Security Cameras Market Size, Share, Trends, Growth and Forecast 2034

Security Cameras Market By Type (Infrared (IR) Bullet, Dome, Box), By Resolution (Full HD, HD, Non HD), By Application (Indoor Cameras, Outdoor Cameras), By Professional Service (Consulting, Installation, Support), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2034

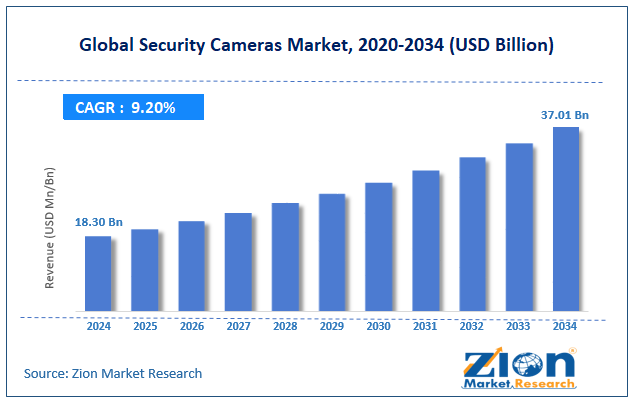

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.30 Billion | USD 37.01 Billion | 9.2% | 2024 |

Security Cameras Industry Perspective:

The global security cameras market size was approximately USD 18.30 billion in 2024 and is projected to reach USD 37.01 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.2% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global security cameras market is estimated to grow annually at a CAGR of around 9.2% over the forecast period (2025-2034)

- In terms of revenue, the global security cameras market size was valued at around USD 18.30 billion in 2024 and is projected to reach USD 37.01 billion by 2034.

- The security cameras market is projected to grow significantly due to urbanization and infrastructure development, technological advancements in IP cameras, HD, motion detection, night vision, and more, and the rising demand for remote monitoring and cloud‑based surveillance.

- Based on type, the Infrared (IR) bullet segment is expected to lead the market, while the dome segment is expected to grow considerably.

- Based on resolution, the full HD segment is the dominating segment, while the HD segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the indoor cameras segment is the largest, while the outdoor cameras segment is projected to record sizeable revenue over the forecast period.

- Based on professional services, the installation segment is expected to lead the market, followed by consulting

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Security Cameras Market: Overview

Security cameras are surveillance devices that monitor and record activity in businesses, homes, and public spaces. They improve safety by deterring crime, offering real-time monitoring, and supplying valuable evidence of incidents and essential events. The global security cameras market is poised for notable growth, driven by growing concerns over security and crime prevention, advances in AI, HD, and smart analytics, and surging demand from the commercial sector. Increasing crime rates are pushing businesses, governments, and individuals to invest in surveillance.

Cameras act as visual deterrents and offer evidence after incidents. This elevated awareness continues to accelerate industry demand. Modern cameras now offer more explicit images, innovative recognition features, and real-time alerts. AI enhances threat-detection accuracy and decreases manual monitoring. These advancements make cameras more appealing and valuable to users. Moreover, warehouses, retailers, and offices steadily depend on cameras for operational oversight and loss prevention. Surveillance helps guarantee safety compliance and incident documentation. This broader commercial need fuels steady adoption.

Nevertheless, the global market faces limitations due to regulatory constraints and privacy concerns, high infrastructure and maintenance costs, and bandwidth shortages. Public resistance to constant monitoring impacts installation in sensitive areas. Stringent privacy regulations may limit data use and impose compliance pressure. These factors complicate or slow deployment. Large-scale installations need cabling, monitoring systems, storage, and upkeep. These long-term costs can outweigh the advantages for some businesses. Hence, adoption may be scaled down or postponed. Similarly, high-definition video consumes significant amounts of data and storage. Limited network infrastructure can cause footage loss or lag.

These technical limitations hamper smooth system operation. Still, the global security cameras industry benefits from several favorable factors, including AI-powered smart surveillance, cloud-based management and storage, and integration with smart-home automation. AI allows automated threat detection, real-time alerts, and behavior analytics. This transforms cameras into proactive security tools. Demand for smart solutions is speedily expanding. Cloud platforms reduce the need for maintenance and on-site servers. Subscription models make surveillance more scalable and affordable. This move offers fresh recurring-revenue prospects. Additionally, cameras that synchronize with alarms, lights, and locks improve residential convenience. Rising interest in home automation propels the demand for connected security solutions. This segment offers strong long-term growth.

Security Cameras Market Dynamics

Growth Drivers

How is the security cameras market driven by the shift toward cloud‑based surveillance and remote monitoring?

Cloud integration has changed how surveillance systems are installed and used. Instead of relying on local storage devices, footage can now be saved in the cloud, eliminating the need for costly maintenance and bulky hardware. Remote monitoring via laptops or smart phones enables users to access live feeds and recordings at any time, from any location. This flexibility is desirable to travelers, homeowners, small business owners, and those managing multiple locations. Cloud-based systems also often streamline setup and reduce ongoing costs compared to traditional DVR/NVR setups. Hence, several users feel comfortable adopting surveillance solutions, expanding the security cameras market far beyond large businesses.

How are rapid technological advancements significantly fueling the growth of the security cameras market?

Modern surveillance cameras offer features beyond recording; they also analyze data. Advanced features such as AI-powered analytics, motion detection, object or facial recognition, and real-time alerting are becoming more common. High-resolution imaging (4K, Full HD), wide-angle lenses, and infrared/night-vision capabilities enhance situational awareness and clarity. As capabilities increase, cameras move from passive recorders to active scrutiny tools that can preempt threats or aid speedy response. These tech upgrades augment the appeal of cameras not only to businesses but also to homeowners and smaller businesses. Overall, technology makes surveillance more reliable, smarter, and far more helpful than ever.

Restraints

Technical complexity, integration difficulties, and lack of expertise unfavorably impact the market progress

Advanced surveillance systems, especially those with smart features, often require technical know-how for installation, maintenance, configuration, and integration with existing infrastructure. Several users, such as small businesses or residential users, may lack the skills, or experts may be costly or scarce. In addition, integrating new camera systems with legacy security or IT infrastructure may offer compatibility issues or demand significant rewiring or software modifications. This technical pressure demotivates adoption, especially among non-technical users or small businesses.

Opportunities

How do cloud‑based video surveillance & Video‑as‑a‑Service (VSaaS) models offer advantageous conditions for the security cameras market development?

The move from on-premises DVR/NVR storage to cloud-based video storage and management offers easy deployment, remote access, scalability, and lower upfront costs for multiple users. Subscription-based VSaaS offerings allow users to avoid heavy capital expenses – paying monthly or annually for services rather than buying complete hardware upfront. This model appeals to small retailers, SMEs, and homeowners who seek flexibility and predictable operating and maintenance expenses. As cloud infrastructure becomes more robust and affordable, demand for these services is likely to grow significantly, thereby impacting the security camera industry.

Challenges

Rapid obsolescence & pressure to continuously upgrade technology restrict the market growth

Surveillance technology advances rapidly, driven by higher resolutions, better sensors, newer network standards and storage, and enhanced analytics. This renders existing camera setups obsolete within a short period. Users may feel persuaded to upgrade frequently to maintain security effectiveness or stay compliant with evolving regulations. This ongoing upgrade pressure increases long-term costs and reduces the appeal of purchasing high-end systems, particularly for budget-sensitive institutions or buyers who distrust recurring investments.

Security Cameras Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Security Cameras Market |

| Market Size in 2024 | USD 18.30 Billion |

| Market Forecast in 2034 | USD 37.01 Billion |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 220 |

| Key Companies Covered | Hikvision, Dahua Technology, Axis Communications, Hanwha Vision, Bosch Security Systems, Avigilon, Vivotek, Mobotix, Uniview (UNV), Honeywell, Panasonic (including Panasonic i-PRO), Eagle Eye Networks, Pelco (Schneider Electric / Pelco), FLIR Systems, and GeoVision. |

| Segments Covered | By Type, By Resolution, By Application, By Professional Service and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America and Middle East |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Security Cameras Market: Segmentation

The global security cameras market is segmented based on type, resolution, application, professional service, and region.

Based on type, the global security cameras industry is divided into infrared (IR) bullet, dome, and box. The infrared (IR) bullet segment holds a leading market share because it delivers reliable night vision and long-range surveillance. This increases their suitability for perimeter, outdoor, and low-light security setups.

On the other hand, the dome segment holds a second-leading share because its discreet design, vandal-resistant housing, and wide-angle coverage make it ideal for indoor use and high-traffic commercial or public spaces.

Based on resolution, the global market is segmented into full HD, HD, and non-HD. The full HD segment holds a dominant market share, offering clear, high-quality video that balances cost and detail, making it widely adopted worldwide.

Conversely, the HD segment ranks second because it offers decent clarity at a lower cost point, attracting mainly budget-sensitive buyers.

Based on application, the global security cameras market is segmented into indoor cameras and outdoor cameras. The indoor cameras segment leads the market due to the bulk of surveillance demand in commercial interiors, offices, and homes, where indoor settings emphasize integration, convenience, and regular monitoring.

Nonetheless, the outdoor cameras segment holds second place because rising concerns about perimeter security, property protection, and external threats are increasingly driving demand for robust outdoor surveillance systems.

Based on professional service, the global market is segmented into consulting, installation, and support. The installation segment captures a leading share because every scrutiny-camera project needs expert setup and configuration. This makes installation the backbone of professional services worldwide.

However, the consulting segment is the fastest-growing segment because businesses depend on expert assessment and planning to design tailored surveillance solutions before installation. This makes consulting the upcoming demanded service.

Security Cameras Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Security Cameras Market?

Asia Pacific is projected to maintain its dominant position in the global security camera market owing to rapid urbanization, high population density, rising security needs, substantial government investments, smart-city initiatives, and a local manufacturing base and a cost-competitive supply chain. Several Asia Pacific economies, including densely populated ones, are experiencing rapid urbanization, increasing demand for surveillance and public security infrastructure. This urban growth fuels broader adoption of CCTV across residential complexes, cities, public spaces, and commercial areas. Moreover, municipal-level and nationwide initiatives in the region have led to large-scale procurement of surveillance systems. These institutional-level initiatives create a high-volume, stable baseline demand for security cameras in the Asia Pacific. Furthermore, the Asia-Pacific region, particularly countries such as China, hosts several leading surveillance camera manufacturers and a robust supply chain. This manufacturing strength helps keep supply abundant and hardware costs competitive. This surges adoption and accessibility throughout the region.

North America remains the second-largest region in the global security camera industry, owing to high adoption of advanced technologies, robust institutional and governmental security spending, heightened security awareness, and a sophisticated regulatory environment. The region has widely adopted AI analytics, IP cameras, and cloud-based surveillance. These technologies enhance the efficiency and intelligence of monitoring systems. Businesses and municipalities increasingly prefer advanced solutions. Technological sophistication strengthens the region's robust market presence. Government agencies, commercial buildings, and infrastructure projects heavily invest in surveillance systems. Public-sector demand usually requires strong, scalable, and compliant solutions. This institutional spending supports steady growth. It strengthens the region's rank in the worldwide market. Additionally, stringent regulations and heightened security awareness drive demand for modern, compliant surveillance systems. Buyers are willing to invest in reliable, high-quality solutions. This regulatory maturity assures consistent adoption. It encourages the deployment of modernized systems in sectors.

Security Cameras Market: Competitive Analysis

The leading players in the global security cameras market are-

- Hikvision

- Dahua Technology

- Axis Communications

- Hanwha Vision

- Bosch Security Systems

- Avigilon

- Vivotek

- Mobotix

- Uniview (UNV)

- Honeywell

- Panasonic (including Panasonic i-PRO)

- Eagle Eye Networks

- Pelco (Schneider Electric / Pelco)

- FLIR Systems

- GeoVision.

Security Cameras Market: Key Market Trends

Shift to Edge AI and hybrid architectures

Edge computing enables cameras to process data locally, reducing bandwidth requirements and latency. Hybrid edge-computing systems combine fast local analytics with centralized storage and management. This also addresses regulatory concerns and privacy. Vendors are increasingly offering these frameworks to enhance compliance and efficiency.

High-resolution, multi-sensor, and advanced imaging adoption

Ultra HD/4K cameras, infrared and thermal imaging, and multi-sensor setups provide clearer footage under varying conditions. IoT integration enables connected, smarter security solutions. These solutions expand use cases in industrial, traffic, public, and retail safety. Consumers increasingly upgrade to advanced imaging systems for enhanced coverage.

The global security cameras market is segmented as follows:

By Type

- Infrared (IR) Bullet

- Dome

- Box

By Resolution

- Full HD

- HD

- Non HD

By Application

- Indoor Cameras

- Outdoor Cameras

By Professional Service

- Consulting

- Installation

- Support

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed