Anisotropic Conductive Film Market Size, Share, Trends, Growth and Forecast 2034

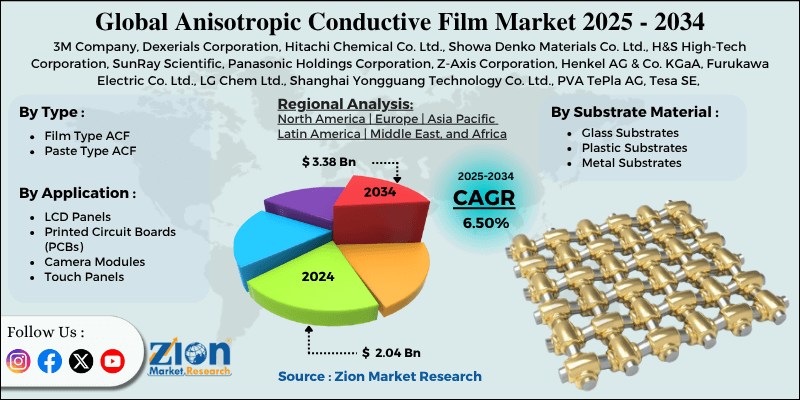

Anisotropic Conductive Film Market By Type (Film Type ACF, Paste Type ACF), By Substrate Material (Glass Substrates, Plastic Substrates, Metal Substrates), By Application (LCD Panels, Printed Circuit Boards [PCBs], Camera Modules, Touch Panels), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

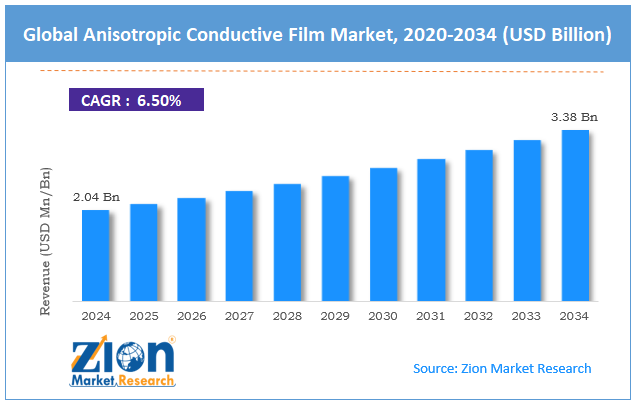

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.04 Billion | USD 3.38 Billion | 6.50% | 2024 |

Anisotropic Conductive Film Industry Perspective:

The global anisotropic conductive film market size was worth around USD 2.04 billion in 2024 and is predicted to grow to around USD 3.38 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.50% between 2025 and 2034.

Anisotropic Conductive Film Market: Overview

The anisotropic conductive film is a dedicated adhesive material majorly used in electronics to create electrical connections among parts without affecting insulation in other directions. It includes conductive elements dispersed in a resin, facilitating the passage of current vertically, making it suitable for high-density interconnections such as torch panels, chip-on-glass assemblies, and LCDs.

The key drivers of the anisotropic conductive film market include intensifying demand for consumer electronics, expansion in automotive electronics, and improvements in display technologies.

The growth in global demand for tablets, smartphones, wearables, and smart TVs is notably fueling the demand for ACF. These devices require precise interconnections and are ultra-thin, making them an ideal use case for anisotropic conductive films. The automotive industry’s shift towards electric vehicles and advanced driver assistance systems has propelled the demand for electronic interconnects. ACFs are important in LCD instrument clusters, infotainment systems, and head-up displays.

Moreover, anisotropic conductive films are vital in bonding components in OLED, LCD, and progressing MicroLED displays. With the rising developments in the display industry, the demand for precise and reliable interconnect solutions surges.

However, the global market is restrained by low reworkability and reusability. Anisotropic conductive films are challenging to reuse and remove once they have been applied and cured. This restricts rework during the repair assembly process, thereby increasing costs and waste in manufacturing environments.

Additionally, performance degradation in extreme conditions also limits industry growth. Despite the reliability of AFCs, they can degrade under harsh environmental conditions, such as thermal cycling or high humidity, which limits their use in outdoor and industrial applications.

Nonetheless, the anisotropic conductive film industry is expected to experience substantial growth over the coming years, driven by its applications in transparent and foldable displays, as well as the advancement of electric vehicle (EV) infrastructure. The growing sophistication of foldable and transparent displays ultimately increases the demand for flexible conductive bonding solutions. ACF producers can invest in the development of transparent and high-flex ACF modified for next-gen screens.

Additionally, electric vehicles are heavily reliant on mature dashboards, infotainment systems, and battery management systems, all of which require compact interconnects. ACFs are well-positioned to serve this growing segment with space-saving and vibration-resistant solutions.

Key Insights:

- As per the analysis shared by our research analyst, the global anisotropic conductive film market is estimated to grow annually at a CAGR of around 6.50% over the forecast period (2025-2034)

- In terms of revenue, the global anisotropic conductive film market size was valued at around USD 2.04 billion in 2024 and is projected to reach USD 3.38 billion by 2034.

- The anisotropic conductive film market is projected to grow significantly owing to mounting demand for consumer electronics, growth of automotive electronics, and rising adoption of flexible displays.

- Based on type, the film type ACF segment is expected to lead the market, while the paste type ACF segment is expected to grow considerably.

- Based on substrate material, the glass substrates segment is the dominant segment, while the plastic substrates segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the LCD panels segment is expected to lead the market compared to the touch panels segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Anisotropic Conductive Film Market: Growth Drivers

Expansion of PCB manufacturing and semiconductors propels market growth

The growth in consumer electronics, 5G infrastructure, and electric vehicles has fueled the demand for PCBs (printed circuit boards) and semiconductor packages. ACFs are vital in chip-on-film, chip-on-glass, and flex-on-board interconnects, which are fundamental in compact and high-speed PCB layouts.

Additionally, governments are increasing incentives for semiconductor production. The United States CHIPS and Science Act 2023 and India's USD 10 billion semiconductor program have propelled domestic IC and PCB packaging ventures, surging ACF demand, and thus, driving the growth of the anisotropic conductive film market.

Technological improvements in high-density interconnects and miniaturization notably drive market growth

Technological advancements in electronics have driven the demand for ultra-fine pitch and high I/O connections, where conventional conductive or soldering adhesives are often insufficient. ACFs offer an exclusive solution by enabling vertical conductivity while horizontal insulation increases their suitability for compact and complex layouts.

The latest modernizations include hybrid ACFs with enhanced conductive heat resistance and particle dispersion, as well as photo-curable ACFs for more precise processing.

Anisotropic Conductive Film Market: Restraints

Licensing and intellectual property barriers negatively impact market progress

The ACF industry is led by prominent players, including 3M, Hitachi Chemical, Showa Denko, and Dexerials. These companies hold numerous patents related to ACF formulations, curing processes, and particle dispersions. Newbies usually face licensing and legal barriers, which hinder competition and innovation.

Dexerials filed a patent infringement suit against a Taiwanese player in 2023 for the illegal use of conductive particle distribution technology, resulting in a ban on regional sales and a notable decline in local supply.

Anisotropic Conductive Film Market: Opportunities

Growth potential in Mixed Reality and AR/VR devices positively impacts market growth

The rapid growth of VR, AR, and MR devices for gaming, healthcare, and professional training presents a key opportunity for the use of ACF, thereby impacting the growth of the anisotropic conductive film industry. These devices rely on high-resolution and compact microdisplays, flexible printed circuit boards (PCBs), and sensors, which require precision interconnection provided by ACFs.

Dexerials Corporation formed a partnership with a prominent AR optics development company in 2024 to supply its ultra-thin anisotropic conductive films for waveguide display modules, expanding into a new application domain. As component density and miniaturization increase, ACFs' potential to bond ultra-fine pitches with thermal control makes it a vital material for VR/AR devices.

Anisotropic Conductive Film Market: Challenges

Technological outmodedness risk in a fast-evolving electronics landscape limits the market growth

The ACF sector is constantly under threat from disruptive bonding substitutes, such as copper hybrid bonding, laser-aided bonding, and advanced flip-chip techniques, which offer improved thermal performance, high speed, and lower total costs in select high-volume use cases.

SK Hynix and TSMC have declared investments in copper-to-copper bonding for next-generation high-bandwidth memory and logic chips, openly noting it as a more efficient and scalable substitute for high-density interconnects.

Anisotropic Conductive Film Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Anisotropic Conductive Film Market |

| Market Size in 2024 | USD 2.04 Billion |

| Market Forecast in 2034 | USD 3.38 Billion |

| Growth Rate | CAGR of 6.50% |

| Number of Pages | 215 |

| Key Companies Covered | 3M Company, Dexerials Corporation, Hitachi Chemical Co. Ltd., Showa Denko Materials Co. Ltd., H&S High-Tech Corporation, SunRay Scientific, Panasonic Holdings Corporation, Z-Axis Corporation, Henkel AG & Co. KGaA, Furukawa Electric Co. Ltd., LG Chem Ltd., Shanghai Yongguang Technology Co. Ltd., PVA TePla AG, Tesa SE, Tatsuta Electric Wire & Cable Co. Ltd., and others. |

| Segments Covered | By Type, By Substrate Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Anisotropic Conductive Film Market: Segmentation

The global anisotropic conductive film market is segmented based on type, substrate material, application, and region.

Based on type, the global anisotropic conductive film industry is divided into film-type ACF and paste-type ACF. The film type ACF registers a considerable market share due to its broader use in OLEDs, LCDs, COG, COF, and flex-on-board (FOB) assemblies. It offers brilliant bonding precision, reliable electrical connectivity, and mechanical strength, thereby increasing its suitability for compact devices such as tablets, high-end TVs, and smartphones. With the increasing adoption of miniaturized devices and fine-pitch displays, the demand for film-type ACF is also on the rise.

Based on substrate material, the global anisotropic conductive film market is segmented into glass substrates, plastic substrates, and metal substrates. The glass substrate segment registered a considerable market share due to its broader use in display technologies such as OLEDs, LCDs, and touch panels. These substrates provide a stable and flat surface, making them suitable for chip-on-glass bonding and high-resolution displays, which are key applications of ACF. As smartphones, large-screen TVs, and tablets drive global demand, glass substrates remain the key choice for ACF applications due to their excellent thermal resistance and dimensional stability.

Based on application, the global market is segmented into LCD panels, printed circuit boards (PCBs), camera modules, and touch panels. The LCD panels segment leads the market due to the high demand for televisions, smartphones, automotive displays, laptops, and monitors. Anisotropic conductive films are broadly used in FOG and COG bonding during LCD assembly, offering reliable and precise electrical connections. As LCD technology dominates in industrial and consumer electronics, it accounts for the larger share of ACF on a global scale.

Anisotropic Conductive Film Market: Regional Analysis

North America to witness significant growth over the forecast period

North America continues to lead the global anisotropic conductive film market due to factors such as its strong semiconductor and electronics manufacturing base, higher adoption of advanced display technologies, and well-developed medical device innovation. North America holds an established infrastructure of semiconductor and electronics manufacturers, especially in the United States.

Leading companies, including Texas Instruments, Intel, and Apple, fuel the demand for high-precision interconnect solutions, such as ACFs. The United States semiconductor industry was estimated to be over $275 billion in 2024, supporting strong demand for ACF.

The region boasts a leading number of consumer electronics companies and early adopters of Mini-LED, OLED, and foldable displays. Anisotropic conductive films are vital in bonding chip-on-film and chip-on-glass displays used in these solutions. The smart TV market in the U.S. alone exceeded 90 million units in 2024, fueling a remarkable increase in ACF use in display assembly.

In addition, the region is leading as a medical electronics hub, comprising diagnostic equipment and health monitors needing high-reliability and compact interconnectors. Brands like GE Healthcare and Medtronic are largely deploying ACF-aided components. The United States medical electronics industry surpassed USD 5.8 billion in the previous year, strongly backing the ACF demand.

The Asia Pacific region is progressing as the second-leading region in the anisotropic conductive film industry, driven by its key electronic manufacturing centers, a strong display panel production network, and cost-effective R&D and manufacturing capabilities.

The Asia Pacific is home to some of the largest manufacturing economies, including South Korea, China, Taiwan, and Japan. These nations dominate the manufacturing of TVs, laptops, and smartphones, all of which need ACF on a large scale in circuit bonding and display.

In 2024, over 80% of global production was conducted in Asia, driving demand for ACF. The Asia Pacific also leads in OLED, LCD, and flexible display panel production, primarily by players such as LG Display, Samsung Display, and BOE Technology. These displays depend on ACF chip-on-film and chip-on-glass assembly. China alone accounted for over 50% of the share in 2024, making display production a propelling factor.

Moreover, the APAC region offers competitive benefits in labor, manufacturing costs, and advanced R&D, which aids large-scale ACF innovation and production. Companies are focused on increasing their ACF product lines. This cost efficiency improves regional supply potential, fulfilling the demands of the global electronics assembly market.

Anisotropic Conductive Film Market: Competitive Analysis

The major operating players in the global anisotropic conductive film market are:

- 3M Company

- Dexerials Corporation

- Hitachi Chemical Co. Ltd.

- Showa Denko Materials Co. Ltd.

- H&S High-Tech Corporation

- SunRay Scientific

- Panasonic Holdings Corporation

- Z-Axis Corporation

- Henkel AG & Co. KGaA

- Furukawa Electric Co. Ltd.

- LG Chem Ltd.

- Shanghai Yongguang Technology Co. Ltd.

- PVA TePla AG

- Tesa SE

- Tatsuta Electric Wire & Cable Co. Ltd.

Anisotropic Conductive Film Market: Key Market Trends

- Development of High-Density and Ultra-Fine Pitch ACFs:

Electronic devices are shrinking in size, which increases complexity. There is a growing demand for ultra-fine pitch ACFs that can bond components with pitches of 30 µm or less. These are important for chip-on-film (COF) and chip-on-glass (COG) uses in high-resolution displays and compact wearables. Manufacturers are capitalizing on high-density interconnect solutions to cater to the future demands for device miniaturization.

- Increasing Focus on Low-Temperature and Reworkable ACFs:

A leading trend in manufacturing is the emergence of low-temperature and reworkable ACFs, allowing more repairable and flexible electronics assembly. These advancements reduce thermal stress on sensitive components and enhance production efficiency. R&D labs and startups are exploring thermally reflowable and UV-curable ACF variants. This may expand the use of ACF in high-precision and low-volume sectors, such as aerospace and medical electronics.

The global anisotropic conductive film market is segmented as follows:

By Type

- Film Type ACF

- Paste Type ACF

By Substrate Material

- Glass Substrates

- Plastic Substrates

- Metal Substrates

By Application

- LCD Panels

- Printed Circuit Boards (PCBs)

- Camera Modules

- Touch Panels

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The anisotropic conductive film is a dedicated adhesive material majorly used in electronics to create electrical connections among parts without affecting insulation in other directions. It includes conductive elements dispersed in a resin, facilitating the passage of current vertically, making it suitable for high-density interconnections such as torch panels, chip-on-glass assemblies, and LCDs.

The global anisotropic conductive film market is projected to grow due to the miniaturization of electronic devices, advancements in the medical electronics sector, and the expansion of 5G infrastructure.

According to study, the global anisotropic conductive film market size was worth around USD 2.04 billion in 2024 and is predicted to grow to around USD 3.38 billion by 2034.

The CAGR value of the anisotropic conductive film market is expected to be around 6.50% during 2025-2034.

North America is expected to lead the global anisotropic conductive film market during the forecast period.

The key players profiled in the global anisotropic conductive film market include 3M Company, Dexerials Corporation, Hitachi Chemical Co., Ltd., Showa Denko Materials Co., Ltd., H&S High-Tech Corporation, SunRay Scientific, Panasonic Holdings Corporation, Z-Axis Corporation, Henkel AG & Co. KGaA, Furukawa Electric Co., Ltd., LG Chem Ltd., Shanghai Yongguang Technology Co., Ltd., PVA TePla AG, Tesa SE, and Tatsuta Electric Wire & Cable Co., Ltd.

The report examines key aspects of the anisotropic conductive film market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that influence the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed