US CPVC Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

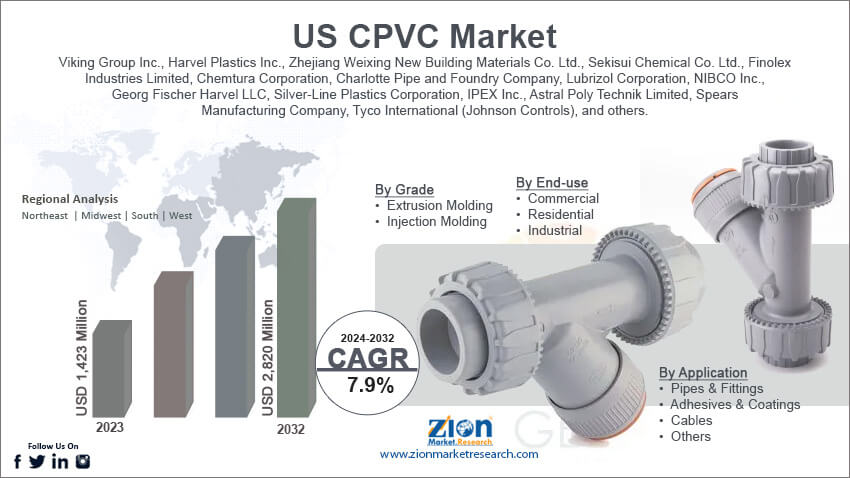

US CPVC Market By Grade (Extrusion Molding and Injection Molding), By Application (Pipes & Fittings, Adhesives & Coatings, Cables, and Others), By End-use (Commercial, Residential, and Industrial), and By Country-State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

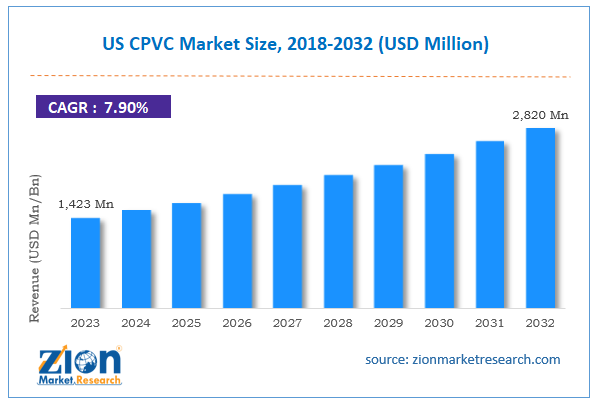

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,423 Million | USD 2,820 Million | 7.9% | 2023 |

US CPVC Industry Perspective:

The US CPVC market size was worth around USD 1,423 million in 2023 and is predicted to grow to around USD 2,820 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.9% between 2024 and 2032.

US CPVC Market: Overview

The further-reacted version of polyvinyl chloride (PVC), known as CPVC, or chlorinated polyvinyl chloride, exhibits several significant similarities and variations from this commonly used plastic. CPVC is a polymer and plastic that is widely utilized in the production of structural materials, chemically resistant equipment, liners, plumbing & vent pipes, and other pipes. Vinyl chloride (VC) monomer molecules undergo a polymerization reaction to create CPVC, just like PVC does. The reaction between ethylene gas from natural hydrocarbon sources and chlorine gas from sodium chloride, or NaCl rock salt, produces the vinyl chloride used in the CPVC/PVC synthesis. The degree of molecular chlorination that CPVC undergoes during manufacturing sets it apart from PVC.

Key Insights

- As per the analysis shared by our research analyst, the US CPVC market is estimated to grow annually at a CAGR of around 7.9% over the forecast period (2024-2032).

- In terms of revenue, the US CPVC market size was valued at around USD 1,423 million in 2023 and is projected to reach USD 2,820 million, by 2032.

- The increasing demand from the construction sector is expected to propel the US CPVC market growth over the projected period.

- Based on the grade, the extrusion molding segment is expected to dominate the market over the forecast period.

- Based on the application, the pipes & fittings segment is expected to grow at a significant rate over the projected period.

- Based on the state, California is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

US CPVC Market: Growth Drivers

Rising emphasis on water management drives market growth

The smooth internal surface of CPVC pipes is well-known for facilitating effective water flow. When CPVC pipes are utilized in water distribution systems, friction losses are reduced and efficient water supply to end customers is guaranteed. Because they are resistant to corrosion and scaling, CPVC pipes are perfect for use in water management systems. The suitability of CPVC pipes for water management applications is attributed to their endurance and durability. Moreover, CPVC pipes are used in irrigation systems in agriculture, where it's critical to use water efficiently. They are appropriate for agricultural water management because of their resistance to corrosion and simplicity of installation. Water is utilized for a variety of purposes in industrial settings, and CPVC pipes are valued for their resistance to chemicals. Thus, the growing emphasis on water management is expected to drive the US CPVC market expansion during the projected period.

US CPVC Market: Restraints

Fluctuations in raw material prices impede market growth

CPVC pipe products may not be as cost-competitive as other insulating materials when raw material prices are high. This may have an impact on contractors' and builders' purchase decisions. The supply chain for CPVC pipes can be disrupted by abrupt changes in the price of raw materials. Furthermore, producers of CPVC pipes might raise pricing to reflect the increased costs of raw materials. This may result in some customers paying less for their CPVC pipes. Additionally, to find substitute raw materials and production techniques that can lessen the effects of price volatility, producers may have to spend funds on research and development. More resources and knowledge are needed for this. Variations in the cost of raw materials may force manufacturers and suppliers to renegotiate, which would affect supply agreements for long-term contracts. Thus, hampering the US CPVC industry expansion.

US CPVC Market: Opportunities

Growing adoption in the construction sector provides a lucrative opportunity for market growth

Growing residential and commercial building projects drive up demand for the material. The product's affordability, durability, and ability to withstand severe environments significantly increase demand. It is a very effective way to supply buildings with water and get rid of garbage. They improve the quality of construction and are incredibly low maintenance and cost-effective. Because of the increased frequency of fire mishaps, fire sprinklers are utilized in many businesses and construction projects. There will likely be a spike in product demand as people become more conscious of the need to protect both workers and residents. Governments impose strict laws about resident and employee safety. Certain rules are required on the installation of high-quality fire systems in commercial buildings by the NFPA 13 Standard. Waste disposal and water supply pipes both employ CPVC pipes and fittings. It can effectively provide commercial buildings with hot and cold water. The fixtures are resistant to strong winds, rain, sunshine, and other environmental contaminants. Because of its cost-effectiveness, builders can lower expenses while still using high-tech, durable materials in their construction. CPVC fixtures are low maintenance and readily replaceable.

US CPVC Market: Challenges

Competition from alternatives poses a major challenge to market expansion

Competitors for CPVC include copper, stainless steel, and PEX (cross-linked polyethylene), which are also utilized in industrial and plumbing settings. Certain materials provide benefits like flexibility, simplicity of installation, or better performance in specific situations, which can prevent CPVC from expanding too much.

US CPVC Market: Segmentation

The US CPVC industry is segmented based on grade, application, end-use, and state.

Based on the grade, the US CPVC market is bifurcated into extrusion molding and injection molding. The extrusion molding segment is expected to dominate the market over the forecast period. Extrusion molding is a very efficient and economical method of producing CPVC pipes and profiles because it enables continuous manufacturing. The capacity to produce in big quantities at a reduced cost helps manufacturers increase their profit margins, which in turn boosts revenue growth. The extrusion molding process's scalability allows producers to quickly increase output in response to rising demand, which further propels market expansion. Furthermore, the creation of multi-layer extrusion methods and other technological developments in extrusion molding have made it possible to produce CPVC products with improved qualities, such as greater temperature resistance or less weight. Novel items have the potential to expand market segments and draw in new customers, which can boost sales.

Based on the application, the US CPVC industry is bifurcated into pipes & fittings, adhesives & coatings, cables, and others. The pipes & fittings segment is expected to grow at a significant rate over the projected period. The need for CPVC pipes and fittings is being driven by the continuous growth of the construction sector in the United States, which includes both residential and commercial projects. Builders and contractors find the material to be an appealing option due to its affordability and longevity. The market for CPVC pipes is also being driven up by investments in infrastructure projects, especially those involving water supply and distribution networks. One major motivator in public infrastructure is the requirement for durable and reliable plumbing systems.

Based on the end-use, the US CPVC market is segmented into commercial, residential, and industrial.

US CPVC Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | US CPVC Market |

| Market Size in 2023 | USD 1,423 Million |

| Market Forecast in 2032 | USD 2,820 Million |

| Growth Rate | CAGR of 7.9% |

| Number of Pages | 222 |

| Key Companies Covered | Viking Group Inc., Harvel Plastics Inc., Zhejiang Weixing New Building Materials Co. Ltd., Sekisui Chemical Co. Ltd., Finolex Industries Limited, Chemtura Corporation, Charlotte Pipe and Foundry Company, Lubrizol Corporation, NIBCO Inc., Georg Fischer Harvel LLC, Silver-Line Plastics Corporation, IPEX Inc., Astral Poly Technik Limited, Spears Manufacturing Company, Tyco International (Johnson Controls), and others. |

| Segments Covered | By Grade, By Application, By End-use, and By State |

| States Covered in US | California, Florida, New York, Washington, Texas, New Jersey, Georgia, Oregon, Arizona, and Colorado |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

US CPVC Market: State Analysis

California is expected to dominate the market over the forecast period

California is expected to dominate the US CPVC market over the forecast period. California has some of the most stringent building regulations in the country, particularly when it comes to fire safety, water conservation, and energy efficiency. These rules encourage the use of materials like CPVC, which meet these norms because they are long-lasting, suitable for potable water systems, and fire-resistant. In addition, the area is still seeing rapid population expansion and urbanization, which is increasing the need for new public facilities, businesses, and housing. The demand for CPVC pipes and fittings in new construction projects is being supported by this rise. Furthermore, the use of CPVC in plumbing systems is being fueled by California's attempts to support water and energy conservation, especially in light of the state's recurrent droughts. The insulating qualities of CPVC contribute to energy savings by lowering heat loss in hot water systems.

US CPVC Market: CPVC Competitive Analysis

The US CPVC market is dominated by players like:

- Viking Group Inc.

- Harvel Plastics Inc.

- Zhejiang Weixing New Building Materials Co. Ltd.

- Sekisui Chemical Co. Ltd.

- Finolex Industries Limited

- Chemtura Corporation

- Charlotte Pipe and Foundry Company

- Lubrizol Corporation

- NIBCO Inc.

- Georg Fischer Harvel LLC

- Silver-Line Plastics Corporation

- IPEX Inc.

- Astral Poly Technik Limited

- Spears Manufacturing Company

- Tyco International (Johnson Controls)

The US CPVC market is segmented as follows:

By Grade

- Extrusion Molding

- Injection Molding

By Application

- Pipes & Fittings

- Adhesives & Coatings

- Cables

- Others

By End-use

- Commercial

- Residential

- Industrial

By State

- California

- Florida

- New York

- Washington

- Texas

- New Jersey

- Georgia

- Oregon

- Arizona

- Colorado

- Others

Table Of Content

Methodology

FrequentlyAsked Questions

The further-reacted version of polyvinyl chloride (PVC), known as CPVC, or chlorinated polyvinyl chloride, exhibits several significant similarities and variations from this commonly used plastic. CPVC is a polymer and plastic that is widely utilized in the production of structural materials, chemically resistant equipment, liners, plumbing and vent pipes, and other pipes.

The US CPVC market is being driven by several factors such as the growing construction industry, technological advancements, increasing investment in infrastructure development, rising government initiatives, growing collaboration among the key market players, and others.

According to the report, the US CPVC market size was worth around USD 1,423 million in 2023 and is predicted to grow to around USD 2,820 million by 2032.

The US CPVC market is expected to grow at a CAGR of 7.9% during the forecast period.

US CPVC market growth is driven by California. It is currently the nation's highest revenue-generating market due to the rising infrastructural development.

The US CPVC market is dominated by players like Viking Group Inc., Harvel Plastics Inc., Zhejiang Weixing New Building Materials Co. Ltd., Sekisui Chemical Co. Ltd., Finolex Industries Limited, Chemtura Corporation, Charlotte Pipe and Foundry Company, Lubrizol Corporation, NIBCO Inc., Georg Fischer Harvel LLC, Silver-Line Plastics Corporation, IPEX Inc., Astral Poly Technik Limited, Spears Manufacturing Company and Tyco International (Johnson Controls) among others.

The US CPVC market report covers the geographical market along with a comprehensive CPVC competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed