Aircraft Refurbishing Market Size, Share, Trends, Growth 2034

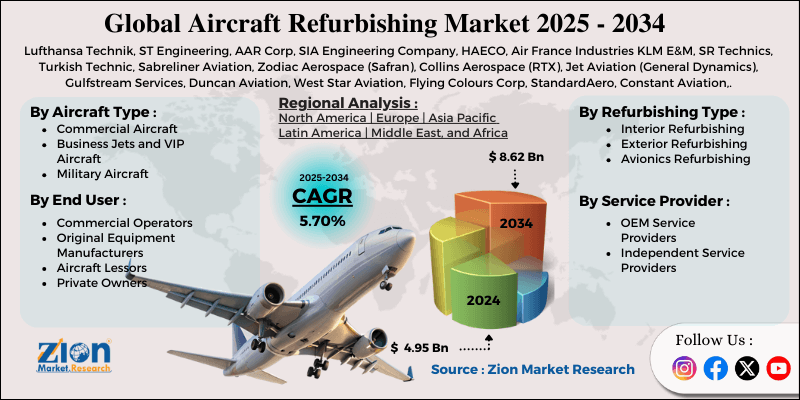

Aircraft Refurbishing Market By Aircraft Type (Commercial Aircraft, Wide-Body, Narrow-Body, Regional, Business Jets and VIP Aircraft, and Military Aircraft), By Refurbishing Type (Interior Refurbishing, Exterior Refurbishing, and Avionics Refurbishing), By End-User (Commercial Operators, Original Equipment Manufacturers, Aircraft Lessors, and Private Owners), By Service Provider (OEM Service Providers and Independent Service Providers) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

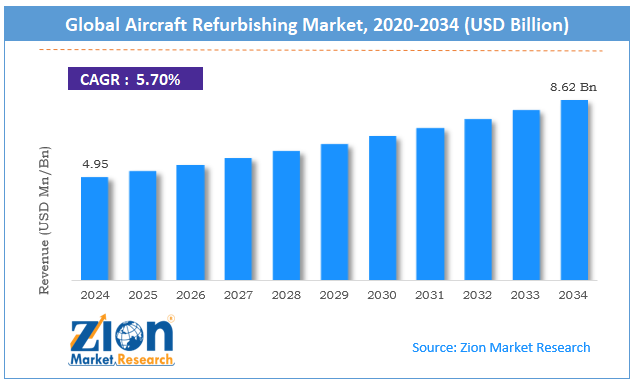

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.95 Billion | USD 8.62 Billion | 5.70% | 2024 |

Aircraft Refurbishing Industry Perspective:

The global aircraft refurbishing market was valued at approximately USD 4.95 billion in 2024 and is expected to reach around USD 8.62 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 5.70% between 2025 and 2034.

Aircraft Refurbishing Market: Overview

Aircraft refurbishment refers to the complete renovation and modernization of an aircraft’s interiors, exteriors, and systems to extend its operational life, enhance passenger comfort, and ensure compliance with regulatory standards. This process includes upgrades to the cabin, seat reconfiguration, modernization of avionics, improvements in environmental control systems, and essential structural maintenance.

The aircraft refurbishment market supports a variety of clients, including commercial airlines seeking to update their fleet without incurring the high cost of new aircraft, leasing companies preparing planes for new operators, private jet owners aiming to enhance luxury and performance, and military organizations working to prolong aircraft service while integrating modern technologies.

Refurbishment services range from minor cabin upgrades to complete overhauls, including structural repairs, avionics updates, and repainting, tailored to various aircraft needs.

The increasing average age of global aircraft fleets, growing focus on passenger experience as a competitive differentiator, and evolving safety and environmental regulations are expected to drive substantial growth in the global aircraft refurbishing industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global aircraft refurbishing market is estimated to grow annually at a CAGR of around 5.70% over the forecast period (2025-2034)

- In terms of revenue, the global aircraft refurbishing market size was valued at around USD 4.95 billion in 2024 and is projected to reach USD 8.62 billion by 2034.

- The aircraft refurbishing market is driven by rising investments in premium cabin upgrades, evolving regulatory compliance requirements for in-service aircraft, and technological advancements enabling modular and cost-effective refurbishment solutions.

- Based on aircraft type, commercial aircraft lead the segment and will continue to lead the global market.

- Based on refurbishing type, interior refurbishing is expected to lead the market.

- Based on the end-user, commercial operators are anticipated to command the largest market share.

- Based on the service provider, independent service providers are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Aircraft Refurbishing Market: Growth Drivers

Fleet aging and economic considerations

The aircraft refurbishing market is growing as global commercial and private aircraft fleets age, and demand for modernization and life extension services increases. The average age of operational commercial aircraft has increased significantly, as many airlines are flying aircraft beyond their original design life.

Economics favors refurbishment over replacement, since refurbishment costs are 25-40% of the new aircraft acquisition cost. Post-pandemic financial constraints have made extending the life of existing assets more critical than aircraft replacement. The backlogs for new aircraft deliveries make the case for refurbishment even more substantial, as operators need capacity now.

Passenger experience and competitive differentiation

The aircraft refurbishing industry is becoming important as airlines focus on cabin experience as a key differentiator in the commercial aviation market. Modern travelers have higher expectations of comfort, connectivity, and onboard amenities that older aircraft cannot provide without refurbishing. Cabin densification requires reconfiguring existing aircraft to maximize revenue while keeping passenger satisfaction.

In-flight entertainment and connectivity systems are evolving rapidly and must be updated regularly to meet passenger expectations. Premium cabin competition has intensified significantly, driving substantial investments in business and first-class refurbishment programs.

Aircraft Refurbishing Market: Restraints

Supply chain constraints and skilled labor shortages

Despite the demand, the aircraft refurbishing industry has supply chain and workforce issues. Specialized materials, components, and systems for aircraft interiors have long lead times, making it challenging for time-critical projects. The aviation maintenance industry has a skills shortage, especially for refurbishment work that requires technical expertise and craftsmanship.

Certification for aircraft modifications adds complexity and potential delays compared to standard maintenance. Global supply chain disruptions have affected material availability and cost, especially for specialized textiles, composites, and electronics. All these factors contribute to capacity constraints in the industry despite strong demand across all market segments.

Aircraft Refurbishing Market: Opportunities

Sustainability initiatives and technological integration

The aircraft refurbishing market has opportunities through sustainability-focused upgrades and technology integration. Growing environmental concerns drive interest in eco-friendly cabin materials, lightweight parts, and fuel efficiency upgrades that can be done during refurbishment. Digital transformation of the passenger experience through advanced connectivity, wireless entertainment, and digital displays is a big refurbishment category.

The post-pandemic trend for touchless technology and antimicrobial surfaces creates new refurbishment requirements across existing fleets. There is growing interest in cabin modifications to support new revenue streams, including flexible cargo passenger configurations and dedicated spaces for premium services.

Aircraft Refurbishing Market: Challenges

Regulatory complexity and certification requirements

The aircraft refurbishing industry faces challenges from changing regulatory environments and lengthy certification processes for aircraft modifications. Each refurbishment project must navigate airworthiness requirements across multiple jurisdictions for international operations and various certifications.

Fire safety regulations for cabin materials are getting tougher, limiting material options and potentially making them more expensive. Noise and emissions standards are evolving and may require additional work beyond the original scope of refurbishment. Certification for major modifications can be lengthy and costly, especially for new configurations or technologies with no precedents.

Aircraft Refurbishing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Refurbishing Market |

| Market Size in 2024 | USD 4.95 Billion |

| Market Forecast in 2034 | USD 8.62 Billion |

| Growth Rate | CAGR of 5.70% |

| Number of Pages | 212 |

| Key Companies Covered | Lufthansa Technik, ST Engineering, AAR Corp, SIA Engineering Company, HAECO, Air France Industries KLM E&M, SR Technics, Turkish Technic, Sabreliner Aviation, Zodiac Aerospace (Safran), Collins Aerospace (RTX), Jet Aviation (General Dynamics), Gulfstream Services, Duncan Aviation, West Star Aviation, Flying Colours Corp, StandardAero, Constant Aviation, Aviation Partners Inc, Evergreen Aviation Technologies, AerSale, GDC Technics, FL Technics, MRO Holdings, MAC Interiors., and others. |

| Segments Covered | By Aircraft Type, By Refurbishing Type, By End-User, By Service Provider, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Refurbishing Market: Segmentation

The global aircraft refurbishing market is segmented into aircraft type, refurbishing type, end-user, service provider, and region.

Based on aircraft type, the market is segregated into commercial aircraft (further divided into wide-body, narrow-body, and regional), business jets and VIP aircraft, and military aircraft. Commercial aircraft lead the market due to their larger fleet sizes, higher utilization rates, and regular refurbishment cycles aligned with lease returns and brand refreshes.

Based on refurbishing type, the aircraft refurbishing industry is classified into interior refurbishing, exterior refurbishing, and avionics refurbishing. Of these, interior refurbishing holds the largest market share due to its direct impact on passenger experience, revenue generation potential through cabin densification, and the more frequent refresh cycles required for cabin elements compared to other aircraft systems.

Based on the end-user, the aircraft refurbishing market is divided into commercial operators, original equipment manufacturers, aircraft lessors, and private owners. Commercial operators are expected to lead the market during the forecast period due to their large fleets, competitive pressures to maintain modern cabins, and cyclical refurbishment requirements.

Based on the service provider, the market is segmented into OEM and independent service providers. Independent service providers lead the market share due to their cost competitiveness, specialized expertise in specific refurbishment categories, and greater flexibility in scheduling and customization compared to OEM-provided services.

Aircraft Refurbishing Market: Regional Analysis

North America to lead the market

North America leads the global aircraft refurbishing market due to its large installed aircraft base, established aviation maintenance infrastructure, and presence of both commercial and business aviation. It accounts for approximately 38% of the global market share, with the US being the most significant contributor due to its large commercial airline industry and the world’s largest business aviation fleet.

The region has a mature MRO (Maintenance, Repair and Overhaul) ecosystem that offers refurbishment capabilities across all aircraft types. North America’s focus on passenger experience and brand differentiation drives regular cabin refresh programs among major airlines.

The large business aviation sector creates steady demand for high-end refurbishment services for private and corporate aircraft. Innovation in cabin technologies and materials often starts in North America before going global, further solidifying the region’s market position.

Asia Pacific is set to grow significantly.

Asia Pacific is the fastest-growing region in the aircraft refurbishing market, driven by air traffic growth, fleet expansion, and increasing competition among carriers. Countries like China, Japan, Singapore, and Australia are developing refurbishment capabilities to support their growing aviation industries.

The region’s growing middle class drives air travel growth and demand for more capacity through new and refurbished aircraft. Regional authorities are strengthening MRO capabilities to reduce dependence on services from other regions and creating new opportunities for local providers.

Growing wealth in the area is expanding business aviation and creating more refurbishment demand for high-end aircraft interiors. Strategic partnerships between international refurbishment specialists and local aviation maintenance providers accelerate technology transfer and establish centers of excellence throughout the region's key aviation hubs.

Recent Market Developments:

- In March 2025, Queensland, Australia, was poised to become a leading MRO hub in the Asia-Pacific region, with over 300 aerospace companies contributing 31% of Australia's MRO activities.

Aircraft Refurbishing Market: Competitive Analysis

The global aircraft refurbishing market is led by players like:

- Lufthansa Technik

- ST Engineering

- AAR Corp

- SIA Engineering Company

- HAECO

- Air France Industries KLM E&M

- SR Technics

- Turkish Technic

- Sabreliner Aviation

- Zodiac Aerospace (Safran)

- Collins Aerospace (RTX)

- Jet Aviation (General Dynamics)

- Gulfstream Services

- Duncan Aviation

- West Star Aviation

- Flying Colours Corp

- StandardAero

- Constant Aviation

- Aviation Partners Inc

- Evergreen Aviation Technologies

- AerSale

- GDC Technics

- FL Technics

- MRO Holdings

- MAC Interiors.

The global aircraft refurbishing market is segmented as follows:

By Aircraft Type

- Commercial Aircraft

- Wide-Body

- Narrow-Body

- Regional

- Business Jets and VIP Aircraft

- Military Aircraft

By Refurbishing Type

- Interior Refurbishing

- Exterior Refurbishing

- Avionics Refurbishing

By End-User

- Commercial Operators

- Original Equipment Manufacturers

- Aircraft Lessors

- Private Owners

By Service Provider

- OEM Service Providers

- Independent Service Providers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aircraft refurbishment refers to the complete renovation and modernization of an aircraft’s interiors, exteriors, and systems to extend its operational life, enhance passenger comfort, and ensure compliance with regulatory standards.

The aircraft refurbishing market is expected to be driven by increasing average age of global aircraft fleets, rising focus on passenger experience as a competitive differentiator, growing aircraft leasing activity requiring refurbishment during transitions, evolving safety and environmental regulations, and extended delivery backlogs for new aircraft.

According to our study, the global aircraft refurbishing market was worth around USD 4.95 billion in 2024 and is predicted to grow to around USD 8.62 billion by 2034.

The CAGR value of the aircraft refurbishing market is expected to be around 5.70% during 2025-2034.

The global aircraft refurbishing market will register the highest growth in Asia Pacific during the forecast period.

Key players in the aircraft refurbishing market include Lufthansa Technik, ST Engineering, AAR Corp, SIA Engineering Company, HAECO, Air France Industries KLM E&M, SR Technics, Turkish Technic, Sabreliner Aviation, Zodiac Aerospace (Safran), Collins Aerospace (RTX), Jet Aviation (General Dynamics), Gulfstream Services, Duncan Aviation, West Star Aviation, Flying Colours Corp, StandardAero, Constant Aviation, Aviation Partners Inc, Evergreen Aviation Technologies, AerSale, GDC Technics, FL Technics, MRO Holdings, and MAC Interiors.

The report comprehensively analyzes the aircraft refurbishing market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, sustainability initiatives, and the evolving passenger experience requirements shaping the aviation aftermarket ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed