Global B2B2C Insurance Market Size, Share, Growth Analysis Report - Forecast 2034

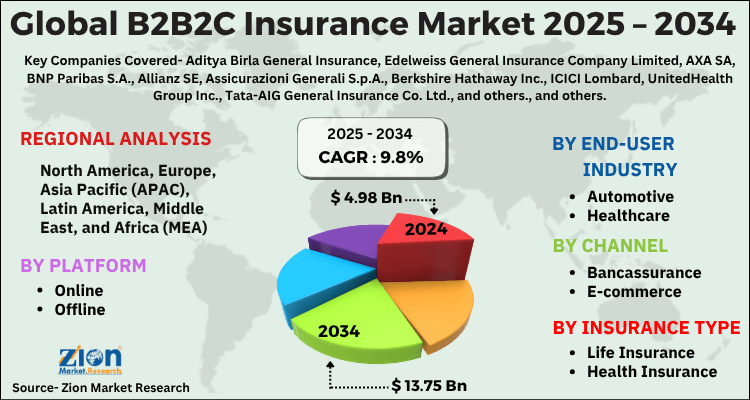

B2B2C Insurance Market By Insurance Type (Life Insurance, Health Insurance, Property & Casualty Insurance, Travel Insurance, Others), By Channel (Bancassurance, E-commerce, Aggregators, OEMs/Device Manufacturers, Retail Chains), By End-user Industry (Automotive, Healthcare, Consumer Electronics, Retail, Travel & Hospitality), By Platform (Online, Offline), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.98 Billion | USD 13.75 Billion | 9.8% | 2024 |

B2B2C Insurance Industry Perspective:

The global B2B2C insurance market size was worth around USD 4.98 Billion in 2024 and is predicted to grow to around USD 13.75 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.8% between 2025 and 2034. The report analyzes the global B2B2C insurance market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the B2B2C insurance industry.

B2B2C Insurance Market: Overview

B2B2C insurance referred to as business to business to consumer is an insurance distribution procedure in which an insurer makes use of a retailer for selling insurance to consumers. Moreover, the deal of providing B2B2C can take place with the help of insurance agents, telecom organizations, private banks, retailers, and various other digital participants.

Key Insights

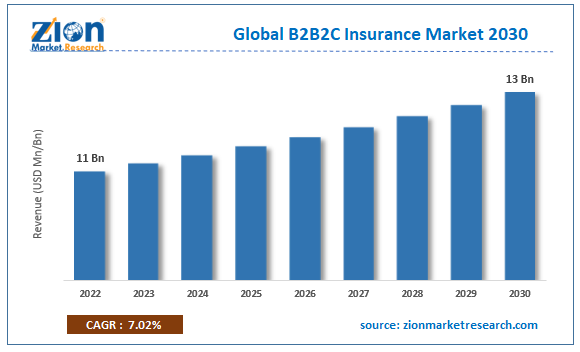

- As per the analysis shared by our research analyst, the global B2B2C insurance market is estimated to grow annually at a CAGR of around 9.8% over the forecast period (2025-2034).

- Regarding revenue, the global B2B2C insurance market size was valued at around USD 4.98 Billion in 2024 and is projected to reach USD 13.75 Billion by 2034.

- The B2B2C insurance market is projected to grow at a significant rate due to digital insurance platforms, embedded insurance solutions, and the need for tailored, customer-centric insurance models.

- Based on Insurance Type, the Life Insurance segment is expected to lead the global market.

- On the basis of Channel, the Bancassurance segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user Industry, the Automotive segment is projected to swipe the largest market share.

- By Platform, the Online segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

B2B2C Insurance Market: Growth Factors

Rise in end-user awareness about B2B2C insurance will drive the global market surge over 2023-2030

Surge in customer awareness about insurance and an increment in the number of insurance firms will prompt the expansion of the global B2B2C insurance market trends. A rampant increase in the competition between key industry participants will drive the global market expansion. Furthermore, strict government laws regulating insurance services will proliferate the growth of the market globally. Growing insurance subscriptions in the emerging economies of Latin America and Asia will expand the scope of the growth of the market space across the globe in the upcoming years. Rapid digitization and increase in the users of social media tools such as Facebook, Instagram, and Pinterest will promulgate the growth of the global market.

A paradigm shift in the domain of technology with the onset of AI, telematics, and Chabot has prompted the expansion of the market across the globe. An increment in insurance devices will expand the size of the global market in the upcoming years. Strategic alliances have played a key role in the growth of any business and B2B2C business is no exception to this. For instance, in the first quarter of 2022, Aditya Birla Health Insurance Company, a key healthcare insurance provider in India, declared to have entered into an alliance with UCO Bank, an Indian public sector bank, for distributing healthcare insurance products through a slew of branches of UCO bank based in India.

B2B2C Insurance Market: Restraints

Availability of traditional insurance at a reasonable premium can shrink the global industry expansion by 2030

Easy access to traditional insurance at low costs can pose a huge threat to the expansion of the global B2B2C insurance industry. Data security concerns can further hamper the global industry growth in the near future.

B2B2C Insurance Market: Opportunities

Rise in the production of electric vehicles can protrude the scale of growth of the global market

Swift expansion of electric vehicle manufacturing activities and demand for lightweight components in vehicles will open new growth avenues for the global B2B2C insurance market. Thriving transport sector will also contribute notably towards the global market earnings in the upcoming years.

B2B2C Insurance Market: Challenges

High taxation rates can put curbs on the expansion of the global industry in the years ahead

Imposing heavy taxes such as GST in countries such as India will increase the premium of insurance coverage, thereby posing a huge challenge to the expansion of the B2B2C insurance industry globally.

B2B2C Insurance Market: Segmentation

The global B2B2C insurance market is segmented based on insurance type, channel, end-user industry, platform, and region.

Based on insurance type, the global b2b2c insurance market is divided into life insurance, health insurance, property & casualty insurance, travel insurance, others.

On the basis of channel, the global b2b2c insurance market is bifurcated into bancassurance, e-commerce, aggregators, oems/device manufacturers, retail chains.

By end-user industry, the global b2b2c insurance market is split into automotive, healthcare, consumer electronics, retail, travel & hospitality.

In terms of platform, the global b2b2c insurance market is categorized into online, offline.

B2B2C Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | B2B2C Insurance Market |

| Market Size in 2024 | USD 4.98 Billion |

| Market Forecast in 2034 | USD 13.75 Billion |

| Growth Rate | CAGR of 9.8% |

| Number of Pages | 219 |

| Key Companies Covered | Aditya Birla General Insurance, Edelweiss General Insurance Company Limited, AXA SA, BNP Paribas S.A., Allianz SE, Assicurazioni Generali S.p.A., Berkshire Hathaway Inc., ICICI Lombard, UnitedHealth Group Inc., Tata-AIG General Insurance Co. Ltd., and others., and others. |

| Segments Covered | By Insurance Type, By Channel, By End-user Industry, By Platform, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

B2B2C Insurance Market: Regional Insights

Asia-Pacific is anticipated to retain dominating position in the global B2B2C insurance market over the predicted timeline

Asia-Pacific, which contributed about two-fifths of the global B2B2C insurance market revenue in 2022, will be a leading region over the estimated timespan. Furthermore, the regional market surge can be subject to a rise in the presence of customers in densely populous countries such as India and China. Furthermore, the surging urban populace along with a rise in the per capita income in the emerging economies of Asia will steer the regional market expansion.

North American B2B2C insurance industry is set to record the fastest CAGR in the upcoming years owing to surging awareness among customers about benefits accrued due to B2B2C insurance purchases in countries such as Canada and the U.S. need for safety and protection as well as reliability will further drive the regional industry trends.

B2B2C Insurance Market: Competitive Space

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the B2B2C insurance market on a global and regional basis.

The global B2B2C insurance market is dominated by players like:

- Aditya Birla General Insurance

- Edelweiss General Insurance Company Limited

- AXA SA

- BNP Paribas S.A.

- Allianz SE

- Assicurazioni Generali S.p.A.

- Berkshire Hathaway Inc.

- ICICI Lombard

- UnitedHealth Group Inc.

- Tata-AIG General Insurance Co. Ltd.

- and others.

The global B2B2C insurance market is segmented as follows;

By Insurance Type

- Life Insurance

- Health Insurance

- Property & Casualty Insurance

- Travel Insurance

- Others

By Channel

- Bancassurance

- E-commerce

- Aggregators

- OEMs/Device Manufacturers

- Retail Chains

By End-user Industry

- Automotive

- Healthcare

- Consumer Electronics

- Retail

- Travel & Hospitality

By Platform

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

B2B2C insurance referred to as business to business to consumer is an insurance distribution procedure in which an insurer makes use of a retailer for selling insurance to consumers.

The global B2B2C insurance market is expected to grow due to digital insurance platforms, embedded insurance solutions, and the need for tailored, customer-centric insurance models.

According to a study, the global B2B2C insurance market size was worth around USD 4.98 Billion in 2024 and is expected to reach USD 13.75 Billion by 2034.

The global B2B2C insurance market is expected to grow at a CAGR of 9.8% during the forecast period.

North America is expected to dominate the B2B2C insurance market over the forecast period.

Leading players in the global B2B2C insurance market include Aditya Birla General Insurance, Edelweiss General Insurance Company Limited, AXA SA, BNP Paribas S.A., Allianz SE, Assicurazioni Generali S.p.A., Berkshire Hathaway Inc., ICICI Lombard, UnitedHealth Group Inc., Tata-AIG General Insurance Co. Ltd., and others., among others.

The report explores crucial aspects of the B2B2C insurance market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed