Africa Lottery Market Size, Share, Value, Industry Trends 2034

Africa Lottery Market By Lottery Type (Draw-Based Games, Instant Win Games, Sports Betting Lottery, Raffle Lottery, Online Lottery, and Others), By Platform (Offline, Online, Mobile Applications), By Prize Structure (Fixed Prize, Progressive Jackpot, Pari-Mutuel), By Ticket Price Range (Low Range, Mid-Range, Premium Range), By Distribution Channel (Retail Outlets, Agents and Vendors, Online Platforms, Mobile Applications, Kiosks and Terminals, and Others), By End-User (Individual Players, Group Players, Corporate Players, Lottery Syndicates), and By Region - Continental and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

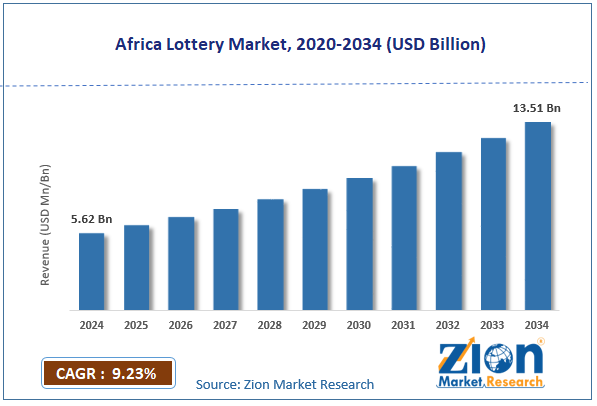

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.62 Billion | USD 13.51 Billion | 9.23% | 2024 |

Africa Lottery Industry Prospective

The Africa lottery market size was worth approximately USD 5.62 billion in 2024 and is projected to grow to around USD 13.51 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.23% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the Africa lottery market is estimated to grow annually at a CAGR of around 9.23% over the forecast period (2025-2034).

- In terms of revenue, the Africa lottery market size was valued at approximately USD 5.62 billion in 2024 and is projected to reach USD 13.51 billion by 2034.

- The Africa lottery market is projected to grow significantly due to rising mobile penetration, increasing urbanization, growing youth population, expanding retail networks, improving regulatory frameworks, and rising disposable incomes across the continent.

- Based on lottery type, the draw-based games segment is expected to lead the Africa lottery market, while the online lottery segment is anticipated to experience significant growth.

- Based on the platform, the offline segment is expected to lead the Africa lottery market, while the mobile applications segment is anticipated to witness notable growth.

- Based on the prize structure, the progressive jackpot segment is the dominating segment, while the fixed prize segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the retail outlets segment is expected to lead the market compared to the online platforms segment.

- Based on end user, the individual players segment is expected to lead the market during the forecast period.

- Based on region, South Africa is projected to dominate the Africa lottery market during the estimated period, followed by Nigeria and Kenya.

Africa Lottery Market: Overview

The Africa lottery market consists of legal gambling activities in which players purchase tickets with selected number combinations, hoping to win cash prizes through random draws or instant results across various African countries. These games give people a chance to win large rewards by spending small amounts, thereby making participation possible for many income groups. Draw lotteries require players to wait for daily or weekly results, while scratch cards show results immediately after revealing covered areas. National lotteries support public projects such as education, healthcare, transport, and sports, which build public interest and trust. Private lottery companies operate with government licenses and manage ticket sales, prize payments, and retail networks.

Mobile lottery services enable players to participate via smartphones without visitin

g physical shops, thereby improving access in remote areas. Sports lottery games mix match predictions with prize draws for added excitement. Group play allows people to share ticket costs and winnings together. Prizes range from small rewards to multi-million dollar jackpots. Country rules control licensing, age limits, taxes, and responsible gaming. Digital lottery use grows with rising mobile and internet access across Africa. The expanding middle class and increasing smartphone adoption are expected to drive growth in the Africa lottery market throughout the forecast period.

Africa Lottery Market Dynamics

Growth Drivers

How are mobile technology and digital payment systems driving the Africa lottery market expansion?

The Africa lottery market is growing as mobile phones have spread widely and digital payments allow people to join games from many locations with ease. Smartphone use increases across cities and towns, which helps more users reach lottery applications and online gaming platforms. Mobile money services such as M-Pesa, MTN Mobile Money, and Orange Money allow safe ticket purchase and prize payment through phones without bank accounts. Internet data prices continue falling, which helps users visit lottery sites and applications often without concern about heavy data costs. Young people across Africa readily adopt mobile tools and prefer digital gaming to paper tickets purchased in shops. Mobile platforms send instant messages for results, winning numbers, and special offers directly to player phones. Players scan tickets or enter numbers into applications to check results quickly with auto verification. Digital wallets keep tickets safe and prevent loss issues linked with paper tickets. Fast mobile sign-up allows quick entry into games and grows participation strongly.

Rising urbanization and an expanding middle class are creating new player demographics.

The Africa lottery market shows strong growth as cities expand fast and more people join the middle-income groups with extra spending. Urban migration brings many residents into city centers, where lottery shops appear in malls, stations, neighborhoods, and busy shopping streets. Steady city jobs give regular income, allowing workers to join lottery games as low-cost leisure and as a means of pursuing hopeful money dreams. Retail chains, supermarkets, and shopping malls place lottery counters near daily services so ticket buying fits easily into normal routines. Young office workers often treat lottery play as light fun and a small chance for major money improvement later. City leisure culture includes lottery play, along with movies, sports, dining, and weekend outings with friends and family groups. Advertising reaches urban users through billboards, television, radio, and social media platforms, while office lottery pools add group fun and shared winning hopes.

Restraints

How are regulatory inconsistencies and licensing challenges creating key restraints for the Africa lottery market?

The Africa lottery industry faces many problems as countries follow different rules and complex licensing systems, which increase business costs and legal risk. Some nations ban lottery activity due to cultural or religious views, which limits growth plans. Licensing changes often occur without warning, which forces operators to stop services or reset approvals before restarting legal operations. Heavy tax charges on lottery sales and prizes reduce company income and weaken the ability to offer large, attractive jackpots. Weak rule of law stability discourages foreign investors seeking clear legal systems before investing in gaming businesses. Corruption and slow government paperwork often delay license approvals and increase setup costs and planning uncertainty for operators. Separate national laws block cross-border lottery operations and prevent shared regional prize systems with wider public appeal. Differences in responsible gaming regulation and political tensions across regions raise compliance costs and create long-term uncertainty for the safe growth of the lottery.

Opportunities

Growing youth population and social gaming trends

The Africa lottery industry gains a strong opportunity as young people form large parts of national populations and enjoy games that mix fun entertainment with real prize-winning chances. More than half of Africa's population remains under 25, which creates a very large future player base as income levels slowly rise. Young adults treat lottery play as modern digital fun linked with global gaming culture rather than older gambling habits tied to past generations. Social media contests and online challenges using lottery ideas attract youth who spend many hours on digital platforms, seeking engagement and shared experiences. The popularity of mobile gaming across African regions makes lottery applications feel simple, familiar, and easier than visiting formal betting shops or distant casino areas. Friend influence across social platforms boosts joining rates as groups share winning stories, celebrate prizes, and join popular draw events together. Education growth among youth improves understanding of odds, safe play habits, entertainment purposes, and digital payment use for smooth mobile lottery participation.

Challenges

How is addressing infrastructure limitations and connectivity gaps challenging for the Africa lottery market?

The Africa lottery market faces access challenges as unreliable electricity and weak internet services limit player participation across many regions. Frequent power cuts disrupt retail terminals, online platforms, and mobile applications, thereby blocking ticket sales during blackouts and frustrating players. Rural communities lack nearby lottery shops because setup costs and low population density reduce business interest, despite strong local demand. Internet reach stays below half of the national population in many countries, which leaves millions unable to join online lottery services. Slow data speeds make mobile lottery applications hard to use, which pushes players back toward physical retailers or full withdrawal. High mobile data prices restrict regular online use for many households, even though smartphone ownership continues rising fast. Limited banking access in rural zones complicates prize collection and blocks digital ticket payments for many potential winners. Transport barriers, language diversity, low literacy, and cash safety risks raise costs and reduce steady participation from distant bases.

Africa Lottery Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Africa Lottery Market Research Report |

| Market Size in 2024 | USD 5.62 Billion |

| Market Forecast in 2034 | USD 13.51 Billion |

| Growth Rate | CAGR of 9.23% |

| Number of Pages | 220 |

| Key Companies Covered | Ithuba Holdings, Premier Lotto, Gidani, SportPesa, Betway, Hollywoodbets, Lottoland, Lotto Star, Bet.co.za, BetKing, Lotto Nigeria, National Lottery Authority Ghana, Kenya National Lottery, Zambia National Lottery, and Tanzania National Lottery |

| Segments Covered | By Lottery Type, By Platform, By Prize Structure, By Ticket Price Range, By Distribution Channel, By End User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Africa Lottery Market: Segmentation

The global Africa lottery market is segmented based on lottery type, platform, prize structure, ticket price range, distribution channel, end-user, and region.

Based on lottery type, the Africa lottery industry is classified into draw-based games, instant win games, sports betting lottery, raffle lottery, online lottery, and others. Draw-based games lead the market due to their traditional appeal, larger prize pools that attract player interest, and regular draw schedules that maintain ongoing participation among loyal players.

Based on the platform, the industry is segregated into offline, online, and mobile applications. Offline leads the market due to established retail networks, trust in physical ticket purchases, and accessibility for populations without reliable internet connections or smartphone access in many African regions.

Based on prize structure, the Africa lottery market is divided into fixed prize, progressive jackpot, and pari-mutuel. Progressive jackpot is expected to lead the market during the forecast period due to the excitement generated by growing prize amounts and media attention around large jackpots.

Based on the ticket price range, the market is segmented into low range, mid-range, and premium range. The low range holds the largest market share due to affordability for players across income levels and its ability to attract frequent participation from individuals with limited disposable income.

Based on distribution channel, the market is segmented into retail outlets, agents and vendors, online platforms, mobile applications, kiosks and terminals, and others. Retail outlets hold the largest market share due to extensive physical presence across African countries, trusted relationships between communities and local vendors, and accessibility for players preferring traditional ticket purchasing methods.

Based on end-user, the market is segmented into individual players, group players, corporate players, and lottery syndicates. Individual players hold the largest market share due to personal decision-making in lottery participation and direct ticket purchases without coordination requirements.

Africa Lottery Market: Regional Analysis

South Africa leads due to its established infrastructure and mature market

South Africa is expected to record steady growth in 2025, with an estimated market share of around 35%, making it the leading country in the Africa lottery market. South Africa holds a leading place in the market due to strict rules, a wide retail reach, and many years of trusted legal lottery operations. The National Lottery operates across the country with high brand trust and large sales networks serving both large cities and small towns. High urban population levels place many players near active lottery outlets, while stable mobile networks support steady digital access for online participation. Income levels remain higher than in many neighboring countries, which supports regular spending on leisure activities, including lottery ticket purchases. Modern banking systems and widespread mobile money use support seamless ticket purchasing and rapid prize payments without significant service delays. Strong oversight from the National Lotteries Commission supports fair play, responsible gaming, and the correct use of lottery funds for social development programs. Private operators bring organized management, smart marketing, and modern technological tools, which raise player interest and improve the overall game experience.

Media coverage of winners and funded public projects keeps attention strong and shows social value beyond only prize winnings. Good educational levels help players understand game rules, safety procedures, and the proper prize-claim process without confusion or misuse. Large retail chains and small stores often include lottery counters, which facilitate ticket purchases during routine shopping visits. These combined features help South Africa remain the most stable and active lottery market across the African region today.

What is driving Nigeria and Kenya's rapid growth in the Africa lottery market?

Nigeria and Kenya are expected to record strong growth in 2025 with an estimated combined CAGR of around 9%, making them the fastest-expanding lottery markets within the Africa region. Nigeria and Kenya show fast growth in the Africa lottery market as large populations, strong mobile use, and clearer rules support steady expansion across urban and rural regions. Nigeria's population size offers a very large future player base, even when only a small share joins regular lottery participation today. Mobile money growth in Kenya, led by M-Pesa, facilitates ticket payments and prize redemption via mobile phones without requiring bank account access. Young age groups in both countries prefer digital games and adopt lottery applications quickly due to their high comfort level with mobile tools. Cities such as Lagos and Nairobi grow fast with rising middle-income groups spending more on leisure activities, including lottery games. Clearer regulations in recent years have improved trust and attracted organized operators who invest in long-term lottery networks.

Sports betting popularity builds gaming awareness and helps lottery play feel like familiar entertainment for many young users. Mobile network expansion brings internet access to more districts, which supports digital lottery growth beyond major city limits. Retail sales grow through supermarkets, fuel stations, and small shops, adding lottery sales beside daily consumer products. Radio, television, and social media advertising feature stories of winners from ordinary families, which builds strong belief in the possibility of winning. Economic hope remains strong despite challenges, which pushes people to try low-cost lottery tickets offering dreams of a life change. International operators bring capital, trained staff, and modern systems, which lift service quality and introduce professional standards across growing lottery markets.

Recent Developments

- In June 2025, ITHUBA Holdings completed a technology migration for the national lottery in South Africa in under two hours, enabling uninterrupted ticket sales and online service continuity.

Africa Lottery Market: Competitive Analysis

The leading players in the Africa lottery market are

- Ithuba Holdings

- Premier Lotto

- Gidani

- SportPesa

- Betway

- Hollywoodbets

- Lottoland

- Lotto Star

- Bet.co.za

- BetKing

- Lotto Nigeria

- National Lottery Authority Ghana

- Kenya National Lottery

- Zambia National Lottery

- Tanzania National Lottery.

The Africa lottery market is segmented as follows:

By Lottery Type

- Draw-Based Games

- Instant Win Games

- Sports Betting Lottery

- Raffle Lottery

- Online Lottery

- Others

By Platform

- Offline

- Online

- Mobile Applications

By Prize Structure

- Fixed Prize

- Progressive Jackpot

- Pari-Mutuel

By Ticket Price Range

- Low Range

- Mid-Range

- Premium Range

By Distribution Channel

- Retail Outlets

- Agents and Vendors

- Online Platforms

- Mobile Applications

- Kiosks and Terminals

- Others

By End User

- Individual Players

- Group Players

- Corporate Players

- Lottery Syndicates

By Region

- The Middle East and Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed