Trade Surveillance Market Size, Share, Growth, Trends, Analysis, Forecast 2032

Trade Surveillance Market By Component Type (Solutions, And Services), Deployment (Cloud-Based, And On-Premises): Global Industry Perspective, Comprehensive Analysis And Forecast, 2024-2032

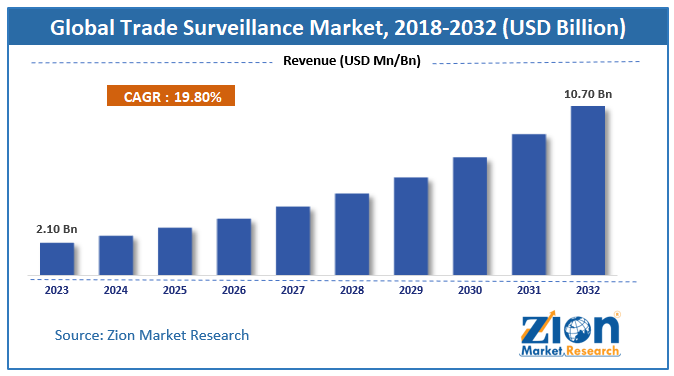

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.10 Billion | USD 10.70 Billion | 19.8% | 2023 |

Trade Surveillance Market: Industry Perspective

The global Trade Surveillance market size accrued earnings worth approximately USD 2.10 Billion in 2023 and is predicted to gain revenue of about USD 10.70 Billion by 2032, is set to record a CAGR of nearly 19.8% over the period from 2024 to 2032. The study includes drivers and restraints for the trade surveillance market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the trade surveillance market on a global level.

Key Insights

- As per the analysis shared by our research analyst, the global trade surveillance market is estimated to grow annually at a CAGR of around 19.8% over the forecast period (2024-2032).

- In terms of revenue, the global trade surveillance market size was valued at around USD 2.10 Billion in 2023 and is projected to reach USD 10.70 Billion by 2032.

- The growth of the trade surveillance market is being driven the increasing regulatory requirements and need to detect market manipulation and fraudulent trading activities.

- Based on component type, the solutions segment is growing at a high rate and is projected to dominate the market.

- On the basis of deployment, the cloud-based segment is projected to swipe the largest market share.

- By region, the North America is expected to dominate the global market during the forecast period.

Trade Surveillance Market Overview

Trade surveillance is a surveillance system that detects and monitors activities for fraud, manipulation, behavioral patterning, and more for preventing any severe damage to the firm's reputation. Some of the main activities carried out in trade surveillance are trade allocations, trade sequencing & price/ volume verification, cross trades/ bunched trades, suspicious transaction reports, audit trail and documentation, insider/ personnel trading, and cross market surveillance The scope of trade surveillance is widening with the passing time. Using trade surveillance with Big Data is one of the emerging trends in this market. Recently Cognizant Corp. has launched its new solution of trade surveillance with Big Data. This solution is expected to assist in real time and high-frequency trading. In the present scenario, direct electronic access and routing arrangements are some of the factors which have increased the need for analyzing the trade patterns and overlay with surveillance alerts.

Trade Surveillance Market Growth Dynamics

Need for surveillance to control market manipulation and market abuse, regulatory and internal compliances, and the quickly expanding requirement of monitoring trade activities in financial institutions are the factors triggering the trade surveillance market growth. However, analyzing multiple parameters and monitoring real-time events for fraud detection is time-consuming and uses a complex algorithm which is hindering the market growth. Additionally, need for modern and proactive trade surveillance, and increasing demand for low-latency reporting and time-series database are some of the potential opportunities for players in this market. Besides of all the factors, design and implementation of surveillance systems, along with non-standardization of compliances, evolving business models, and expanding global regulations are few of the major challenges faced by the players in this market.

This report offers comprehensive coverage of global trade surveillance market along with, market trends, drivers, and restraints of the trade surveillance market. This report includes a detailed competitive scenario and product portfolio of key vendors. To understand the competitive landscape in the market, an analysis of Porter’s five forces model for the trade surveillance market has also been included. The study encompasses a market attractiveness analysis, wherein all segments are benchmarked based on their market size, growth rate, and general attractiveness. This report is prepared using data sourced from in-house databases, secondary and primary research team of industry experts.

Trade Surveillance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Trade Surveillance Market |

| Market Size in 2023 | USD 2.10 Billion |

| Market Forecast in 2032 | USD 10.70 Billion |

| Growth Rate | CAGR of 19.8% |

| Number of Pages | 201 |

| Key Companies Covered | CRISIL, Software AG, Nasdaq, FIS, Cinnober, SIA S.P.A., B-Next, IPC, Aquis Technologies, Nice Systems, ACA Compliance Group, and others. |

| Segments Covered | By Component, By Deployment, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Trade Surveillance Market Segmentation Analysis

The study provides a decisive view on the trade surveillance market by segmenting the market based on component type, deployment, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Trade surveillance market is segmented on the basis of component, deployment, and region. The componentwise market is bifurcated into solutions and services which include risk and compliance, reporting and monitoring, surveillance and analytics, case management, managed services, and professional services. In addition by deployment type market is classified as Cloud-based and on—premises. In terms of geographic region, North America and Europe have the large market size for trade surveillance as big data analytics is used with trade surveillance which provides a better solution, also interrelation between asset classes (equity/ options) has increased the need for consistent, scalable and proficient data platforms. Meanwhile, the Asia Pacific region also holds high opportunities for trade surveillance vendors which can also boost the market for this region in the coming years.

The report covers detailed competitive outlook including the market share and company profiles of the key participants operating in the global trade surveillance market include

- CRISIL

- Software AG

- Nasdaq

- FIS

- Cinnober

- SIA S.P.A.

- B-Next

- IPC

- Aquis Technologies

- Nice Systems

- ACA Compliance Group, and others.

The report segments global trade surveillance market as follows:

Global Trade Surveillance Market: Component Type Segments

- Solutions

- Services

Global Trade Surveillance Market: Deployment Segments

- Cloud-based

- On-Premises

Global Trade Surveillance Market: Regional Segments

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed