Track and Trace Solutions Market Demand, Size, Share, Forecast 2032

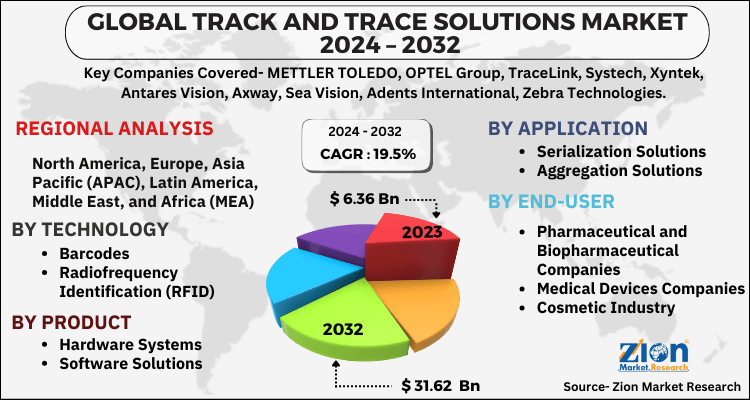

Track and Trace Solutions Market By Technology (RFID and Barcodes), By Product (Software Solutions and Hardware Systems), By Application (Aggregation Solutions and Serialization Solutions), By End-User (Medical Devices Companies, Pharmaceutical and Biopharmaceutical Companies, Cosmetic Industry, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

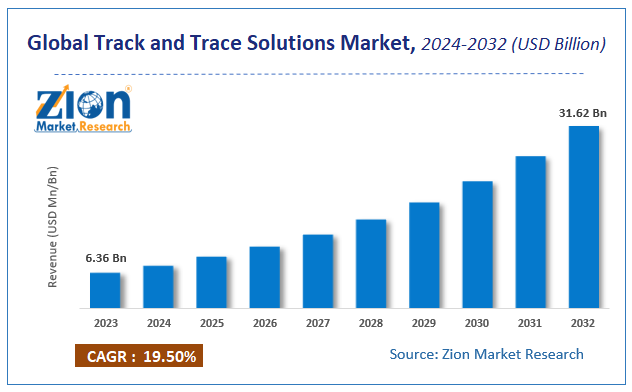

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.36 Billion | USD 31.62 Billion | 19.5% | 2023 |

Track and Trace Solutions Market: Industry Perspective

The global track and trace solutions market size was worth around USD 6.36 billion in 2023 and is predicted to grow to around USD 31.62 billion by 2032 with a compound annual growth rate (CAGR) of roughly 19.5% between 2024 and 2032. The report analyzes the global track and trace solutions market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the track and trace solutions industry.

The report covers a forecast and an analysis of the track and trace solutions market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints for the track and trace solutions market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the track and trace solutions market on a global and regional level.

Track and trace solutions, such as automatic identification technologies and software, are both effective and reliable in ensuring proficient delivery of components and materials to customers. Track and trace solution technologies help to improve security and drug traceability. Tracking and tracing solutions are gaining popularity and importance across various sectors, such as pharmaceutical, food industries, etc., that have high legal restrictions and requirements for transactions of high-valued goods.

The global demand for medical devices is growing rapidly, owing to the increasing prevalence of life-threatening diseases. Medical equipment transported from manufacturing units to installation sites is a long and tedious procedure. Track and trace solutions play a vital role in the distribution and logistics of medical devices. Stringent regulatory requirements for the implementation of serialization are the major growth driver of the track and trace solutions market globally. Other factors that are likely to contribute notably toward the track and trace solutions market in the estimated timeframe are increasing emphasis on brand protection by manufacturers, rising product recalls concerned with packaging, and emerging pharmaceutical, biopharmaceutical, and medical device sectors. However, huge aggregation and serialization costs might restrain this market’s growth in the years ahead. Nevertheless, technological advancements and the growing number of pharmaceutical, biotechnology, and medical devices manufacturing facilities are likely to create new growth avenues for the track and trace solutions market players in the future.

In order to give the users of this report a comprehensive view of the track and trace solutions market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the track and trace solutions market on a global and regional basis.

Track and Trace Solutions Market: Segmentation Analysis

The study provides a decisive view of the track and trace solutions market by segmenting the market based on technology, product, application, end-user, and region.

Based on technology market is segmented into Radio-Frequency Identification (RFID) and barcodes. The barcode technology segment is sub-segmented into 2D barcodes and linear barcodes.

Based on product, this market is segmented into software solutions and hardware systems. Hardware systems are sub-segmented into monitoring and verification, printing and marking, checkweighers, labeling, barcode scanners, and RFID readers. Software solutions are sub-categorized into line controller, plant manager, bundle tracking, case tracking, warehouse, and shipment manager, pallet tracking, and enterprise and network manager.

Aggregation solutions and serialization solutions form the application segment of the track and trace solutions market. The aggregation solutions segment is further categorized into the case, pallet, and bundle. The serialization solutions segment is sub-segmented into bottle, blister, vials and ampoules, carton, and medical device serialization.

Medical devices companies, pharmaceutical and biopharmaceutical companies, the cosmetic industry, and others comprise the end-user segment of this market.

Track and Trace Solutions Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further segmentation into major countries including the U.S., Canada, Germany, France, UK, China, Japan, India, and Brazil.

Track and Trace Solutions Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Track and Trace Solutions Market |

| Market Size in 2023 | USD 6.36 Billion |

| Market Forecast in 2032 | USD 31.62 Billion |

| Growth Rate | CAGR of 19.5% |

| Number of Pages | 110 |

| Key Companies Covered | METTLER TOLEDO, OPTEL Group, TraceLink, Systech, Xyntek, Antares Vision, Axway, Sea Vision, Adents International, Zebra Technologies, Siemens, ACG Worldwide, and Körber Medipak Systems, among others |

| Segments Covered | By Technology, By Product, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Track and Trace Solutions Market: Competitive Analysis

Some of the major players in the global track and trace solutions market include:

- METTLER TOLEDO

- OPTEL Group

- TraceLink

- Systech

- Xyntek

- Antares Vision

- Axway

- Sea Vision

- Adents International

- Zebra Technologies

- Siemens

- ACG Worldwide

- Körber Medipak Systems

The global track and trace solutions market is segmented as follows;

Global Track and Trace Solutions Market: By Technology

- Barcodes

- 2D Barcodes

- Linear Barcodes

- Radiofrequency Identification (RFID)

Global Track and Trace Solutions Market: By Product

- Hardware Systems

- Printing and Marking

- Monitoring and Verification

- Labeling

- Checkweighers

- RFID Readers

- Barcode Scanners

- Software Solutions

- Plant Manager

- Line Controller

- Bundle Tracking

- Warehouse and Shipment Manager

- Case Tracking

- Pallet Tracking

- Enterprise and Network Manager

Global Track and Trace Solutions Market: By Application

- Serialization Solutions

- Bottle

- Blister

- Vials and Ampoules

- Carton

- Medical Device Serialization

- Aggregation Solutions

- Case

- Pallet

- Bundle

Global Track and Trace Solutions Market: By End-User

- Pharmaceutical and Biopharmaceutical Companies

- Medical Devices Companies

- Cosmetic Industry

- Others

Global Track and Trace Solutions Market: By Region

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Track and trace solutions are systems that monitor the movement of products through a supply chain. They use technologies like barcodes, RFID, and GPS to track the location, status, and history of items. This information is used to improve efficiency, security, and transparency within the supply chain.

According to a study, the global track and trace solutions market size was worth around USD 6.36 billion in 2023 and is expected to reach USD 31.62 billion by 2032.

The global track and trace solutions market is expected to grow at a CAGR of 19.5% during the forecast period.

North America is expected to dominate the track and trace solutions market over the forecast period.

Leading players in the global track and trace solutions market include METTLER TOLEDO, OPTEL Group, TraceLink, Systech, Xyntek, Antares Vision, Axway, Sea Vision, Adents International, Zebra Technologies, Siemens, ACG Worldwide, and Körber Medipak Systems, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed