Surgical Stapling Devices Market Size, Share Report, Analysis, Trends, Growth 2032

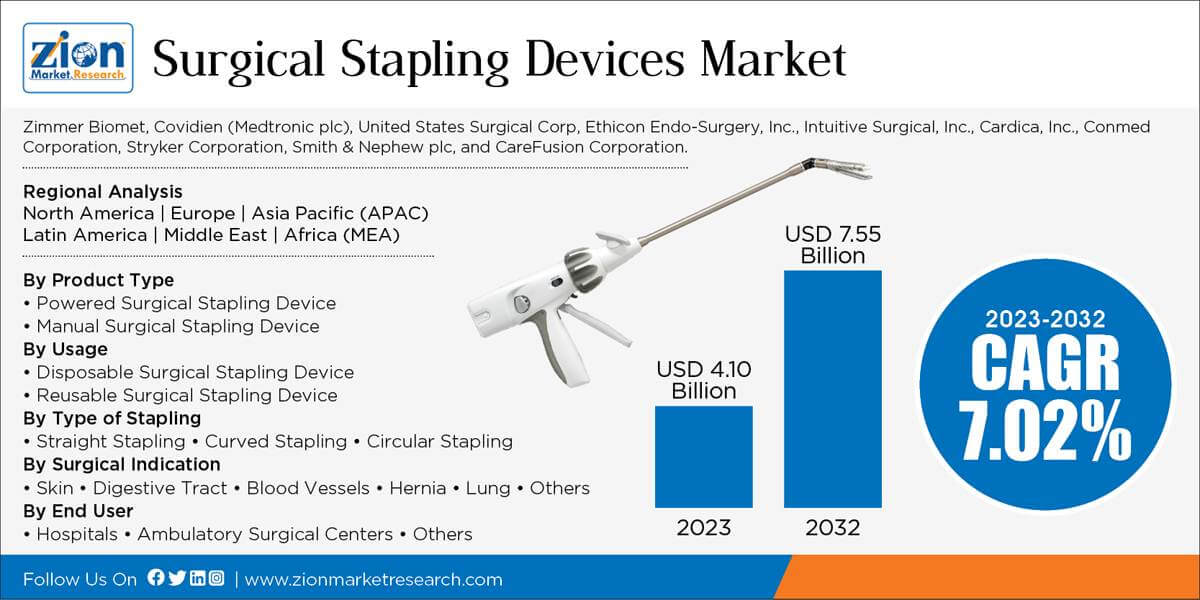

Surgical Stapling Devices Market By Product Type (Powered Surgical Stapling Device and Manual Surgical Stapling Device), By Usage (Disposable Surgical Stapling Device and Reusable Surgical Stapling), By Type of Stapling (Straight Stapling, Curved Stapling, and Circular Stapling), By Surgical Indication (Skin, Digestive Tract, Blood Vessels, Hernia, Lung and others), and By End-User (Hospitals, Ambulatory Surgical Centers and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.10 Billion | USD 7.55 Billion | 7.02% | 2023 |

Surgical Stapling Devices Industry Perspective:

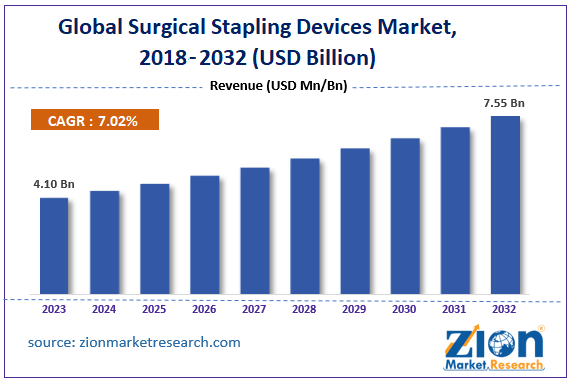

The global Surgical Stapling Devices market size accrued earnings worth approximately USD 4.10 Billion in 2023 and is predicted to gain revenue of about USD 7.55 Billion by 2032, is set to record a CAGR of nearly 7.02% over the period from 2024 to 2032. The study includes drivers and restraints for the surgical stapling devices market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the surgical stapling devices market on a global level.

Key Insights

- As per the analysis shared by our research analyst, the surgical stapling devices market is anticipated to grow at a CAGR of 7.02% during the forecast period (2024-2032).

- The global surgical stapling devices market was estimated to be worth approximately USD 4.10 billion in 2023 and is projected to reach a value of USD 7.55 billion by 2032.

- The growth of the surgical stapling devices market is being driven by the rising volume of surgical procedures and the growing preference for minimally invasive techniques.

- Based on the product type, the powered surgical stapling device segment is growing at a high rate and is projected to dominate the market.

- On the basis of usage, the disposable surgical stapling device segment is projected to swipe the largest market share.

- In terms of type of stapling, the straight stapling segment is expected to dominate the market.

- Based on the surgical indication, the skin segment is expected to dominate the market.

- On the basis of end user, the hospitals segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Surgical Stapling Devices Market: Overview

In order to give the users of this report a comprehensive view of the surgical stapling devices market, we have included a competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses customer and region segments that are benchmarked based on their market size, growth rate, and general attractiveness.

Surgical staples are specialized fasteners used in surgery to heal skin wounds or join body parts instead of stitches. These devices were created in response to growing worries about the effectiveness of conventional stitches in promoting healing. Surgical stapling devices offer superior precision, efficiency, and uniformity in wound closure compared to stitches, which are susceptible to tearing and leakage.

In 2023, the World Health Organization (WHO) reported that over 2.4 billion persons aged 18 years and older, which is 21% of the global adult population, were overweight. Of these, more than 600 million adults were obese. Obesity has become prevalent, leading to a rise in chronic diseases globally due to lifestyle changes. This has increased the need for bariatric surgery, with physicians now prescribing less invasive approaches for these procedures. The increasing prevalence of bariatric surgeries has led to the utilization of surgical staples, which provide advantages including decreased discomfort, lower postoperative infection rates, quicker recovery, enhanced precision, and improved bleeding management. The increasing number of operations conducted on elderly individuals to avoid age-related disorders is anticipated to boost the need for surgical stapling devices among the geriatric population. Request Free Sample

Request Free Sample

The report provides a company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

Recent Development

- In March 2021, Ethicon (Johnson & Johnson) introduced the ECHELON+ Stapler with Gripping Surface Technology (GST) Reloads—a powered surgical stapler engineered to enhance staple line security by delivering more consistent tissue compression and improved staple formation, thereby reducing procedural complications.

- In August 2022, Teleflex Incorporated acquired Standard Bariatrics, Inc. for US$170 million upfront, with potential milestone payments of up to US$130 million. The acquisition brought in a novel powered stapling technology tailored for bariatric surgery, expanding Teleflex’s surgical solutions portfolio.

- In May 2024, Ethicon launched the ECHELON LINEAR™ Cutter, the first linear cutter to integrate both 3D-Stapling Technology and GST. Clinical trials demonstrated a ~47% reduction in staple-line leaks, targeting improved outcomes in colorectal and other high-risk procedures.

- In June 2025, Johnson & Johnson MedTech debuted the ETHICON 4000 Stapler in the U.S.—a next-generation stapling system featuring proprietary 3D Staple Technology, a redesigned end effector, and advanced ETHICON 3D Reloads. Approved for both open and laparoscopic surgeries, the device is also intended for future integration with the OTTAVA™ Robotic Surgical System.

Surgical Stapling Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Surgical Stapling Devices Market |

| Market Size in 2023 | USD 4.10 Billion |

| Market Forecast in 2032 | USD 7.55 Billion |

| Growth Rate | CAGR of 7.02% |

| Number of Pages | 211 |

| Key Companies Covered | Zimmer Biomet, Covidien (Medtronic plc), United States Surgical Corp, Ethicon Endo-Surgery, Inc., Intuitive Surgical, Inc., Cardica, Inc., Conmed Corporation, Stryker Corporation, Smith & Nephew plc, and CareFusion Corporation. |

| Segments Covered | By Product Type, By Usage, By Type of Stapling, By Surgical Indication, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Surgical Stapling Devices Market Segmentation Analysis

The study provides a decisive view of the surgical stapling devices market by segmenting the market based on customers and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2018 to 2024.

Based on product type, the surgical stapling devices market has been segmented into powered and manual. For skin sutures in general surgeries and emergency treatments manual staples are used traditionally, whereas due to the increasing number of emergency cases, powered surgical staplers are witnessing growing demand in the market.

Based on usage, the surgical stapling devices market is classified into disposable and reusable. Due to the elimination of cross-infection transferred by medical devices, disposable staples are the fastest-growing segment. Besides, reusable surgical stapling devices are preferred by the procurement team of hospitals as they are labeled under the category of green products, resulting in considerably less impact on the environment, compared to plastic single-use disposable surgical stapling devices.

Based on the type, stapling devices market is classified into straight, curved, and circular. Based on the surgical indication, the surgical stapling devices market is classified into the skin, digestive tract, blood vessels, hernia, lung, and others. Based on the end user, the surgical stapling devices market is classified into hospitals, ambulatory surgical centers, and others.

Based on the surgical indication, the surgical stapling devices market has been segmented to the skin, digestive tract, blood vessels, hernia, lung, and others.

Based on the end user, the surgical stapling devices market has been divided into hospitals, ambulatory surgical centers, and others.

Surgical Stapling Devices Market Regional Segmentation Analysis

North America is expected to remain the dominant region over the forecasted period, owing to the growing geriatric population and escalating demand for advanced medical technology. The U.S. presents key growth opportunities for manufacturers of surgical stapling devices. Asia Pacific region is the fastest growing sector due to the presence of a large target patient pool requiring minimally invasive techniques and other laparoscopic surgeries and also the growing number of aesthetic and cosmetic procedures in countries such as South Korea and India is further expected to propel the market growth.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with its further bifurcation into major countries including the U.S. Germany, France, the UK, China, Japan, India, and Brazil. This segmentation includes demand for surgical stapling devices based on individual segments and applications in all regions and countries.

Key Players Insights

The growing utilization of surgical stapling devices in bariatric operations worldwide is a significant factor driving the global surgical stapling devices market. The market is likely to develop in the next years because to a rise in surgical operations and a growing desire for minimally invasive surgeries. Yet, the price of surgical staples and the accessibility of alternative wound care methods could provide a challenge to the market for surgical stapling equipment. Consistent integration of cutting-edge and effective surgical staplers will create significant prospects for the surgical stapling devices market in the future.

Some of the key players in the surgical stapling devices market are

- Zimmer Biomet

- Covidien (Medtronic plc)

- United States Surgical Corp

- Ethicon Endo-Surgery, Inc.

- Intuitive Surgical, Inc.

- Cardica, Inc.

- Conmed Corporation

- Stryker Corporation

- Smith & Nephew plc

- and CareFusion Corporation.

This report segments the global surgical stapling devices market as follows:

By Product Type

- Powered Surgical Stapling Device

- Manual Surgical Stapling Device

By Usage

- Disposable Surgical Stapling Device

- Reusable Surgical Stapling Device

By Type of Stapling

- Straight Stapling

- Curved Stapling

- Circular Stapling

By Surgical Indication

- Skin

- Digestive Tract

- Blood Vessels

- Hernia

- Lung

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed