Sodium Silicate Market Size, Share, Analysis, Trends, Growth, 2032

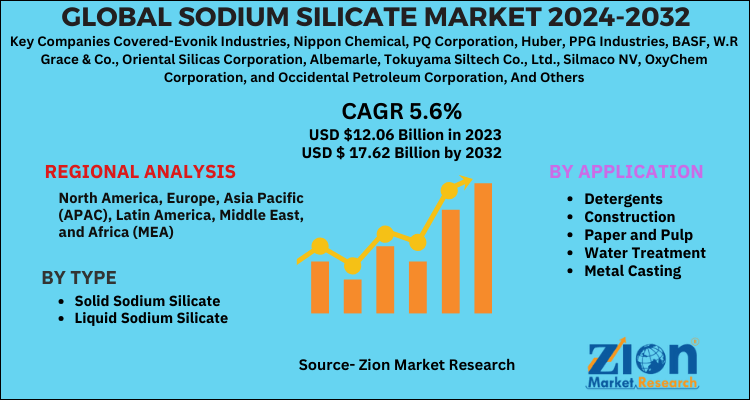

Sodium Silicate Market By Type (Solid Sodium Silicate And Liquid Sodium Silicate) And By Application (Detergents, Construction, Paper & Pulp, Water Treatment, Metal Casting, And Others), By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

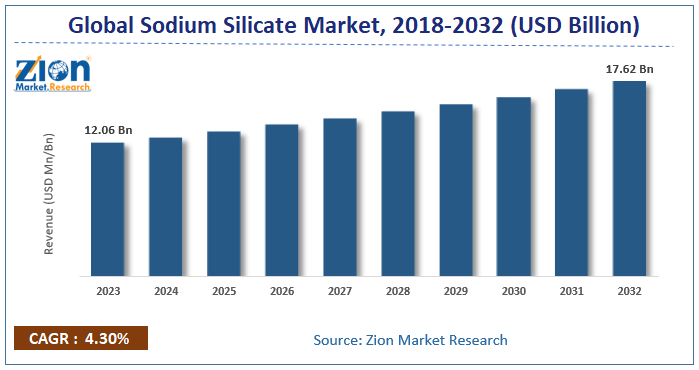

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.06 Billion | USD 17.62 Billion | 4.30% | 2023 |

Sodium Silicate Industry Perspective:

The global sodium silicate market size was worth around USD 12.06 Billion in 2023 and is predicted to grow to around USD 17.62 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.30% between 2024 and 2032.

The report analyzes the global sodium silicate market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the sodium silicate industry.

The report covers a forecast and an analysis of the sodium silicate market on a global and regional level. The study provides historical data for 2018 and 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion) and volume (Kilotons). The study includes drivers and restraints for the sodium silicate market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the sodium silicate market on a global level.

In order to give the users of this report a comprehensive view of the sodium silicate market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Sodium Silicate Market: Overview

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launches, agreements, partnerships, collaborations & joint ventures, research & development, technology, and regional expansion of the major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis and product portfolios of various companies according to regions.

Scientists from Europe made the discovery of sodium silicate in the early 1500s. Sodium silicate is a chemical molecule that is essentially an alkali metal. Sodium and silicon make up the majority of its constituents. It is possible to dissolve sodium silicate in water. These substances are either in the form of translucent granules or clear liquids. In most cases, it is made up of oxygen-silicon polymer water in the form of a molecular matrix constituent. Sodium silicate chemical compounds can be produced in the form of thick liquids or solids, and they are utilized in a wide variety of applications. Some of these uses include passive fire protection, the formulation of cement, the production of refractory ceramics, textiles, and timber processing as adhesives. Additionally, they are utilized in the production of silica gel.

Sodium Silicate Market: Growth Drivers

The increasing demand for sodium silicate as an adhesive in the paper and pulp sector is projected to be the primary factor driving the market for sodium silicate in the years to come. As a sealer for concrete mixtures, sodium silicate is also utilized in the building industry besides its other applications. In order to strengthen the binding strength of cement, it is combined with cement paste and concrete. This is accomplished by reducing the porosity of the combination. Therefore, the continued development of smart buildings and infrastructure in the construction industry is projected to have a beneficial impact on the growth of the sodium silicate market in the future. As the chemical compound that aids in regulating the pH level when it is introduced to water and works as a bleaching agent, sodium silicate is frequently used in detergents and other cleaning solutions. This is because sodium silicate is considered to be a bleaching agent. According to the forecast, these factors are anticipated to make a substantial contribution to the growth of the sodium silicate market during the course of the forecast year. However, the expansion of this market may be hindered in the years to come due to the toxicity and adverse consequences of sodium silicate.

Sodium Silicate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sodium Silicate Market Research Report |

| Market Size in 2023 | USD 12.06 Billion |

| Market Forecast in 2032 | USD 17.62 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Evonik Industries, Nippon Chemical, PQ Corporation, Huber, PPG Industries, BASF, W.R Grace & Co., Oriental Silicas Corporation, Albemarle, Tokuyama Siltech Co., Ltd., Silmaco NV, OxyChem Corporation, and Occidental Petroleum Corporation, And Others |

| Segments Covered | By Type, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sodium Silicate Market: Segmentaion

The study provides a decisive view of the sodium silicate market by segmenting the market based on type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032. The regional segmentation includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East, and Africa.

Sodium Silicate Market: Regional Anaysis

The Asia Pacific region had the fastest rate of growth in the worldwide sodium silicate market in 2023, according to the region's geographical breakdown. Considering the growing number of development projects that are taking place all across the region, it is anticipated that the region will maintain its position as the dominant region in the years to come. Increases in disposable income, an increase in the demand for smart buildings, and an increase in the number of advancements in infrastructure are some of the other variables that are anticipated to further drive this regional market throughout the specified time period. In the years to come, it is anticipated that the European area will present substantial growth prospects in the sodium silicate market. This is due to the fact that the paper and pulp sector is experiencing an increasing demand for sodium silicate as an adhesive, which is likely to boost this regional market.

Sodium Silicate Market: Competitive Analysis

The report also includes detailed profiles of various end players, such as

- Evonik Industries

- Nippon Chemical

- PQ Corporation

- Huber

- PPG Industries

- BASF

- W.R Grace & Co.

- Oriental Silicas Corporation

- Albemarle

- Tokuyama Siltech Co., Ltd.

- Silmaco NV

- OxyChem Corporation

- Occidental Petroleum Corporation.

This report segments the global sodium silicate market into:

Global Sodium Silicate Market: Type Analysis

- Solid Sodium Silicate

- Liquid Sodium Silicate

Global Sodium Silicate Market: Application Analysis

- Detergents

- Construction

- Paper and Pulp

- Water Treatment

- Metal Casting

- Others

Global Sodium Silicate Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sodium silicate is a chemical compound, which is mainly composed of sodium and silicon. Sodium silicate is soluble in water. They are either clear liquid form or transparent powders. It is generally composed of oxygen-silicon polymer water in molecular matrix form.

The sodium silicate market is likely to be driven by the growing demand for sodium silicate as an adhesive in the paper and pulp industry in the upcoming years. Moreover, the growing demand for sodium silicates for manufacturing detergents as a bleaching agent is likely to further propel the sodium silicate market in the future.

According to the report, the global sodium silicate market size was worth around USD 12.06 billion in 2023 and is predicted to grow to around USD 17.62 billion by 2032.

The global sodium silicate market is expected to grow at a CAGR of 4.30% during the forecast period.

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa comprise the regional segment of the global sodium silicate market. Asia Pacific region registered the highest rate of growth in the global sodium silicate market in 2023.

Some industry players operating in the sodium silicate market include Evonik Industries, Nippon Chemical, PQ Corporation, Huber, PPG Industries, BASF, W.R Grace & Co., Oriental Silicas Corporation, Albemarle, Tokuyama Siltech Co., Ltd., Silmaco NV, OxyChem Corporation, and Occidental Petroleum Corporation, And Others

The global sodium silicate market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed