Alcohol Based Disinfectant Market Size, Share, Trends, Growth and Forecast 2032

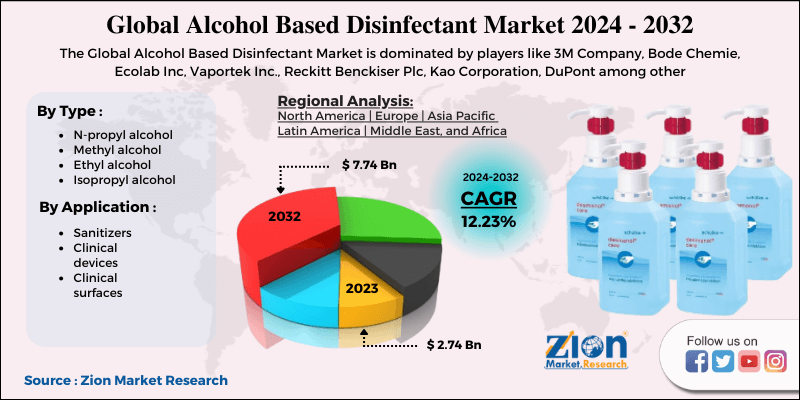

Alcohol Based Disinfectant Market - By Type (N-Propyl Alcohol, Methyl Alcohol, Ethyl Alcohol, Isopropyl Alcohol), By Application (Sanitizers, Clinical Devices, Clinical Surfaces), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

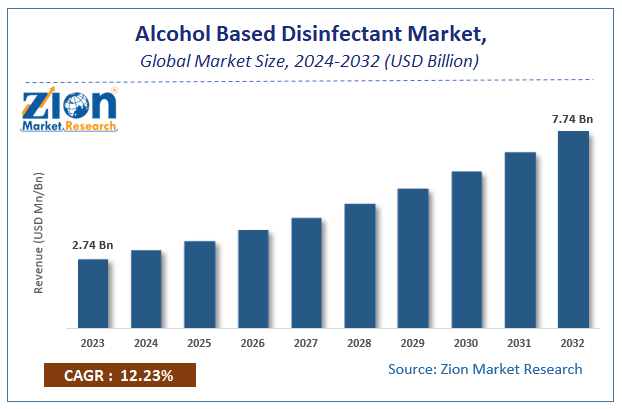

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.74 Billion | USD 7.74 Billion | 12.23% | 2023 |

Alcohol Based Disinfectant Market Insights

According to Zion Market Research, the global Alcohol Based Disinfectant Market was worth USD 2.74 Billion in 2023. The market is forecast to reach USD 7.74 Billion by 2032, growing at a compound annual growth rate (CAGR) of 12.23% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Alcohol Based Disinfectant Market industry over the next decade.

Global Alcohol Based Disinfectant Market Overview

Alcohol-based disinfectants are antimicrobial agents that are added to a surface to destroy microorganisms and provide a sterile atmosphere. The term "alcohol-based disinfectant" refers to a concentrated solution of alcohol (mostly isopropyl alcohol) used for sanitation. Alcohol-based disinfectants are made up of a mixture of 60–90% alcohol and 10–30% distilled water. For cleansing and moisturizing purposes, alcohol-based disinfectants are added to glycerin soaps. Alcohol-based disinfectants are used in aerosol sprays used for coverage and adhesion on rough surfaces such as counter-tops, showers, and toilets. Alcohol is an excellent disinfectant since it evaporates quickly and leaves no traces. Alcohols can also dissolve liquids, making them effective against viral cells that are covered in liquid. Furthermore, they are low-cost and easy to use. Because of the increase in hospital-acquired infections, nearly all hospitals now use alcohol-based disinfectants in any operation.

The global alcohol-based disinfectant industry has grown as people's understanding of hygiene has increased around the world. The global alcohol-based disinfectant market is expected to rise due to rising demand from the soap industry.

Alcohol-based disinfectants are disinfectants containing antimicrobial properties which effectively execute microorganisms.Alcohols are effective disinfectants and it contains ethanol as a base component which has different applications. Alcohol based disinfectant are utilized as a cleaning agent in hospitals, food industry, hand sanitizers and for other cleaning purposes. They are reasonable and generally simple to handle, although their vapors are combustible.

High growth in the healthcare sector is anticipated to increase the global alcohol based disinfectant market. The increase in hospital-acquired infections has driven hospitals to utilize alcohol based disinfectants in all procedure.Continuous rising knowledge about hygiene all over the globe has positively driven the global alcohol based disinfectant market growth. Additionally, growing healthcare expenditure can fuel the alcohol based disinfectant market.In terms of application hand, sanitizers sector holds the majority of share approximately 60% of the overall market in 2015. The World Health Organization (WHO) has prescribed alcohol based disinfectant as the best tool to keep up hand hygiene.

COVID-19 Impact Analysis

The worldwide lockdown of processing plants as a result of the Coronavirus pandemic has affected supply chains. However, new entrants in the manufacture of sanitizers and disinfectants have emerged to meet the growing demand for alcohol-based chemicals in the wake of an increase in COVID-19 cases around the world. Because of the growing use of these chemicals for disinfection purposes in clinics, laboratories, private offices, and households, government lockdowns and production halts have had no effect on this sector. The market would remain bullish in upcoming year.

The significant increase in the global Alcohol Based Disinfectant market size in 2020 is estimated on the basis of the COVID-19 outbreak and its positive impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Growth Factors

A variety of epidemics have been recorded in the last few years. From previous outbreaks of Nipah and Ebola to the current Coronavirus pandemic, these have prompted people to take greater precautions to protect themselves against potentially lethal viral infections. Alcohol-based disinfectants are also essential in the fight against COVID-19 which has boosted the market growth in last year. The demand for alcohol-based disinfectants and sanitizers has increased as people become more aware of the importance of sanitation and cleanliness in order to avoid contamination.

However, the increased use of non-alcoholic based disinfectants can suppress the growth of the alcoholic based disinfectant market in the coming years.

Alcohol Based Disinfectant Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Alcohol Based Disinfectant Market |

| Market Size in 2023 | USD 2.74 Billion |

| Market Forecast in 2032 | USD 7.74 Billion |

| Growth Rate | CAGR of 12.23% |

| Number of Pages | 155 |

| Key Companies Covered | 3M Company, Bode Chemie, Ecolab Inc, Vaportek Inc., Reckitt Benckiser Plc, Kao Corporation, DuPont among other |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Type Segment Analysis Preview

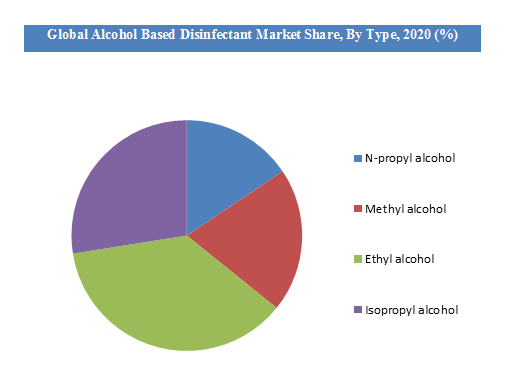

Based on types, the Alcohol Based Disinfectants market is divided as N-propyl alcohol, Methyl alcohol, Ethyl alcohol and Isopropyl alcohol. Ethyl alcohol contributes majorly in the type segment. Ethyl alcohol is commonly used in disinfectants at concentrations of 60–80% because it is an active virucidal agent that can inactivate all lipophilic viruses, including herpes, vaccinia, and other influenza viruses, as well as other hydrophilic viruses.

Application Segment Analysis Preview

Alcohol Based Disinfectants are used in Sanitizers, Clinical devices and Clinical surfaces. Hand sanitizers are in high demand, and this development is expected to continue in the coming years. The outstanding success is the result of increased public knowledge of diseases and pathogens spread by unclean hands.

However, strict regulatory necessities in developed countries can hamper the alcohol based disinfectant market. Sterilization and disinfection of sophisticated medical instruments is a challenge for the growth of this market. Currently, non-alcoholic disinfectants have begun substituting the traditional alcohol-based disinfectants. These non-alcoholic disinfectants are less expensive; this trend may hamper the alcohol based disinfectant market in near future.

The product type segment for the alcohol based disinfectant market includes n-propyl alcohol, methyl alcohol, ethyl alcohol and isopropyl alcohol.Ethyl alcohol and isopropyl alcohol dominated the market and acquired around 70% of the overall market share in 2015. Based on application, the worldwide alcohol based disinfectant market is segmented into sanitizers, clinical devices, and clinical surfaces.

Geographically, North America dominated the global alcohol based disinfectant market with over 35% market share in 2015. This was mainly contributed by increasing alcohol based disinfectant demand in medical industry for equipment sanitization. Europe was one of the major players in the market due to higher usage of alcohol based disinfectant. Asia-Pacific is expected to emerge as a growing market for manufacturers. Africa and the Middle East represent a region with a large potential for alcohol based disinfectant products.

Key Market Players & Competitive Landscape

Some of the major players of global Alcohol Based Disinfectant market includes -

- 3M Company

- Bode Chemie

- Ecolab Inc

- Vaportek Inc.

- Reckitt Benckiser Plc

- Kao Corporation

- DuPont among other

The global Alcohol Based Disinfectant Market is segmented as follows:

By Type

- N-propyl alcohol

- Methyl alcohol

- Ethyl alcohol

- Isopropyl alcohol

By Application

- Sanitizers

- Clinical devices

- Clinical surfaces

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

global Alcohol Based Disinfectant Market was worth USD 2.74 Billion in 2023

global Alcohol Based Disinfectant Market was worth USD 2.74 Billion in 2023. The market is forecast to reach USD 7.74 Billion by 2032, growing at a compound annual growth rate (CAGR) of 12.23% during the forecast period 2024-2032

Alcohol-based disinfectants are also essential in the fight against COVID-19 which has boosted the market growth in last year. The demand for alcohol-based disinfectants and sanitizers has increased as people become more aware of the importance of sanitation and cleanliness in order to avoid contamination.

In 2020, North America accounted towards a major share of alcohol based disinfectant market and will continue to dominate the market over the next few years. But, increase in infectious diseases would propel the growth of the market worldwide

Some of the major players of global Alcohol Based Disinfectant market includes 3M Company, Bode Chemie, Ecolab Inc, Vaportek Inc., Reckitt Benckiser Plc, Kao Corporation, DuPont among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed