Video Analytics Market Size & Share, Growth, Trends 2032

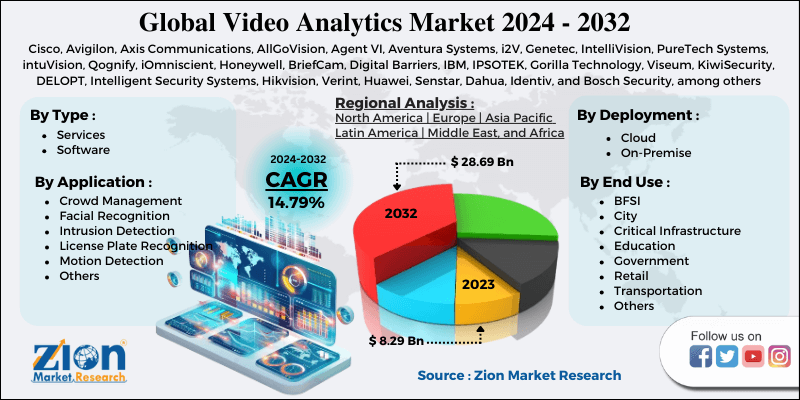

Video Analytics Market By Type (Software and Services), By Deployment (Cloud and On-premise), By Application (Crowd Management, Facial Recognition, Intrusion Detection, License Plate Recognition, Motion Detection, and Others), By End-use (BFSI, City, Critical Infrastructure, Education, Government, Retail, Transportation, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

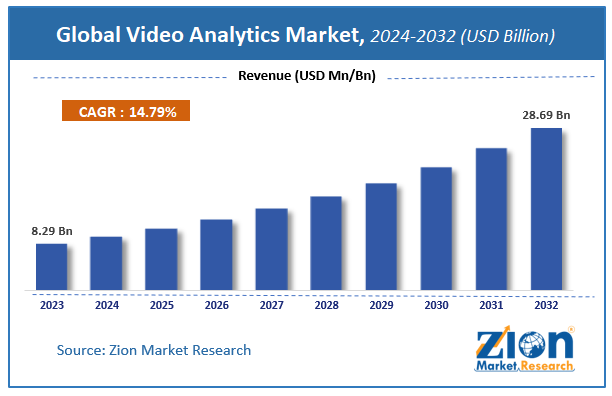

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.29 Billion | USD 28.69 Billion | 14.79% | 2023 |

Video Analytics Market Insights

Zion Market Research has published a report on the global Video Analytics Market, estimating its value at USD 8.29 Billion in 2023, with projections indicating that it will reach USD 28.69 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 14.79% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Video Analytics Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Video analytics transmits a video signal digitally using an algorithm to perform security-related functions. It has been promoted as a solution to provide security by detecting intruders and tracking objects or people.

COVID-19 Impact Analysis

The outbreak of COVID-19 will impact both demand and supply. It will not decrease demand or supply but lockdown has impacted transportation which resulted in disruption of the supply and demand chain. The growth in this market is expected to boom in the coming years due to the introduction of AI-enabled surveillance systems.

Video Analytics Market: Growth Factors

Video analytics is helping many sectors to enhance security and situational awareness. Live and recorded video are the main drivers for the demand for video analytics technology. Video surveillance systems in private or public places help in reducing crime rates and safeguarding areas by identifying people or number plates on vehicles.

Further public institutions are expected to invest heavily in this market owing to thefts and crime in the city. Video surveillance helps reduce the crime rate, to ensure public and infrastructure safety.

Video Analytics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Video Analytics Market |

| Market Size in 2023 | USD 8.29 Billion |

| Market Forecast in 2032 | USD 28.69 Billion |

| Growth Rate | CAGR of 14.79% |

| Number of Pages | 110 |

| Key Companies Covered | Cisco, Avigilon, Axis Communications, AllGoVision, Agent VI, Aventura Systems, i2V, Genetec, IntelliVision, PureTech Systems, intuVision, Qognify, iOmniscient, Honeywell, BriefCam, Digital Barriers, IBM, IPSOTEK, Gorilla Technology, Viseum, KiwiSecurity, DELOPT, Intelligent Security Systems, Hikvision, Verint, Huawei, Senstar, Dahua, Identiv, and Bosch Security, among others |

| Segments Covered | By Type, By Deployment, By Application, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Video Analytics Market: Segmentation Analysis

Segmentation Analysis by Deployment

The on-premise segment held a share of over 30% in 2023. Business operations On-premise are carried out on the server of the user’s company’s site with a server. In recent years, companies have shifted from on-premise to cloud deployment as it can highly support and scale unlimited cameras and it also provides real-time data. Cloud is another deployment type.

Segmentation Analysis by Application

Intrusion management segment is projected to grow at a CAGR of around 15% from 2024 to 2032. The intrusion system offers real-time videos, if an intruder breaks the security, it generates an alarm along with a video and sends it to the VMS Video Management Software to inform the concerned authorities.

Video Analytics Market: Regional Analysis

North America accounted for a share of around 37% in 2023. Enterprises and governments in majorly US and Canada have invested heavily in the deployment of video analytics systems. Rapid technological development and a developed economy are helping the growth of this market.

Asia Pacific is projected to grow at a CAGR of over 22% during the forecast period. Countries like China and India are investing in security surveillance systems for the safety of the residents. The Middle East and Africa are actively improving their surveillance systems and are expected to grow in the future due to large funding by the government into technologies like AI, 5G, cloud, IoT, networking and others.

Video Analytics Market: Competitive Analysis

Some of the major players in the global Video Analytics market include:

- Cisco

- Avigilon

- Axis Communications

- AllGoVision

- Agent VI

- Aventura Systems

- i2V

- Genetec

- IntelliVision

- PureTech Systems

- intuVision

- Qognify

- iOmniscient

- Honeywell

- BriefCam

- Digital Barriers

- IBM

- IPSOTEK

- Gorilla Technology

- Viseum

- KiwiSecurity

- DELOPT

- Intelligent Security Systems

- Hikvision

- Verint

- Huawei

- Senstar

- Dahua

- Identiv

- Bosch Security

The global video analytics market is segmented as follows:

By Type

- Services

- Software

By Deployment

- Cloud

- On-Premise

By Application

- Crowd Management

- Facial Recognition

- Intrusion Detection

- License Plate Recognition

- Motion Detection

- Others

By End Use

- BFSI

- City

- Critical Infrastructure

- Education

- Government

- Retail

- Transportation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Video Analytics market size was worth around USD 8.29 billion in 2023 and is expected to reach USD 28.69 billion by 2032.

The global Video Analytics market is expected to grow at a CAGR of 14.79% during the forecast period.

Some of the key factors driving the global video analytics market growth are heavy investment of public and private corporations in video surveillance systems, awareness of benefits from real time surveillance videos.

North America region held a substantial share of the video analytics market in 2023. The government in the region is heavily investing in the technology.

Some of key players in video analytics market are Cisco, Avigilon, Axis Communications, AllGoVision, Agent VI, Aventura Systems, i2V, Genetec, IntelliVision, PureTech Systems, intuVision, Qognify, iOmniscient, Honeywell, BriefCam, Digital Barriers, IBM, IPSOTEK, Gorilla Technology, Viseum, KiwiSecurity, DELOPT, Intelligent Security Systems, Hikvision, Verint, Huawei, Senstar, Dahua, Identiv and Bosch Security, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed