Animal Biotechnology Market Size, Trend, Growth, Industry Analysis 2034

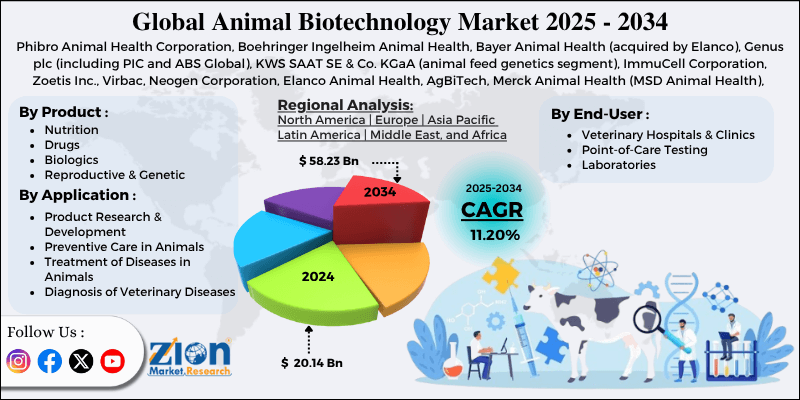

Animal Biotechnology Market By Product (Nutrition, Drugs, Biologics, Reproductive & Genetic, and Diagnostic), By Application (Product Research & Development, Preventive Care in Animals, Treatment of Diseases in Animals, Diagnosis of Veterinary Diseases, and Others), By End-User Industry (Veterinary Hospitals & Clinics, Point-of-Care Testing, Laboratories, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.14 Billion | USD 58.23 Billion | 11.20% | 2024 |

Animal Biotechnology Industry Perspective:

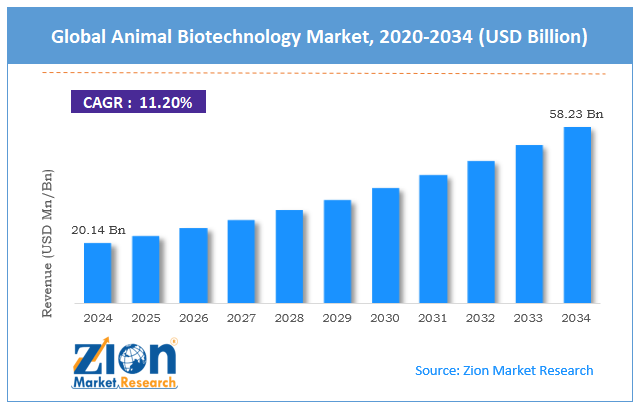

The global animal biotechnology market size was worth around USD 20.14 billion in 2024 and is predicted to grow to around USD 58.23 billion by 2034, with a compound annual growth rate (CAGR) of roughly 11.20% between 2025 and 2034.

Animal Biotechnology Market: Overview

Animal biotechnology is a special segment of the broader biotechnology industry. It deals with modern molecular biology techniques to genetically modify animals. The end goal is to enhance their suitability for applications across industries, such as pharmaceutical, animal healthcare, and agriculture. In addition to this, animal biotechnology is also used to genetically modify animals to improve their disease-fighting mechanisms, synthesize therapeutic proteins, and improve growth rates. The industry growth rate is facilitated by a large number of factors, such as ongoing advancements in gene expression, metabolic profiling of animal cells, and sequencing animal genomes.

During the forecast period, developments in breakthrough technologies such as Zinc Finger Nucleases and Clustered Regularly Interspaced Short Palindromic Repeats – CRISPR-associated systems (CRISPR-Cas) are expected to generate new opportunities for the industry players. Additionally, the increased demand for animal-based products across the food & beverages and pharmaceutical sectors will facilitate growth in animal biotechnology solutions.

Key Insights:

- As per the analysis shared by our research analyst, the global animal biotechnology market is estimated to grow annually at a CAGR of around 11.20% over the forecast period (2025-2034)

- In terms of revenue, the global animal biotechnology market size was valued at around USD 20.14 billion in 2024 and is projected to reach USD 58.23 billion by 2034.

- The animal biotechnology market is projected to grow at a significant rate due to the rising use of animal-based products across major end-user industries.

- Based on the product, the biologics segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user industry, the laboratories segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Animal Biotechnology Market: Growth Drivers

Rising use of animal-based products across major end-user industries to propel market expansion

The global animal biotechnology market is expected to be driven by the increasing demand for animal-based products across major industries. For instance, several types of animal meat are widely consumed across the globe. According to market research, more than 85% of the world's population consumes some form of meat such as poultry-based items or seafood. Additionally, animals play a crucial role in the global pharmaceutical industry's overall growth, as they are utilized for a wide range of drug development and production operations. Animal models are critical to conducting disease-oriented research & development.

Furthermore, they are also used for vaccine development and neurological research. As demand for animals and their end products is growing globally, industry players are encouraged to invest more in animal biotechnology solutions to meet the growing end-user demand. For instance, in April 2025, the US Food & Drugs Administration (FDA) announced the approval of a genetically modified pig that is mutated to be resistant to Porcine Reproductive and Respiratory Syndrome (PRRS). In 2020, the agency approved GalSafe pigs for individuals with alpha-gal syndrome, a meat allergy.

Increasing focus on animal welfare and related government initiatives to further escalate market revenue

In recent years, awareness of animal welfare has increased across the globe. Support from regional governments, mass awareness drives, and increased knowledge among consumers have further amplified revenue in animal biotechnology solutions. According to extensive market analysis, animals are genetically modified to enhance their resistance to a number of diseases. The growing incidence of fatal and serious medical conditions among animals across various species will be critical to the global animal biotechnology market.

Animal Biotechnology Market: Restraints

Ethical concerns over genetic mutation in animals will limit the market expansion rate

The global animal biotechnology industry is expected to be restricted due to ethical concerns over conducting experiments on animals. Research suggests that animals may be subject to extreme pain and deformities when undergoing genetic mutation or once the process is complete. In addition, the process is considered an action against the natural course of the ecosystem. These factors are likely to affect market revenue in the long run.

Animal Biotechnology Market: Opportunities

Advancements in animal biotechnology to generate growth opportunities in the future

The global animal biotechnology market is expected to generate growth opportunities due to the rising advancements in animal biotechnology. The most significant improvements include the launch of cutting-edge genome editing technologies, including CRISPR-Cas systems, Zinc Finger Nucleases, and Transcription Activator-Like Effector Nucleases (TALENs).

In April 2024, University of Nebraska — Lincoln researchers announced the identification of two new genetic mutations related to bovine familial convulsions and ataxia (BFCA) in Angus cattle and delayed blindness in Herefords. The information will assist beef producers in making informed breeding decisions.

Surging launch of technology assisting animal biotechnological developments will expand growth avenues

The industry for animal biotechnology is expected to further expand due to the rising introduction of modern assisting technologies for conducting research & analysis. The surging investments in Artificial Intelligence (AI)-powered software programs & imaging solutions, microfluidic devices, robotics & automation, and advanced bioreactor systems, among other equipment, will simplify and aid novel innovations in biotechnology related to animals.

Animal Biotechnology Market: Challenges

High cost of investment to challenge market growth during the forecast period

The global animal biotechnology market is expected to be challenged by the high cost of investment required to develop the required infrastructure and maintain the facility. For instance, the average construction cost of a large-scale facility can reach over USD 80 million. Moreover, extensive regulatory hurdles worldwide may further limit industry expansion trends in the future.

Animal Biotechnology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Animal Biotechnology Market |

| Market Size in 2024 | USD 20.14 Billion |

| Market Forecast in 2034 | USD 58.23 Billion |

| Growth Rate | CAGR of 11.20% |

| Number of Pages | 218 |

| Key Companies Covered | Phibro Animal Health Corporation, Boehringer Ingelheim Animal Health, Bayer Animal Health (acquired by Elanco), Genus plc (including PIC and ABS Global), KWS SAAT SE & Co. KGaA (animal feed genetics segment), ImmuCell Corporation, Zoetis Inc., Virbac, Neogen Corporation, Elanco Animal Health, AgBiTech, Merck Animal Health (MSD Animal Health), AB Vista, Ceva Santé Animale, IDEXX Laboratories, and others. |

| Segments Covered | By Product, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Animal Biotechnology Market: Segmentation

The global animal biotechnology market is segmented based on product, application, end-user industry, and region.

Based on the product, the global market segments are nutrition, drugs, biologics, reproductive & genetic, and diagnostic. In 2024, the highest growth rate was listed in the biologics segment, which held prominence over 32% of the total revenue. It is expected to deliver a CAGR of more than 10.01% during the forecast period. The rising number of animal infections worldwide has created an urgent demand for effective biologics, thereby facilitating segmental revenue growth.

Based on application, the global animal biotechnology industry is divided into product research & development, preventive care in animals, treatment of diseases in animals, diagnosis of veterinary diseases, and others.

Based on the end-user industry, the global market divisions are veterinary hospitals & clinics, point-of-care testing, laboratories, and others. In 2024, around 35% of the final market share was dominated by the laboratories segment. The surging rate of research & innovation associated with animal biotechnology is propelling the segmental revenue. Furthermore, the increased demand for improved animal welfare will escalate segmental expansion in the coming years.

Animal Biotechnology Market: Regional Analysis

North America to deliver the highest revenue during the forecast period

The global animal biotechnology market is expected to be led by North America during the forecast period. In 2024, it accounted for nearly 34.01% of the global revenue, with the US delivering the highest return on investment in the regional industry. The presence of a wide range of animal welfare programs across North America has enabled the region to dominate the global sector.

In September 2024, the U.S. Department of Agriculture’s (USDA) National Institute of Food and Agriculture (NIFA) unit announced an investment of $17.6 million to enhance agricultural research aimed at protecting the health and welfare of agricultural animals in the region. Europe is expected to emerge as the second-highest revenue generator. The growing presence of critical companies operating in the animal biotechnology industry is promoting regional revenue.

Additionally, the increasing demand for animal-based products, particularly in the meat sector, is driving advancements in animal biotechnology throughout Europe. In 2024, Scout Bio was acquired by Ceva. The former is a leading company with a special focus on developing biotech-based pet therapies.

Animal Biotechnology Market: Competitive Analysis

The global animal biotechnology market is led by players like:

- Phibro Animal Health Corporation

- Boehringer Ingelheim Animal Health

- Bayer Animal Health (acquired by Elanco)

- Genus plc (including PIC and ABS Global)

- KWS SAAT SE & Co. KGaA (animal feed genetics segment)

- ImmuCell Corporation

- Zoetis Inc.

- Virbac

- Neogen Corporation

- Elanco Animal Health

- AgBiTech

- Merck Animal Health (MSD Animal Health)

- AB Vista

- Ceva Santé Animale

- IDEXX Laboratories

The global animal biotechnology market is segmented as follows:

By Product

- Nutrition

- Drugs

- Biologics

- Reproductive & Genetic

- Diagnostic

By Application

- Product Research & Development

- Preventive Care in Animals

- Treatment of Diseases in Animals

- Diagnosis of Veterinary Diseases

- Others

By End-User Industry

- Veterinary Hospitals & Clinics

- Point-of-Care Testing

- Laboratories

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Animal biotechnology is a special segment of the broader biotechnology industry. It deals with modern molecular biology techniques to genetically modify animals.

The global animal biotechnology market is expected to be driven by the increasing demand for animal-based products across major industries.

According to study, the global animal biotechnology market size was worth around USD 20.14 billion in 2024 and is predicted to grow to around USD 58.23 billion by 2034.

The CAGR value of the animal biotechnology market is expected to be around 11.20% during 2025-2034.

The global animal biotechnology market is expected to be led by North America during the forecast period.

The global animal biotechnology market is led by players like Phibro Animal Health Corporation, Boehringer Ingelheim Animal Health, Bayer Animal Health (acquired by Elanco), Genus plc (including PIC and ABS Global), KWS SAAT SE & Co. KGaA (animal feed genetics segment), ImmuCell Corporation, Zoetis Inc., Virbac, Neogen Corporation, Elanco Animal Health, AgBiTech, Merck Animal Health (MSD Animal Health), AB Vista, Ceva Santé Animale, and IDEXX Laboratories.

The report explores crucial aspects of the animal biotechnology market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed