UHD 4K Panel Market Size, Share, Growth, Opportunities 2034

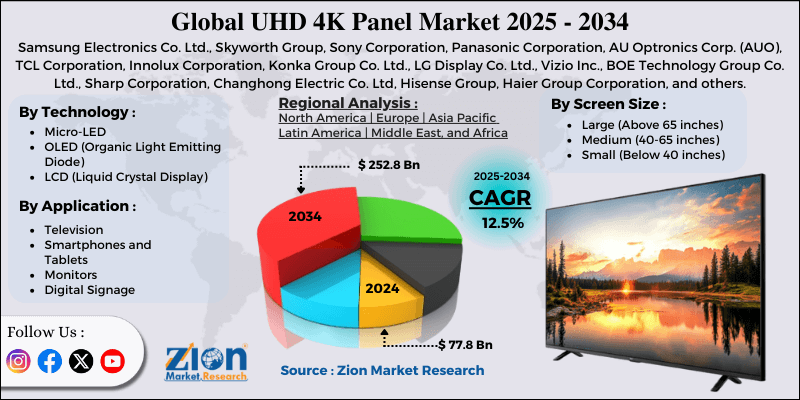

UHD 4K Panel Market By Technology (Micro-LED, OLED (Organic Light Emitting Diode), and LCD (Liquid Crystal Display)), By Screen Size (Large (Above 65 inches), Medium (40-65 inches), and Small (Below 40 inches)), By Application (Television, Smartphones and Tablets, Monitors and Digital Signage), By End-Use (Consumer Electronics, Industrial, Automotive, Commercial, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

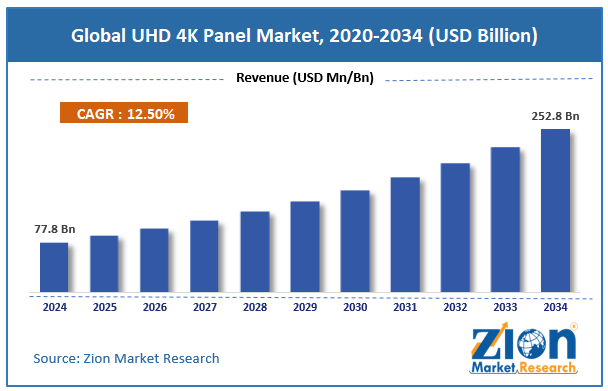

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 77.8 Billion | USD 252.8 Billion | 12.5% | 2024 |

UHD 4K Panel Industry Perspective:

What will be the size of the global UHD 4K panel market during the forecast period?

The global UHD 4K Panel market size was worth around USD 77.8 billion in 2024 and is predicted to grow to around USD 252.8 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global UHD 4K Panel market is estimated to grow annually at a CAGR of around 12.5% over the forecast period (2025-2034).

- In terms of revenue, the global UHD 4K Panel market size was valued at around USD 77.8 billion in 2024 and is projected to reach USD 252.8 billion by 2034.

- Rising consumer demand for high-resolution displays is expected to drive the UHD 4K Panel market.

- Based on the technology, in 2024, the OLED (Organic Light Emitting Diode) segment holds the majority of market share.

- Based on the screen size, the Large (Above 65 inches) is expected to grow significant rate over the analysis period.

- Based on the application, the smartphones and tablets segment captures a significant market share in 2024.

- Based on the end-use, the consumer electronics segment garners the largest revenue share over the projected period.

- Based on region, North America is expected to lead the UHD 4K Panel market over the projected period.

UHD 4K Panel Market: Overview

The UHD 4K panels offer a resolution of 3840 × 2160 pixels, which is 4 times that of Full HD. UHD 4K panels feature more pixels than standard panels, making them ideal for people who want to watch movies and TV shows in a more immersive way. The photographs look better, with more depth and richer colors throughout. The extensive use of these panels in TVs, monitors, laptops, cellphones, digital signage, and professional displays for applications such as gaming, healthcare imaging, education, and commercial advertising. People who use UHD 4K panels with modern display technologies like OLED, Mini-LED, and sophisticated LCD backlighting get superior picture quality, including better contrast and brightness, as well as better overall visual performance.

UHD 4K Panel Market: Dynamics

Growth Drivers

Why does the rising consumer demand for high-resolution displays propel the development of the UHD 4K panel market?

More people want high-resolution screens, which is driving the UHD 4K Panel market growth. This changes how people shop and sets technical criteria for all goods. People who stream, play games, work from home, and create more digital content want sharper visuals, more engaging visual experiences, and more information. High-resolution displays such as UHD 4K help achieve these goals by making images appear clearer on larger screens.

Lower resolutions, on the other hand, can make images look jagged. This goal pushes companies to improve their products, speeds up the replacement of HD and Full HD displays, and encourages the development of new technologies like OLED and Mini-LED. As high-resolution content becomes cheaper and easier to find, UHD displays become more valuable. This means more sales, more uses, and growth all around the firm.

Restraints

High manufacturing & production costs are hindering the industry’s growth

UHD 4K panels require expensive materials, complex manufacturing processes, and precise manufacturing technologies, making it hard for the UHD 4K Panel sector to grow. High-resolution screens require costly tools, cleanrooms, high-quality glass substrates, and advanced backlighting or emissive technologies, such as OLED and Mini-LED. These factors significantly increase production costs, and companies often pass them on to customers by raising prices.

Because of this, price-sensitive customers and small to medium-sized business buyers may put off upgrades or choose lower-resolution options. High costs can deter new manufacturers from entering the market and reduce profit margins for existing firms. This makes it harder for enterprises to grow, innovate, and expand their capacity.

Opportunities

Does the innovative product launch present an opportunity for the UHD 4K panel market growth?

Innovative product launches are effective strategies for market growth, as they address evolving client needs while accommodating current market constraints. The arrival of improved UHD 4K panels with higher brightness, faster refresh rates, more accurate colors, thinner designs, and lower power use makes 4K displays even more valuable. OLED, Mini-LED backlighting, bezel-less designs, and smart connectivity features make UHD panels useful for a wider range of applications, including gaming, professional content creation, medical imaging, digital signage, and smart homes.

Also, product releases that focus on lowering costs and increasing energy efficiency help overcome pricing barriers, making it easier for mass-market customers to adopt them more quickly. Manufacturers set their products apart by developing new ideas. This leads more people to buy new products, which opens new ways for the company to make revenue and, in the long run, creates big opportunities for the UHD 4K Panel market expansion.

For instance, in May 2025, the BRAVIA 2 II series is Sony India's newest model. It has a 4K Ultra HD LED display. This is meant to make the entertainment experience better for consumers who want to upgrade. It works with Google TV, which makes it easier for people to identify apps, streaming services, and live TV stations that match their interests.

Challenges

How does the limited availability of native 4K content pose a significant threat to the UHD 4K panel industry?

The lack of native 4K content is a big problem for the business, as it makes people less willing to buy UHD 4K TVs. UHD displays don't look as nice as HD or Full HD panels since people and businesses can't always watch real 4K movies, TV shows, broadcasts, games, or professional material. This means customers who wish to buy might wait or prefer cheaper, lower-resolution solutions. This absence of substance lengthens replacement cycles, reduces demand momentum, and makes it difficult for producers to justify higher prices. Broadcasting, education, and corporate media are some other businesses that might wait to invest in UHD infrastructure until 4K content ecosystems are more developed. This would slow the UHD 4K Panel market's overall growth.

UHD 4K Panel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | UHD 4K Panel Market |

| Market Size in 2024 | USD 77.8 Billion |

| Market Forecast in 2034 | USD 252.8 Billion |

| Growth Rate | CAGR of 12.5% |

| Number of Pages | 212 |

| Key Companies Covered | Samsung Electronics Co. Ltd., Skyworth Group, Sony Corporation, Panasonic Corporation, AU Optronics Corp. (AUO), TCL Corporation, Innolux Corporation, Konka Group Co. Ltd., LG Display Co. Ltd., Vizio Inc., BOE Technology Group Co. Ltd., Sharp Corporation, Changhong Electric Co. Ltd, Hisense Group, Haier Group Corporation, and others. |

| Segments Covered | By Technology, By Screen Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

UHD 4K Panel Market: Segmentation`

Technology Insights

Why do OLED (Organic Light Emitting Diode) dominate the UHD 4K Panel market in 2024?

In 2024, the OLED (Organic Light-Emitting Diode) segment accounts for the majority of the market share. The segment's growth is driven by its strong display performance and increasing adoption in high-end consumer and business applications. OLED-based UHD 4K panels have self-emissive pixels, true blacks, infinite contrast ratios, faster response times, and wider viewing angles. These features make them popular among people who want high-end visuals in TVs, smartphones, laptops, and professional displays.

As more people want to watch movies, play games, and stream shows in a more immersive way, manufacturers are pushing OLED 4K panels as their top products. This leads to higher average selling prices and bigger profits. Also, costs are declining steadily as OLED manufacturing becomes more efficient and panel lifetimes increase. This encourages more people to utilize them outside of the luxury category.

Screen Size Insights

Will the Large (Above 65 inches) hold the largest share in the UHD 4K panel industry over the projected period?

The Large (Above 65 inches) segment is expected to grow at a significant rate over the analysis period. The rise is due to more people wanting to watch movies and TV shows at home and in businesses that feel like movie theaters. As screens get bigger, the benefits of 4K resolution become clearer. These include sharper images, finer details, and less pixelation. This makes UHD panels the best choice for high-end TVs, home theaters, and digital signs. Demand for large-format UHD screens is rising as more people use streaming services that can play 4K content and spend more on luxury and home entertainment gadgets.

Also, panel prices are declining, production yields are rising, and new display technologies like OLED and Mini-LED are making 65-inch and larger UHD 4K panels more accessible. This means the average selling price is rising, a major driver of overall market revenue growth.

Application Insights

Why smartphones and tablets segment dominate the UHD 4K panel industry?

The smartphones and tablets segment captures a significant market share in 2024. Customers want better display clarity, color accuracy, and high-quality visual experiences, especially on mobile devices. It's simpler to watch videos, play games, take pictures, and use professional programs that need clarity and detail on high-end tablets and flagship smartphones with UHD 4K panels. To make their products stand out and justify higher prices, manufacturers add high-resolution displays. This is because many people use their phones and tablets to record and watch 4K video. Also, the average selling price is rising because more people are buying high-end smart devices, OLED-based 4K mobile screens are improving faster, and apps with a lot of content are becoming more popular. This indicates that this segment of the UHD 4K panel market consistently generates higher revenue.

End Use Insights

Do consumer electronics segment hold the potential to transform the UHD 4K Panel Market?

The consumer electronics segment garners the largest revenue share over the projected period. The rise is attributable to the increased use of high-resolution screens on TVs, monitors, PCs, cellphones, and tablets. More and more consumers desire higher picture quality, immersive viewing, and high-quality display performance for streaming, gaming, working from home, and creating content. This means that UHD 4K screens are better than lower-resolution panels. More 4K content is available on OTT platforms, consumers have more money to spend, and TVs and monitors are getting bigger, all of which are driving up demand.

Regional Insights

Why does North America hold the largest share in the UHD 4K Panel market?

North America is expected to dominate the industry growth. Strong consumer spending, increased adoption of advanced display technologies, and a growing digital content ecosystem are driving growth. The high number of 4K TVs, monitors, smartphones, and laptops, along with the wide availability of UHD content from streaming services, gaming consoles, and broadcasters, keeps replacement and upgrade demand high. The area also benefits from being among the first to adopt high-end technologies like OLED and Mini-LED, which command higher average selling prices and boost overall market revenues.

Also, the growing use of UHD 4K panels in business settings, including digital signage, healthcare imaging, education, and corporate applications, supports revenue growth, making North America a vital market for generating value worldwide.

UHD 4K Panel Market: Competitive Analysis

The global UHD 4K Panel market is dominated by players like:

- Samsung Electronics Co. Ltd.

- Skyworth Group

- Sony Corporation

- Panasonic Corporation

- AU Optronics Corp. (AUO)

- TCL Corporation

- Innolux Corporation

- Konka Group Co. Ltd.

- LG Display Co. Ltd.

- Vizio Inc.

- BOE Technology Group Co. Ltd.

- Sharp Corporation

- Changhong Electric Co. Ltd

- Hisense Group

- Haier Group Corporation

The global UHD 4K Panel market is segmented as follows:

By Technology

- Micro-LED

- OLED (Organic Light Emitting Diode)

- LCD (Liquid Crystal Display)

By Screen Size

- Large (Above 65 inches)

- Medium (40-65 inches)

- Small (Below 40 inches)

By Application

- Television

- Smartphones and Tablets

- Monitors

- Digital Signage

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed