Silver Sintering Paste Market Size, Share, Trends, Growth and Forecast 2034

Silver Sintering Paste Market By Type (Pressureless Sintering Paste and Pressure Sintering Paste), By Applications (RF Power Device, Power Semiconductor Device, High Performance LED, Solar Panel Metallization, SiC & GaN Device Bonding, Medical Device Electronics, Sensor Packaging, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

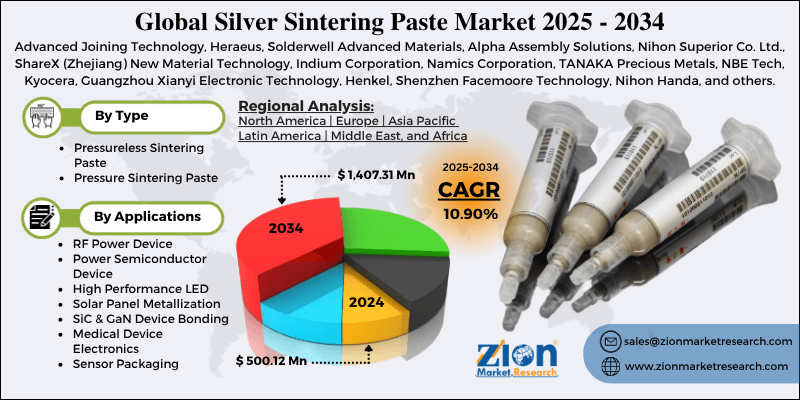

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 500.12 Million | USD 1,407.31 Million | 10.90% | 2024 |

Silver Sintering Paste Industry Perspective:

The global silver sintering paste market size was worth around USD 500.12 million in 2024 and is predicted to grow to around USD 1,407.31 million by 2034, with a compound annual growth rate (CAGR) of roughly 10.90% between 2025 and 2034.

Silver Sintering Paste Market: Overview

Silver sintering paste is a commonly used conductive material essential for the smooth functioning of the electronic manufacturing industry. The material is applied to create strong bonds between electronic components, thus creating electrical connections across industries and end applications. According to market research, silver sintering paste consists of silver particles, a solvent, an organic binder, and certain additives. The final composition offers unique properties, making it highly popular in electronic production procedures. One of the common applications of silver sintering paste is in the form of die attachment in integrated circuits (ICs), microprocessors, and other independent devices.

Furthermore, the conductive material is also used in the fabrication of printed circuit boards (PCBs) and other flexible electronics. During the forecast period, the industry for silver sintering paste is expected to be driven by the growing applications in 5G infrastructure.

Moreover, advancements in high-frequency equipment for major industries may further facilitate new growth opportunities in the coming years. A major growth-limiting factor for the market is the risk of supply chain disruptions that can impede the industry’s growth trajectory. Moreover, the rising cost of raw materials may further impact the overall market revenue generated by the players.

Key Insights:

- As per the analysis shared by our research analyst, the global silver sintering paste market is estimated to grow annually at a CAGR of around 10.90% over the forecast period (2025-2034)

- In terms of revenue, the global silver sintering paste market size was valued at around USD 500.12 million in 2024 and is projected to reach USD 1,407.31 million by 2034.

- The silver sintering paste market is projected to grow at a significant rate due to the rising investment in 5G infrastructure.

- Based on the type, the pressure sintering paste segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the applications, the power semiconductor device segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Silver Sintering Paste Market: Growth Drivers

How will rising investment in 5G infrastructure promote growth of the silver sintering paste market?

The global silver sintering paste market is expected to be driven by the increasing investments in 5G infrastructure worldwide. The material has exceptional electrical and thermal conductivity, making it a highly sought-after element in high-frequency-related applications. In 5G infrastructure, silver sintering paste is used for connecting power amplifier components. It also assists in managing the thermal components of 5G bases. The ongoing advancements in 5G architecture worldwide will create more applications of silver sintering paste.

According to recent reports, major satcom companies such as Eutelsat, OneWeb, and SpaceX are expected to enter the Indian telecom industry through strategic partnerships. The companies are expected to expand 5G solutions to remote locations in the developing country.

In May 2025, researchers in China conducted the world’s first direct 5G satellite-to-smartphone broadband video call. Theoretically, the technology can facilitate streaming video content to mobile phones through satellites. An increasing rate of such advancements in 5G technologies will be critical to the overall use of silver sintering paste in the coming years.

Automotive industry to continue propelling market demand, according to research

Demand for silver sintering paste is further expected to benefit from the rising applications in the automotive industry. The emergence of electric vehicles (EVs) has propelled the growth trajectory of the automotive industry in a new direction. In addition to this, advancements in battery technology, with a primary focus on improving the driving range and overall safety features of the vehicles, will further aid a higher demand for electric vehicles in the future.

Industry analysis suggests that the material is critical for the efficient functioning of power conversion systems and onboard charging components in automotive. Increasing government support for the growing EV sector will emerge as a critical catalyst for the ongoing growth in the global silver sintering paste market.

Silver Sintering Paste Market: Restraints

Will disruptions in supply chain and price volatility limit expansion of the silver sintering paste market?

The global silver sintering paste industry is expected to be restricted due to several risks linked to supply chain disruptions. The changing global trading partnerships and increasing geopolitical tensions may affect the availability of raw materials and final goods in the market.

In addition to this, supply chain disruptions can also lead to price volatility, further impacting the smooth expansion of silver sintering paste across global economies. For instance, the silver price was reported to have increased by over 34% in 2024.

Silver Sintering Paste Market: Opportunities

Launch of new materials in the market to generate growth opportunities during the projection duration

The global silver sintering paste market is expected to generate growth opportunities due to the rising launch of new materials in the market. For instance, in June 2024, Heraeus Electronics launched its latest offering in the market in the form of mAgic® PE360 Silver Sinter Paste. The new product introduced a new landmark in Large Area Sintering (LAS) pastes. It offers improved thermal performance as compared to conventional soldering techniques. The product is engineered to provide exceptionally reliable joints with superior thermal conductivity. Moreover, it also promises compliance since mAgic® PE360 is halogen and lead-free.

In July 2023, Toyo Ink SC Holdings, a Japanese provider of specialty chemicals, launched a new silver (Ag) nanoparticle paste with application in die-attach procedures. The lead-free material can be used even at low temperatures under pressure-assisted and pressureless techniques.

According to the company’s claims, the product is designed to meet the evolving needs of end-users, offering higher heat dissipation and heat resistance properties of electrical components. In April 2023, MacDermid Alpha, a leading provider of circuitry, assembly, and semiconductor solutions for electronics manufacturers, launched Argomax 2148, which is a new silver sintering product. The product is designed to power investors in electric vehicles.

Silver Sintering Paste Market: Challenges

Increasing development of alternative solutions to challenge market expansion in the future

The global silver sintering paste industry is expected to be challenged by the rising development of substitute solutions. Some of the other popular alternatives include the use of copper and silver-copper bimetallic pastes. In addition to this, environmental concerns over the excessive use of silver sintering paste may further impact market expansion in the long run.

Silver Sintering Paste Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Silver Sintering Paste Market |

| Market Size in 2024 | USD 500.12 Million |

| Market Forecast in 2034 | USD 1,407.31 Million |

| Growth Rate | CAGR of 10.90% |

| Number of Pages | 215 |

| Key Companies Covered | Advanced Joining Technology, Heraeus, Solderwell Advanced Materials, Alpha Assembly Solutions, Nihon Superior Co. Ltd., ShareX (Zhejiang) New Material Technology, Indium Corporation, Namics Corporation, TANAKA Precious Metals, NBE Tech, Kyocera, Guangzhou Xianyi Electronic Technology, Henkel, Shenzhen Facemoore Technology, Nihon Handa, and others. |

| Segments Covered | By Type, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Silver Sintering Paste Market: Segmentation

The global silver sintering paste market is segmented based on type, applications, and region.

Based on the type, the global market segments are pressure sintering paste and pressure sintering paste. In 2024, the pressure sintering paste market experienced the highest growth, contributing nearly 65% to the total share. The paste requires external pressure for application and is the most commonly used type worldwide. Typically, the applied pressure strength ranges between 5 and 40 MPa and results in the formation of void-free, solid joints.

Based on the applications, the global market divisions are RF power devices, power semiconductor devices, high-performance LED, solar panel metallization, SiC & GaN device bonding, medical device electronics, sensor packaging, and others. In 2024, the highest revenue was generated by the power semiconductor device segment. The increasing demand for highly advanced semiconductors across rapidly growing end-user industries is propelling segmental revenue. In 2021, more than 1.5 trillion units of semiconductors were produced and shipped globally.

Silver Sintering Paste Market: Regional Analysis

What factors help Asia-Pacific continue to lead the global silver sintering paste market?

Asia-Pacific will lead the global silver sintering paste market during the forecast period. China, South Korea, Taiwan, and India may emerge as critical regional market growth drivers. The increasing use of silver sintering paste in producing next-generation semiconductors and high-frequency devices is helping fuel regional market expansion.

In March 2025, researchers from China’s Peking University developed a breakthrough 100-gigahertz chip that relies on light. According to the researchers, the chip could pave the way for future growth in the field of Artificial Intelligence (AI). Furthermore, the ongoing investments in the regional expansion of semiconductor production may further facilitate higher revenue in the Asia-Pacific.

North America is another region in the silver sintering paste industry expected to be dominated by the US during the forecast period. The increasing end-user applications of silver sintering paste across automotive, military & defense, and electronics industries will propel regional revenue.

Moreover, the accelerating adoption of SiC/GaN devices in North America will be pivotal to the region’s final growth rate by the end of the forecast period. The ongoing investments in upgrading EV charging station architecture, rising innovations in military weapons & technologies, and surging expansion of 5G infrastructure will facilitate higher growth in North American countries.

Silver Sintering Paste Market: Competitive Analysis

The global silver sintering paste market is led by players like:

- Advanced Joining Technology

- Heraeus

- Solderwell Advanced Materials

- Alpha Assembly Solutions

- Nihon Superior Co. Ltd.

- ShareX (Zhejiang) New Material Technology

- Indium Corporation

- Namics Corporation

- TANAKA Precious Metals

- NBE Tech

- Kyocera

- Guangzhou Xianyi Electronic Technology

- Henkel

- Shenzhen Facemoore Technology

- Nihon Handa

The global silver sintering paste market is segmented as follows:

By Type

- Pressureless Sintering Paste

- Pressure Sintering Paste

By Applications

- RF Power Device

- Power Semiconductor Device

- High Performance LED

- Solar Panel Metallization

- SiC & GaN Device Bonding

- Medical Device Electronics

- Sensor Packaging

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Silver sintering paste is a commonly used conductive material essential for the smooth functioning of the electronic manufacturing industry.

The global silver sintering paste market is expected to be driven by the increasing investments in 5G infrastructure worldwide.

According to study, the global silver sintering paste market size was worth around USD 500.12 million in 2024 and is predicted to grow to around USD 1,407.31 million by 2034.

The CAGR value of the silver sintering paste market is expected to be around 10.90% during 2025-2034.

The global silver sintering paste market will be led by Asia-Pacific during the forecast period.

The global silver sintering paste market is led by players like Advanced Joining Technology, Heraeus, Solderwell Advanced Materials, Alpha Assembly Solutions, Nihon Superior Co., Ltd., ShareX (Zhejiang) New Material Technology, Indium Corporation, Namics Corporation, TANAKA Precious Metals, NBE Tech, Kyocera, Guangzhou Xianyi Electronic Technology, Henkel, Shenzhen Facemoore Technology, and Nihon Handa.

The report explores crucial aspects of the silver sintering paste market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed