Solar Farm Market Size, Share, Trends, Growth & Forecast 2034

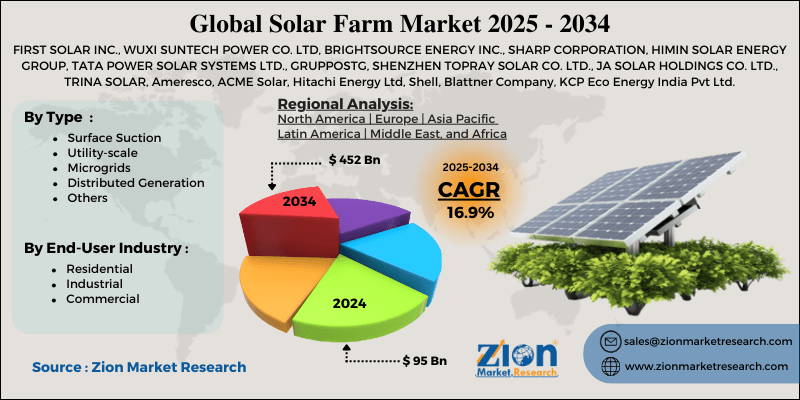

Solar Farm Market By Type (Surface Suction, Utility-scale, Microgrids, Distributed Generation, and Others), By End-User Industry (Residential, Industrial, and Commercial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

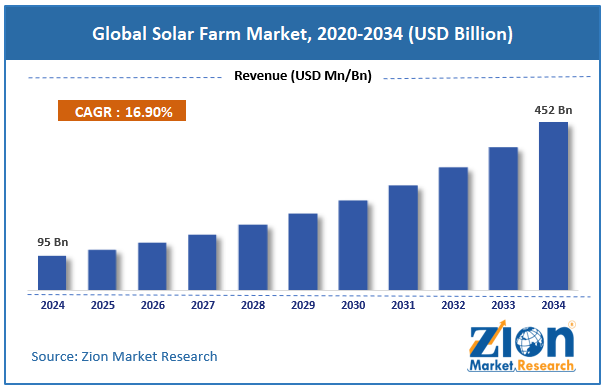

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 95 Billion | USD 452 Billion | 16.9% | 2024 |

Solar Farm Industry Perspective:

The global solar farm market size was worth around USD 95 billion in 2024 and is predicted to grow to around USD 452 billion by 2034, with a compound annual growth rate (CAGR) of roughly 16.9% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global solar farm market is estimated to grow annually at a CAGR of around 16.9% over the forecast period (2025-2034).

- In terms of revenue, the global solar farm market size was valued at around USD 95 billion in 2024 and is projected to reach USD 452 billion by 2034.

- Increasing demand for energy is expected to drive the solar farm market over the forecast period.

- Based on the type, the utility-scale segment is expected to capture the largest market share over the projected period.

- Based on the end-user industry, the commercial segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Solar Farm Market: Overview

A solar farm is a large group of solar panels installed on the ground that uses photovoltaic (PV) cells to convert sunlight into electricity. These PV cells change sunlight into direct current (DC) electricity. Then, inverters change the DC electricity into alternating current (AC) electricity, which is sent to the power grid or consumed locally. Solar farms usually cover a lot of land and have thousands of panels on them. This makes the most of the sun's rays for making energy. Solar farms use semiconductor-based solar cells to collect solar energy. These cells make electricity while they are in the sun. To make arrays that get the most power, the panels are connected in series or parallel. The electricity generated can either go straight into the utility grid or be stored in battery systems for later use. Solar farms today can employ new technologies like solar plus storage, microinverters on each panel, and continuous performance monitoring to improve maintenance and efficiency.

Solar Farm Market Dynamics

Growth Drivers

How does the rapid decline in solar PV costs drive the solar farm industry growth?

The ongoing decline in the cost of solar photovoltaic (PV) systems is helping the industry grow by making solar energy more affordable and available. The initial cost of installing solar systems is declining as PV module costs fall. This is because of new technology, economies of scale, and higher production efficiency. This lower cost means shorter payback times and higher returns on investment (ROI) for both residential and commercial solar projects. This makes more people and businesses want to adopt solar energy. Lower solar PV costs stimulate demand in many markets, especially in emerging countries, by enabling the construction of more solar farms and rooftop solar systems. Also, government programs, subsidies, and business-friendly incentives make price cuts even more effective, speeding up market entry. More affordable solar energy options help strengthen the renewable energy sector, reduce reliance on fossil fuels, and encourage sustainability, thereby driving long-term growth in solar power.

Restraints

High initial capital investment is hampering the market growth

The solar farm sector can't grow because it's expensive to get started, making it hard for new businesses to enter. Solar panels, inverters, mounting structures, wiring, site acquisition or leasing, installation personnel, and grid connection infrastructure are all costs that come with starting a solar farm. Building a 1-megawatt solar power plant in India can cost between ₹ 4 and ₹7 crore. Bigger projects can cost tens of crores. In the same way, the cost of a solar farm in the UK and the US can range from hundreds of thousands to millions of dollars, depending on its size and capacity. This makes it hard for smaller investors or developers with limited funds to secure funding. These high initial costs slow adoption, as project developers need to raise substantial capital before they can see any returns. This means that only companies with a lot of money or access to investor finance or loans can participate in the market. Also, the difficulties of obtaining permits, land, and government approvals add to the risks of delays and higher costs at the outset.

Opportunities

Does the growing partnership offer a potential opportunity for the solar farm industry growth?

The rising partnership is expected to offer a potential opportunity to the solar farm market. For instance, in August 2025, JA Solar and Advance Prime Power Corporation (AP Power), one of the Philippines' leading renewable energy companies, signed a strategic partnership agreement. The signing event at JA Solar's headquarters in Beijing is a big step toward working together to get more people in Southeast Asia to use solar energy.

The new memorandum of understanding creates a two-year cooperation to build solar PV projects and promote the usage of renewable energy in the Philippines and nearby territories. This comes after a successful supply deal from earlier this year. The agreement shows that both sides are committed to leading the region's move to cleaner energy.

Challenges

How do the transmission capacity limitations pose a major challenge to solar farm market expansion?

Transmission capacity constraints pose a significant challenge for the solar farm business, creating bottlenecks that make it more complicated to deliver renewable energy to end users efficiently. For instance, as of mid-2025, over 50 GW of renewable energy capacity in India is stuck because transmission infrastructure isn't sufficient. This causes project delays and higher transmission prices. Because the transmission network is growing more slowly than the amount of renewable energy being produced, renewable energy curtailment happens. This means that the available solar power can't be fully used or sent to where it is needed most. There are several reasons for this difficulty, including slow progress on new transmission lines, delays in regulatory approvals, problems acquiring land, environmental restrictions, and some groups hoarding capacity.

Solar Farm Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Solar Farm Market |

| Market Size in 2024 | USD 95 Billion |

| Market Forecast in 2034 | USD 452 Billion |

| Growth Rate | CAGR of 16.9% |

| Number of Pages | 213 |

| Key Companies Covered | FIRST SOLAR INC., WUXI SUNTECH POWER CO. LTD, BRIGHTSOURCE ENERGY INC., SHARP CORPORATION, HIMIN SOLAR ENERGY GROUP, TATA POWER SOLAR SYSTEMS LTD., GRUPPOSTG, SHENZHEN TOPRAY SOLAR CO. LTD., JA SOLAR HOLDINGS CO. LTD., TRINA SOLAR, Ameresco, ACME Solar, Hitachi Energy Ltd, Shell, Blattner Company, KCP Eco Energy India Pvt Ltd, VIKRAM SOLAR LTD., Adani Group, and others. |

| Segments Covered | By Type, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Solar Farm Market: Segmentation

The global solar farm industry is segmented based on type, end-user industry, and region.

Based on the type, the global solar farm market is bifurcated into surface suction, utility-scale, microgrids, distributed generation, and others. The utility-scale segment is expected to dominate the market. This growth is driven primarily by declining solar technology costs, supportive government policies, and rising demand for clean, affordable electricity.

Based on the end-user industry, the global solar farm industry is bifurcated into residential, industrial, and commercial. The commercial segment holds the major market share. The global economic expansion and urbanization have contributed to a shortage of electricity. The use of solar energy in commercial buildings, such as offices, retail malls, and airports, reduces strain on traditional fossil-fuel power plants and lowers these structures' carbon footprint. Because of the increased use of solar photovoltaics, solar farms are being used more successfully to generate power.

Solar Farm Market: Regional Analysis

Will North America dominate the solar farm market over the projected period?

North America dominates the solar farm sector. The industry is growing because solar PV systems are getting cheaper, laws are being passed to boost the use of renewable energy, companies are working to be more environmentally friendly, and technology is making solar panels more efficient and easier to connect to the grid. The US is the leader in private investment in photovoltaics. Companies such as First Solar, Hanwha Q CELLS, and Canadian Solar operate in this field. The Topaz Solar Farm in California and the Roadrunner Solar Project in Texas are two significant projects that help increase capacity. Besides, Asia Pacific is expected to grow at the fastest CAGR over the projected period, driven by increasing government initiatives and the presence of major players.

Solar Farm Market: Competitive Analysis

The global solar farm market is dominated by players like:

- FIRST SOLAR INC.

- WUXI SUNTECH POWER CO. LTD

- BRIGHTSOURCE ENERGY INC.

- SHARP CORPORATION

- HIMIN SOLAR ENERGY GROUP

- TATA POWER SOLAR SYSTEMS LTD.

- GRUPPOSTG

- SHENZHEN TOPRAY SOLAR CO. LTD.

- JA SOLAR HOLDINGS CO. LTD.

- TRINA SOLAR

- Ameresco

- ACME Solar

- Hitachi Energy Ltd

- Shell

- Blattner Company

- KCP Eco Energy India Pvt Ltd

- VIKRAM SOLAR LTD.

- Adani Group

The global solar farm market is segmented as follows:

By Type

- Surface Suction

- Utility-scale

- Microgrids

- Distributed Generation

- Others

By End-User Industry

- Residential

- Industrial

- Commercial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed