Global Sexually Transmitted Diseases (STD) Diagnostics Market Size, Share, Forecast 2034

Sexually Transmitted Diseases (STD) Diagnostics Market By Type (Chlamydia Testing, Syphilis Testing, Gonorrhea Testing, Herpes Simplex Virus Testing, Human Papilloma Virus Testing, and Human Immunodeficiency Virus Testing), By Testing Devices (Laboratory Equipment And Point Of Care Equipment), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

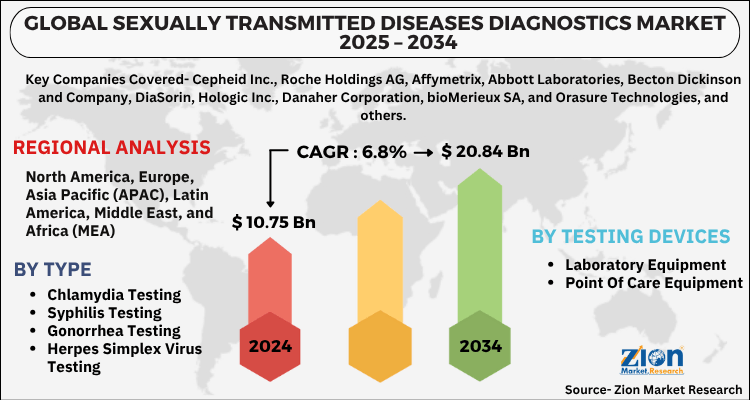

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.75 Billion | USD 20.84 Billion | 6.8% | 2024 |

Sexually Transmitted Diseases (STD) Diagnostics Market Size

The global sexually transmitted diseases (STD) diagnostics market size was worth around USD 10.75 Billion in 2024 and is predicted to grow to around USD 20.84 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.8% between 2025 and 2034.

The report analyzes the global sexually transmitted diseases (STD) diagnostics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the sexually transmitted diseases (STD) diagnostics industry.

Sexually Transmitted Diseases (STD) Diagnostics Market: Overview

Early diagnosing of sexually transmitted diseases is predicted to minimize the effect of disease on human health. Reportedly, if sexually transmitted diseases such as syphilis, gonorrhea, human papillomavirus, chlamydia, and genital herpes are not treated in time, it can result in long-term complications in affected persons. These complications encompass mental retardation, blindness, infertility, birth defects, cancer, heart disorders, and bone deformities in patients. Moreover, healthcare service providers diagnose sexually transmitted diseases through physically examination of subjects, blood tests, and through use of swabbed cultures at labs. Sexual transmitted diseases (STD) diagnosis involves lab testing and screening. Lab tests can recognize cause and identify co-infection through testing of blood, urine, and fluid samples. For the record, sexually transmitted disease patients are treated by prescribing them medications such as antiviral drugs and antibiotics.

Furthermore, researchers at NIAID have carried out immunological studies for knowing as to why large number of sexually transmitted ailments in individuals are asymptomatic. Moreover, these studies have unleashed how a mutation in the infection accounted notably towards drug resistance in STD patients due to constant infection & co-infection. This can pose a big challenge to growth of sexually transmitted diseases (STD) diagnostics market.

The term sexually transmitted diseases or STD is commonly used to refer to clinical syndromes and infectious diseases caused by pathogens that can be acquired and transmitted through sexual activity. These infections can easily spread by vaginal or anal intercourse, and sometimes by oral sex. STDs can also spread from the blood of infected patients. In addition, pregnant women with STDs may pass their infection to infants in the uterus (womb), during birth, or through breast-feeding. Prevention of STD infection is possible by having protective sex (using condoms) or abstaining from sex.

Key Insights

- As per the analysis shared by our research analyst, the global sexually transmitted diseases (STD) diagnostics market is estimated to grow annually at a CAGR of around 6.8% over the forecast period (2025-2034).

- Regarding revenue, the global sexually transmitted diseases (STD) diagnostics market size was valued at around USD 10.75 Billion in 2024 and is projected to reach USD 20.84 Billion by 2034.

- The sexually transmitted diseases (STD) diagnostics market is projected to grow at a significant rate due to rising prevalence of STDs, increasing awareness about early diagnosis, and advancements in diagnostic technologies.

- Based on Type, the Chlamydia Testing segment is expected to lead the global market.

- On the basis of Testing Devices, the Laboratory Equipment segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Sexually Transmitted Diseases (STD) Diagnostics Market: Growth Dynamics

Rise in awareness about educational campaigns and supportive government schemes will proliferate size of sexually transmitted diseases (STD) diagnostics market over ensuing years. Furthermore, increase in persons having living relationships with many partners and people having sexual encounters with more than one partner resulting in causing of sexually transmitted diseases will boost market trends.

Globally, STD diagnostics market has been accelerated by the rise in the percentage of unprotected sex which leads to increase in the prevalence of sexually transmitted diseases. Furthermore, lack of awareness coupled with unprotected sex is considered as major governing factors which promote the cause of sexually transmitted diseases and thus STD diagnostic market. Moreover, many lifestyle-related factors, such as having multiple sex partners are estimated to drive the sexual transmitted diseases diagnostic market.

However, lack of education, psychological impact and the unwillingness of the infected population to undergo prognosis is expected to hinder the growth of the market. In addition, prevention of infection by vaccination is major restraining factor in a growth of STDs diagnostic market.

Sexually Transmitted Diseases (STD) Diagnostics Market: Restraints

Growing importance of sex education and reduction in taboo related to discussion over topics such as sexual activities & sexual arousal will hinder market surge. Rise in awareness about spread of sexually transmitted diseases such as HIV and need of avoiding it by taking preventive measures such as use of condoms can decrement growth of sexually transmitted diseases (STD) diagnostics market.

Sexually Transmitted Diseases (STD) Diagnostics Market: Opportunities

Rise in point of care testing activities due to influx of new diagnostic kits, reagents, and instruments will create new growth avenues for sexually transmitted diseases (STD) diagnostics market. Reportedly, technologically advanced equipment in diagnostics domain offers precise testing outcomes, thereby driving market size.

Sexually Transmitted Diseases (STD) Diagnostics Market: Challenges

Fluctuating costs of raw materials impacting demand and supply of diagnostics devices has severely impacted import & export of raw materials as well as production of sexually transmitted diseases devices, thereby posing a huge challenge to expansion of sexually transmitted diseases (STD) diagnostics market.

Sexually Transmitted Diseases (STD) Diagnostics Market: Segmentation Analysis

The global sexually transmitted diseases (STD) diagnostics market is segmented based on type, testing devices, and region.

Based on the type, the sexually transmitted diseases (STD) diagnostics market is bifurcated into chlamydia testing, syphilis testing, gonorrhea testing, herpes simplex virus testing, human papilloma virus testing, and human immunodeficiency virus testing. Chlamydia testing dominates the type segment. The growth of the chlamydia testing segment over the forecasting timeframe can be attributed to low barrier protection and less awareness about chlamydia disease in under-developed and third-world countries. The PAP smear tests segment accounted for the largest share of approximately more than 50% of the total HPV testing market in 2021. Factors attributed to its growth due to its lower test prices and growing awareness about cancer diagnosis. Similarly, the HPV testing market is forecast to grow at the fastest growth rate within the forecast period.

By testing devices, the global STD diagnostic market is segmented into laboratory equipment and point of care equipment. The laboratory equipment segment to contribute humungously towards market size by 2028. The laboratory testing device market is further sub-segmented into thermal cyclers - PCR, lateral flow readers – immunochromatographic assays, flow cytometers, differential light scattering machines, absorbance microplate readers - Enzyme-Linked Immunosorbent Assay (ELISA), and others. Massive demand for laboratory devices for testing & diagnosing sexually transmitted diseases in individuals will boost segmental growth. Furthermore, most diagnostic testing takes place in labs, thereby generating a huge need for lab equipment.

Sexually Transmitted Diseases (STD) Diagnostics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sexually Transmitted Diseases (STD) Diagnostics Market |

| Market Size in 2024 | USD 10.75 Billion |

| Market Forecast in 2034 | USD 20.84 Billion |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 184 |

| Key Companies Covered | Cepheid Inc., Roche Holdings AG, Affymetrix, Abbott Laboratories, Becton Dickinson and Company, DiaSorin, Hologic Inc., Danaher Corporation, bioMerieux SA, and Orasure Technologies, and others. |

| Segments Covered | By Type, By Testing Devices, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sexually Transmitted Diseases (STD) Diagnostics Market: Regional Analysis

North America STD Diagnostics Market To Witness Sizable Surge In 2025-2034

Based on geographies, the global STD diagnostics market is bifurcated into five types: North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. These segments are further bifurcated into the U.S., UK, Germany, France, China, Japan, India, and Brazil. North America accounted for the largest share of the global STD diagnostic market followed by Europe. This growth is attributed to rising awareness related to health care in this region. Moreover, the STD diagnostics market has a huge opportunity in the emerging markets of Asia Pacific due to the increasing standard of living, and the large patient base in this region.

However, the Asia-Pacific market is projected to grow at the highest CAGR during the forecast period, due to the rising incidence of sexually transmitted diseases, increasing government support, and growing upper middle-class population, and the rise in disposable income levels in this region.

Recent Developments

- In April 2019, Quest Diagnostics introduced three laboratory testing packages for diagnosing sexually transmitted diseases in the U.S. Reportedly, these packages can be purchased online for diagnosing frequently occurring sexually transmitted diseases across the U.S.

- In February 2022, Lupin Limited – Mumbai-based Indian Pharmaceutical firm- received approval from the U.S. FDA for use of its antibiotic Solosec for treating sexually transmitted infections referred to as trichomoniasis and vaginal infection termed as bacterial vaginosis in women.

- In February 2022, Trinity Biotech – a Medical Laboratory Company based in Ireland & specializing in the production and marketing of clinically diagnostic products- got approval from the WHO for an HIV screening test.

Sexually Transmitted Diseases (STD) Diagnostics Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the sexually transmitted diseases (STD) diagnostics market on a global and regional basis.

The global sexually transmitted diseases (STD) diagnostics market is dominated by players like:

- Cepheid Inc.

- Roche Holdings AG

- Affymetrix

- Abbott Laboratories

- Becton Dickinson and Company

- DiaSorin

- Hologic Inc.

- Danaher Corporation

- bioMerieux SA

- and Orasure Technologies

The global sexually transmitted diseases (STD) diagnostics market is segmented as follows;

By Type

- Chlamydia Testing

- Syphilis Testing

- Gonorrhea Testing

- Herpes Simplex Virus Testing

- Human Papilloma Virus Testing

- and Human Immunodeficiency Virus Testing

By Testing Devices

- Laboratory Equipment

- Point Of Care Equipment

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global sexually transmitted diseases (STD) diagnostics market is expected to grow due to increasing awareness and screening programs, rising STD prevalence, advancements in diagnostic technologies, and growing government initiatives for early detection and prevention.

According to a study, the global sexually transmitted diseases (STD) diagnostics market size was worth around USD 10.75 Billion in 2024 and is expected to reach USD 20.84 Billion by 2034.

The global sexually transmitted diseases (STD) diagnostics market is expected to grow at a CAGR of 6.8% during the forecast period.

North America is expected to dominate the sexually transmitted diseases (STD) diagnostics market over the forecast period.

Leading players in the global sexually transmitted diseases (STD) diagnostics market include Cepheid Inc., Roche Holdings AG, Affymetrix, Abbott Laboratories, Becton Dickinson and Company, DiaSorin, Hologic Inc., Danaher Corporation, bioMerieux SA, and Orasure Technologies, among others.

The report explores crucial aspects of the sexually transmitted diseases (STD) diagnostics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-diagnostics-market-size.png)