Global Sulfur Bentonite Market Size, Share, Growth Analysis Report - Forecast 2034

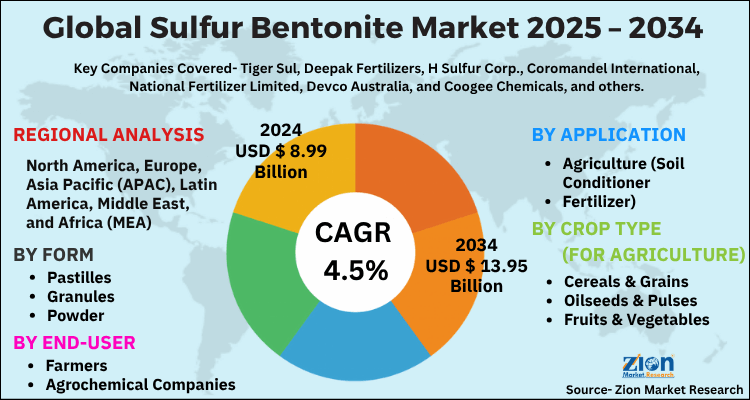

Sulfur Bentonite Market By Form (Pastilles, Granules, Powder), By Crop Type (for agriculture) (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), By Application (Agriculture (Soil Conditioner, Fertilizer), Industrial (Construction, Drilling Mud, Iron Ore Pelletizing)), By End-user (Farmers, Agrochemical Companies, Industrial Manufacturers), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

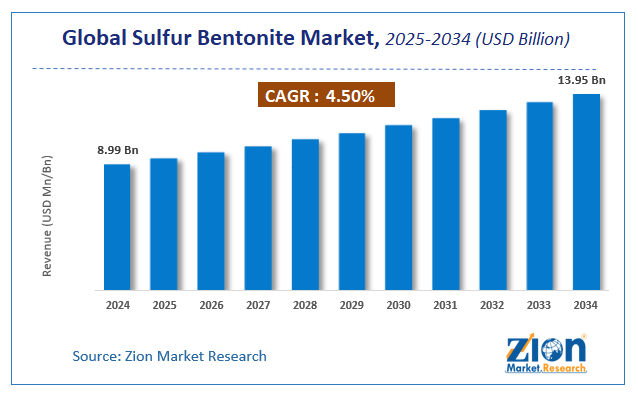

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.99 Billion | USD 13.95 Billion | 4.5% | 2024 |

Sulfur Bentonite Market: Industry Perspective

The global sulfur bentonite market size was worth around USD 8.99 Billion in 2024 and is predicted to grow to around USD 13.95 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034.

The report analyzes the global sulfur bentonite market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the sulfur bentonite industry.

Sulfur Bentonite Market Overview:

Sulfur Bentonite is one of the key concentrated sulphur sources. Reportedly, Sulfur deficiency is witnessed majorly in Indian soils. For the record, Sulfur Bentonite consists of ninety percent of sulphur and ten percent of Bentonite clay. Moreover, the product acts as a dispersing agent after adding it to soils. According to NCBI, Sulfur Bentonite based organic fertilizers are utilized as tools for enhancing the anti-oxidant activity in red onions.

Furthermore, the compound is used in fertilizers for raising the crop output and improving the soil quality along with maintaining land arability. Apparently, sulfur plays a major role in synthesis of chlorophyll and enhances plant metabolism. In addition to this, Sulfur Bentonite fertilizers are utilized as flame retardant, oil & gas drilling applications, and organic intermediates.

Key Insights

- As per the analysis shared by our research analyst, the global sulfur bentonite market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034).

- Regarding revenue, the global sulfur bentonite market size was valued at around USD 8.99 Billion in 2024 and is projected to reach USD 13.95 Billion by 2034.

- The sulfur bentonite market is projected to grow at a significant rate due to rising demand for high-efficiency sulfur fertilizers and increasing focus on crop yield and soil health.

- Based on Form, the Pastilles segment is expected to lead the global market.

- On the basis of Crop Type (for agriculture), the Cereals & Grains segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Agriculture (Soil Conditioner segment is projected to swipe the largest market share.

- By End-user, the Farmers segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Sulfur Bentonite Market Market Growth Dynamics

The market's growth over the forecast period is attributed to the need to remove sulfur deficiency from soil in order to increase the yield of corn, apples, potatoes, apples, oranges, soybeans, tea, and coffee.Large scale use of the compound in wastewater treatment, desalination, and food and beverages will boost market trends. Additionally, the escalating need for fertilizers fortified with sulfur for increasing crop cultivation will provide new growth avenues for the sulfur bentonite market over the ensuing years. Apparently, the oxidative feature of the compound helps in controlling the nutrient loss of the soil without creating any environmental hazards, and this will steer the market's growth over the forecast timeframe.

Furthermore, easy availability of raw substances, commercialization of products, and huge business avenues will facilitate market growth over 2025–2034. Moreover, low sulfur content in the soil can cause poor water drainage, soil runoff, pollution, and bacterial proliferation. Hence, in order to prevent the soil damage as well as retain its arability, it is necessary to add Sulfur Bentonite to soil. Such moves are anticipated to boost market demand in the near future. However, large amount of subsidizes provided to conventional fertilizers in the developing countries will decimate the market expansion.

Sulfur Bentonite Market: Segmentation Analysis

The global sulfur bentonite market is segmented based on Form, Crop Type (for agriculture), Application, End-user, and region.

Based on Form, the global sulfur bentonite market is divided into Pastilles, Granules, Powder.

On the basis of Crop Type (for agriculture), the global sulfur bentonite market is bifurcated into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables.

By Application, the global sulfur bentonite market is split into Agriculture (Soil Conditioner, Fertilizer), Industrial (Construction, Drilling Mud, Iron Ore Pelletizing).

In terms of End-user, the global sulfur bentonite market is categorized into Farmers, Agrochemical Companies, Industrial Manufacturers.

Sulfur Bentonite Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sulfur Bentonite Market |

| Market Size in 2024 | USD 8.99 Billion |

| Market Forecast in 2034 | USD 13.95 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 110 |

| Key Companies Covered | Tiger Sul, Deepak Fertilizers, H Sulfur Corp., Coromandel International, National Fertilizer Limited, Devco Australia, and Coogee Chemicals, and others. |

| Segments Covered | By Form, By Crop Type (for agriculture), By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sulfur Bentonite Market: Regional Analysis

North America To Make Remarkable Contributions Towards Overall Market Revenue By 2034

The market growth in the region over the estimated timespan can be credited to the huge demand for the product because of the huge crop yield. Furthermore, its use has been found to benefit enhancement of crop health in the countries like Canada. Apart from this, the subcontinent is the major manufacturer and consumer of the compound, with Canada being the leading canola producer. In addition to this, the U.S. is predicted to generate high demand for soybeans and corn, which will boost product penetration in the country. All these aforementioned factors are predicted to enhance business growth in the region over the ensuing years.

Sulfur Bentonite Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the sulfur bentonite market on a global and regional basis.

The global sulfur bentonite market is dominated by players like:

- Tiger Sul

- Deepak Fertilizers

- H Sulfur Corp.

- Coromandel International

- National Fertilizer Limited

- Devco Australia

- and Coogee Chemicals

The global sulfur bentonite market is segmented as follows;

By Form

- Pastilles

- Granules

- Powder

By Crop Type (for agriculture)

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

By Application

- Agriculture (Soil Conditioner

- Fertilizer)

- Industrial (Construction

- Drilling Mud

- Iron Ore Pelletizing)

By End-user

- Farmers

- Agrochemical Companies

- Industrial Manufacturers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global sulfur bentonite market is expected to grow due to rising demand for high-efficiency sulfur fertilizers and increasing focus on crop yield and soil health.

According to a study, the global sulfur bentonite market size was worth around USD 8.99 Billion in 2024 and is expected to reach USD 13.95 Billion by 2034.

The global sulfur bentonite market is expected to grow at a CAGR of 4.5% during the forecast period.

North America is expected to dominate the sulfur bentonite market over the forecast period.

Leading players in the global sulfur bentonite market include Tiger Sul, Deepak Fertilizers, H Sulfur Corp., Coromandel International, National Fertilizer Limited, Devco Australia, and Coogee Chemicals, among others.

The report explores crucial aspects of the sulfur bentonite market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed