

The dairy ingredients market is anticipated to see good growth over the forecast period owing to the rise in consumption of dairy ingredients and this is expected to be a major trend driving market potential over the forecast period. Increasing focus on health and fitness is also expected to boost the Dairy Ingredient market growth over the forecast period.

The rising population, increasing consumption of Dairy ingredients, and increasing demand for Dairy ingredients in multiple food sectors are other factors that will influence the Dairy Ingredient market potential in the long run. However, the increasing popularity of veganism and the presence of plant-based alternatives are expected to have a major restraining effect on the Dairy Ingredient market potential through the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global dairy ingredient market is estimated to grow annually at a CAGR of around 5.2% over the forecast period (2025-2034).

- Regarding revenue, the global dairy ingredient market size was valued at around USD 89.63 Billion in 2024 and is projected to reach USD 146.76 Billion by 2034.

- The dairy ingredient market is projected to grow at a significant rate due to increasing demand for functional dairy ingredients in food, infant nutrition, and sports nutrition.

- Based on Source, the Milk segment is expected to lead the global market.

- On the basis of Type, the Milk Powder segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Pediatric segment is projected to swipe the largest market share.

- Based on region, Europe is predicted to dominate the global market during the forecast period.

Dairy Ingredient Market: Growth Drivers

Increasing Health Awareness

The global population has become more aware of their health than ever before in the wake of the rising prevalence of chronic diseases and increasing popularity of preventive healthcare on a global scale and this is expected to drive the Dairy Ingredient market growth as dairy ingredients comprise some of the most common nutrition required for a healthy and balanced diet across the world. High demand for protein-based foods will be a major trend that will further bolster the Dairy Ingredient market potential over the forecast period.

Dairy Ingredient Market: Restraints

The emergence of Alternatives and veganism

Dairy Ingredients are mostly animal-derived but the vegetarian population has announced a war against these products and asking for cruelty-free products that are purely plat and this is expected to hamper the Dairy Ingredient market potential through 2028.

The increasing popularity of veganism is also expected to have a major hindering effect on the Dairy Ingredient market. Rising research and development for plant-based protein and increasing availability of plant-based products will also result in drop of sales for Dairy Ingredient through 2028.

Global Dairy Ingredient Market: Segmentation

The global dairy ingredient market is segmented based on source, type, application, and region.

Based on Source, the global dairy ingredient market is divided into milk and whey. The milk segment dominates the Dairy Ingredient Market, driven by its versatile applications in food, beverages, and nutritional formulations. However, the Whey segment is witnessing strong growth, fueled by rising demand for high-protein, functional, and sports nutrition products.

On the basis of Type, the global dairy ingredient market is bifurcated into milk powder, whey protein, milk protein, third-generation ingredients, casein, buttermilk powder, whey permeate, and lactose.

In terms of Application, the global dairy ingredient market is segmented into pediatric, sports nutrition, medical nutrition, functional food, bakery, confectionery, dairy, animal feed, and others. The bakery and confectionery segment is projected to hold a dominant outlook over the forecast period as the use of dairy ingredients in this application increases. Increasing use of skimmed milk and dried milk in this application is expected to propel the Dairy Ingredient market growth over the forecast period.

Dairy Ingredient Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dairy Ingredient Market |

| Market Size in 2024 | USD 89.63 Billion |

| Market Forecast in 2034 | USD 146.76 Billion |

| Growth Rate | CAGR of 5.2% |

| Number of Pages | 190 |

| Key Companies Covered | Nestle S.A., Fonterra Cooperative Group, Royal FrieslandCampina N.V., Arla Foods, Lactalis Group, Dairy Farmers of America Inc., Agropur Cooperative, Schreiber Foods Inc., Savencia S.A., Glanbia PLC., Gujarat Cooperative Milk Marketing Federation Ltd. (AM, and others. |

| Segments Covered | By Source, By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dairy Ingredient Market: Regional Landscape

The market for Dairy ingredients in the Asia Pacific region is projected to exhibit growth at the fastest CAGR through 2028. The increasing consumption of dairy products by the rising population in nations of China, India, and Indonesia is expected to be a major factor propelling the Dairy Ingredient market growth in this region. Increasing health awareness and the rising availability of Dairy ingredients are also expected to shape the market potential in this region. The increasing popularity of fitness trends and rising demand for protein and protein-based foods are also expected to be prominent trends driving the Dairy Ingredient market growth in this region.

Europe and North America are also expected to see high demand for Dairy Ingredients and Dairy Ingredient manufacturers are projected to have lucrative opportunities in these regions over the forecast period. However, rising veganism in these regions is expected to restrain the market from growing at its full potential.

Recent Developments

- In January 2021 – Fonterra and Royal DSM major firms operating in the food sciences industry announced their efforts to team up and reduce greenhouse gas emissions from their facilities in New Zealand.

Dairy Ingredient Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the dairy ingredient market on a global and regional basis.

Some of the main competitors dominating the global dairy ingredient market include –

- Nestle S.A.

- Fonterra Cooperative Group

- Royal FrieslandCampina N.V.

- Arla Foods

- Lactalis Group

- Dairy Farmers of America Inc.

- Agropur Cooperative

- Schreiber Foods Inc.

- Savencia S.A.

- Glanbia PLC.

- Gujarat Cooperative Milk Marketing Federation Ltd. (AMUL)

- Meiji Holdings Co., Ltd.

- Mengniu Dairy Co., Ltd.

- Megmilk Snow Brand Co., Ltd.

- Yili China

- Saputo Inc.

- Kraft Heinz Company

- Agropur Inc

- Morinaga Milk Co., Ltd.

The global dairy ingredient market is segmented as follows;

By Source

- Milk

- Whey

By Type

- Milk Powder

- Whey Protein

- Milk Protein

- Third-Generation Ingredient

- Casein

- Buttermilk Powder

- Whey Permeate

- Lactose

By Application

- Pediatric

- Sports Nutrition

- Medical Nutrition

- Functional Food

- Bakery

- Confectionery

- Dairy

- Animal Feed

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

List of Contents

Dairy Ingredient Industry PerspectiveDairy Ingredient OverviewKey InsightsDairy Ingredient Growth DriversDairy Ingredient RestraintsGlobal Dairy Ingredient SegmentationDairy Ingredient Report Scope Dairy Ingredient Market:Regional LandscapeRecent DevelopmentsDairy Ingredient Competitive LandscapeRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed