Alloy Wheels Aftermarket Market Size, Share, Trends, Growth & Forecast 2034

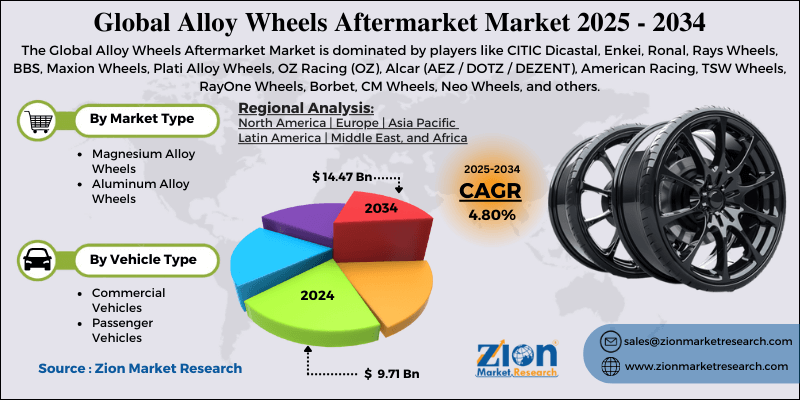

Alloy Wheels Aftermarket Market By Market Type (Magnesium Alloy Wheels and Aluminum Alloy Wheels), By Vehicle Type (Commercial Vehicles and Passenger Vehicles), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.71 Billion | USD 14.47 Billion | 4.80% | 2024 |

Alloy Wheels Aftermarket Industry Perspective:

What will be the size of the global alloy wheels aftermarket during the forecast period?

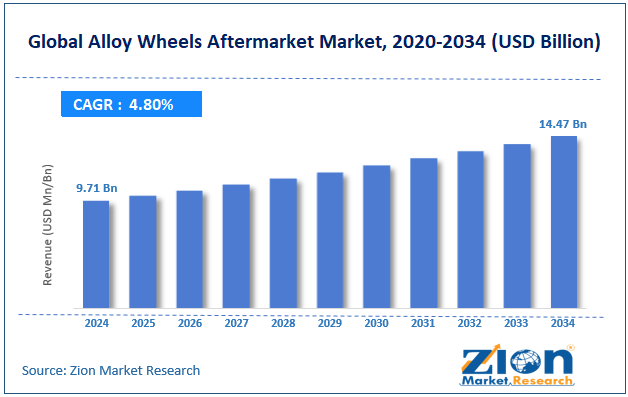

The global alloy wheels aftermarket market size was worth around USD 9.71 billion in 2024 and is predicted to grow to around USD 14.47 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global alloy wheels aftermarket market is estimated to grow annually at a CAGR of around 4.80% over the forecast period (2025-2034)

- In terms of revenue, the global alloy wheels aftermarket market size was valued at around USD 9.71 billion in 2024 and is projected to reach USD 14.47 billion by 2034.

- The alloy wheels aftermarket market is projected to grow at a significant rate due to the rising rate of vehicle ownership worldwide.

- Based on the market type, the aluminum wheels segment is growing at a high rate and will continue to dominate the global market, as per industry projections

- Based on the vehicle type, the passenger vehicles segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Alloy Wheels Aftermarket Market: Overview

The aftermarket alloy wheel segment of the automotive industry refers to third-party service providers. These specially designed wheels are not offered by the original equipment manufacturer (OEM) but by third-party providers once the vehicle has undergone the sale from the OEM. Alloy wheels, unlike traditionally used automotive wheels, are made using different metals. Generally, they are made of aluminum along with other essential elements such as nickel and magnesium. According to industry research, alloy wheels offer significant advantages over conventional counterparts. For instance, the former are lightweight and hence assist in improving the fuel efficiency of a vehicle. During the forecast period, demand for alloy wheel aftermarket is expected to continue growing, driven by multiple factors. Several technical advantages associated with alloy wheels will help the industry thrive during the forecast period.

Additionally, the growing demand for performance-oriented wheels and automobiles may drive improved revenue in the market. A major drawback for the alloy wheel aftermarket market will be reported in the form of high cost of services and volatility of the raw material supply chain.

Alloy Wheels Aftermarket Market: Dynamics

Growth Drivers

How will the surge in vehicle ownership worldwide influence the alloy wheels aftermarket market growth?

The global alloy wheels aftermarket market is expected to be driven by the rising rate of vehicle ownership worldwide. According to the Society of Indian Automotive Manufacturers (SIAM), India recorded sales of more than 43 lakh vehicles in fiscal year 2024-2025. Similar statistics are observed across the globe, including developing and developed nations.

For instance, Europe has an over 56% vehicle ownership rate, and it is expected to continue growing in the coming years. One of the major factors driving vehicle demand is the changing lifestyle of consumers and easier access to vehicles through financial assistance. Additionally, several economies have reported reduced vehicle costs, further fueling the car ownership rate. The rapid expansion of electric and hybrid vehicles may work in favor of the alloy wheel aftermarket industry as sustainability concerns continue to influence consumer behavior.

Rising emphasis on lightweight vehicles and fuel economy to promote market expansion during the forecast period

Lightweight automotives offer improved fuel efficiency or electric range as compared to traditional heavyweight vehicles. In addition, they have a lower environmental impact and deliver improved performance. These factors have influenced a greater demand for lightweight vehicles worldwide. Fuel economy or electric range has become crucial for end consumers, especially as fuel prices continue to remain volatile worldwide.

Additionally, the environmental impact of fuel-powered vehicles continues to drive demand for electric vehicles that offer a higher range. In addition, federal fuel-related regulatory standards have further shaped supply and demand for lightweight passenger or commercial vehicles. According to industry analysis, allowing wheels to be lightweight by construction assists in improving fuel efficiency, along with overall vehicle handling. During the forecast period, the global alloy wheels aftermarket market will continue to benefit from the advantages associated with the industry offerings.

Restraints

Why will performance limitations restrict the alloy wheel aftermarket market growth rate?

The global alloy wheel aftermarket industry is expected to be constrained by several performance limitations. For instance, research suggests that alloy wheels are more vulnerable to damage on poor roads or speed bumps. Alloy wheels can bend or crack when subjected to harsh potholes or tough terrains. In addition, due to the lightweight of the wheels, they have a lower load-carrying capacity, which further limits market expansion trends.

Opportunities

Ongoing efforts to standardize and regulate the aftermarket market to offer expansion opportunities

The global alloy wheel aftermarket market is expected to see further growth opportunities as regional governments and private companies intensify efforts to standardize the aftermarket sector. This includes several government-led initiatives to create a concrete operational structure for aftermarket service providers. This will always ensure consumer protection against fraud and poor service.

For instance, the US automobile aftermarket is heavily regulated by the National Traffic and Motor Vehicle Safety Act, designed to monitor vehicle components circulating in the aftermarket parts sector. Other initiatives include focusing on wheel design and efficiency to enhance vehicle performance and safety.

Will the introduction of new alloys create new expansion possibilities for alloy wheel aftermarket service providers?

The industry for alloy wheel aftermarket is witnessing the growing introduction of new alloys and subsequent products aimed at improving vehicle performance and offering higher customization options. The industry is further encouraged by evolving consumer demands and preferences, forcing market players to invest in wheel innovation. These novel offerings include advanced aluminum alloy wheels, hybrid material wheels, and magnesium alloy wheels.

Challenges

High cost of alloy wheels and raw material supply chain disruption to challenge industry growth

The global alloy wheels aftermarket industry is expected to be challenged by the high cost of the wheels. Furthermore, maintenance expenses associated with alloy wheels are significantly high, further impacting consumer decisions. Another key factor limiting market growth is the risk of raw material supply chain disruptions as geopolitical tensions continue to escalate worldwide.

Alloy Wheels Aftermarket Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Alloy Wheels Aftermarket Market |

| Market Size in 2024 | USD 9.71 Billion |

| Market Forecast in 2034 | USD 14.47 Billion |

| Growth Rate | CAGR of 4.80% |

| Number of Pages | 216 |

| Key Companies Covered | CITIC Dicastal, Enkei, Ronal, Rays Wheels, BBS, Maxion Wheels, Plati Alloy Wheels, OZ Racing (OZ), Alcar (AEZ / DOTZ / DEZENT), American Racing, TSW Wheels, RayOne Wheels, Borbet, CM Wheels, Neo Wheels, and others. |

| Segments Covered | By Market Type, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Alloy Wheels Aftermarket Market: Segmentation

The global alloy wheels aftermarket market is segmented based on market type, vehicle type, and region.

Based on market type, the global market segments are magnesium alloy wheels and aluminum alloy wheels. In 2024, the highest growth was listed in the aluminum wheels segment. Products available in this segment offer higher durability and improved performance. Magnesium alloys, on the other hand, are more expensive and hence enjoy limited demand in the consumer market. Although the performance benefits of magnesium alloys may aid segmental growth in the future.

Based on vehicle type, the global industry is divided into commercial vehicles and passenger vehicles. In 2024, the highest revenue-generating segment was passenger vehicles. The growing rate of vehicle ownership worldwide will fuel segmental expansion. Additionally, increased demand for customization options in the automotive sector will fuel higher revenue for alloy wheel aftermarket industry players.

Alloy Wheels Aftermarket Market: Regional Analysis

Why will North America continue to dominate the alloy wheels aftermarket industry during the forecast period?

The global alloy wheels aftermarket market is expected to be dominated by North America during the forecast period. The regional prominence will be led by the US and Canada. These regions have a higher number of car enthusiasts and large vehicle drivers. For instance, recent research suggests that over 7 million young vehicle drivers across the US invest heavily in customizing their cars. In addition, regional industry growth is further fueled by the presence of a highly organized and extensive aftermarket for alloy wheels, ensuring smoother penetration into the domestic economy.

Europe is another growing region in the alloy wheels aftermarket market with exceptional growth potential. Fuel efficiency offered by alloy wheels is one of the major regional market growth drivers. European countries are increasingly encouraging the adoption of new solutions to reduce the environmental impact of automobiles, thereby facilitating greater use of alloy wheels.

Additionally, the surging rate of new alloy introduction across Europe will work in favor of the regional industry. Asia-Pacific is expected to emerge as the fastest revenue generator during the projection period. The rapid expansion of the regional automotive industry, higher demand for passenger vehicles, and favorable government policies will aid accelerated regional growth trends during the forecast duration.

Alloy Wheels Aftermarket Market: Competitive Analysis

The global alloy wheels aftermarket market is led by players like:

- CITIC Dicastal

- Enkei

- Ronal

- Rays Wheels

- BBS

- Maxion Wheels

- Plati Alloy Wheels

- OZ Racing (OZ)

- Alcar (AEZ / DOTZ / DEZENT)

- American Racing

- TSW Wheels

- RayOne Wheels

- Borbet

- CM Wheels

- Neo Wheels

Alloy Wheels Aftermarket Market: Key Market Trends

Growing adoption in commercial vehicles

A major trend in the aftermarket for alloy wheels is the growing use of alloy wheels in the commercial vehicle sector. Factors such as improved vehicle performance and reduced fuel consumption will help accelerate the adoption of alloy wheels across commercial vehicles.

Global expansion of business operations

Alloy wheel aftermarket service providers are actively seeking new opportunities to enter new markets, especially emerging economies. Global expansion will help them diversify revenue streams and ensure sustained long-term growth.

The global alloy wheels aftermarket market is segmented as follows:

By Market Type

- Magnesium Alloy Wheels

- Aluminum Alloy Wheels

By Vehicle Type

- Commercial Vehicles

- Passenger Vehicles

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed