Timber Plants Market Size, Trend, Growth, Industry Analysis 2034

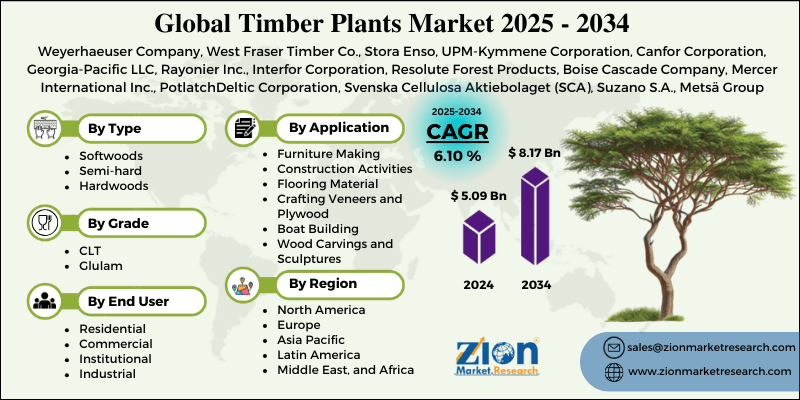

Timber Plants Market By Type (Softwoods, Semi-hard, Hardwoods), By Grade (CLT, Glulam), By Application (Furniture Making, Construction Activities, Flooring Material, Crafting Veneers and Plywood, Boat Building, Wood Carvings and Sculptures, Paper and Pulp Products Manufacturing, and Others), By End-User (Residential, Commercial, Institutional, Industrial, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.09 Billion | USD 8.17 Billion | 6.10% | 2024 |

Timber Plants Industry Perspective:

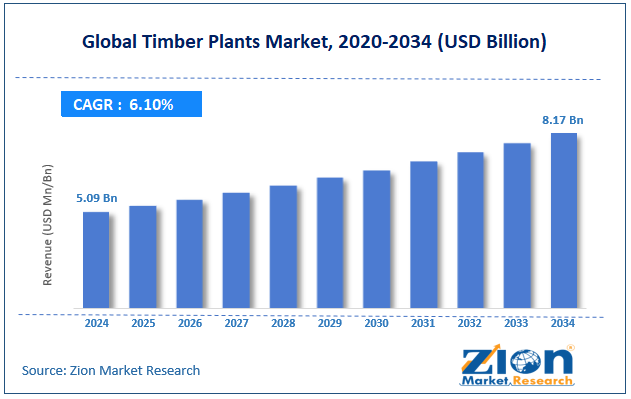

The global timber plants market size was worth around USD 5.09 billion in 2024 and is predicted to grow to around USD 8.17 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.10% between 2025 and 2034.

Timber Plants Market: Overview

Timber plants, broadly referred to as timber-producing trees, are cultured mainly for their wood, which is extensively used in furniture, paper, construction, and different industrial applications. These comprise species like eucalyptus, pine, teak, mahogany, and oak. The global timber plants market is likely to expand rapidly, driven by increasing awareness of carbon sequestration and sustainability, the growth of the interior design and furniture industry, and government afforestation initiatives. Timber plants absorb CO2, making them a more eco-friendly option than concrete or steel. Green building standards like BREEAM and LEED motivate the use of timber, thus strengthening its industry presence in environmentally friendly construction projects. The expanding global furniture industry, estimated at more than $740 billion in 2024, is fueling the demand for quality timber. Wood is broadly demanded for its durability, aesthetics, and versatility, mainly in premium domains.

Moreover, a majority of governments are encouraging timber plantations as a part of their reforestation and afforestation initiatives. For example, Brazil's tree plantation subsidies and CAMPA fund are aiding the expansion of timber cultivation areas.

Despite the growth, the global market is impeded by factors such as biodiversity and deforestation concerns, natural disasters, and climate change. Large-scale timber plantations can lead to soil degradation and biodiversity loss if not managed sustainably. This invites criticism from environmental groups and results in regulatory limitations. Timber plantations are vulnerable to wildfires, pests, storms, and droughts – threats that are increasing with climate change. Incidents like the 2023 Canadian wildfires destroyed millions of hectares of timber.

Nonetheless, the global timber plants industry stands to gain from a few key opportunities, such as urban green infrastructure, landscaping, and high-value timber species cultivation. Cities are increasingly planting timber species for environmental and commercial purposes. Urban forestry programs produce long-term resources while improving biodiversity and air quality.

Furthermore, integrating timber plantations with livestock or crops offers land-use efficacy and provides farmers with diversified income. Programs in Southeast Asia and Africa are mainly encouraging such models. Timber from rosewood, sandalwood, and African mahogany commands premium market value. Farmers are increasingly turning to high-margin and niche options.

Key Insights:

- As per the analysis shared by our research analyst, the global timber plants market is estimated to grow annually at a CAGR of around 6.10% over the forecast period (2025-2034)

- In terms of revenue, the global timber plants market size was valued at around USD 5.09 billion in 2024 and is projected to reach USD 8.17 billion by 2034.

- The timber plants market is projected to grow significantly due to increasing housing development projects and urbanization, a rise in timber international trade and exports, and rising consumer preference for renewable and natural products.

- Based on type, the hardwoods segment is expected to lead the market, while the softwoods segment is expected to grow considerably.

- Based on grade, the glulam segment is the dominating segment, while the CLT segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the construction activities segment is expected to lead the market compared to the furniture-making segment.

- Based on end-user, the residential segment is expected to lead the market compared to the commercial segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Timber Plants Market: Growth Drivers

How is surging demand from the packaging and pulp & paper industry boosting the timber plants market?

The pulp and paper market continues to be a leading consumer of timber, especially softwood species. With the renaissance in paperboard packaging due to consumer eco-friendly choices and the progress of e-commerce, the demand for timber-obtained pulp is escalating remarkably.

International Paper and Mondi Group announced the capacity of pulp mills in Latin America and Europe in April 2025, citing increasing input requirements. Timber plants are vital in promising a high-quality and stable wood supply for these mills, which ultimately increases their value in the supply chain.

In what way is the expansion of the interior design industry and wood-based furniture fueling the timber plants market?

The worldwide furniture industry is experiencing strong growth, with the growing consumer preferences for customizable, durable, and eco-friendly furnishings. According to Statista, the furniture sector is anticipated to hit $317.2 billion by 2025, progressing at more than 5.6% yearly. Timber, mainly hardwoods like oak, mahogany, and teak, remains the highly favored material for decorative interiors and premium furniture.

IKEA declared its collaboration with forest timber farms in Eastern Europe in 2024, to promise sustainable sourcing for its expanding product lines. Expansions like these ultimately propel the timber plants market worldwide.

Timber Plants Market: Restraints

How are unsustainable competition and illegal logging hindering the timber plants market?

The incidences of illegal logging in several emerging nations continue to distort the global market. Illegally sourced timber usually undercuts the cost of plantation-grown wood, increasing the difficulty for legitimate timber planters to compete profitably.

Despite stringent administration, the underground timber economy flourishes because of weak governance, loopholes, and corruption in tracking systems. This challenges confidence in legal timber certification schemes like PEFC and FSC, and restricts the incentives for formal plantation growth.

Timber Plants Market: Opportunities

Digital forestry and smart plantation management favorably propel the market

The application of digital tools like IoT sensors, AI, drones, and satellite monitoring is transforming plantation management. These solutions improve yield prediction, moisture monitoring, pest detection, and forest inventory tracking, mainly decreasing operational efficiencies. Startups in Australia, Europe, and India are fueling advancements in this segment, thus driving the global timber plants industry.

For instance, Timbeter, an Estonian startup, collaborated with the Indian Ministry of Environment in 2024 to deploy digital log tracking in timber plantations in Madhya Pradesh and Maharashtra.

Timber Plants Market: Challenges

Growing competition from alternative materials limits the market growth

The worldwide furniture, construction, and packaging industries are increasingly exploring alternatives to traditional timber, comprising bio-composites, hemp, bamboo, metal substitutes, and recycled plastic. These alternatives can be grown faster, are more flexible in use, and are more cost-efficient under some conditions. With improvements in technology, they are registering a notable share of the markets that were previously dominated by timber.

Several nations, such as India and China, are actively promoting bamboo plantations as a viable timber substitute; meanwhile, timber plants continue to be competitive in terms of sustainability credentials and pricing.

Timber Plants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Timber Plants Market |

| Market Size in 2024 | USD 5.09 Billion |

| Market Forecast in 2034 | USD 8.17 Billion |

| Growth Rate | CAGR of 6.10% |

| Number of Pages | 214 |

| Key Companies Covered | Weyerhaeuser Company, West Fraser Timber Co., Stora Enso, UPM-Kymmene Corporation, Canfor Corporation, Georgia-Pacific LLC, Rayonier Inc., Interfor Corporation, Resolute Forest Products, Boise Cascade Company, Mercer International Inc., PotlatchDeltic Corporation, Svenska Cellulosa Aktiebolaget (SCA), Suzano S.A., Metsä Group, and others. |

| Segments Covered | By Type, By Grade, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Timber Plants Market: Segmentation

The global timber plants market is segmented based on type, grade, application, end user, and region.

Based on type, the global timber plants industry is divided into softwoods, semi-hardwoods, and hardwoods. The hardwoods segment held a dominating share owing to their enhanced durability, superior strength, demand in flooring, high-end furniture, and construction.

On the other hand, the softwoods segment also grows considerably owing to their cost-effectiveness, fast growth, and broader use in paper, general construction, and packaging.

Based on grade, the global market is segmented into CLT and glulam. Glulam holds leadership in the market due to its cost-effectiveness, flexibility, and long-established use in structural applications like bridges, beams, and arches.

Conversely, the CLT segment follows prominence, gaining speedy momentum in prefabricated structures and multi-story buildings.

Based on application, the global timber plants market is segmented as furniture making, construction activities, flooring material, crafting veneers and plywood, boat building, wood carvings and sculptures, paper and pulp products manufacturing, and others. The construction activities segment registered a leading share owing to the large-scale demand for timber in engineered wood products like CLT and glulam, and in structural framing.

Nonetheless, the furniture-making segment ranks second due to surging demand for aesthetically pleasing and durable wooden furniture in commercial and domestic spaces.

Based on end-user, the global market is segmented as residential, commercial, institutional, industrial, and others. The residential segment holds a leading share because of high demand for timber in housing construction, home décor, interior furniture, and flooring.

However, the commercial segment also grows a significant share, driven by timber use in retail spaces, offices, and hospitality infrastructure.

Timber Plants Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Timber Plants Market?

Asia Pacific is anticipated to retain its leading role in the global timber plants market due to its large-scale plantation areas, abundant forest resources, reforestation programs, government support, and strong timber trade networks and export capabilities. Asia Pacific leads as the world's largest forested region, especially in countries like Malaysia, China, Indonesia, and India.

According to FAO, APAC registers for more than 18% of the global forest area, with significant shares allocated to timber plantations. These large-scale managed forests aid a cost-effective and consistent supply of timber for domestic export and use. Moreover, the regional governments are encouraging sustainable timber cultivation and commercial forestry.

For example, the Green Great Wall project of China and India's CAMPA has fueled millions of hectares of plantation forests. China alone added 47 million hectares of plantation forests by 2023, as per the State Forestry Administration. Furthermore, APAC nations like Vietnam, Indonesia, and Malaysia are the leading exporters of wood and timber products. APAC registers for more than 40% of global tropical timber exports, according to the ITTO. These strong export-oriented supply chains improve the region's leadership in timber processing and plant cultivation.

North America ranks as the second-leading region in the global timber plants industry as a result of high demand from housing and construction sectors, strong presence of engineered wood manufacturing, and modernized forestry technology and research infrastructure. The United States construction sector alone was estimated at over $2.1 trillion in 2024, with timber being a main material for wood-frame structures and residential buildings.

Wood is used broadly in North American housing because of its insulation and cost-effectiveness properties. This fuels major demand for engineered and softwood timber. North America is a leader in engineered wood production, mainly CLT, glulam, plywood, and OSB. In 2024, more than 100 CLT manufacturing settings operate in Canada and the U.S. The rising preference for prefab and sustainable construction drives the growth of timber plantations for this sector.

Additionally, North America benefits from key investments in forestry research and development, comprising pest-resistant species, genetic improvements, and precision forestry solutions. Institutions like the Canadian Forest Service and the U.S. Forest Service drive advancements in high-yield timber cultivation. This improves forest health and plantation productivity in the region.

Timber Plants Market: Competitive Analysis

The leading players in the global timber plants market are:

- Weyerhaeuser Company

- West Fraser Timber Co.

- Stora Enso

- UPM-Kymmene Corporation

- Canfor Corporation

- Georgia-Pacific LLC

- Rayonier Inc.

- Interfor Corporation

- Resolute Forest Products

- Boise Cascade Company

- Mercer International Inc.

- PotlatchDeltic Corporation

- Svenska Cellulosa Aktiebolaget (SCA)

- Suzano S.A.

- Metsä Group

Timber Plants Market: Key Market Trends

Integration of smart technologies and precision forestry:

Forestry operations are using remote sensing, drones, and AI-based monitoring solutions to enhance plantation growth, forecast yields, and detect diseases beforehand. This digital transformation is improving sustainability and productivity in timber cultivation.

Shift toward high-value and fast-growing species:

There is a rising interest in cultivating fast-growing species like poplar and eucalyptus, and premium hardwoods like sandalwood and teak. These species offer higher profit margins and faster returns, complying with the growing demand for dissimilar timber applications.

The global timber plants market is segmented as follows:

By Type

- Softwoods

- Semi-hard

- Hardwoods

By Grade

- CLT

- Glulam

By Application

- Furniture Making

- Construction Activities

- Flooring Material

- Crafting Veneers and Plywood

- Boat Building

- Wood Carvings and Sculptures

- Paper and Pulp Products Manufacturing

- Others

By End User

- Residential

- Commercial

- Institutional

- Industrial

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Timber plants, broadly referred to as timber-producing trees, are cultured mainly for their wood, which is extensively used in furniture, paper, construction, and different industrial applications. These comprise species like eucalyptus, pine, teak, mahogany, and oak.

The global timber plants market is projected to grow due to technological improvements in timber treatment and processing, rising lifestyle changes and disposable income in developing economies, and the expansion of global interior design and furniture industries.

According to study, the global timber plants market size was worth around USD 5.09 billion in 2024 and is predicted to grow to around USD 8.17 billion by 2034.

The CAGR value of the timber plants market is expected to be around 6.10% during 2025-2034.

Asia Pacific is expected to lead the global timber plants market during the forecast period.

Market trends in the timber plants market are shifting towards eco-certified wood products and sustainable forestry due to increasing environmental awareness. Consumers actively favor fast-growing species and engineered wood for durable and cost-effective solutions.

The construction and furniture making applications are expected to offer significant growth opportunities due to the demand for sustainable materials and rising urbanization. Moreover, the flooring and interior design segments are gaining attention for their eco-friendly and aesthetic appeal.

Leading players are adopting strategies such as acquisitions, mergers, and geographic expansion to increase market reach and boost supply chains. They are also investing in digital forestry management and sustainable technologies for operational efficiency.

The key players profiled in the global timber plants market include Weyerhaeuser Company, West Fraser Timber Co., Stora Enso, UPM-Kymmene Corporation, Canfor Corporation, Georgia-Pacific LLC, Rayonier Inc., Interfor Corporation, Resolute Forest Products, Boise Cascade Company, Mercer International Inc., PotlatchDeltic Corporation, Svenska Cellulosa Aktiebolaget (SCA), Suzano S.A., and Metsä Group.

The report examines key aspects of the timber plants market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed