Subsea Well Intervention Market Size, Share, Trends, Growth & Forecast 2034

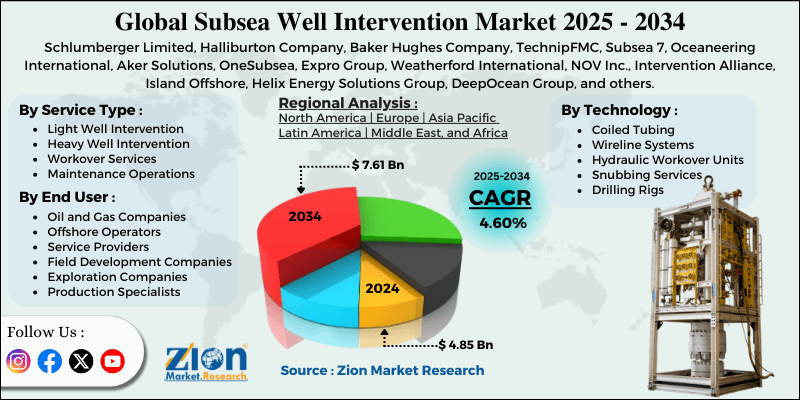

Subsea Well Intervention Market By Service Type (Light Well Intervention, Heavy Well Intervention, Workover Services, Maintenance Operations, Completion Services, Remedial Services), By Technology (Coiled Tubing, Wireline Systems, Hydraulic Workover Units, Snubbing Services, Drilling Rigs, Robotic Systems), By End-User (Oil and Gas Companies, Offshore Operators, Service Providers, Field Development Companies, Exploration Companies, Production Specialists), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

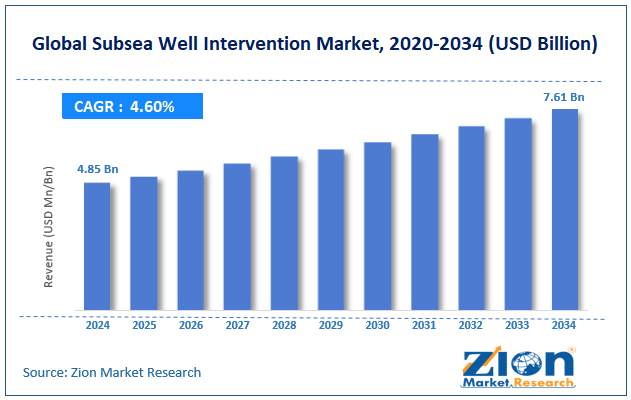

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.85 Billion | USD 7.61 Billion | 4.60% | 2024 |

Subsea Well Intervention Industry Perspective:

The global subsea well intervention market size was worth approximately USD 4.85 billion in 2024 and is projected to grow to around USD 7.61 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global subsea well intervention market is estimated to grow annually at a CAGR of around 4.60% over the forecast period (2025-2034).

- In terms of revenue, the global subsea well intervention market size was valued at approximately USD 4.85 billion in 2024 and is projected to reach USD 7.61 billion by 2034.

- The subsea well intervention market is projected to grow significantly due to the expansion of deep-water exploration activities and the rise of advanced offshore drilling technologies.

- Based on service type, the light well intervention segment is expected to lead the market, while the heavy well intervention segment is anticipated to experience significant growth.

- Based on technology, the coiled tubing segment is the dominating segment, while the robotic systems segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the oil and gas companies segment is expected to lead the market compared to the exploration companies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Subsea Well Intervention Market: Overview

Subsea well intervention is a set of specialized services in offshore oil and gas that focus on maintaining, repairing, improving, and optimizing the performance of underwater wells throughout their working life. It encompasses a wide range of specialized tasks designed to maintain, repair, improve, and optimize the performance of underwater oil and gas wells throughout their operational life. These operations require advanced tools and trained specialists to carry out complex activities on wells located deep below the ocean floor, often under extreme depths and challenging marine conditions. Modern subsea well intervention uses advanced methods, such as remotely operated vehicles, specialized intervention vessels, robotic systems, and enhanced completion technologies, which allow operators to service wells without lifting them to the surface.

The industry uses several techniques, including coiled tubing operations, wireline services, hydraulic workovers, and planned maintenance programs, to boost well output and extend the lifespan. Strict safety rules and global standards are applied across all processes to protect workers, safeguard equipment, and preserve the marine environment from risks. The continuous adoption of new technologies and safety innovations ensures reliability, efficiency, and sustainability in subsea well intervention.

The increasing complexity of offshore oil and gas developments and the growing need to maintain aging subsea infrastructure are expected to drive substantial growth in the subsea well intervention market throughout the forecast period.

Subsea Well Intervention Market Dynamics

Growth Drivers

How are increasing offshore exploration and production activities propelling the subsea well intervention market growth?

The subsea well intervention market is growing quickly as offshore oil and gas exploration and production activities expand in both established and newly developed deep-water regions. Major oil and gas companies are investing heavily in complex offshore projects, which depend on advanced intervention services to maintain production levels and ensure long-term safety of assets. With onshore reserves declining and global energy needs rising, operators are moving to deep-water locations, where subsea wells demand regular intervention for repairs, maintenance, and performance improvement. S

upportive government policies and new technology for subsea systems are creating favorable conditions for growth. National and international companies are working together on large-scale offshore projects that require reliable intervention services to remain profitable. The discovery of new offshore reserves and the development of previously unreachable fields are driving consistent demand for specialized services. This combination of rising demand, new reserves, and improved access is pushing the industry forward at a steady pace.

Technological advancements in subsea intervention systems

The subsea well intervention industry is rapidly evolving, driven by new innovations in robotic systems, automation, and digital technologies that improve both safety and efficiency. Developments such as artificial intelligence, real-time monitoring, and advanced data analytics are transforming the way operators handle subsea well repairs and optimization. One key breakthrough has been the introduction of intelligent intervention systems and fully digital platforms that provide complete well management solutions. These new systems not only improve traditional operations but also allow for predictive maintenance, automatic fault detection, and more efficient scheduling of interventions.

With rising operational costs and growing technical challenges, these technologies are becoming essential for cost-effective and sustainable offshore operations. The ability to predict problems before they occur, reduce downtime, and improve decision-making makes these innovations highly valuable. As more companies adopt these solutions, the industry is set to benefit from faster, safer, and more reliable intervention processes worldwide.

Restraints

How are high operational costs and technical complexity restricting the subsea well intervention market’s progress?

One of the biggest challenges for the subsea well intervention market is the high cost of equipment, vessels, and skilled professionals required to carry out offshore projects. Mobilizing ships, transporting advanced tools, and meeting strict safety rules all add to the expense, creating barriers for smaller operators. These high costs can delay or even cancel between 25% and 40% of planned projects, especially in uncertain markets or marginal oil fields.

To overcome this, companies are working on lowering costs through innovation, efficiency improvements, and more affordable technologies. Technical complexity is another major challenge, as subsea operations need detailed planning, specialized skills, and high-end machinery that may not always be available in every region. This creates reliance on a small number of global service providers, reducing flexibility and increasing costs. Without simpler systems and wider expertise, market accessibility remains limited. However, gradual improvements in technology and training may help reduce these barriers over time.

Opportunities

Digitalization and automation technologies

The subsea well intervention market is expanding through the integration of digital technologies and automated systems that improve operational efficiency and reduce human risk exposure. Companies are using advanced data analytics, machine learning, and predictive tools to better plan maintenance and reduce operating costs. These systems help operators schedule interventions at the right time, lowering risks and extending the lifespan of offshore wells.

The growing use of automation also reduces human exposure to dangerous deep-water conditions. New digital platforms bring together sensors, real-time monitoring, and automated controls, giving operators greater visibility and better decision-making ability. These improvements not only cut costs but also make subsea interventions more attractive for both new field projects and existing fields that need upgrades. As more companies adopt these systems, the overall reliability and performance of offshore operations will continue to improve, creating long-term growth potential.

Challenges

How are harsh operating environments and safety requirements limiting the growth of the subsea well intervention market?

The subsea well intervention market faces major difficulties due to extreme deep-water conditions and strict safety regulations. Offshore wells are located in areas with high pressures, freezing temperatures, and unpredictable weather, all of which require advanced equipment and highly skilled professionals. These tough conditions make operations complex and add to the already high costs. Each offshore region also has different environmental challenges, so intervention methods must be customized, which makes it hard to standardize procedures and raises expenses further.

Without common global safety rules and consistent operating methods, companies find it difficult to ensure reliable performance at lower costs. This highlights the need for stronger equipment, better training, and clear safety standards across the industry. Developing more durable systems can reduce weather-related delays, improve efficiency, and build greater trust in subsea well intervention. If these challenges are addressed, the industry will be better positioned for stable and safer growth.

Subsea Well Intervention Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Subsea Well Intervention Market |

| Market Size in 2024 | USD 4.85 Billion |

| Market Forecast in 2034 | USD 7.61 Billion |

| Growth Rate | CAGR of 4.60% |

| Number of Pages | 212 |

| Key Companies Covered | Schlumberger Limited, Halliburton Company, Baker Hughes Company, TechnipFMC, Subsea 7, Oceaneering International, Aker Solutions, OneSubsea, Expro Group, Weatherford International, NOV Inc., Intervention Alliance, Island Offshore, Helix Energy Solutions Group, DeepOcean Group, and others. |

| Segments Covered | By Service Type, By Technology, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Subsea Well Intervention Market: Segmentation

The global subsea well intervention market is segmented based on service type, technology, end-user, and region.

Based on service type, the global subsea well intervention industry is divided into light well intervention, heavy well intervention, workover services, maintenance operations, completion services, and remedial services. Light well intervention leads the market due to its cost-effectiveness, shorter operation duration, and widespread application in routine maintenance and minor repair activities across various offshore developments.

Based on technology, the global subsea well intervention market is categorized into coiled tubing, wireline systems, hydraulic workover units, snubbing services, drilling rigs, and robotic systems. Coiled tubing is expected to lead the market during the forecast period due to its operational flexibility, proven reliability, and strong suitability for various intervention applications in both shallow and deep-water environments.

Based on end-user, the global market is classified into oil and gas companies, offshore operators, service providers, field development companies, exploration companies, and production specialists. Oil and gas companies hold the largest market share due to their extensive offshore portfolios, significant capital investments, and widespread use of intervention services across their global operations.

Subsea Well Intervention Market: Regional Analysis

What factors are contributing to North America's dominance in the global subsea well intervention market?

North America is the leading region in the subsea well intervention market, supported by its well-developed offshore industry, advanced deep-water infrastructure, and strong technological expertise. Approximately 45% of global subsea intervention activities occur here, with the United States leading the way through its active Gulf of Mexico operations and a mature offshore service sector. Operators across the region prefer subsea intervention because it ensures reliable well maintenance, enhances production, and offers proven performance in demanding offshore conditions. North America benefits from advanced manufacturing facilities, strong logistics systems, and highly skilled personnel that reinforce its leadership. Local regulatory frameworks and strict industry standards further promote safe and efficient operations.

In addition, ongoing offshore development, the need to optimize mature fields, and regular infrastructure maintenance sustain steady demand growth. Most technological innovations in intervention equipment, monitoring systems, and autonomous platforms originate in North America, influencing both domestic and global markets. Recently, operators have been adopting intelligent intervention systems and digital solutions that enhance well performance, reduce risks, and more accurately predict future maintenance needs.

Europe is expected to show strong growth.

Europe’s subsea well intervention market is steadily expanding as operators increase investments in the North Sea, renewable energy projects, and modern offshore technologies. Subsea intervention services are widely used in field life extension projects and decommissioning work, helping manage aging offshore infrastructure in a safe and cost-efficient way. Harmonized EU regulations play a crucial role in setting consistent technical standards and ensuring compliance with stringent safety and environmental regulations. As operators adopt advanced intervention capabilities, demand is spreading beyond traditional oil and gas into new applications.

Environmental policies and sustainability goals are also driving opportunities for specialized services that support emission reduction and environmental protection initiatives. With the transition to cleaner energy, versatile intervention solutions are gaining importance. Backed by strong government support and growing industry confidence, operators across Europe are now adopting advanced subsea technologies and integrated well management systems. Leading offshore service providers are also forming partnerships with North American technology companies to access proven solutions and accelerate innovation in subsea operations, digital integration, and environmental sustainability.

Recent Market Developments:

- In March 2025, the Norwegian government announced new offshore development incentives that promote the use of advanced subsea intervention technologies, offering tax benefits to encourage sustainable offshore operations and enhanced environmental protection measures across Nordic waters.

Subsea Well Intervention Market: Competitive Analysis

The leading players in the global subsea well intervention market are:

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- TechnipFMC

- Subsea 7

- Oceaneering International

- Aker Solutions

- OneSubsea

- Expro Group

- Weatherford International

- NOV Inc.

- Intervention Alliance

- Island Offshore

- Helix Energy Solutions Group

- DeepOcean Group

The global subsea well intervention market is segmented as follows:

By Service Type

- Light Well Intervention

- Heavy Well Intervention

- Workover Services

- Maintenance Operations

- Completion Services

- Remedial Services

By Technology

- Coiled Tubing

- Wireline Systems

- Hydraulic Workover Units

- Snubbing Services

- Drilling Rigs

- Robotic Systems

By End User

- Oil and Gas Companies

- Offshore Operators

- Service Providers

- Field Development Companies

- Exploration Companies

- Production Specialists

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Subsea well intervention is a set of specialized services in offshore oil and gas that focus on maintaining, repairing, improving, and optimizing the performance of underwater wells throughout their working life. Well intervention represents one of the most critical service sectors in offshore oil and gas operations. It encompasses a wide range of specialized activities designed to maintain, repair, enhance, and optimize the performance of underwater oil and gas wells throughout their productive lifecycle.

The global subsea well intervention market is projected to grow due to increasing offshore exploration and production activities, rising adoption of advanced intervention technologies, and growing demand for cost-effective well maintenance solutions.

According to a study, the global subsea well intervention market size was worth around USD 4.85 billion in 2024 and is predicted to grow to around USD 7.61 billion by 2034.

The CAGR value of the subsea well intervention market is expected to be around 4.60% during 2025-2034.

North America is expected to lead the global subsea well intervention market during the forecast period.

The major players profiled in the global subsea well intervention market include Schlumberger Limited, Halliburton Company, Baker Hughes Company, TechnipFMC, Subsea 7, Oceaneering International, Aker Solutions, OneSubsea, Expro Group, Weatherford International, NOV Inc., Intervention Alliance, Island Offshore, Helix Energy Solutions Group, and DeepOcean Group.

The report examines key aspects of the subsea well intervention market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

The market trends and consumer preferences evolving in the subsea well intervention market are that operators are shifting toward cost-effective light well intervention, greater use of digital/remote operations, prioritizing safety, uptime, lifecycle optimization through predictive maintenance, and data analytics.

Mature field life-extension, routine maintenance campaigns, and decommissioning support, along with deep-water production optimization, tie-back readiness, and digitalized condition monitoring/predictive maintenance programs are application areas that will offer significant growth opportunities in the subsea well intervention market.

Adoption of robotic and autonomous systems, AI-enabled real-time monitoring, integrated digital platforms for intelligent intervention and scheduling, automated fault detection, and modular LWI vessels/equipment that cut costs, enhance safety, and improve reliability are the emerging trends and innovations impacting the subsea well intervention market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed