Clot Management Devices Market Size, Share, Trends, Growth & Forecast 2034

Clot Management Devices Market By Product (Neurovascular Embolectomy Devices, Embolectomy Balloon Catheters, Percutaneous Thrombectomy Devices, Catheter-Directed Thrombolysis [CDT] Devices, Inferior vena cava filters [IVCF]), By Percutaneous Thrombectomy Devices Type (Aspiration Thrombectomy Devices, Percutaneous Mechanical Thrombectomy Devices), By End-Use (Diagnostic Centers, Hospitals), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

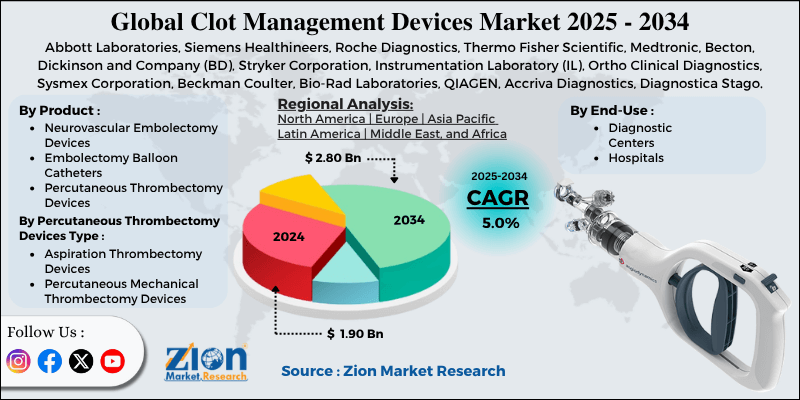

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.90 Billion | USD 2.80 Billion | 5.0% | 2024 |

Clot Management Devices Industry Perspective:

The global clot management devices market size was approximately USD 1.90 billion in 2024 and is projected to reach around USD 2.80 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global clot management devices market is estimated to grow annually at a CAGR of around 5% over the forecast period (2025-2034)

- In terms of revenue, the global clot management devices market size was valued at around USD 1.90 billion in 2024 and is projected to reach USD 2.80 billion by 2034.

- The clot management devices market is projected to grow significantly due to the increasing prevalence of thrombosis and stroke, technological advancements in clot management devices, and the expansion of healthcare infrastructure in emerging markets.

- Based on product, the percutaneous thrombectomy devices segment is expected to lead the market, while the neurovascular embolectomy devices segment is expected to grow considerably.

- Based on percutaneous thrombectomy devices type, the aspiration thrombectomy devices segment is the dominating segment. In contrast, the percutaneous mechanical thrombectomy devices segment is projected to witness sizeable revenue over the forecast period.

- Based on end-use, the hospitals segment is expected to lead the market, followed by the diagnostic centers segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Clot Management Devices Market: Overview

Clot management devices are specialized medical instruments designed to detect, prevent, or treat blood clots in the human body. These devices comprise infusion catheters, thrombectomy systems, clot detection technologies, and clot retrieval devices, which are widely used in the treatment of conditions such as pulmonary embolism, stroke, and deep vein thrombosis. The global clot management devices market is projected to experience substantial growth, driven by the aging population, technological advancements, and an increase in minimally invasive procedures. The global geriatric population is experiencing rapid growth. The elderly population is more prone to blood clots because of comorbid conditions and reduced mobility. This demographic trend is driving the demand for advanced clot management solutions that offer minimally invasive and efficient treatment options.

Moreover, advancements in clot management devices, such as catheter-based thrombectomy systems, real-time imaging guidance, and robotic-assisted clot retrieval, enhance treatment safety and efficiency. These technological advancements are encouraging clinics and hospitals to adopt newer devices. Furthermore, minimally invasive procedures decrease hospital stays, enhance recovery time, and lower complication rates. The trend towards catheter-based and percutaneous interventions is fueling the adoption of clot management devices over conventional surgical techniques.

Although drivers exist, the global market is challenged by factors such as the scarcity of skilled professionals and the risk of complications. Operating clot management devices requires trained interventional radiologists and cardiologists; the lack of qualified experts in emerging regions limits the use and adoption of these devices. Likewise, despite innovations, clot management procedures carry risks such as infection, bleeding, and vascular injury, which may create hesitation among patients and healthcare providers.

Even so, the global clot management devices industry is well-positioned due to the integration with imaging and AI technologies, the development of home-based and portable devices, and partnerships and collaborations. Advanced imaging and AI-based diagnostics can enhance clot detection and procedural accuracy, presenting opportunities for device manufacturers to develop more intelligent solutions. Portable clot management solutions, home-use devices, and wearable monitoring systems can increase access for patients outside hospitals and clinics. Additionally, associations between hospitals, device manufacturers, and research institutions can fuel innovations, accelerate product commercialization, and reduce R&D costs.

Clot Management Devices Market Dynamics

Growth Drivers

Rising cases of lifestyle-related disorders noticeably fuel the market growth

Smoking, obesity, poor diet, and sedentary lifestyle raise the risk of blood clots and associated cardiovascular conditions. Nearly 42% of individuals in the United States are obese, which is a key risk factor for venous thromboembolism, fueling the need for preventive screening. Hospitals are prioritizing the monitoring of high-risk patients with advanced clot management devices. Associations between hospitals and tech companies to develop coagulation monitors are augmenting the industry adoption.

How is the growing awareness of preventive healthcare and early diagnosis driving the growth of the clot management devices market?

Awareness of preventive care and early detection of blood clots is impacting device adoption. A 2024 United States survey presented that 68% of individuals now understand risk factors of thrombosis, up from 54% in 2020. Initiatives and campaigns, such as the European Heart Network's 'Know Your Clot Risk' program, have enhanced awareness and driven growth in the clot management devices market.

Restraints

How do limited reimbursement policies impact the clot management devices market?

Reimbursement coverage for clot management procedures and devices varies broadly between regions, restricting patient access. In several Latin American markets and economies, like India, many coagulation tests are out-of-pocket expenditures, limiting demand. A 2023 survey reported that only 45% of private insurance plans in the developing regions encompass advanced coagulation devices. Without standardized reimbursement policies, hospitals are deterred from investing in expensive equipment. Recent updates indicate that some U.S. insurance providers are limiting coverage for novel wearable coagulation monitoring devices due to concerns about pricing.

Opportunities

How is the clot management devices market favorably impacted by the increasing point-of-care testing and home healthcare?

The growing preference for home-based healthcare and decentralized diagnostics is creating prospects for portable coagulation devices. Patients with chronic conditions like atrial fibrillation benefit from POC monitoring, which decreases hospital visits. A 2024 report predicts that the global POC coagulation devices market will reach $1.1 billion by 2030. Wearable devices that continuously monitor clotting parameters are gaining prominence. Latest product introductions, such as Abbott's home-use coagulation monitor in 2025, demonstrate the growing segment of the clot management devices industry.

Challenges

Supply chain disruptions and dependence on raw materials limit the market growth

Clot management devices rely on specialized reagents, sensors, and electronics, which are susceptible to supply chain vulnerabilities. Worldwide chip shortages and delays in reagent supply have previously disrupted production timelines. According to reports (2023), nearly 20% of device manufacturers faced delays due to shortages of raw materials. Geopolitical stresses and logistical barriers intensify these risks. Companies are increasingly diversifying their suppliers to mitigate production interruptions.

Clot Management Devices Market: Segmentation

The global clot management devices market is segmented based on product, percutaneous thrombectomy device type, end-use, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on product, the global clot management devices industry is divided into neurovascular embolectomy devices, embolectomy balloon catheters, percutaneous thrombectomy devices, catheter-directed thrombolysis (CDT) devices, and inferior vena cava filters (IVCF). The percutaneous thrombectomy devices segment registered a significant share due to the growing cases of cardiovascular disorders worldwide. These devices are minimally invasive tools designed to remove blood clots from veins and arteries mechanically. They are broadly used for treating conditions like acute ischemic stroke, pulmonary embolism, and deep vein thrombosis. Their high efficiency, low complication rates, and shorter recovery times increase their demand among clinicians.

Based on percutaneous thrombectomy devices type, the global clot management devices market is segmented into aspiration thrombectomy devices and percutaneous mechanical thrombectomy devices. The aspiration thrombectomy devices segment dominated the global market due to extensive clinical adoption. These devices work by suctioning blood clots directly from veins and arteries, providing speedy reperfusion in conditions such as DVT and acute ischemic stroke. Their speed, simplicity, and efficiency make them ideal for emergency interventions. Stroke centers and hospitals favor these devices due to their shorter operation time and lower procedural complexity.

Based on end-use, the global market is segmented into diagnostic centers and hospitals. The hospitals segment holds leadership because of the availability of proficient interventional cardiologists, emergency care facilities, and advanced imaging systems. They handle acute cases like DVT, pulmonary embolism, and stroke that need immediate intervention. The high patient volume and capability to perform complex procedures make hospitals the leading category, thus the segmental dominance.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Clot Management Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Clot Management Devices Market |

| Market Size in 2024 | USD 1.90 Billion |

| Market Forecast in 2034 | USD 2.80 Billion |

| Growth Rate | CAGR of 5.0% |

| Number of Pages | 217 |

| Key Companies Covered | Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Thermo Fisher Scientific, Medtronic, Becton, Dickinson and Company (BD), Stryker Corporation, Instrumentation Laboratory (IL), Ortho Clinical Diagnostics, Sysmex Corporation, Beckman Coulter, Bio-Rad Laboratories, QIAGEN, Accriva Diagnostics, Diagnostica Stago, and others. |

| Segments Covered | By Product, By Percutaneous Thrombectomy Devices Type, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Clot Management Devices Market: Regional Analysis

Why does North America hold a dominant position in the global Clot Management Devices Market?

North America is likely to sustain its leadership in the clot management devices market due to its advanced healthcare infrastructure, high incidence of cardiovascular diseases, technological improvements, and innovation. North America boasts well-established healthcare systems worldwide, featuring highly equipped hospitals and specialized cardiovascular and stroke centers. The presence of cutting-edge interventional and imaging facilities allows broader adoption of clot management devices. According to a 2024 report, nearly 85% of leading hospitals in the United States have access to neurovascular intervention and mechanical thrombectomy capabilities.

Moreover, the region holds a significant burden of cardiovascular disorders, comprising deep vein thrombosis, stroke, and pulmonary embolism. According to the American Heart Association, approximately 121 million adults in the United States have at least one form of heart-related condition, fueling the demand for clot management solutions. This high prevalence promises constant use and adoption of advanced clot removal and prevention solutions.

Additionally, the region is a leading hub for medical device advancements, especially in percutaneous thrombectomy and minimally invasive technologies. Constant research and development result in advanced devices with higher efficiency, safety, and procedural efficacy. Several novel neurovascular embolectomy and aspiration thrombectomy systems are initially introduced in the region, driving local industry growth before global expansion.

Europe continues to hold the second-highest share in the clot management devices industry, primarily due to its well-established healthcare infrastructure, growing incidence of cardiovascular diseases, and increasing prevalence of lifestyle factors. Europe boasts a robust healthcare system, particularly in economies such as France, Germany, and the United Kingdom, offering broader access to specialized cardiovascular centers and advanced hospitals. Several hospitals are equipped with high-class imaging systems and interventional packages essential for clot management procedures. According to a 2024 report, more than 70% of major hospitals in Western Europe are equipped to perform neurovascular interventions and mechanical thrombectomy.

Furthermore, the region registers a significant volume of thrombotic disorders like deep vein thrombosis, stroke, and pulmonary embolism. According to the European Society of Cardiology, cardiovascular disease causes more than 3.9 million deaths every year in Europe, accounting for 45% of total deaths. This high disease burden produces continuous demand for advanced clot management devices.

Additionally, Europe has the highest proportion of geriatric populations worldwide, with more than 20% of its residents aged 65 and older in 2025. Sedentary lifestyles and age-related conditions raise the risk of thrombotic events, propelling device adoption. Governments are also focusing on elderly care programs, raising hospital readiness to invest in advanced thrombectomy and clot management solutions.

Clot Management Devices Market: Competitive Analysis

The leading players in the global clot management devices market are:

- Abbott Laboratories

- Siemens Healthineers

- Roche Diagnostics

- Thermo Fisher Scientific

- Medtronic

- Becton

- Dickinson and Company (BD)

- Stryker Corporation

- Instrumentation Laboratory (IL)

- Ortho Clinical Diagnostics

- Sysmex Corporation

- Beckman Coulter

- Bio-Rad Laboratories

- QIAGEN

- Accriva Diagnostics

- Diagnostica Stago

Clot Management Devices Market: Key Market Trends

Integration of AI and advanced imaging:

Advanced imaging tools and artificial intelligence are integrated into clot management workflows for rapid diagnostics and precise device navigation. AI algorithms help in detecting clot size, location, and vessel occlusion in real-time. This trend enhances success rates, procedural efficacy, and patient outcomes, fueling adoption in key stroke centers and hospitals.

Development of home-based and portable devices:

There is a growing demand for home-based and portable monitoring solutions to facilitate the early detection of blood clots. Remote monitoring devices and wearable sensors help high-risk patients manage thrombotic conditions outside hospital settings. This trend signifies a shift towards preventive care and continuous patient monitoring, thereby expanding the global market.

The global clot management devices market is segmented as follows:

By Product

- Neurovascular Embolectomy Devices

- Embolectomy Balloon Catheters

- Percutaneous Thrombectomy Devices

- Catheter-Directed Thrombolysis (CDT) Devices

- Inferior vena cava filters (IVCF)

By Percutaneous Thrombectomy Devices Type

- Aspiration Thrombectomy Devices

- Percutaneous Mechanical Thrombectomy Devices

By End-Use

- Diagnostic Centers

- Hospitals

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Clot management devices are specialized medical instruments designed to detect, prevent, or treat blood clots in the human body. These devices comprise infusion catheters, thrombectomy systems, clot detection technologies, and clot retrieval devices, which are widely used in the treatment of conditions such as pulmonary embolism, stroke, and deep vein thrombosis.

The global clot management devices market is projected to grow due to the increasing prevalence of cardiovascular diseases, growing awareness about early diagnosis and treatment, and the rising number of hospital admissions for clot-related conditions.

According to study, the global clot management devices market size was worth around USD 1.90 billion in 2024 and is predicted to grow to around USD 2.80 billion by 2034.

The CAGR value of the clot management devices market is expected to be approximately 5% from 2025 to 2034.

Pricing in the clot management devices market is gradually increasing due to the adoption of premium devices, technological advancements, and rising manufacturing costs.

North America is expected to lead the global clot management devices market during the forecast period.

The United States is a significant contributor to the global clot management devices market, mainly due to its high incidence of cardiovascular diseases and advanced healthcare infrastructure.

The key players profiled in the global clot management devices market include Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Thermo Fisher Scientific, Medtronic, Becton, Dickinson and Company (BD), Stryker Corporation, Instrumentation Laboratory (IL), Ortho Clinical Diagnostics, Sysmex Corporation, Beckman Coulter, Bio-Rad Laboratories, QIAGEN, Accriva Diagnostics, and Diagnostica Stago.

What strategies should stakeholders adopt to stay competitive in the clot management devices market?

Stakeholders should focus on partnerships, innovation, regulatory compliance, geographic expansion, and digital integration to remain competitive in the clot management devices market.

The report examines key aspects of the clot management devices market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed