Aircraft Synthetic Vision Systems Market Size, Share, Trends, Growth and Forecast 2034

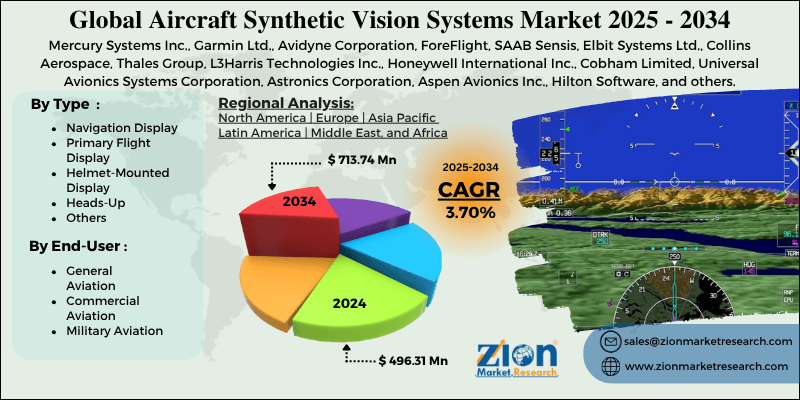

Aircraft Synthetic Vision Systems Market By Type (Navigation Display, Primary Flight Display, Helmet-Mounted Display, Heads-Up, and Others), By End-User (General Aviation, Commercial Aviation, and Military Aviation), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

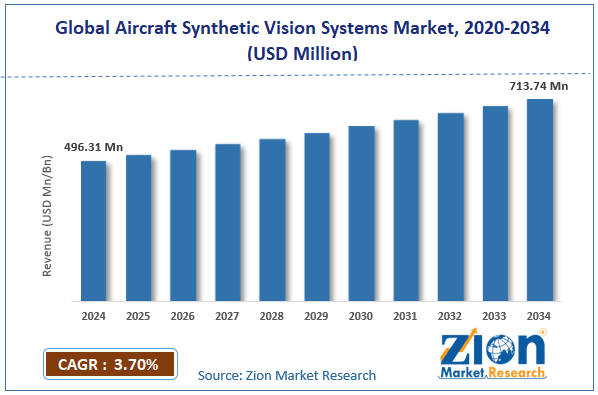

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 496.31 Million | USD 713.74 Million | 3.70% | 2024 |

Aircraft Synthetic Vision Systems Industry Perspective:

The global aircraft synthetic vision systems market size was worth around USD 496.31 million in 2024 and is predicted to grow to around USD 713.74 million by 2034, with a compound annual growth rate (CAGR) of roughly 3.70% between 2025 and 2034.

Aircraft Synthetic Vision Systems Market: Overview

An aircraft synthetic vision system (SVS) is a modern installation that provides flight crews with a 3-dimensional display of the outer environment even in difficult environmental conditions. The technology works as a combination of an intuitive display and 3-dimensional data. It assists in enhancing the situational awareness of the onboard flight crew.

In addition, SVS installations are also useful in reducing pilot workload, especially during challenging circumstances such as on approach. Aircraft synthetic vision displays merge information about existing obstacles and terrains with high-resolution displays, data feeds from other aircraft, aeronautical information, and global positioning system (GPS) to provide detailed information about where the pilots are flying and the nearby surroundings. During the forecast period, demand for aircraft synthetic vision systems is projected to grow at a steady pace, driven by several factors.

For instance, the growing number of commercial aircraft worldwide and increased focus on aircraft safety measures will create higher market revenue in the long term.

Furthermore, increased investments in Artificial Intelligence (AI)-powered SVS with improved displays may open new avenues for further growth. The high cost of initial research will emerge as the most significant growth barrier for the industry players.

Key Insights:

- As per the analysis shared by our research analyst, the global aircraft synthetic vision systems market is estimated to grow annually at a CAGR of around 3.70% over the forecast period (2025-2034)

- In terms of revenue, the global aircraft synthetic vision systems market size was valued at around USD 496.31 million in 2024 and is projected to reach USD 713.74 million by 2034.

- The aircraft synthetic vision system market is projected to grow at a significant rate due to the growing number of commercial aircraft worldwide.

- Based on the type, the primary flight display segment is growing at a high rate and will continue to dominate the global market as per industry projections

- Based on the end-user, the generation aviation segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Aircraft Synthetic Vision Systems Market: Growth Drivers

Growing number of commercial aircraft worldwide to propel market expansion rate

The global aircraft synthetic vision systems market is expected to be driven by the rising number of commercial aircraft worldwide. The global aviation industry is witnessing a sharp rise in the number of air travelers across domestic and international borders.

The booming travel & tourism industry has been a major driving force for increased demand for higher air connectivity across geographical locations. In addition, business-based travel has also improved in the last few years.

In July 2024, Virgin Atlantic, a leading airline connecting global destinations, announced the completion of fleet transformation with the addition of new aircraft owned by the company. The company will gain access to seven new A330-900s by 2027, according to the recent deal.

Additionally, the number of airports with world-class infrastructure has increased. In April 2025, TAV Airports Holding and Fraport announced the completion of the first construction phase related to the expansion of Antalya Airport (AYT) on the Turkish Mediterranean coast. The facility will register expansion of its terminal areas along with other developments.

Growing demand for stringent safety mandates in the aerospace industry to propel market growth

One of the major growth drivers for SVS in the aviation industry is the increasing focus on improving aircraft and passenger safety. In the last few years, the aerospace sector has been plagued by several fatal incidents, causing higher casualty rates.

According to the International Air Transport Association (IATA), 7 fatal accidents were reported in 2024 with 244 onboard fatalities. Synthetic vision systems in aircraft are developed to enhance situation awareness for the onboard flight crew.

Hence, it acts as an additional and highly effective safety feature against sudden changes in the external conditions during flight. The global aircraft synthetic vision systems market growth rate is expected to excel in the coming years as safety precautions in the industry become more stringent.

Aircraft Synthetic Vision Systems Market: Restraints

High cost of initial development to limit market revenue in the long run

The high initial development cost is expected to restrict the global aircraft synthetic vision systems industry. Synthetic vision systems are advanced tools developed using cutting-edge engineering solutions such as advanced display mechanisms and real-time data processing features.

For instance, deploying synthetic vision systems in a small aircraft may cost between USD 5,000 and USD 20,000. The cost further increases when installed in larger commercial or private airplanes.

Aircraft Synthetic Vision Systems Market: Opportunities

Increased launch of new & advanced SVS to generate more growth opportunities for industry players

The global aircraft synthetic vision systems market is projected to generate growth opportunities due to the rising launch of highly advanced SVS with improved features. The use of highly intuitive display systems and terrain databases helps SVS deliver exceptional performance.

In November 2024, official reports confirmed that European Cessna Citation CJ3s can now be installed with European Aviation Safety Agency (EASA)-certified Pro Line Fusion avionics by Collins Aerospace Systems. The technology is equipped with a breakthrough synthetic vision system with exceptional performance even in challenging environmental conditions.

In addition, advancements are also registered in ancillary technologies such as display systems and detailed 3D representation. The industry players can benefit by integrating Artificial Intelligence (AI) with SVS to deliver more powerful tools.

Increased military applications of SVS globally to further amplify market expansion

Military applications of synthetic vision systems have been growing steadily over the last few years. Aircraft synthetic vision systems have proved helpful in aiding smooth navigation across difficult terrains. The growing investments in regional military technologies and improving budgets will further escalate the use of SVS in the coming years.

For instance, in April 2025, India announced it would procure 26 Rafale Marine Jets for the Indian Navy in the coming years. Heightened the need for advanced national security measures and growing geopolitical tensions to escalate military budgets, creating revenue scope for SVS providers.

Aircraft Synthetic Vision Systems Market: Challenges

Regulatory challenges and integration complexities in legacy systems to challenge market expansion

The global industry for aircraft synthetic vision systems is expected to be challenged by the regulatory challenges faced by the industry players. The technologies can only be launched after receiving approvals from regulatory agencies such as EASA, the Federal Aviation Administration (FAA), or others. Furthermore, modern SVS may not be compatible with legacy solutions, creating growth barriers for the market players.

Aircraft Synthetic Vision Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Synthetic Vision Systems Market |

| Market Size in 2024 | USD 496.31 Million |

| Market Forecast in 2034 | USD 713.74 Million |

| Growth Rate | CAGR of 3.70% |

| Number of Pages | 215 |

| Key Companies Covered | Mercury Systems Inc., Garmin Ltd., Avidyne Corporation, ForeFlight, SAAB Sensis, Elbit Systems Ltd., Collins Aerospace, Thales Group, L3Harris Technologies Inc., Honeywell International Inc., Cobham Limited, Universal Avionics Systems Corporation, Astronics Corporation, Aspen Avionics Inc., Hilton Software, and others. |

| Segments Covered | By Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Synthetic Vision Systems Market: Segmentation

The global aircraft synthetic vision systems market is segmented based on type, end-user, and region.

Based on the type, the global market segments are navigation display, primary flight display, helmet-mounted display, heads-up, and others. In 2024, the highest growth was listed in the primary flight display segment. It is primarily used across all aircraft types, including commercial and business. The navigation display segment continues to act as a major revenue propeller. Increasing demand for enhanced display technologies will promote segmental revenue in the coming years. The average cost of commercial SVS can reach USD 200,000 or more.

Based on the end-user, the global market divisions are general aviation, commercial aviation, and military aviation. In 2024, the highest revenue was generated by the generation aviation sector. It includes aviation activities such as business air travel, private flying, and charter flights. Aircraft synthetic vision systems are regularly used in Cessna 172, Robinson R44, and Cirrus SR22. The global aviation industry was valued at over USD 28 billion in 2024.

Aircraft Synthetic Vision Systems Market: Regional Analysis

North America to lead the market expansion rate in the future

The global aircraft synthetic vision systems market will be led by North America during the forecast period. The US is expected to lead the regional revenue in the coming years. According to market research, around 32 aircraft in the US are already updated with the latest offering of Collins Aerospace Systems’ Pro Line Fusion avionics.

In addition, the presence of a thriving general aviation sector in the region further aids higher revenue in North America. The US Air Force, at the start of 2025, announced a new hybrid program for pilot training. The country is witnessing a shortage of pilots and is expected to overhaul its existing training schemes.

In addition to this, the US enjoys the presence of a well-established and stringent aircraft safety framework and extensive regulations. The growing advancements in aviation technology in North America and the increase in the number of commercial or general-purpose aircraft will promote regional expansion in the future.

Military applications of SVS have also registered improved revenue in the last few years. The surging development of new synthetic vision systems with AI capabilities is expected to open new avenues for further growth in the regional market.

Aircraft Synthetic Vision Systems Market: Competitive Analysis

The global aircraft synthetic vision systems market is led by players like:

- Mercury Systems Inc.

- Garmin Ltd.

- Avidyne Corporation

- ForeFlight

- SAAB Sensis

- Elbit Systems Ltd.

- Collins Aerospace

- Thales Group

- L3Harris Technologies Inc.

- Honeywell International Inc.

- Cobham Limited

- Universal Avionics Systems Corporation

- Astronics Corporation

- Aspen Avionics Inc.

- Hilton Software

The global aircraft synthetic vision systems market is segmented as follows:

By Type

- Navigation Display

- Primary Flight Display

- Helmet-Mounted Display

- Heads-Up

- Others

By End-User

- General Aviation

- Commercial Aviation

- Military Aviation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An aircraft synthetic vision system (SVS) is a modern installation that provides flight crews with a 3-dimensional display of the outer environment even in difficult environmental conditions.

Which key factors will influence the aircraft synthetic vision systems market growth over 2025-2034?

The global aircraft synthetic vision systems market is expected to be driven by the rising number of commercial aircraft worldwide.

According to study, the global aircraft synthetic vision systems market size was worth around USD 496.31 million in 2024 and is predicted to grow to around USD 713.74 million by 2034.

The CAGR value of the aircraft synthetic vision systems market is expected to be around 3.70% during 2025-2034.

The global aircraft synthetic vision systems market will be led by North America during the forecast period.

The global aircraft synthetic vision systems market is led by players like Mercury Systems Inc., Garmin Ltd., Avidyne Corporation, ForeFlight, SAAB Sensis, Elbit Systems Ltd., Collins Aerospace, Thales Group, L3Harris Technologies Inc., Honeywell International Inc., Cobham Limited, Universal Avionics Systems Corporation, Astronics Corporation, Aspen Avionics Inc., and Hilton Software.

The report explores crucial aspects of the aircraft synthetic vision systems market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed