Banking BPS Market Size, Share, And Growth Report 2032

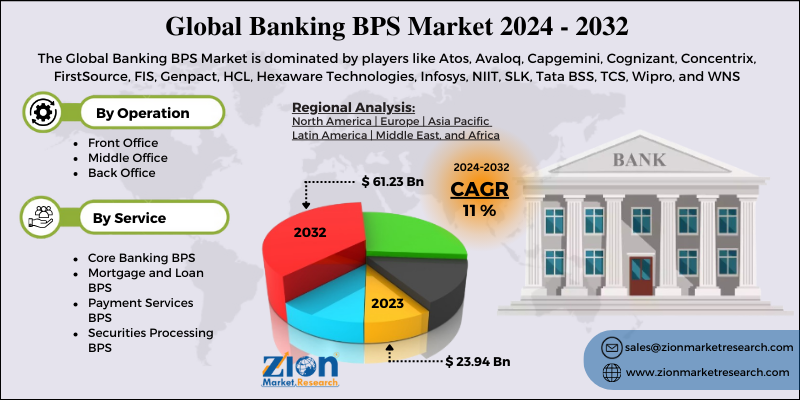

Banking BPS Market by Operations (Front Office, Middle Office, and Back Office) and by Service (Core Banking BPS, Mortgage & Loan BPS, Payment Services BPS, and Securities Processing BPS): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

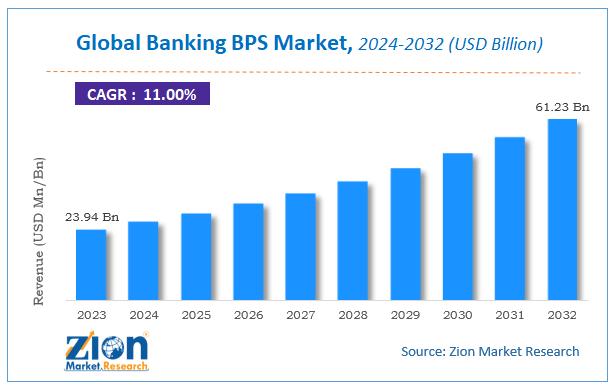

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.94 Billion | USD 61.23 Billion | 11% | 2023 |

Banking BPS Market: Size

The global Banking BPS market size was worth around USD 23.94 billion in 2023 and is predicted to grow to around USD 61.23 billion by 2032 with a compound annual growth rate (CAGR) of roughly 11% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the Banking BPS market on a global and regional level.

Banking BPS Market: Overview

Banking BPS is a matured, large-scale business, which is highly adoption by tier 1 banks in mature markets, whereas shows low adoption by mid/small tier banks in emerging markets. Vendors are offering elemental processes that are mainly focused on reconciliation, disputes, and data management from distant locations. According to HCL, business process services are outsourced to organizations that specialize in performing outsourcing activities. Specific business processes that are not the core competencies of an organization can be outsourced to companies specializing in those specific activities. This gives those companies greater flexibilities in terms of managing both their finances and operations. Most global markets have matured the way business is delivered in this dynamic economy. Banking BPS services provide a low-risk approach to transform banking operations and improving their bottom line.

Globally, the banking BPS market is growing due to the increase in the overall digitalization, centralization, and competition in the banking sector across the world. The banking BPS market is established in mature markets and is fuelled affordability and quality that improves accuracy, reduces TAT, and allows access to labor arbitrage. Banking BPS solutions are compliant to major sectors. A shift from risk- to transaction-based products requires a lower cost of delivery at any volume. The need to increase revenues to offset margin declines is done by shifting focus from product to customer, including customer value maximization (mature markets) and customer acquisition (emerging markets). However, the lack of professionals and technology in many parts of developing economies may restrain the global banking BPS market.

Banking BPS Market: Segmentation

The study provides a decisive view of the banking BPS market based on operation, service, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By operation, the market covers front office (customer management services, document management, and sales and marketing outsourcing), middle office (insurance BPS, banking BPS, and healthcare providers BPS), and back office (F&A outsourcing and procurement).

By service, the market includes core banking BPS, mortgage and loan BPS (origination services BPS and mortgage and loan administration BPS), payment services BPS (cheque processing BPS, credit card processing BPS and EFT services BPS), and securities processing BPS (portfolio services BPS and trade services BPS).

Banking BPS Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Banking BPS Market |

| Market Size in 2023 | USD 23.94 Billion |

| Market Forecast in 2032 | USD 61.23 Billion |

| Growth Rate | CAGR of 11% |

| Number of Pages | 110 |

| Key Companies Covered | Atos, Avaloq, Capgemini, Cognizant, Concentrix, FirstSource, FIS, Genpact, HCL, Hexaware Technologies, Infosys, NIIT, SLK, Tata BSS, TCS, Wipro, and WNS |

| Segments Covered | By operation, By service and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Banking BPS Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. These regions are further sub-segmented into the U.S., Canada, Germany, UK, France, China, Italy, Japan, India, and Brazil.

In terms of revenue, North America holds the largest market share of the global banking BPS market. This growth of the North American banking BPS market is attributed to the adoption of technological advancement by the banking sector, increasing government initiatives, growing BPS awareness, and a high literacy rate of the regional population.

Banking BPS Market: Competitive Players

Some key participants operating in the global banking BPS market include:

- Atos

- Avaloq

- Capgemini

- Cognizant

- Concentrix

- FirstSource

- FIS

- Genpact

- HCL

- Hexaware Technologies

- Infosys

- NIIT

- SLK

- Tata BSS

- TCS

- Wipro

- WNS

The Global Banking BPS Market is segmented as follows:

Global Banking BPS Market: Operation Analysis

- Front Office

- Customer Management Services

- Document Management

- Sales and Marketing Outsourcing

- Middle Office

- Insurance BPS

- Banking BPS

- Healthcare Providers BPS

- Back Office

- F&A Outsourcing

- Procurement

Global Banking BPS Market: Service Analysis

- Core Banking BPS

- Mortgage and Loan BPS

- Origination Services BPS

- Mortgage and Loan Administration BPS

- Payment Services BPS

- Cheque Processing BPS

- Credit Card Processing BPS

- EFT Services BPS

- Securities Processing BPS

- Portfolio Services BPS

- Trade Services BPS

Global Banking BPS Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Banking BPS is a matured, large-scale business, which is highly adoption by tier 1 banks in mature markets, whereas shows low adoption by mid/small tier banks in emerging markets.

According to study, the Banking BPS Market size was worth around USD 23.94 billion in 2023 and is predicted to grow to around USD 61.23 billion by 2032.

The CAGR value of Banking BPS Market is expected to be around 11% during 2024-2032.

North America has been leading the Banking BPS Market and is anticipated to continue on the dominant position in the years to come.

The Banking BPS Market is led by players like Atos, Avaloq, Capgemini, Cognizant, Concentrix, FirstSource, FIS, Genpact, HCL, Hexaware Technologies, Infosys, NIIT, SLK, Tata BSS, TCS, Wipro, and WNS.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed