Wood Adhesives And Binders Market Size, Share, Trends, Growth 2032

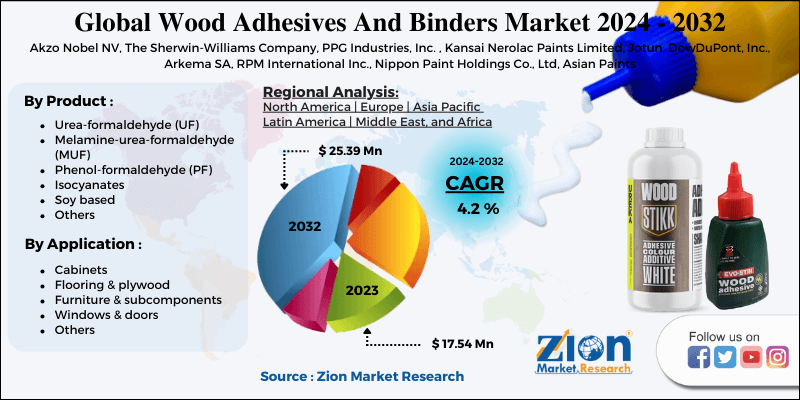

Wood Adhesives And Binders Market By Type (Urea Formaldehyde (UF), Melamine Urea Formaldehyde (MUF), Phenol Formaldehyde (PF), Isocyanates, Soy Based And Others), By Applications (Cabinets, Flooring & Plywood, Furniture & Subcomponents, Windows & Doors And Other)- Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

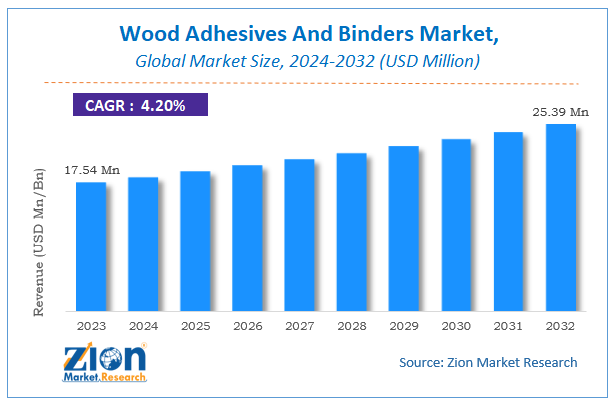

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.54 Million | USD 25.39 Million | 4.2% | 2023 |

Wood Adhesives And Binders Market Insights

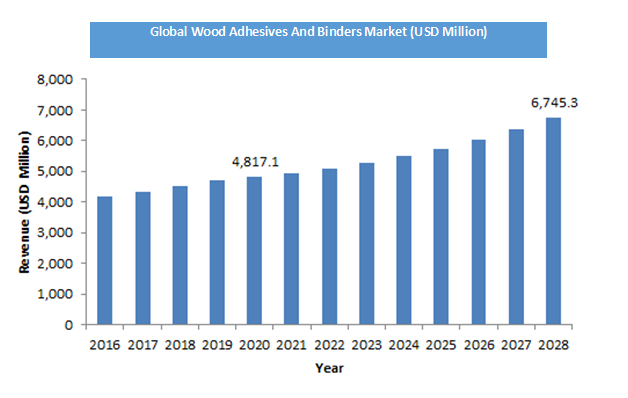

According to a report from Zion Market Research, the global Wood Adhesives And Binders Market was valued at USD 17.54 Million in 2023 and is projected to hit USD 25.39 Million by 2032, with a compound annual growth rate (CAGR) of 4.2% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Wood Adhesives And Binders Market industry over the next decade.

Wood Adhesives And Binders Market: Market Overview

Wood adhesives and binders are the substances which are used to bind two materials by applying the substances on the surface of material. Adhesives and binders are widely used due to their beneficial properties as time efficiency, lightness in weight, ease of use and low price. Adhesives are used in various applications such as making cabinets, furniture, plywood, windows and doors.

Due to globalization wood adhesives for shipping and transportation are in demand, which results into growth of wood adhesive and binders market. Also, the increasing investment across construction industries and infrastructural development are driving the wood adhesives and binders market.

Wood Adhesives And Binders Market: COVID-19 Impact Analysis

The covid-19 have led us to serious implications for most suppliers of chemicals and materials, for all the sectors as it has deepen the growth to a significant level and Wood Adhesives and Binders Market wasn’t an exception. Owing to the lockdown and shutdown of various manufacturing plants in many countries have increased the supply gap which have led to hinder the growth of Wood Adhesives and Binders Market.

The end of the lockdown is expected to elevate the growth of market significantly higher consumer traffic. Many local companies are focusing on domestic market in order to grab the opportunities in the covid-19 situation.

Wood Adhesives And Binders Market: Growth Factors

The increase in demand of eco-friendly and green furniture with the changing business environment the global wooden furniture market is expected to grow over the forecast period. The increasing understanding and concern about the lessening if the trees and global warming have led to the tremendous upward movement in the use of engineered wood-based panels. Moreover, owing to increasing in the spending power of the people and rapid urbanization has contributed to a higher demand for engineered wood furniture. Also, it is anticipated that this can be a reason to be vital factor in influencing product demand.

The Demand from the shipping and transportation industry, growing demand from the building and construction sector is anticipated to increase growth of the global wood adhesives and binders market. Also, owing to the new trends in home furnishing and with a rise in demand for modern furniture and wooden flooring are likely to boost the market for the forecast period.

Wood Adhesives And Binders Market: System Segment Analysis Preview

Soy-based adhesives are expected to witness the fastest growth of the Wood Adhesives and Binders Market CAGR of 8.2% over the forecast period. These adhesives are friendly to the nature and increase the overall performance of the wood. As the soy based adhesives are the nature loving and with the increasing understanding and concern about the lessening if the trees and global warming in peoples, which can be the driver of the Wood Adhesives and Binders Market.

Wood Adhesives And Binders Market: Application Segment Analysis Preview

Flooring application is anticipated to observe the fastest growth over the forecast period. Owing to increasing in the spending power of the people and rapid urbanization has contributed to a higher demand for engineered wood furniture. Also, it is anticipated that this can be a reason to be vital factor in influencing product demand.

Wood Adhesives And Binders Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wood Adhesives And Binders Market |

| Market Size in 2023 | USD 17.54 Million |

| Market Forecast in 2032 | USD 25.39 Million |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 167 |

| Key Companies Covered | Akzo Nobel NV, The Sherwin-Williams Company, PPG Industries, Inc. , Kansai Nerolac Paints Limited, Jotun, DowDuPont, Inc., Arkema SA, RPM International Inc., Nippon Paint Holdings Co., Ltd, Asian Paints. |

| Segments Covered | By Product Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

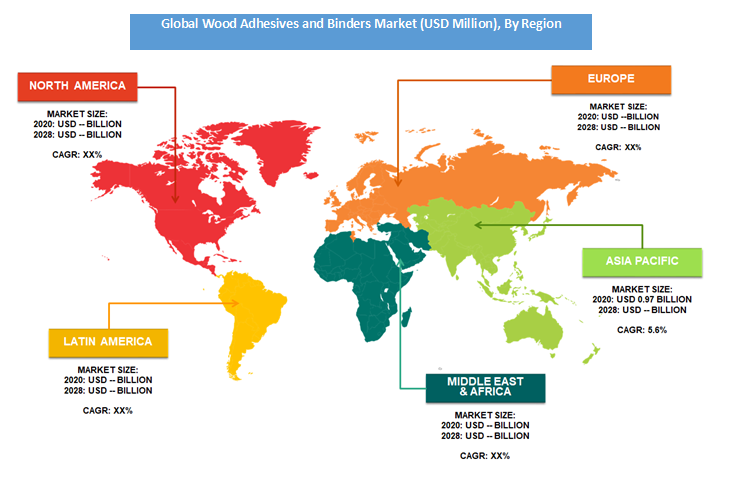

Wood Adhesives And Binders Market: Regional Analysis Preview

Over the forecast period Asia Pacific held the largest market share of 59.2% in 2020 and is expected to grow at the fastest CAGR of 5.6%. In emerging economies such as China, India, Indonesia, and Vietnam the construction industry in this region is expected to grow at a rapid rate. This is anticipated to stimulate the demand for engineered panels, which in turn is expected to elevate the wood adhesives market.

Key Market Players & Competitive Landscape

Some of key players in Wood Adhesives and Binders Market are

- Akzo Nobel NV

- The Sherwin-Williams Company

- PPG Industries, Inc

- Kansai Nerolac Paints Limited

- Jotun

- DowDuPont, Inc

- Arkema SA

- RPM International Inc

- Nippon Paint Holdings Co Ltd

- Asian Paints

The Wood Adhesives and Binders Market is segmented as follows:

By Product Type

- Urea-formaldehyde (UF)

- Melamine-urea-formaldehyde (MUF)

- Phenol-formaldehyde (PF)

- Isocyanates

- Soy based

- Others

By Application

- Cabinets

- Flooring & plywood

- Furniture & subcomponents

- Windows & doors

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the Global Wood Adhesives And Binders Market was valued at USD 17.54 Million in 2023 and is projected to hit USD 25.39 Million by 2032.

According to a report from Zion Market Research, the Global Wood Adhesives And Binders Market a compound annual growth rate (CAGR) of 4.2% during the forecast period 2024-2032.

The increase in demand of eco-friendly and green furniture with the changing business environment the Global wooden furniture market is expected to grow over the forecast period. Moreover, owing to increasing in the spending power of the people and rapid urbanization has contributed to a higher demand for engineered wood furniture. Also, it is anticipated that this can be a reason to be vital factor in influencing product demand.

Asia Pacific region held a substantial share of the Wood Adhesives and Binders Market in 2020.

Some of the major companies operating in the wood adhesives and binders market are Akzo Nobel NV, The Sherwin-Williams Company, PPG Industries, Inc. , Kansai Nerolac Paints Limited, Jotun, DowDuPont, Inc., Arkema SA, RPM International Inc., Nippon Paint Holdings Co., Ltd, Asian Paints.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed