Autonomous Mining Equipment Market Size, Share, Trends, Growth 2034

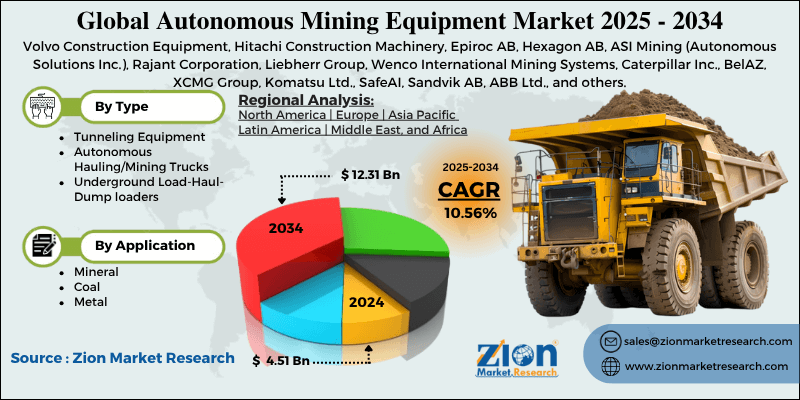

Autonomous Mining Equipment Market By Type (Tunneling Equipment, Autonomous Hauling/Mining Trucks, Underground Load-Haul-Dump loaders, and Others), By Application (Mineral, Coal, and Metal), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

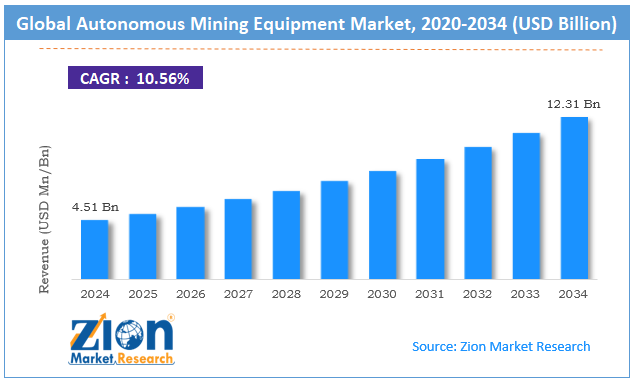

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.51 Billion | USD 12.31 Billion | 10.56% | 2024 |

Autonomous Mining Equipment Industry Perspective:

The global autonomous mining equipment market size was worth around USD 4.51 billion in 2024 and is predicted to grow to around USD 12.31 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.56% between 2025 and 2034.

Autonomous Mining Equipment Market: Overview

Autonomous mining equipment is modern-age machinery and vehicles used in the mining sector that do not require human intervention for operational purposes. These machines can be operated from above the surface using advanced technologies. Autonomous mining equipment is equipped with cutting-edge software and robotic components that turn the tools into autonomous solutions.

Some of the most commonly used autonomous mining equipment includes drilling rigs, trucks, excavators, haulers, and loaders. The growing need to amplify the speed of mining operations has created an urgent demand for efficient autonomous mining equipment.

Additionally, factors such as growing risk to human lives during mining activities and stringent safety standards have further helped the industry thrive. During the projection period, the demand for autonomous mining equipment is expected to continue growing, driven by several influential factors.

For instance, the rising rate of mining across the globe will promote the market growth rate. On the other hand, the expenses associated with applications of autonomous mining equipment may impede the overall growth trajectory for the market players, according to research.

Key Insights:

- As per the analysis shared by our research analyst, the global autonomous mining equipment market is estimated to grow annually at a CAGR of around 10.56% over the forecast period (2025-2034)

- In terms of revenue, the global autonomous mining equipment market size was valued at around USD 4.51 billion in 2024 and is projected to reach USD 12.31 billion by 2034.

- The autonomous mining equipment market is projected to grow at a significant rate due to the increasing mining processes.

- Based on the type, the hauling/mining trucks segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the metal segment is anticipated to command the largest market share.

- Based on region, Asia is projected to dominate the global market during the forecast period.

Autonomous Mining Equipment Market: Growth Drivers

Increasing mining processes to fuel the market expansion rate in the coming years

The global autonomous mining equipment market is expected to be led by the rising mining procedures worldwide. The processes involved in extracting crucial natural resources from the depths of the planet are known as mining activities.

Some of the most commonly mined materials include metal ores, fossil fuels, gemstones, and construction materials. These elements have significant applications across major industries globally. Mining events have increased in the last few years as consumption and subsequent demand for the materials are on the rise.

For instance, lead, a critical metal ore, is witnessing an increase in demand due to the production of lead-acid batteries, which account for more than 84% of global lead use. Fossil fuel continues to remain a primary energy source with commercial, industrial, and residential applications.

In May 2025, the US government added 10 new mining projects as the latest government aims to fast-track the permitting list to extend the availability of critical materials in the backdrop of an ongoing trade war with China. The surge in the number of mining events will coherently drive the use of autonomous mining equipment, according to research.

Demand for safer mining procedures to promote the use of self-governing equipment

The mining industry is plagued with several hazards, putting the lives of employed personnel at risk. According to Science Direct, more than 15,000 deaths occur in the mining industry every year. Some of the fatal accidents are on-site, while some are induced due to long-term exposure to harmful chemicals and dust particles. Governments across the globe are seeking ways to strengthen safety laws preventing serious health-related harm to employed staff.

For instance, in December 2024, the International Labor Organization (ILO) announced the launch of a new project aimed at improving occupational safety and health in the mining sector of Kazakhstan. The demand for safer mining procedures will subsequently impact the global autonomous mining equipment market revenue in the coming years.

Autonomous Mining Equipment Market: Restraints

High cost of equipment and operational expenses to limit market expansion

The global industry for autonomous mining equipment is expected to be restricted by the high cost of the machinery. For instance, the average price of an autonomous large-scale dragline mining excavator can cost as much as USD 100 million, depending on the features installed in the machine. Furthermore, the operational and maintenance costs of the equipment can further affect the overall revenue generated by the market players.

Autonomous Mining Equipment Market: Opportunities

Surge in equipment innovation rate to generate growth opportunities for the industry players

The global autonomous mining equipment market is expected to generate growth opportunities due to the surge in the rate of equipment innovation.

In October 2024, Regroup, an Australian mining services provider, announced a partnership with Scania. The latter is a leading provider of heavy buses, trucks, and marine engines. The collaboration is aimed at developing the first fleet of autonomous in-pit mining trucks for Regroup’s commercial operations. The autonomous rigid G 560 8x4 tippers will be made operational at Element 25’s Butcherbird Mine by the end of 2025.

Around 11 autonomous trucks will be delivered by Scania as part of the agreement. In November 2024, Caterpillar Inc. launched the fully autonomous operation of its Cat® 777 off-highway truck. The latest model strengthens the company’s aim to deliver advanced autonomous hauling solutions for the quarry sector.

On the other hand, in a recent event, PT Pamapersada Nusantara (PAMA), Indonesia’s leading mining contractor, announced a partnership with RCT, a global supplier of mining automation solutions. PAMA will leverage autonomous dozers at the autonomous dozer, aiming to improve safety at the critical mining site.

Autonomous Mining Equipment Market: Challenges

Difficulties in smooth integration with existing mining infrastructure to challenge market growth rate

The global autonomous mining equipment industry is projected to be challenged by the difficulty in smoothly integrating modern mining equipment with existing infrastructure.

Most mining facilities continue to use traditional mining machines and may face challenges when using modern tools. Furthermore, companies will be required to train the workforce to make them comfortable with novel tools, further raising market growth constraints.

Autonomous Mining Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Autonomous Mining Equipment Market |

| Market Size in 2024 | USD 4.51 Billion |

| Market Forecast in 2034 | USD 12.31 Billion |

| Growth Rate | CAGR of 10.56% |

| Number of Pages | 216 |

| Key Companies Covered | Volvo Construction Equipment, Hitachi Construction Machinery, Epiroc AB, Hexagon AB, ASI Mining (Autonomous Solutions Inc.), Rajant Corporation, Liebherr Group, Wenco International Mining Systems, Caterpillar Inc., BelAZ, XCMG Group, Komatsu Ltd., SafeAI, Sandvik AB, ABB Ltd., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Autonomous Mining Equipment Market: Segmentation

The global autonomous mining equipment market is segmented based on type, application, and region.

Based on the type, the global market divisions are tunneling equipment, autonomous hauling/mining trucks, underground load-haul-dump loaders, and others. In 2024, the highest growth was listed in the hauling/mining trucks segment due to the increasing penetration of electric vehicles in the mining sector. Furthermore, mining trucks are some of the most commonly used equipment in the general ore extraction sector. The average cost of a high-performance autonomous mining truck can range between USD 4 million and USD 6 million.

Based on the application, the autonomous mining equipment industry divisions are mineral, coal, and metal. In 2024, the highest growth rate was listed in the metal segment. The growing demand for critical metal components such as gold and copper is propelling the segmental revenue. In 2024, the global copper mining sector was valued at over USD 10 billion and is projected to generate significant CAGR in the coming years. Coal and mineral segments will continue to deliver significant revenue during the projection period.

Autonomous Mining Equipment Market: Regional Analysis

Asia to reclaim its dominance in the market, according to a comprehensive analysis

The global autonomous mining equipment market will be led by Asia-Pacific during the projection period. Countries such as China, India, Australia, and Indonesia lead the regional market growth rate. China, for instance, has a massive gold and rare mineral mining industry growing at a terrific rate.

According to the latest reports, China has currently unearthed a massive gold reserve in the Northeastern province of the country. According to certain estimates, the mine is expected to hold more than 1000 metric tons of gold reserves. The regional government support for the mining sector has played a crucial role in putting Asia-Pacific’s mining industry on the global map.

In February 2025, EACON Mining Technology, a Chinese technology company, announced the successful completion of the mining autonomy project at the Shuicheng iron ore mine in the country. The company will officially hand over the operational aspects of the mine to the Shougang Group.

In December 2024, Xuzhou Construction Machinery Group Co., Ltd. (XCMG), a leading provider of heavy machinery and construction equipment, launched the next generation of 85-class cableless, autonomous, and electric mining trucks called the ZNK95 for the coal mining industry.

Autonomous Mining Equipment Market: Competitive Analysis

The global autonomous mining equipment market is led by players like:

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Epiroc AB

- Hexagon AB

- ASI Mining (Autonomous Solutions Inc.)

- Rajant Corporation

- Liebherr Group

- Wenco International Mining Systems

- Caterpillar Inc.

- BelAZ

- XCMG Group

- Komatsu Ltd.

- SafeAI

- Sandvik AB

- ABB Ltd.

The global autonomous mining equipment market is segmented as follows:

By Type

- Tunneling Equipment

- Autonomous Hauling/Mining Trucks

- Underground Load-Haul-Dump loaders

- Others

By Application

- Mineral

- Coal

- Metal

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Autonomous mining equipment is modern-age machinery and vehicles used in the mining sector that do not require human intervention for operational purposes.

The global autonomous mining equipment market is expected to be led by the rising mining procedures worldwide.

According to study, the global autonomous mining equipment market size was worth around USD 4.51 billion in 2024 and is predicted to grow to around USD 12.31 billion by 2034.

The CAGR value of the autonomous mining equipment market is expected to be around 10.56% during 2025-2034.

The global autonomous mining equipment market will be led by Asia-Pacific during the projection period.

The global autonomous mining equipment market is led by players like Volvo Construction Equipment, Hitachi Construction Machinery, Epiroc AB, Hexagon AB, ASI Mining (Autonomous Solutions Inc.), Rajant Corporation, Liebherr Group, Wenco International Mining Systems, Caterpillar Inc., BelAZ, XCMG Group, Komatsu Ltd., SafeAI, Sandvik AB, and ABB Ltd.

The report explores crucial aspects of the autonomous mining equipment market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed