Sleep Apnea Devices Market Size, Share, Growth, Trends, and Forecast 2032

Sleep Apnea Devices Market by Product (Therapeutic Devices (Positive Airway Pressure (PAP) Devices [Automatic Positive Airway Pressure Devices, Continuous Positive Airway Pressure Devices and Bi-level Positive Airway Pressure Devices], Facial Interfaces [Masks and Cushions], Adaptive Servo-Ventilation (ASV) Devices, Oral Appliances [Mandibular Advancement Devices and Tongue-Retaining Devices] and Other Therapeutic Devices), and Diagnostic Devices (Polysomnography (PSG) Devices [Clinical PSG Devices and Ambulatory PSG Devices], Home Sleep Testing Devices, Oximeters [Fingertip Oximeters, Handheld Oximeters, Wrist-Worn Oximeters, and Tabletop Oximeters], Actigraphy Systems, Sleep Screening Devices, and Others) and by End-User (Hospitals, Home Healthcare, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

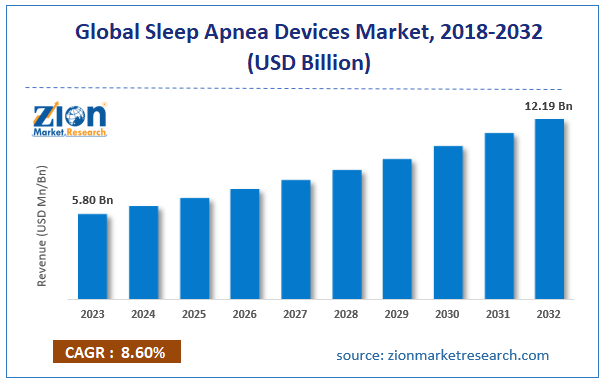

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.80 Billion | USD 12.19 Billion | 8.60% | 2023 |

Sleep Apnea Devices Industry Perspective:

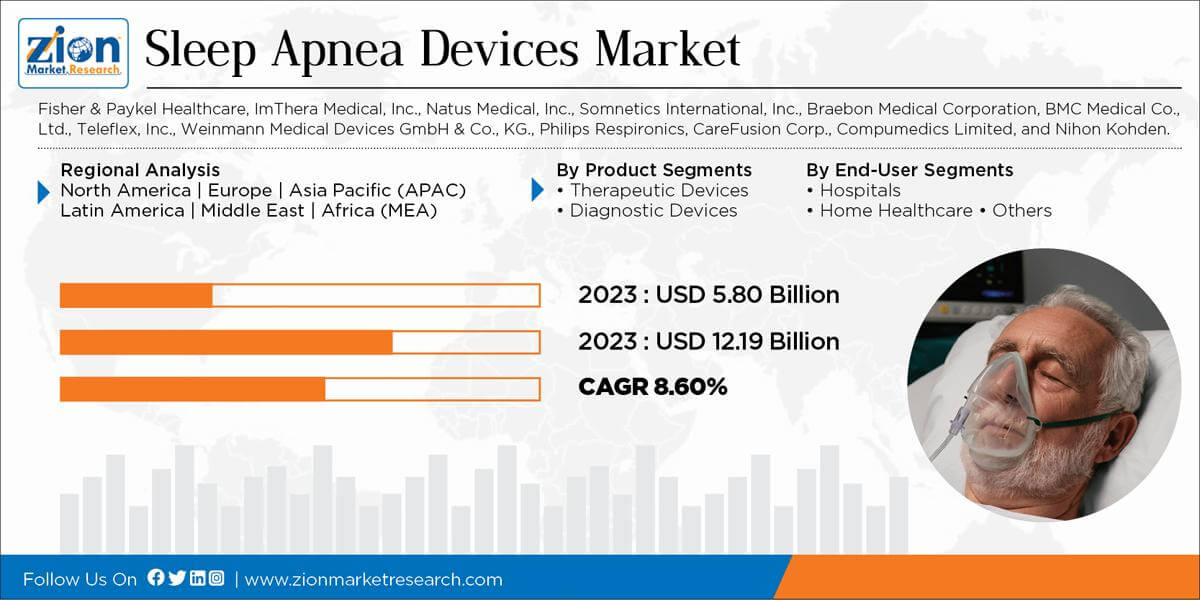

The global Sleep Apnea Devices market size accrued earnings worth approximately USD 5.80 Billion in 2023 and is predicted to gain revenue of about USD 12.19 Billion by 2032, is set to record a CAGR of nearly 8.60% over the period from 2024 to 2032.

Key Insights

- As per the analysis shared by our research analyst, the sleep apnea devices market is anticipated to grow at a CAGR of 8.60% during the forecast period.

- The global sleep apnea devices market was estimated to be worth approximately USD 5.80 billion in 2023 and is projected to reach a value of USD 12.19 billion by 2032.

- The growth of the sleep apnea devices market is being driven by increasing prevalence of obstructive sleep apnea (OSA) and rising awareness of sleep-related health disorders.

- Based on the product, the therapeutic devices segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user, the hospitals segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Sleep apnea is a chronic respiratory sleeping disorder, which is mainly characterized by episodes of pauses and breaks during sleep. These disruptive events occur multiple times during the night. People with loud snoring habits are more susceptible to sleep apnea. Apnea basically is the squeezing of air that passes through the blockage during breathing and results in loud snoring. Many people remain undiagnosed with this disorder since it occurs in the night and is also difficult to be detected during routine hospital visits. These blockages are mainly encountered in obese people. People suffering from diabetes are more likely to be affected by sleep apnea. Major types of sleep apnea are central sleep apnea, mixed sleep apnea, and obstructive sleep apnea. The mixed sleep apnea is a combination of central and obstructive sleep apnea. Among these, obstructive sleep apnea is most commonly found among the populace.

Request Free Sample

Request Free Sample

Sleep Apnea Devices Market Growth Analysis

Today, around 100 million people globally suffer from obstructive sleep apnea, but the majority of this population remains undiagnosed. Obstructive sleep apnea prevails in approximately 4 to 8% of adult men and 3 to 6% of adult females. Lucrative growth prospects regarding sleep apnea devices market are offered by novelty and innovation in the design and features of therapeutic devices provided by most of the market players. Technological advancements have led toward the development of various conventional therapies for the treatment of sleep apnea. Several companies are engaged in the development of advanced devices, which increases the popularity of this market. Ample opportunities and increasing awareness among the population coupled with a favorable reimbursement scenario are likely to improve the adoption rate of sleep apnea devices in the near future.

Sleep Apnea Devices Market Share Analysis

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

Recent Development

- In May 2025, ResMed acquired VirtuOx to significantly expand its virtual care and diagnostic capabilities, particularly in the areas of sleep and respiratory conditions. This strategic acquisition is designed to accelerate the patient pathway from at-home testing to connected care by streamlining the diagnostic process and improving patient access and adherence to treatment.

- In October 2023, Eargo, Inc. announced a definitive agreement to be taken private by an affiliate of its majority owner, Patient Square Capital. This acquisition, which closed in February 2024, was viewed by the company as a positive move that allows Eargo to focus on longer-term product innovation.

- In September 2021, ZOLL Medical announced a definitive agreement to acquire Itamar Medical for approximately $538 million. The acquisition incorporated Itamar Medical's leading sleep-diagnostics technologies, primarily the WatchPAT home sleep apnea device and its SleePATh digital health platform, into ZOLL's global medical device platform.

Sleep Apnea Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sleep Apnea Devices Market |

| Market Size in 2023 | USD 5.80 Billion |

| Market Forecast in 2032 | USD 12.19 Billion |

| Growth Rate | CAGR of 8.60% |

| Number of Pages | 201 |

| Key Companies Covered | Fisher & Paykel Healthcare, ImThera Medical, Inc., Natus Medical, Inc., Somnetics International, Inc., Braebon Medical Corporation, BMC Medical Co., Ltd., Teleflex, Inc., Weinmann Medical Devices GmbH & Co., KG., Philips Respironics, CareFusion Corp., Compumedics Limited, and Nihon Kohden. |

| Segments Covered | By Product Type, By Manufacturing Process, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sleep Apnea Devices Market Segmentation Analysis

The study provides a decisive view of the sleep apnea devices market by segmenting the market based on product, end-user, and regions.

By product type, the sleep apnea devices market is segmented into therapeutic devices and diagnostic devices segments. The therapeutic devices segment is sub-segmented into positive airway pressure (PAP) devices, adaptive servo-ventilation (ASV) devices, oral appliances, facial interfaces, and other therapeutic devices. The oral appliances are bifurcated divided into mandibular advancement devices and tongue-retaining devices. The facial interfaces sub-segment is further divided into masks and cushions. The PAP devices sub-segment is further segmented into automatic positive airway pressure devices, continuous positive airway pressure devices, and bi-level positive airway pressure devices. The diagnostic devices segment is further segmented into home sleep testing devices, oximeters, actigraphy systems, sleep screening devices, polysomnography (PSG) devices, and others. The PSG segment is further sub-segmented into clinical PSG devices and ambulatory PSG devices. The oximeters segment is further classified into handheld oximeters, fingertip oximeters, tabletop oximeters, and wrist-worn oximeters.

Based on end-user, the market is segmented into hospitals, home healthcare, and others.

Sleep Apnea Devices Regional Segment Analysis

North America and Europe are anticipated to dominate the sleep apnea devices market and hold a share accounting for almost more than 60% of the sleep apnea devices market. This will be mainly due to the presence of technically sleep specialists and technologically proven sleep laboratories, along with raising awareness of sleep apnea devices in these two regions. In addition, the increasingly obese population and favorable reimbursement scenario are further boosting the growth of the sleep apnea devices market in these regions. The Asia Pacific and Latin America are anticipated to record restricted growth in comparison to other regions, owing to the lack of product awareness and under-developed healthcare infrastructure. The low adoption rate of technological advances in these regions is anticipated to further slow down the growth of the sleep apnea devices market in these regions.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America and the Middle East and Africa, with its further bifurcation into major countries.

Some leading players of the sleep apnea devices market include

- Fisher & Paykel Healthcare

- ImThera Medical, Inc.

- Natus Medical, Inc.

- Somnetics International, Inc.

- Braebon Medical Corporation

- BMC Medical Co., Ltd.

- Teleflex, Inc.

- Weinmann Medical Devices GmbH & Co., KG.

- Philips Respironics

- CareFusion Corp.

- Compumedics Limited

- and Nihon Kohden.

This report segments the global sleep apnea devices market as follows:

By Product Segments

- Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- Automatic Positive Airway Pressure Devices

- Continuous Positive Airway Pressure Devices

- Bi-level Positive Airway Pressure Devices

- Facial Interfaces

- Masks

- Cushions

- Adaptive Servo-Ventilation (ASV) Devices

- Oral Appliances

- Mandibular Advancement Devices

- Tongue-Retaining Devices

- Other Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- Diagnostic Devices

- Polysomnography (PSG) Devices

- Clinical PSG Devices

- Ambulatory PSG Devices

- Home Sleep Testing Devices

- Oximeters

- Fingertip Oximeters

- Handheld Oximeters

- Wrist-Worn Oximeters

- Tabletop Oximeters

- Actigraphy Systems

- Sleep Screening Devices

- Others

- Polysomnography (PSG) Devices

By End-User Segments

- Hospitals

- Home Healthcare

- Others

By Regional Segments

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed