Butyl Acrylate Market Size, Share, Trends, Growth & Forecast 2034

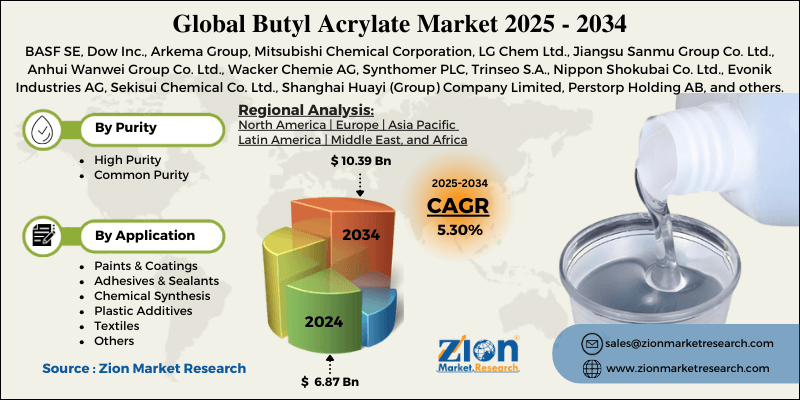

Butyl Acrylate Market By Purity (High Purity, Common Purity), By Application (Paints & Coatings, Adhesives & Sealants, Chemical Synthesis, Plastic Additives, Textiles, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

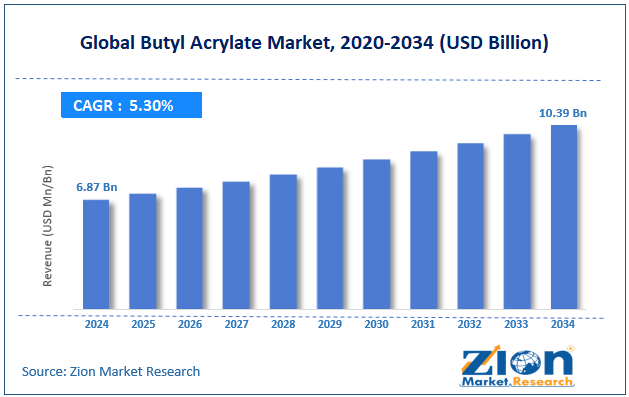

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.87 Billion | USD 10.39 Billion | 5.30% | 2024 |

Butyl Acrylate Industry Perspective:

The global butyl acrylate market size was approximately USD 6.87 billion in 2024 and is projected to reach around USD 10.39 billion by 2034, with a compound annual growth rate (CAGR) of approximately 5.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global butyl acrylate market is estimated to grow annually at a CAGR of around 5.30% over the forecast period (2025-2034)

- In terms of revenue, the global butyl acrylate market size was valued at around USD 6.87 billion in 2024 and is projected to reach USD 10.39 billion by 2034.

- The butyl acrylate market is projected to grow significantly due to the rise in adhesives and sealants applications, the growth of water-based polymer production, and the increasing infrastructure and construction activities.

- Based on purity, the high-purity segment is expected to lead the market, while the common-purity segment is expected to grow considerably.

- Based on application, the paints & coatings segment is the dominant segment, while the adhesives & sealants segment is projected to witness sizable revenue growth over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Butyl Acrylate Market: Overview

Butyl acrylate is a versatile chemical compound primarily used as a monomer in the production of resins and acrylic polymers. It offers optimal flexibility, adhesion, and water resistance, thereby increasing its significance in applications such as adhesives, coatings, textiles, and paints. The global butyl acrylate market is projected to experience substantial growth, driven by the expansion of the sealants and adhesives sector, the development of the automotive industry, and the increasing demand from the textile sector. The sealants and adhesives industry is growing due to the rise in packaging, automotive, and construction sectors. BA-based adhesives offer optimal bonding strength and flexibility, fueling their adoption in industrial applications.

Moreover, BA derivatives are used in automotive adhesives and coatings for vehicle exteriors and interiors. With worldwide automotive production anticipated to reach 95 million by 2027, BA demand is surging to meet specialized polymer and coating requirements. Butyl acrylate is used in textile finishing to enhance the durability and flexibility of fabrics. The APAC region, particularly China and India, has experienced a 6-7% CAGR in textile production, resulting in increased consumption of butyl acrylate.

Although drivers exist, the global market is challenged by factors like varying prices of raw materials, health and environmental concerns, and high production costs. The production of butyl acrylate relies on acrylic acid and propylene, whose prices are subject to fluctuations. Raw material price variations impact profit margins and limit industry growth. BA is categorized as a volatile organic compound with potential health risks. Stringent norms in Europe and North America regarding VOC emissions restrict its use in a few applications. Additionally, the energy-intensive polymerization process raises BA production costs, decreasing its competitiveness against alternative monomers in specific applications.

Even so, the global butyl acrylate industry is well-positioned due to the rise in low-VOC and environmentally friendly products, growth in automotive coatings, and increasing demand in the packaging industry. The development of eco-friendly butyl acrylate derivatives can help manufacturers meet ecological regulations and attract sustainability-conscious users. Advanced BA-based polymers for protective coatings and paint offer higher growth opportunities, mainly with EV adoption. BA-based polymers are primarily used in specialty and flexible packaging, offering opportunities associated with food packaging trends and e-commerce growth.

Butyl Acrylate Market Dynamics

Growth Drivers

How is surging demand in the packaging industry driving growth in the butyl acrylate market?

The packaging industry, especially flexible packaging, is a rapidly progressing application domain for butyl acrylate-based coatings and adhesives. With the global packaging industry anticipated to reach $1.3 trillion by 2028, demand for durable, lightweight, and recyclable packaging materials is expected to skyrocket. The food packaging, e-commerce, and pharmaceutical sectors largely depend on butyl acrylate for optimal sealing and adhesion performance.

Sustainability trends, such as the use of compostable and recyclable packaging, further encourage the adoption of acrylic-based and water-based adhesives. As packaging continues to evolve with eco-friendly and smart advancements, demand for butyl acrylate is expected to surge in line with the growing modernization of the industry.

The rapid growth of waterborne acrylic polymers considerably fuels the market growth

Waterborne acrylic emulsions, derived from butyl acrylate, are gaining traction due to their eco-compliance and low VOC emissions. The waterborne polymer sector reached $16 billion in 2024 and is anticipated to progress at a 6% CAGR by 2030, according to reports. Recent advancements comprise high-performance butyl acrylate emulsions that offer enhanced gloss retention and weather resistance for automotive and construction applications. Government regulations worldwide, such as the U.S. EPA and EU REACH, encourage manufacturers to adopt environmentally friendly alternatives. This environmental shift is a key driver of the rising demand for butyl acrylate, influencing the global butyl acrylate market.

Restraints

How are health and safety concerns restraining the butyl acrylate market's progress?

Butyl acrylate is a hazardous chemical with irritant and flammable properties, posing risks to the environment and workers. Exposure can cause eye, skin, and respiratory irritation, requiring stringent safety measures in storage and handling. According to Occupational Safety Reports, more than 120 minor chemical incidents in acrylic-based plants were recorded worldwide in the previous year.

Recent news underscored stringent safety audits at many Asian chemical plants, amplifying operational risks. These safety and health concerns restrict the use and slow the adoption of technology in small-scale industries, thereby limiting the industry's growth.

Opportunities

How does innovation in acrylic emulsions for textiles create promising avenues for the growth of the butyl acrylate industry?

BA is primarily used in elastic, soft-touch, and durable textile finishes. The worldwide technical textile industry is estimated to be worth $212 billion in 2024, with an anticipated 5.2% CAGR, driving the expansion of the BA-based polymers sector. Recent news highlights European textile manufacturers' integration of BA-based eco-friendly coatings in sustainable fabrics.

Advancements in stretchable and washable fabrics for industrial applications and sportswear offer additional growth prospects. This trend enables BA producers to diversify their applications beyond customary paints and adhesives, affecting the butyl acrylate industry.

Challenges

Trade uncertainties and economic slowdowns limit the market growth

Worldwide construction and industrial slowdowns impact BA consumption, mainly in price-sensitive regions. According to the World Bank's 2025 report, a 2.8% slowdown was observed in global industrial production. Recent news on trade tensions between the United States and China underscored potential export limitations on chemical intermediates. Reduced demand from the construction, textile, and automotive sectors during slowdowns restricts the BA market's expansion. Producers face challenges in balancing production capacity with fluctuating global demand.

Butyl Acrylate Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Butyl Acrylate Market |

| Market Size in 2024 | USD 6.87 Billion |

| Market Forecast in 2034 | USD 10.39 Billion |

| Growth Rate | CAGR of 5.30% |

| Number of Pages | 216 |

| Key Companies Covered | BASF SE, Dow Inc., Arkema Group, Mitsubishi Chemical Corporation, LG Chem Ltd., Jiangsu Sanmu Group Co. Ltd., Anhui Wanwei Group Co. Ltd., Wacker Chemie AG, Synthomer PLC, Trinseo S.A., Nippon Shokubai Co. Ltd., Evonik Industries AG, Sekisui Chemical Co. Ltd., Shanghai Huayi (Group) Company Limited, Perstorp Holding AB, and others. |

| Segments Covered | By Purity, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Butyl Acrylate Market: Segmentation

The global butyl acrylate market is segmented based on purity, application, and region.

Based on purity, the global butyl acrylate industry is divided into high-purity and common-purity. The high-purity segment holds a leadership position in the market compared to the common-purity segment. High-purity BA is primarily used in specialized applications, such as adhesives, coatings, and electronics, where stability and performance are crucial. Stringent quality requirements in established economies such as Europe and North America fuel its demand. Manufacturers emphasizing high-purity production benefit from higher margins due to their specialized applications and limited substitutes.

On the other hand, the common purity segment holds a second-leading share in the market. Standard purity BA is broadly used in general-purpose paints, polymers, and textiles, where ultra-high purity is not needed. Its broad applicability and affordability make it popular in developing markets, especially in the APAC region, where construction and industrial activities are rapidly growing. The segment's steady demand promises continuous consumption and production worldwide.

Based on application, the global butyl acrylate market is segmented into paints & coatings, adhesives & sealants, chemical synthesis, plastic additives, textiles, and others. The paints & coatings segment registered a higher market share of the adhesives & sealants segment. Butyl acrylate is a vital monomer in acrylic-based paints and coatings, offering optimal adhesion, weather resistance, and flexibility. The demand is driven by automotive, construction, and industrial projects worldwide, particularly in Europe and North America. Its high consumption in protective and decorative coatings promises that the segment consistently rules the industry.

Conversely, the adhesives & sealants segment holds a second rank since BA-based adhesives offer enhanced durability, bonding strength, and flexibility, making them suitable for automotive, construction, and packaging applications. Growth in these end-use sectors, mainly in the APAC region, supports the rising demand. The segment benefits from butyl acrylate's ability to improve product performance while meeting water resistance and strength standards.

Butyl Acrylate Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Butyl Acrylate Market?

The Asia Pacific is likely to sustain its leadership in the butyl acrylate market due to rapid urbanization and industrialization, the growth of the paints and coatings industry, and the expansion of adhesives & sealants applications. The Asia Pacific, particularly India and China, has experienced significant urban growth and industrialization. The automotive and construction industries are growing at a 6-7% CAGR, fueling elevated demand for BA-based adhesives and coatings. This speedy industrial development positions the region as the leading consumer of BA worldwide. The region's paints and coatings industry is progressing, with China alone registering more than 30% of the worldwide architectural coating production. BA is a vital raw material for acrylic coatings because of its durability and flexibility. Growing demand from commercial and infrastructure projects propels the industry dominance in the Asia Pacific.

Furthermore, the consumption of sealants and adhesives is rising in APAC, fueled by the packaging, construction, and automotive industries. BA-based adhesives offer superior water resistance and bonding, meeting industrial standards. The growing manufacturing base in nations such as South Korea, Japan, and India drives BA adoption in these areas.

North America continues to hold the second-highest share in the butyl acrylate industry, owing to its well-developed paints & coatings sector, the primary automotive sector, and high-quality product standards. North America has a well-developed paints & coatings industry, registering more than 25% of the regional BA consumption. Butyl acrylate is a crucial component in acrylic coatings for commercial, residential, and industrial applications. Steady renovation and construction activities in Canada and the United States sustain robust demand for BA-based products.

North America's automotive sector is modernized, with BA used in sealants, adhesives, and protective coatings for automobiles. This contributes to the regional consistent rank as a key BA consumer. North American industries demand high-purity butyl acrylate for specialty coatings, industrial applications, and adhesives. Manufacturers focus on producing high-performance BA to meet quality and regulatory standards. This emphasis on premium applications fuels steady growth, despite the region's smaller population compared to the APAC region.

Butyl Acrylate Market: Competitive Analysis

The leading players in the global butyl acrylate market are:

- BASF SE

- Dow Inc.

- Arkema Group

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- Jiangsu Sanmu Group Co. Ltd.

- Anhui Wanwei Group Co. Ltd.

- Wacker Chemie AG

- Synthomer PLC

- Trinseo S.A.

- Nippon Shokubai Co. Ltd.

- Evonik Industries AG

- Sekisui Chemical Co. Ltd.

- Shanghai Huayi (Group) Company Limited

- Perstorp Holding AB

Butyl Acrylate Market: Key Market Trends

Growth in eco- and water-friendly products:

There is a surging demand for low-VOC and water-based BA formulations in adhesives and coatings. Sustainability goals and environmental regulations are fueling this shift. Companies are actively investing in greener BA solutions to meet consumer preferences and regulatory requirements.

Mounting demand from the construction and automotive sectors:

BA consumption is increasing in automotive adhesives, coatings, and construction materials due to the growth of automotive production and infrastructure. Specialized BA-based polymers improve adhesion, flexibility, and chemical resistance. This trend is particularly evident in North America and the Asia Pacific.

The global butyl acrylate market is segmented as follows:

By Purity

- High Purity

- Common Purity

By Application

- Paints & Coatings

- Adhesives & Sealants

- Chemical Synthesis

- Plastic Additives

- Textiles

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Butyl acrylate is a versatile chemical compound primarily used as a monomer in the production of resins and acrylic polymers. It offers optimal flexibility, adhesion, and water resistance, thereby increasing its significance in applications such as adhesives, coatings, textiles, and paints.

The global butyl acrylate market is projected to grow due to elevated demand in coatings for packaging, advancements in resin and polymer technologies, and increasing industrialization in developing economies.

According to study, the global butyl acrylate market size was worth around USD 6.87 billion in 2024 and is predicted to grow to around USD 10.39 billion by 2034.

The CAGR value of the butyl acrylate market is expected to be approximately 5.30% from 2025 to 2034.

Technological advancements are enhancing the purity, production efficiency, and performance of Butyl Acrylate, enabling its use in high-value coatings, specialty polymers, and adhesives.

Investment and partnership opportunities exist in developing high-purity and eco-friendly BA products, expanding production capacities, and entering developing markets with surging industrial demand.

Asia Pacific is expected to lead the global butyl acrylate market during the forecast period.

China is a key contributor to the global Butyl Acrylate market, leading in consumption and production due to its large industrial base and extensive chemical manufacturing capabilities.

The key players profiled in the global butyl acrylate market include BASF SE, Dow Inc., Arkema Group, Mitsubishi Chemical Corporation, LG Chem Ltd., Jiangsu Sanmu Group Co., Ltd., Anhui Wanwei Group Co., Ltd., Wacker Chemie AG, Synthomer PLC, Trinseo S.A., Nippon Shokubai Co., Ltd., Evonik Industries AG, Sekisui Chemical Co., Ltd., Shanghai Huayi (Group) Company Limited, and Perstorp Holding AB.

The report examines key aspects of the butyl acrylate market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed