Sterilization Equipment Market Size, Share, Growth Report 2032

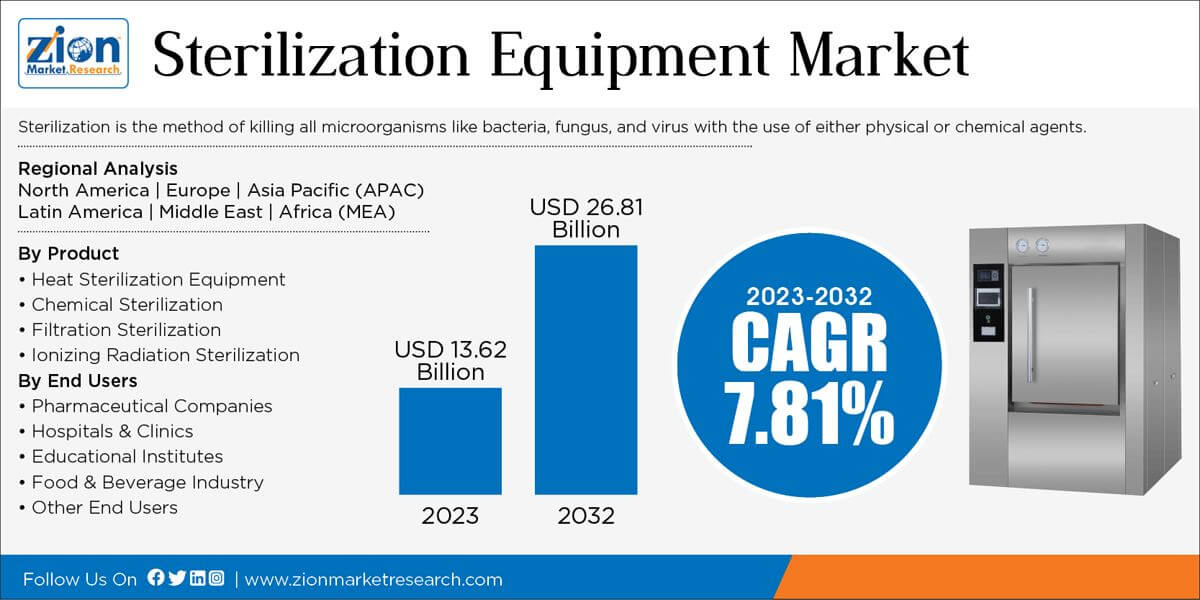

Sterilization Equipment Market By Instrument Type (Heat Sterilization Equipment, Chemical Sterilization, Filtration Sterilization And Ionizing Radiation Sterilization), By End-User (Pharmaceutical Companies, Hospitals & Clinics, Educational Institutes, Food & Beverage Industry, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

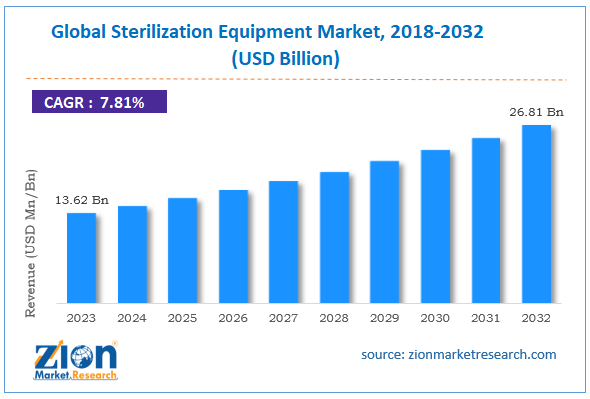

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.62 Billion | USD 26.81 Billion | 7.81% | 2023 |

Sterilization Equipment Industry Perspective:

The global sterilization equipment market size was worth around USD 13.62 billion in 2023 and is predicted to grow to around USD 26.81 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.81% between 2024 and 2032. According to recent research, Sterilization equipment plays an essential part in healthcare operations, it controls a large share of the global medical device industry.

Key Insights

- As per the analysis shared by our research analyst, the global sterilization equipment market is estimated to grow annually at a CAGR of around 5% over the forecast period (2024-2032).

- In terms of revenue, the global sterilization equipment market size was valued at around USD 13.62 Billion in 2023 and is projected to reach USD 26.81 Billion by 2032.

- The growth of the sterilization equipment market is being driven by the increasing focus on infection control and strict hospital hygiene regulations.

- Based on product, the heat sterilization equipment segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Sterilization Equipment Market: Overview

Sterilization is the method of killing all microorganisms like bacteria, fungus, and virus with the use of either physical or chemical agents. These methods involve reacting microorganisms or microbial pores by using moist heat, dry heat, and chemicals or by passing medium through filters. Hot air oven and autoclaves are the most commonly used equipment for sterilizations.

Globally, sterilization equipment market has been accelerated due to rising number of hospitals across the globe. Moreover increasing number of the geriatric population across the world coupled with the wide application of the equipment in the medical and pharmaceutical industries are considered as major factors which help in driving the sterilization equipment market. However, stringent rules and regulations for pharmaceutical companies is the key factor that hinders the growth of sterilization equipment market. Nonetheless, ongoing research and development in the field of technology may bring huge growth opportunities for the growth of the market within the forecast period.

Sterilization is the method of killing all microorganisms like bacteria, fungus, and virus with the use of either physical or chemical agents. These methods involve reacting microorganisms or microbial pores by using moist heat, dry heat, and chemicals or by passing medium through filters. Hot air oven and autoclaves are the most commonly used equipment for sterilizations.

Globally, sterilization equipment market has been accelerated due to rising number of hospitals across the globe. Moreover increasing number of the geriatric population across the world coupled with the wide application of the equipment in the medical and pharmaceutical industries are considered as major factors which help in driving the sterilization equipment market. However, stringent rules and regulations for pharmaceutical companies is the key factor that hinders the growth of sterilization equipment market. Nonetheless, ongoing research and development in the field of technology may bring huge growth opportunities for the growth of the market within the forecast period.

Sterilization Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sterilization Equipment Market Research Report |

| Market Size in 2023 | USD 13.62 Billion |

| Market Forecast in 2032 | USD 26.81 Billion |

| Growth Rate | CAGR of 7.81% |

| Number of Pages | 214 |

| Key Companies Covered | Steris, Getinge Group, 3M, Sortera Health, and Advanced Sterilization Products, and among others. |

| Segments Covered | By Instrument Type, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sterilization Equipment Market: Segmentation

The study provides a decisive view of the sterilization equipment market by segmenting the market based on instrument type, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on instrument type, the global sterilization equipment market is segmented into four types: heat sterilization equipment, chemical sterilization, filtration sterilization and ionizing radiation sterilization. The heat sterilization equipment is the most preferred sterilization instruments in the medical sector and thus this segment accounted for the largest market share in terms of revenue in the year 2023. Other factors attributing to this growth are increasing numbers of laboratories and healthcare centers across the world.

Based on end-users, the global sterilization equipment market is segmented into five types: pharmaceutical companies, hospitals & clinics, educational institutes, food & beverage industry and others. The pharmaceutical companies accounted for the largest market share in terms of revenue in 2023. Pharmaceutical companies and hospitals are the major users of sterilization equipment. Patient safety and stringent government regulation are the major factors driving the growth sterilization equipment market.

Sterilization Equipment Market: Regional Insights

Based on region, the global sterilization equipment market is fragmented into five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In terms of revenue, North America is expected to account for the largest market share of the global sterilization equipment market during the forecast period. Personal healthcare awareness is the major factor which helps in driving the market. Europe accounted for the second largest market share in the year 2023 whereas Asia Pacific is expected to grow with the fastest CAGR in the forecast period. Developing economies such as China and India are the major revenue holders leading to the growth of this region in sterilization equipment market.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with its further bifurcation into major countries including the U.S. Germany, France, UK, China, Japan, India, and Brazil. In terms of revenue, North America is expected to account for the largest market share of the global sterilization equipment market during the forecast period. Personal healthcare awareness is the major factor which helps in driving the market. Europe accounted for the second largest market share in the year 2023 whereas Asia Pacific is expected to grow with the fastest CAGR in the forecast period. Developing economies such as China and India are the major revenue holders leading to the growth of this region in sterilization equipment market. This segmentation includes demand for sterilization equipment based on individual segments and applications in all regions and countries.

The report covers competitive outlook in detail which includes various reimbursement policies, market shares by segments as well as the company profiles of the key participants operating in the global sterilization equipment market. Some of the key participants in the global sterilization equipment market include Steris, Getinge Group, 3M, Sortera Health, and Advanced Sterilization Products.

Sterilization Equipment Market: Competitive Space

The global sterilization equipment market profiles key players such as:

- Steris

- Getinge Group

- 3M

- Sortera Health

- Advanced Sterilization Products.

- Others

This report segments the global sterilization equipment market as follows:

By Product

-

Heat Sterilization Equipment

- Dry Heat Sterilization

- Moist Heat/Steam Sterilization Equipment

- Chemical Sterilization

- Ethylene Oxide Sterilization

- Hydrogen Peroxide Sterilization

- Ozone-based Sterilization

- Formaldehyde Sterilization

- Others

- Filtration Sterilization

- Ionizing Radiation Sterilization

- E-beam Radiation Sterilization

- Gamma Sterilization

- Others

By End Users

-

Pharmaceutical Companies

- Hospitals & Clinics

- Educational Institutes

- Food & Beverage Industry

- Other End Users

By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sterilization is the method of killing all microorganisms like bacteria, fungus, and virus with the use of either physical or chemical agents.

According to study, the global Sterilization Equipment market size was worth around USD 13.62 billion in 2023 and is predicted to grow to around USD 26.81 billion by 2032.

The CAGR value of Sterilization Equipment market is expected to be around 7.81% during 2024-2032.

North America has been leading the global Sterilization Equipment market and is anticipated to continue on the dominant position in the years to come, states the Sterilization Equipment market study.

The global Sterilization Equipment market is led by players like Steris, Getinge Group, 3M, Sortera Health, and Advanced Sterilization Products, and among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed