Spinal implants and surgical devices Market Size Report, Industry Share, Analysis, Growth, 2034

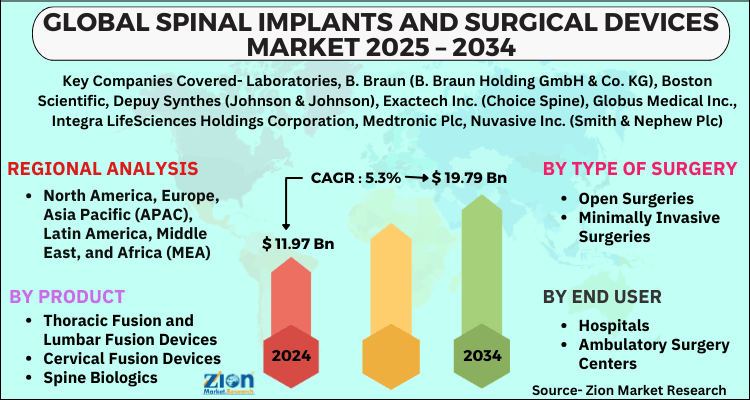

Spinal implants and surgical devices Market By Product (Thoracic Fusion and Lumbar Fusion Devices, Cervical Fusion Devices, Spine Biologics, Vertebral Compression Fracture Treatment Devices, Spinal Decompression Devices, Non-Fusion Devices, Spine Bone Stimulators), By Type of Surgery (Open Surgeries, Minimally Invasive Surgeries), By End user (Hospitals, Ambulatory Surgery Centers, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

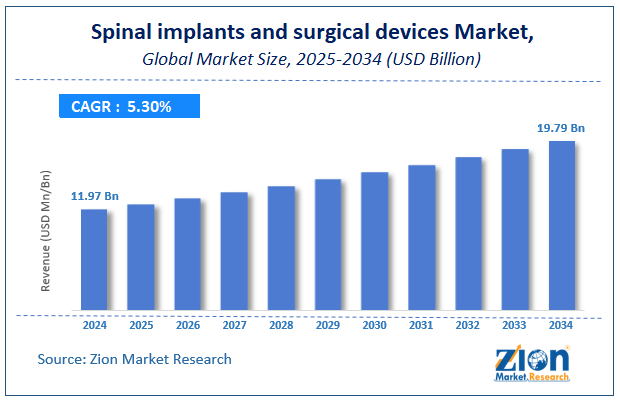

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.97 Billion | USD 19.79 Billion | 5.3% | 2024 |

Spinal implants and surgical devices Market Size And Forecast

The global spinal implants and surgical devices market size was worth around USD 11.97 Billion in 2024 and is estimated to grow to about USD 19.79 Billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.3% between 2025 and 2034. The report analyzes the spinal implants and surgical devices market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the spinal implants and surgical devices market.

Spinal implants and surgical devices Market: Overview

Spinal implants and surgical devices are used in the treatment of spine injuries and spine disorders and are crucial to their treatment procedures. There has been an increase in instances of spine disorders over the past few years and this has majorly driven the demand for spinal implants and surgical devices and is expected to be the same for the forecast period.

Lifestyle disorders and an increasingly sedentary lifestyle have been deemed as the major cause for increasing instances of spinal diseases and this is expected to majorly drive the spinal implants and surgical devices market potential over the forecast period. The increasing geriatric population will also boost the spinal implants and surgical devices market potential.

However, the high costs of these spinal implants and surgical devices and the unsurety of the credibility of treatment via these are expected to have a hindering effect on the global spinal implants and surgical devices market through 2034.

Key Insights

- As per the analysis shared by our research analyst, the global spinal implants and surgical devices market is estimated to grow annually at a CAGR of around 5.3% over the forecast period (2025-2034).

- Regarding revenue, the global spinal implants and surgical devices market size was valued at around USD 11.97 Billion in 2024 and is projected to reach USD 19.79 Billion by 2034.

- The spinal implants and surgical devices market is projected to grow at a significant rate due to increasing demand for minimally invasive surgeries, rising prevalence of spinal disorders, advancements in implant technologies, and growing aging population.

- Based on Product, the Thoracic Fusion and Lumbar Fusion Devices segment is expected to lead the global market.

- On the basis of Type of Surgery, the Open Surgeries segment is growing at a high rate and will continue to dominate the global market.

- Based on the End user, the Hospitals segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Spinal implants and surgical devices Market: Growth Drivers

Increasing Instances of Spinal Disorders

Spinal diseases and spinal disorders have seen a substantial rise in recent times and this has propelled the demand for spinal implants and surgical devices. The spinal implants and surgical devices market is expected to be benefitted from the growing geriatric population as well which is more prone to spinal injuries due to weak bones. The increasing availability of treatment procedures and favorable reimbursement policies are expected to boost the spinal implants and surgical devices market potential over the forecast period.

Spinal implants and surgical devices Market: Restraints

High Costs to Restrain growth

Spinal implants and surgical devices are usually priced at a higher price point and this is expected to hinder the spinal implants and surgical devices adoption over the forecast period. Moreover, uncertainty in treatment success is also expected to have a negative impact on the spinal implants and surgical devices market potential. Spinal implants and surgical devices companies are focusing on solving this issue to boost revenue generation potential through 2034.

Spinal implants and surgical devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Spinal implants and surgical devices Market |

| Market Size in 2024 | USD 11.97 Billion |

| Market Forecast in 2034 | USD 19.79 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 155 |

| Key Companies Covered | Laboratories, B. Braun (B. Braun Holding GmbH & Co. KG), Boston Scientific, Depuy Synthes (Johnson & Johnson), Exactech Inc. (Choice Spine), Globus Medical Inc., Integra LifeSciences Holdings Corporation, Medtronic Plc, Nuvasive Inc. (Smith & Nephew Plc),, and others. |

| Segments Covered | By Product, By Type of Surgery, By End user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Spinal Implants and surgical devices Market: Segmentation

The global spinal implants and surgical devices market is segregated based on product, type of surgery, end user, and region.

By product, the spinal implants and surgical devices market includes spinal fusion devices, spine biologics, vertebral compression fracture (VCF) treatment devices, spinal bone stimulators, non-fusion devices, and spinal decompression devices. Spinal fusion devices are further sub-segmented into thoracolumbar fixation devices, interbody fusion devices, and cervical fixation devices. Lumbar plates, pedicle screws, rods, hooks, and others comprise the thoracolumbar fixation devices segment. Interbody fusion devices sub-segment includes bone and non-bone fusion devices.

Hook fixation systems, anterior cervical plates, screws, and others comprise the cervical fixation devices sub-segment. The non-fusion devices segment includes dynamic stabilization devices, artificial discs, nuclear disc prostheses, and annulus repair devices. The VCF treatment devices are further sub-segmented into vertebroplasty devices and balloon kyphoplasty devices. The spinal bones stimulators sub-segment includes invasive and non-invasive spine bone stimulators. Spine biologics segment is further sub-segmented into bone graft substitutes, bone graft, and bone marrow aspirate therapy. Spinal fusion devices segment is expected to dominate the product segment.

By type of surgery, the market is bifurcated into minimally invasive spine surgery and open spine surgery. Minimally invasive spine surgery is dominating the market due to increasing awareness and demand for minimally invasive surgeries by the patients.

By end-user, this market includes hospitals, orthopedic centers, and ambulatory surgical centers. The hospital segment is likely to dominate the market, due to the presence of a large patient pool in the hospitals and the use of technologically advanced products.

Recent Developments

- In 2020 – Medtronic a leading name in healthcare industry announced the acquisition of Stimgenics a United States based medical company that is responsible for pioneering novel spinal cord stimulation (SCS).

Regional Landscape

Asia Pacific region leads the global spinal implants and surgical devices market and is expected to rise at the fastest CAGR of all regions. Increasing cases of spinal injuries and spinal disorders, rising development of healthcare infrastructure, and increasing investments in research and development of spinal implants and surgical devices are major factors that will boost the spinal implants and surgical devices market potential through 2028. Increasing awareness for spine treatments and the rising availability of spine treatments will also influence spinal implants and surgical devices market growth. India and China are expected to be the most lucrative market for spinal implants and surgical devices manufacturers over the forecast period owing to rising investments in the development of healthcare infrastructure of these countries.

The market for spinal implants and surgical devices in North America is also expected to show beneficial opportunities owing to the presence of developed healthcare infrastructure and favorable reimbursement policies by healthcare providers and government. The United States is projected to be the most lucrative market in this region.

Competitive Landscape

Some of the main competitors dominating the global spinal implants and surgical devices market include -

- Laboratories

- B. Braun (B. Braun Holding GmbH & Co. KG)

- Boston Scientific

- Depuy Synthes (Johnson & Johnson)

- Exactech Inc. (Choice Spine)

- Globus Medical Inc.

- Integra LifeSciences Holdings Corporation

- Medtronic Plc

- Nuvasive Inc. (Smith & Nephew Plc)

- Orthofix Medical Inc.

- RTI Surgical Inc.

- Stryker Corporation and

- Zimmer Biomet Holdings Inc.

Global spinal implants and surgical devices market is segmented as follows:

By Product

- Thoracic Fusion and Lumbar Fusion Devices

- Cervical Fusion Devices

- Spine Biologics

- Vertebral Compression Fracture Treatment Devices

- Spinal Decompression Devices

- Non-Fusion Devices

- Spine Bone Stimulators

By Type of Surgery

- Open Surgeries

- Minimally Invasive Surgeries

By End user

- Hospitals

- Ambulatory Surgery Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global spinal implants and surgical devices market is expected to grow due to rising prevalence of spinal disorders, advancements in minimally invasive surgical technologies, growing aging population, and increasing demand for innovative fusion and non-fusion implants.

According to a study, the global spinal implants and surgical devices market size was worth around USD 11.97 Billion in 2024 and is expected to reach USD 19.79 Billion by 2034.

The global spinal implants and surgical devices market is expected to grow at a CAGR of 5.3% during the forecast period.

North America is expected to dominate the spinal implants and surgical devices market over the forecast period.

Leading players in the global spinal implants and surgical devices market include Laboratories, B. Braun (B. Braun Holding GmbH & Co. KG), Boston Scientific, Depuy Synthes (Johnson & Johnson), Exactech Inc. (Choice Spine), Globus Medical Inc., Integra LifeSciences Holdings Corporation, Medtronic Plc, Nuvasive Inc. (Smith & Nephew Plc),, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed