Steel Forging Market Size, Share, Trends, Growth and Forecast 2034

Steel Forging Market By Product (Bearing, Crankshaft, Axle, Piston, Connecting Rods, Steering Knuckle, CV Joint, Gear, Beam, and Others), By Type (Open Die Forging, Closed Die Forging, Rolled Ring Forging, and Stamping), By Material (Carbon Steel, Alloy Steel, Stainless Steel, and Tool Steel), By End User (Passenger Car, Commercial Vehicles, Industrial Machinery, and Energy Sector), And By Region: Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2025 - 2034

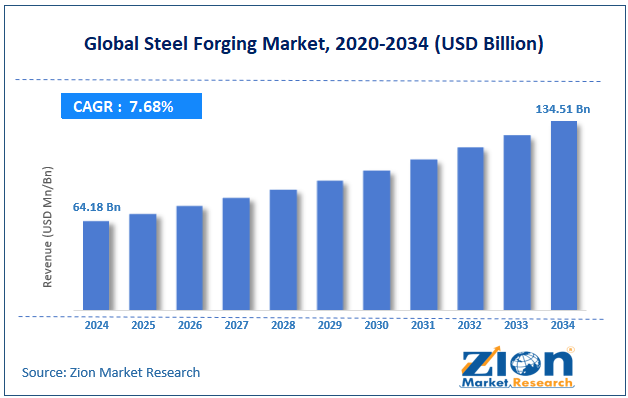

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 64.18 Billion | USD 134.51 Billion | 7.68% | 2024 |

Steel Forging Market: Industry Perspective

The global steel forging market size was worth around USD 64.18 billion in 2024 and is predicted to grow to around USD 134.51 billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.68% between 2025 and 2034. The report analyzes the global steel forging market's drivers, restraints/challenges, and the effect they have on the demand during the projection period. In addition, the report explores emerging opportunities in the steel forging industry.

Steel Forging Market: Overview

The developing automotive sector everywhere on the planet may be a major catalyst for the global steel forging market. Its cost-effective technique is anticipated to drive the growth of the steel forging market within the automotive sector. On the other hand, the availability of an optional metal gorging process is probably going to hinder the expansion of the steel forging market. Nevertheless, the employment of environment-friendly and energy-efficient techniques in forging is planned to supply new opportunities for the main companies within the coming years in the steel forging market. Moreover, different mergers and acquisitions by major players of the steel forging market are set to bolster the growth of the market. For instance, in May 2018, ArcelorMittal got approval from the European Commission for its acquisition of Ilva, fostering the event of the global steel forging market.

Key Insights

- As per the analysis shared by our research analyst, the global steel forging market is estimated to grow annually at a CAGR of around 7.68% over the forecast period (2025-2034).

- Regarding revenue, the global steel forging market size was valued at around USD 64.18 billion in 2024 and is projected to reach USD 134.51 billion by 2034.

- The steel forging market is projected to grow at a significant rate due to surging demand from the automotive (including EVs) and aerospace sectors, continuous infrastructure and industrial development, the need for lightweight, high-strength forged components, and the adoption of precision forging and automation technologies.

- Based on Product, the Gear segment is expected to lead the global market.

- On the basis of End User, the Passenger Car segment held the largest market share in 2024 with 55.2% and will continue to dominate the global market.

- Based on region, Asia Pacific, with approximately 35.6% share, is predicted to dominate the global market during the forecast period.

COVID-19 Impact Analysis

The global Steel Forging market has witnessed a slight decline in sales in the short term due to the lockdown enforcement placed by governments to contain COVID. Retail sales of vehicles across all the regions are also likely to suffer due to subdued consumer sentiment because of the rising infections and curbs. The automotive industry in the U.S remains fragile, vehicle sales decline by 5-10%, whereas China's vehicle sales continue their fast recovery. European automotive shows a decline of 8- 12% Y-o-Y. The restrictions imposed by various nations to contain COVID had stopped the production, resulting in disruption across the whole supply chain. However, the global markets are slowly opening to their full potential, and theirs a surge in demand for auto parts of the vehicles.

Steel Forging Market: Growth Factors

Increasing demand for steel forging in the automotive and aerospace industries is one of the major driving factors for the growth of the Steel Forging market. Moreover, stringent norms and regulations specific to CO2 emissions, especially in regions such as North America and Europe, are anticipated to spur the market size in these regions during the forecast period. However, the high cost can lead to limit the growth of the market. Furthermore, growth in the automotive industry is predicted to provide fruitful results for the market. For example, India is witnessing a positive growth rate in terms of vehicle sales in the second half of 2020. Passenger vehicle sales increased by 14% in August 2020 from the previous year.

Steel Forging Market: Segmentation Analysis

The global steel forging market is segmented based on product, type, material, end-user, and region.

Based on Product, the global steel forging market is divided into bearing, crankshaft, axle, piston, connecting rods, steering knuckle, CV joint, gear, beam, and others. The gear segment surfaced as a top component that added up to over 30% share in 2024 for the global steel forging market. Furthermore, the crankshaft was the second-biggest product section of the steel forging market in 2024. Moreover, this fashion is predicted to sustain within the forecast period for the steel forging market. Bearings and axles are important products that are believed to exhibit significant development during the approaching years within the steel forging market.

On the basis of Type, the global steel forging market is bifurcated into open die forging, closed die forging, rolled ring forging, and stamping.

By Material, the global steel forging market is split into carbon steel, alloy steel, stainless steel, and tool steel.

In terms of End-user, the global steel forging market is categorized into passenger cars, commercial vehicles, industrial machinery, and energy sector. The passenger car application segment accounted for the largest volume share of more than 55.2% in 2024, and this trend is expected to continue over the forecast period. Automotive components or parts manufactured by forging are sturdier than those manufactured by casting or machining. In addition, forged parts need little or no machining, which aids in saving both cost and time. Cumulative investments in the automotive industry are anticipated to augment the product demand in the near future. For example, in October 2020, Nissan announced it to build two new vehicle-assembly plants in China.

Steel Forging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Steel Forging Market |

| Market Size in 2024 | USD 64.18 Billion |

| Market Forecast in 2034 | USD 134.51 Billion |

| Growth Rate | CAGR of 7.68% |

| Number of Pages | 185 |

| Key Companies Covered | Mitsubishi Materials, Bharat Forge, Thyssenkrupp, Nippon Steel Corporation, Engineered Precision Machining, Eagle Stainless, Sunrise Enterprises, Allegheny Technologies, Marmon Group, Aichi Steel, Precision Castparts, ArcelorMittal, Fountaintown Forge, Raymond Corporation, Alcoa, and others. |

| Segments Covered | By Product, By Type, By Material, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Steel Forging Market: Regional Analysis

Asia Pacific to dominate the global market

With more than 35.6% share, the Asia Pacific led the global Steel Forgings market in 2024. The increasing demand for automobiles, coupled with the rising disposable incomes in the Asia Pacific countries, is expected to propel the demand for the Steel Forgings market over the years to come. The growing demand for passenger vehicles because of emerging industrialization in the region is likely to drive the demand for the automotive industry. Piercing development in the automotive industry in China and India is likely to have a positive effect on the steel forging market in this area.

India is believed as the most important area for the steel forging market. Some of the major reasons, such as tie-ups with the potent automakers and government programs for outsourcing their forged elements, contribute to the development of the steel forging market in this area. Furthermore, North America and Europe are also expected to exhibit exponential growth for the Steel Forgings market in the near future.

Recent Developments

- In May 2024, Balu Forge Industries Ltd. acquired a 72,000-tonne forging line in Karnataka, significantly boosting its manufacturing capacity for high-quality components for the automotive, aerospace, and defense sectors.

- In October 2024, Bharat Forge Ltd. announced a strategic agreement to acquire AAMIMCPL, aiming to strengthen its global market position and enhance its product offerings in the automotive and aerospace segments through advanced technology integration.

Steel Forging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the steel forging market on a global and regional basis.

The global steel forging market is dominated by players like:

- Mitsubishi Materials

- Bharat Forge

- Thyssenkrupp

- Nippon Steel Corporation

- Engineered Precision Machining

- Eagle Stainless

- Sunrise Enterprises

- Allegheny Technologies

- Marmon Group

- Aichi Steel

- Precision Castparts

- ArcelorMittal

- Fountaintown Forge

- Raymond Corporation

- Alcoa

The global steel forging market is segmented as follows;

By Product

- Bearing

- Crankshaft

- Axle

- Piston

- Connecting Rods

- Steering Knuckle

- CV Joint

- Gear

- Beam

- Others

By Type

- Open Die Forging

- Closed Die Forging

- Rolled Ring Forging

- Stamping

By Material

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Tool Steel

By End User

- Passenger Car

- Commercial Vehicles

- Industrial Machinery

- Energy Sector

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Steel forging is a manufacturing process that shapes a piece of steel (often heated) into a high-strength component by applying localized compressive forces (hammering, pressing, or rolling), which refines the internal grain structure for superior mechanical properties.

Key factors influencing steel forging market growth over 2025-2034 include booming demand from the automotive (especially EVs) and aerospace sectors, global infrastructure development, the shift toward lightweight and high-strength materials, and technological advancements like automation and precision forging.

According to a study, the global steel forging market size was worth around USD 64.18 billion in 2024 and is expected to reach USD 134.51 billion by 2034.

The global steel forging market is expected to grow at a CAGR of 7.68% during the forecast period.

Asia Pacific is expected to dominate the steel forging market over the forecast period.

Leading players in the global steel forging market include Mitsubishi Materials, Bharat Forge, Thyssenkrupp, Nippon Steel Corporation, Engineered Precision Machining, Eagle Stainless, Sunrise Enterprises, Allegheny Technologies, Marmon Group, Aichi Steel, Precision Castparts, ArcelorMittal, Fountaintown Forge, Raymond Corporation, and Alcoa, among others.

The report explores crucial aspects of the steel forging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed