SiC Fibers Market Size, Share, Trends, Growth 2032

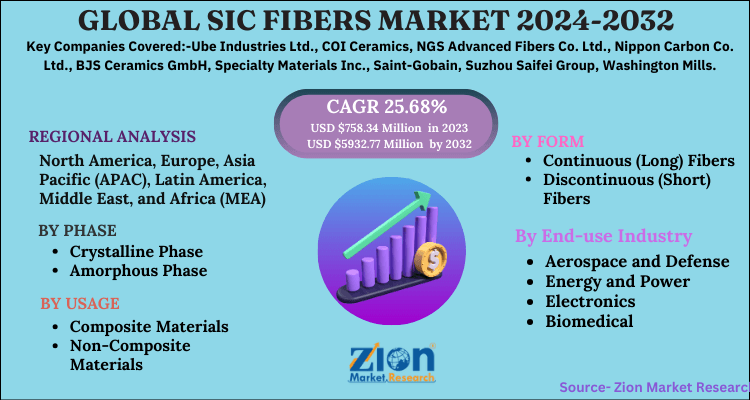

SiC Fibers Market By Phase (Crystalline Phase and Amorphous Phase), By Usage (Composite Materials and Non-Composite Materials), By Form (Continuous Fibers and Short Fibers), By End-use Industry (Aerospace and Defense, Energy and Power, Electronics, Biomedical and Others) and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

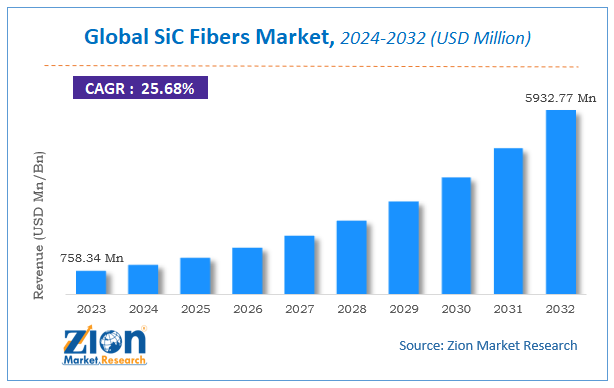

| USD 758.34 Million | USD 5932.77 Million | 25.68% | 2023 |

SiC Fibers Market Insights

According to a report from Zion Market Research, the global SiC Fibers Market was valued at USD 758.34 Million in 2023 and is projected to hit USD 5932.77 Million by 2032, with a compound annual growth rate (CAGR) of 25.68% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the SiC Fibers Market industry over the next decade.

SiC Fibers Market: Overview

SiC (Silicon Carbide) fibers are basically fibers that are primarily composed of silicon and carbon molecule, coupled with a less electrically negative element (carbide). The amorphous form of the fibers also contain oxygen. Based on their properties, such as displaying high temperature, stress, deformation and pressure resistance, being chemically stable and lightweight, SiC Fibers are widely utilized in various end-use industries. They also display properties of semiconductors, which only enhances their range of applications.

The accelerated development of the Aerospace and Defense industry, various stimulus packages from governments across the world and the enhanced demand for life sciences and biomedical research are some of the major factors that are augmenting the growth of the SiC fibers market, globally.

COVID-19 Impact Analysis

Before the COVID-19 pandemic, companies in the SiC Fibers market were expanding at a steady pace. However, during the pandemic, the Aviation industry took a sharp hit because of the worldwide lockdown, business shutdowns and travel bans. This ultimately affected the SiC Fibers market as SiC Fibers are largely used in the Aerospace and Defense industry.

Furthermore, with the lockdown, manufacturing facilities across various countries were shut down which affected the manufacturing and thereby, sales of SiC Fibers. The efforts of the companies to widen their reach and sales had come to a halt as they saw a sudden disruption in their supply chain as well as demand.

Subsequently, the Oil and Gas industries, Academic and Research institutes were impacted negatively due to the worldwide lockdown. This, in turn, had repercussions on the SiC Fibers market as they are utilized in oil and gas exploration projects as well as in research institutes.

SiC Fibers Market: Growth Factors

The accelerated development of the Aerospace and Defense industry, various stimulus packages from governments across the world and the enhanced demand for life sciences and biomedical research are some of the key factors that are responsible for the growth of the SiC Fibers market.

SiC Fibers are widely utilized in the Aerospace and Defense industry, for a large number of applications. They are employed in the manufacturing of ultra-lightweight scanning mirrors, engines, thermal protection systems and thermostable satellite structures.

Furthermore, they are employed in Biomedical and Research industry as scaffolds for tissue engineering, biosensors, biomembranes, drug delivery systems, quantum dots, in the development of stents, orthopedic implants and imaging agents.

They are inseparable from all of these industries, thus, with the announcement of government stimulus packages for aerospace and defense industry and the increasing significance of R&D activities, these industries are expected to grow. This, in turn, will boost the demand and thereby, market for SiC Fibers.

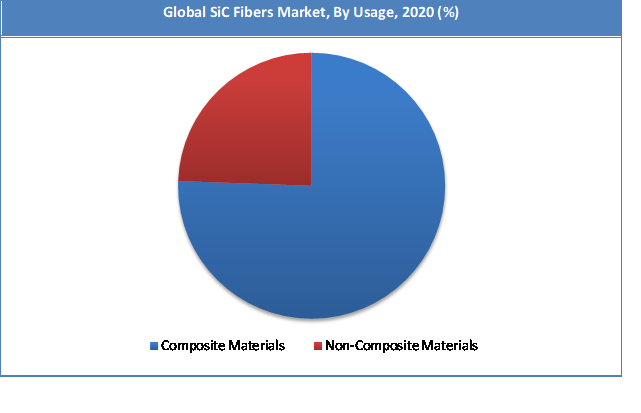

Usage Segment Analysis Preview

The Composite Materials segment held a share of over 36% in 2020. This is attributable to their stellar properties that include high tensile strength, ability to withstand harsh conditions such as extreme temperature, pressure and oxidizing environmental conditions and high creep-rupture resistance. Owing to these features, they are predominantly utilized in the Aerospace and Defense industry as well as the Energy and Power industry.

SiC Fibers reinforced with Ceramic Matrix Composites (CMCs), Carbon Composites, Polymer Matrix Composites (PMCs) and Metal Matrix Composites (MMCs) are used in reactors, turbines, surge arresters and light arresters. Additionally, SiC Fibers reinforced with Metal Matrix Composites such as Aluminum, Magnesium, Titanium, Copper and Iron are used in the equipment utilized for oil and gas exploration projects.

Subsequently, owing to their semiconductor properties, they are utilized in the manufacturing of transistors, sensors, LEDs, circuits, cutting tools and diodes. Furthermore, MMCs are utilized in the Automotive industry for brake discs and sensors.

End-use Industry Segment Analysis Preview

The Aerospace and Defense segment is anticipated to reach a significant CAGR between 2021 and 2028. This is attributable to various features of SiC Fibers that help in the advancement of Aerospace and Defense industry. SiC Fibers are durable, highly heat and pressure resistant, extremely durable and exceptionally lightweight. They enhance the operational efficiency and life-cycle of aircrafts and defense equipment, owing to their characteristics.

They are employed in the manufacturing of propulsion systems, rocket engines, aircraft engines, combustion systems and sensors. Additionally, they are employed in the manufacturing of drones and missiles. Furthermore, they have applications in the optical components of satellite structures.

The Power and Energy segment also contributes greatly to the global SiC Fibers market. SiC Fibers are utilized in the manufacturing of reformers, radiant tubes, heaters, preheaters, furnace components and recuperators in power plants, owing to their thermal resistance properties.

SiC Fibers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | SiC Fibers Market |

| Market Size in 2023 | USD 758.34 Million |

| Market Forecast in 2032 | USD 5932.77 Million |

| Growth Rate | CAGR of 25.68% |

| Number of Pages | 150 |

| Key Companies Covered | Ube Industries Ltd., COI Ceramics, NGS Advanced Fibers Co. Ltd., Nippon Carbon Co. Ltd., BJS Ceramics GmbH, Specialty Materials Inc., Saint-Gobain, Suzhou Saifei Group, Washington Mills and Haydale Technologies Inc. among others. |

| Segments Covered | By Phase, By Usage, By Form, By End-use Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

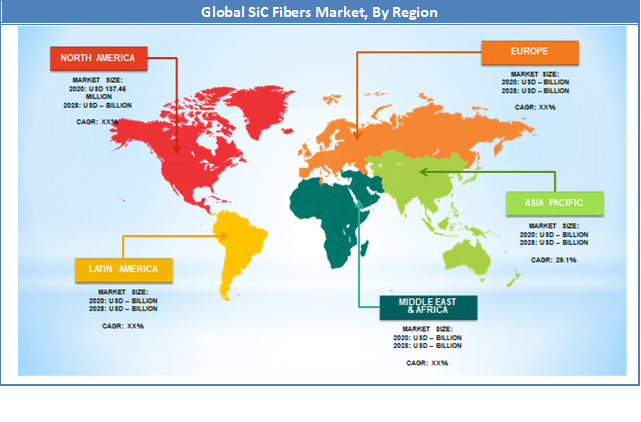

SiC Fibers Market: Regional Analysis Preview

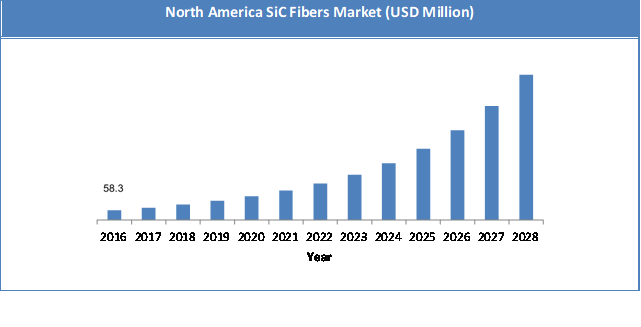

The North America region held a share of over 33% in 2020. This immense share can be credited to the presence of prominent players such as COI Ceramics Inc., Specialty Materials Inc., Matech Inc. and Global Materials Inc., in the region. Additionally, countries like the US and Canada have a major share in the Aerospace and Defense industry as majority of aircraft manufacturing companies are located in these regions. These countries are also highly advanced, in terms of technology. Technological advancements aid the enhancement of the Aerospace and Defense industry, in the region.

With the boom of Aerospace and Defense industry, in developed and advanced economies like the US and Canada, the SiC Fibers market is expected to grow as well, during the forecast period.

The Asia Pacific region is expected to grow with a CAGR of over 29.1% between 2021 and 2028. This massive growth can be credited to factors such as the increasing manufacturing activities, growth of the Energy and Power industry and the presence of multiple developing economies.

Countries like China and India are focusing on utilizing renewable sources of energy such as sun and wind. This, in turn, enhances the growth of the SiC Fibers market, in the region, as the blades utilized in wind turbines and the Photovoltaic (PV) cells utilized in solar panels, make use of SiC Fibers in their manufacturing.

Additionally, manufacturers in China are utilizing SiC Fibers in the production of several products such as epitaxial wafer, abrasives, microwaves, 5G base stations and electronic vehicles, among others.

Key Market Players & Competitive Landscape

Some of the key players in the SiC Fibers market are

- Ube Industries Ltd

- COI Ceramics

- NGS Advanced Fibers Co. Ltd

- Nippon Carbon Co. Ltd

- BJS Ceramics GmbH

- Specialty Materials Inc

- Saint-Gobain

- Suzhou Saifei Group

- Washington Mills

- Haydale Technologies Inc

The companies in the SiC Fibers market are focusing on widening their portfolio, to create novel solutions and technologies. This strategy helps them in catering to the requirements of their end-users proficiently and also helps them in getting an advantage over their competitors. For instance, in September 2020, third generation SiC Fibers, able to withstand temperature as high as 1500°C, were produced by BJS Ceramics. They are predominantly utilized in Thermal Protection Systems.

The global SiC Fibers Market is segmented as follows:

By Phase

- Crystalline Phase

- Amorphous Phase

By Usage

- Composite Materials

- Non-Composite Materials

By Form

- Continuous (Long) Fibers

- Discontinuous (Short) Fibers

By End-use Industry

- Aerospace and Defense

- Energy and Power

- Electronics

- Biomedical

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed