Global Tuna Fish Market Size, Share, Growth Analysis Report - Forecast 2034

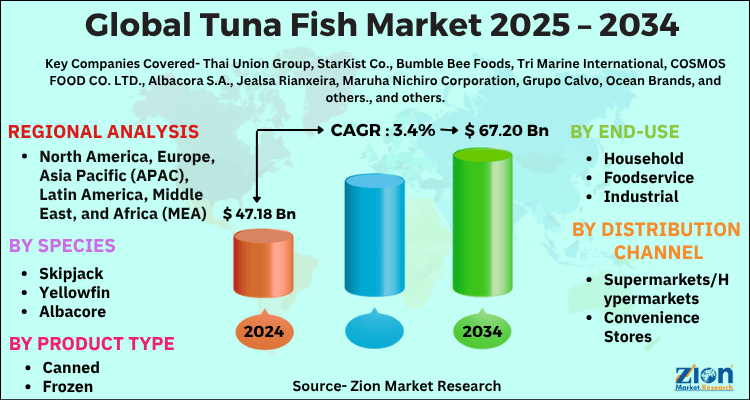

Tuna Fish Market By Species (Skipjack, Yellowfin, Albacore, Bigeye, Bluefin), By Product Type (Canned, Frozen, Fresh), By End-use (Household, Foodservice, Industrial), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 47.18 Billion | USD 67.20 Billion | 3.4% | 2024 |

Global Tuna Fish Market: Industry Perspective

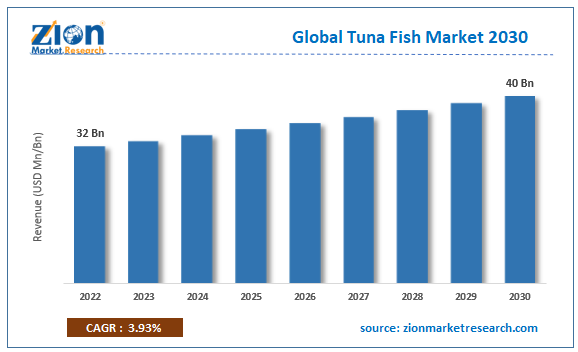

The global tuna fish market size was worth around USD 47.18 Billion in 2024 and is predicted to grow to around USD 67.20 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.4% between 2025 and 2034. The report analyzes the global tuna fish market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the tuna fish industry.

Global Tuna Fish Market: Overview

Tuna, a globally popular fish, belongs to the Thunnini tribe and is extensively harvested for its culinary versatility and nutritional benefits. Found in both temperate and tropical oceans, tuna species include the albacore, bluefin, yellowfin, and skipjack. Renowned for its rich, meaty texture and distinct flavor, tuna is a staple in various cuisines, particularly in sushi and sashimi preparations. Its lean, protein-packed flesh is an excellent source of omega-3 fatty acids, promoting heart health. Tuna fisheries, however, face sustainability challenges due to overfishing, habitat degradation, and bycatch concerns. To address these issues, sustainable fishing practices and responsible consumer choices, such as choosing tuna certified by organizations like the Marine Stewardship Council (MSC), are crucial. Tuna's significance in global fisheries and diets underscores the need for balanced conservation efforts to preserve both the species and the ecosystems they inhabit. Sustainable practices aim to ensure the long-term availability of this prized fish while minimizing environmental impact and supporting the livelihoods of those dependent on tuna fisheries.

Global Tuna Fish Market: Growth Drivers

Tuna is renowned for its high protein content, omega-3 fatty acids, and various essential nutrients, making it a favored choice among health-conscious consumers. As lifestyles become more health-oriented, the demand for lean and nutritious protein options has surged, propelling the tuna fish market forward. Moreover, the popularity of tuna in various culinary traditions and the increasing consumption of seafood contribute to the market's growth. Tuna's versatility in dishes such as sushi, sashimi, salads, and canned products has expanded its market reach globally. The convenience and accessibility of canned tuna also cater to busy lifestyles, further driving its consumption. Another driving force behind the tuna fish market is the rise of the global seafood industry. Tuna's integral role in this sector, particularly in the context of commercial fishing and aquaculture, underscores its economic importance. However, the industry faces challenges related to overfishing and sustainability, necessitating a balance between meeting consumer demand and implementing responsible fishing practices. Sustainable initiatives, such as certifications for responsibly sourced tuna, play a crucial role in ensuring the long-term viability of the global tuna fish market.

According to the World Economic Forum, coastal countries such as Iceland and the Maldives have the highest levels of seafood consumption, averaging more than 80 kg per person per year. These regions often have a strong cultural connection to seafood and rely on it as a staple food source. The rich nutritional value of tuna and its taste and versatility in dishes like sushi has fueled its demand. As consumers prioritize health-conscious choices and seek protein-rich foods, the demand for tuna will continue its upward trajectory in the coming years.

Tuna Fish Market: Restraints

Growing concern over sustainability and environmental impact may slow down the market growth.

The industry faces challenges related to overfishing, habitat degradation, and bycatch issues, which have led to increased scrutiny from environmentally conscious consumers and advocacy groups. Over-exploitation of tuna stocks, especially if not managed responsibly, can lead to long-term ecological imbalances and threaten the sustainability of the industry. As a result, there is a pressing need for the tuna fishing industry to adopt and adhere to sustainable practices to ensure the long-term viability of tuna stocks and maintain consumer confidence in the market. Additionally, regulatory measures and quotas imposed by regional fisheries management organizations add another layer of complexity to the canned tuna market. Compliance with these regulations is necessary for sustainable fishing practices, but it can pose challenges for the industry in terms of operational costs and adapting to changing catch limits. Striking a balance between meeting global demand for canned tuna and adhering to these regulatory frameworks is crucial for the industry's sustainable growth. Addressing these environmental and regulatory challenges will be essential for the canned tuna market to continue thriving while minimizing its ecological footprint.

Tuna Fish Market: Opportunities

Rising demand for premium and sustainably sourced products to provide growth opportunities

An exciting opportunity in the global canned tuna market lies in the rising demand for premium and sustainably sourced products. As consumers become increasingly conscious of the environmental impact of their food choices, there is a growing market for responsibly harvested and eco-friendly canned tuna. Companies that emphasize sustainable fishing practices, traceability, and certifications such as Marine Stewardship Council (MSC) can capitalize on this trend. By aligning with consumer values, these brands can not only attract a discerning customer base but also contribute to the long-term sustainability of the industry. Furthermore, there is potential for innovation in product offerings to cater to changing consumer preferences. The introduction of value-added and convenience-focused canned tuna products, such as those incorporating unique flavors, eco-friendly packaging, or ready-to-eat options, presents an opportunity for market growth. Meeting the demand for healthier and more diverse alternatives, while maintaining a focus on sustainability, can position companies strategically in the evolving landscape of the canned tuna market. Embracing these opportunities can enhance brand competitiveness and contribute to the overall development of a more sustainable and consumer-oriented industry.

Tuna Fish Market: Challenges

Rapid pace of technological advancements and the need for continuous innovation to challenge market growth

The tuna fish market faces significant challenges stemming from the need to adapt production and harvesting methods in response to environmental concerns and increased demand. Preservation of wild stocks poses a substantial challenge, leading to sustainability issues, particularly with the ban on Fish Aggregating Devices (FADs) in the supply of canned tuna. While ranching production has seen notable development, the sustainability of this method remains uncertain due to limitations in the availability of wild juveniles.

Despite efforts to address these challenges, the market's growth is constrained by factors such as the maturation of traditional markets and the necessity to explore new regions for consumption growth. Additionally, the increasing global popularity of sushi contributes to the overall growth of the tuna market, but concerns about safety and sustainability emerge as significant obstacles. Consumer apprehensions, whether related to conflicts in the international arena or rising awareness of ethical considerations, pose a potential threat to market development. The industry must navigate these challenges by fostering transparency, engaging in dialogue with the public, and exploring innovative value-added products to maintain profitability amid potential increases in raw material prices.

Key Insights

- As per the analysis shared by our research analyst, the global tuna fish market is estimated to grow annually at a CAGR of around 3.4% over the forecast period (2025-2034).

- Regarding revenue, the global tuna fish market size was valued at around USD 47.18 Billion in 2024 and is projected to reach USD 67.20 Billion by 2034.

- The tuna fish market is projected to grow at a significant rate due to Increasing global seafood consumption and health benefits of tuna drive demand. Expansion of canned and frozen seafood markets supports market growth.

- Based on Species, the Skipjack segment is expected to lead the global market.

- On the basis of Product Type, the Canned segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-use, the Household segment is projected to swipe the largest market share.

- By Distribution Channel, the Supermarkets/Hypermarkets segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Global Tuna Fish Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Tuna Fish Market |

| Market Size in 2024 | USD 47.18 Billion |

| Market Forecast in 2034 | USD 67.20 Billion |

| Growth Rate | CAGR of 3.4% |

| Number of Pages | 207 |

| Key Companies Covered | Thai Union Group, StarKist Co., Bumble Bee Foods, Tri Marine International, COSMOS FOOD CO. LTD., Albacora S.A., Jealsa Rianxeira, Maruha Nichiro Corporation, Grupo Calvo, Ocean Brands, and others., and others. |

| Segments Covered | By Species, By Product Type, By End-use, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Tuna Fish Market: Segmentation Analysis

The global tuna fish market is segmented based on Species, Product Type, End-use, Distribution Channel, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on Species, the global tuna fish market is divided into Skipjack, Yellowfin, Albacore, Bigeye, Bluefin.

On the basis of Product Type, the global tuna fish market is bifurcated into Canned, Frozen, Fresh.

By End-use, the global tuna fish market is split into Household, Foodservice, Industrial.

In terms of Distribution Channel, the global tuna fish market is categorized into Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Tuna fish Market: Regional Analysis

The global tuna fish market between 2025 and 2034 is expected to exhibit notable regional differences: the Asia‑Pacific region—anchored by major producers and consumers such as Japan, China, Indonesia, and the Philippines—is projected to dominate, accounting for roughly 45 % of market revenue by 2024 and continuing strong growth fueled by urbanization, rising middle-class incomes, and sustained investments in aquaculture and sustainable fisheries practices. Europe, holding approximately a 20 % share, will grow at a moderate CAGR (around 2.8 %) supported by stringent safety regulations, high quality preferences, and strong retail systems. North America will command about 25 %, with growth near 3–3.5 %, propelled by heightened health consciousness and consumer demand for protein‑rich seafood . Latin America (~7 %) and Middle East & Africa (~3 %) will grow faster (CAGRs of approx. 4 % and 3 %, respectively) driven by expanding local processing capacities, urbanization, and changing dietary preferences. Together, these regional trends reflect evolving demographics, sustainability efforts, and shifting consumption patterns.

Global Tuna Fish Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the tuna fish market on a global and regional basis.

The global tuna fish market is dominated by players like:

- Thai Union Group

- StarKist Co.

- Bumble Bee Foods

- Tri Marine International

- COSMOS FOOD CO. LTD.

- Albacora S.A.

- Jealsa Rianxeira

- Maruha Nichiro Corporation

- Grupo Calvo

- Ocean Brands

- Others.

Global Tuna Fish Market: Segmentation Analysis

The global tuna fish market is segmented as follows;

By Species

- Skipjack

- Yellowfin

- Albacore

- Bigeye

- Bluefin

By Product Type

- Canned

- Frozen

- Fresh

By End-use

- Household

- Foodservice

- Industrial

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

Global Tuna Fish Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Tuna, a globally popular fish, belongs to the Thunnini tribe and is extensively harvested for its culinary versatility and nutritional benefits. Found in both temperate and tropical oceans, tuna species include the albacore, bluefin, yellowfin, and skipjack. Recognized for its streamlined body and remarkable speed, tuna is a highly migratory species, covering vast distances in search of prey. Renowned for its rich, meaty texture and distinct flavor, tuna is a staple in various cuisines, particularly in sushi and sashimi preparations.

The global tuna fish market is expected to grow due to Increasing global seafood consumption and health benefits of tuna drive demand. Expansion of canned and frozen seafood markets supports market growth.

According to a study, the global tuna fish market size was worth around USD 47.18 Billion in 2024 and is expected to reach USD 67.20 Billion by 2034.

The global tuna fish market is expected to grow at a CAGR of 3.4% during the forecast period.

Asia-Pacific is expected to dominate the tuna fish market over the forecast period.

Leading players in the global tuna fish market include Thai Union Group, StarKist Co., Bumble Bee Foods, Tri Marine International, COSMOS FOOD CO. LTD., Albacora S.A., Jealsa Rianxeira, Maruha Nichiro Corporation, Grupo Calvo, Ocean Brands, and others., among others.

The report explores crucial aspects of the tuna fish market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed