Scaffolding Market Size, Share, Trends, Growth and Forecast 2034

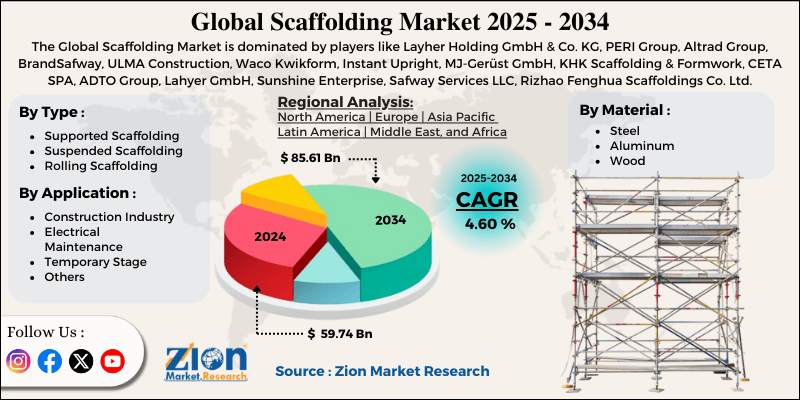

Scaffolding Market By Type (Supported Scaffolding, Suspended Scaffolding, and Rolling Scaffolding), By Material (Steel, Aluminum, Wood, and Others), By Application (Construction Industry, Electrical Maintenance, Temporary Stage, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

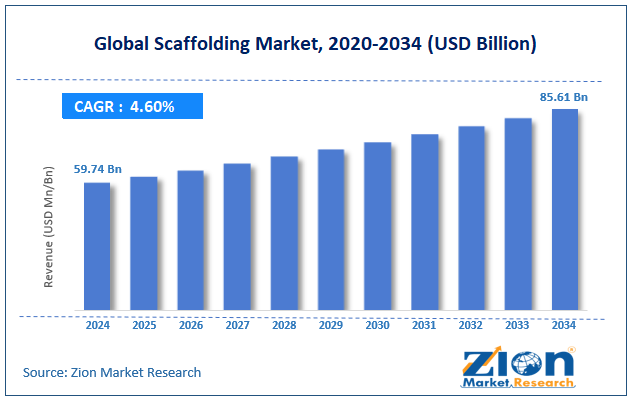

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 59.74 Billion | USD 85.61 Billion | 4.60% | 2024 |

Scaffolding Market: Industry Perspective

The global scaffolding market size was worth around USD 59.74 billion in 2024 and is predicted to grow to around USD 85.61 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.60% between 2025 and 2034.

Scaffolding Market: Overview

Scaffolding is a temporary structure used in repair, maintenance, and construction projects to provide workers with safe access to higher areas. It supports both materials and personnel, assuring safety and stability during tasks such as painting, structural inspection, and building. They are mainly made of aluminum, steel, and reinforced materials for better durability. The global scaffolding market is projected to witness substantial growth driven by infrastructure modernization projects, industrial repair and maintenance, and technological improvements in scaffold systems. Government initiatives to advance energy, transportation, and utility infrastructure are propelling scaffolding requirements. Large-scale projects like metro systems, renewable energy installations, and bridges need durable and advanced scaffolding systems.

Moreover, power plants, refineries, and factories require regular maintenance, which often involves high-elevation work. Scaffolds offer efficient and safe access in such environments, mainly for overhauls and shutdowns. This demand is continuous since industrial sites should obey operational and safety regulations. Also, manufacturers are developing modular, lightweight, and quick assembly scaffolding systems to enhance efficiency. Composite-based and aluminum designs decrease labor costs and setup time, while integrated safety features improve compliance.

Although drivers exist, the global market is challenged by factors like high labor costs and scarcity of skilled workforce, stringent safety compliance costs, and environmental regulations on manufacturing. Dismantling and scaffolding setup need well-trained personnel. The scarcity of a professional workforce in developed regions, combined with significant labor costs, may increase overall project costs and slow down project schedules. Meeting evolving safety standards usually requires upgrading equipment, investing in conducting regular inspections, and training. For small contractors, these compliance costs may be worrying.

Furthermore, scaffolding production, mainly steel fabrication, has a significant carbon footprint. Governments imposing emission control norms may restrict operations and increase production costs. Even so, the global scaffolding industry is well-positioned due to smart scaffolding integration, the rise in lightweight and modular systems, and sustainable materials in scaffolding. IoT-based scaffolding with load sensors, digital monitoring, and stability alerts can improve operational efficacy and enhance safety, appealing to high-value contracts. There is a surging demand for quick-to-install and easy-to-transport scaffolding, mainly for medium and small-sized projects in urban regions. Likewise, developing scaffolding from bamboo composites, recycled steel, and other eco-friendly materials may attract green construction initiatives.

Key Insights:

- As per the analysis shared by our research analyst, the global scaffolding market is estimated to grow annually at a CAGR of around 4.60% over the forecast period (2025-2034)

- In terms of revenue, the global scaffolding market size was valued at around USD 59.74 billion in 2024 and is projected to reach USD 85.61 billion by 2034.

- The scaffolding market is projected to grow significantly owing to the growing focus on regulatory compliance and worker safety, the expansion of industrial plants and facilities, and increasing investments in transport infrastructure.

- Based on type, the supported scaffolding segment is expected to lead the market, while the suspended scaffolding segment is expected to grow considerably.

- Based on material, the steel segment is the dominating segment, while the aluminum segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the construction industry segment is expected to lead the market compared to the electrical maintenance segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Scaffolding Market: Growth Drivers

How are retrofitting, renovation, & green building trends boosting the scaffolding market?

A maturing building stock in the established market shifts activity towards energy-efficiency retrofits, seismic upgrades, and façade restorations, moving away from greenfield projects that primarily require scaffolding. It also needs a specialist access solution for restricted urban façades. Green retrofits also propel the demand for scaffold platforms, which are compatible with insulation installation, temporary weather protection, and façade replacement, surging opportunities for specialized product lines and high-margin services. These factors ultimately propel the global scaffolding market.

Energy, industrial, & specialty sectors (power, oil & gas, shipbuilding) propel the industry growth

Maintenance outages, turnarounds, decommissioning, and new-builds in heavy industry produce short-duration but high-value scaffolding demand for engineered shoring, specialty coatings, and confined-space access, generating peaks in rental revenue and demand for expertise in risky-environment access. These industries value safety-certified, stainless, and coated scaffolds, as well as integrated access planning, which supports long-term service contracts and premium pricing.

Scaffolding Market: Restraints

How does the shortage of skilled labor hamper the global scaffolding market?

Safe scaffolding assembly needs a certified and trained workforce, yet several regions are facing acute scarcity in skilled construction labor. The Construction Industry Training Board in the United Kingdom anticipated in 2024 that the industry needs more than 2,25,000 new workers by 2027 to meet the rising demand.

A similar gap is seen in the GCC and the U.S. markets, where large-scale infrastructure projects are competing for a low labor pool. This scarcity raises labor costs, increases project schedules, and elevates safety risks because of inexperienced workers entering the domain. For scaffolding providers, the talent breach is restricting their ability to accept additional contracts, mainly in peak construction periods.

Scaffolding Market: Opportunities

How is the integration of smart monitoring and digital tools benefiting the scaffolding market?

The scaffolding industry is largely adopting IoT-driven monitoring systems, BIM integration, and AI-based risk prediction tools to improve efficiency, safety, and compliance. These advancements enable contractors to monitor load distribution, structural stability, and environmental stress in real-time, remarkably decreasing downtime and accident risk. The smart construction technologies industry is expected to progress at a 14.3% CAGR by 2030, generating a high-value niche for scaffolding providers, offering incorporated technology solutions.

Peri introduced a BIM-linked scaffolding inspection platform that allows automated compliance reports and remote audits in 2023, setting a precedent for digital transformation in a conventionally manual market. Besides boosting safety records, the trend also adds premium service revenue streams for scaffolding firms.

Scaffolding Market: Challenges

Price pressure and high competition restrict the growth of the market

The worldwide market is highly fragmented, with a large number of multinational players competing alongside several regional rental companies, creating intense price pressure. In price-sensitive areas, such as Southeast Asia, the arrival of low-cost scaffolding imports from China has led to a nearly 6% decrease in average rental rates in 2023, while maintaining profit margins.

Large-scale infrastructure projects usually award contracts based on the lowest bid, which increases difficulties for companies with high-quality but costly systems that do not compromise their margins. This commoditization trend risks undermining long-term investments in safety and innovation.

Scaffolding Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Scaffolding Market |

| Market Size in 2024 | USD 59.74 Billion |

| Market Forecast in 2034 | USD 85.61 Billion |

| Growth Rate | CAGR of 4.60% |

| Number of Pages | 212 |

| Key Companies Covered | Layher Holding GmbH & Co. KG, PERI Group, Altrad Group, BrandSafway, ULMA Construction, Waco Kwikform, Instant Upright, MJ-Gerüst GmbH, KHK Scaffolding & Formwork, CETA SPA, ADTO Group, Lahyer GmbH, Sunshine Enterprise, Safway Services LLC, Rizhao Fenghua Scaffoldings Co. Ltd., and others. |

| Segments Covered | By Type, By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Scaffolding Market: Segmentation

The global scaffolding market is segmented based on type, material, application, and region.

Based on type, the global scaffolding industry is divided into supported scaffolding, suspended scaffolding, and rolling scaffolding. The supported scaffolding segment holds a dominating share of the market owing to its unmatched capacity, versatility, and stability to handle heavy loads. Constructed from the ground up with strong vertical supports, it is suitable for long-term projects like industrial facilities, bridges, high-rise buildings, and significant infrastructure works. Its comparatively easy assembly, adaptability to diverse site conditions, and cost-efficiency increase its suitability and favorability for contractors in the emerging and developed markets. The segment benefits from progressing construction activity in the Middle East and Asia Pacific, where mega infrastructure projects lead the demand.

Based on material, the global scaffolding market is segmented into steel, aluminum, wood, and others. The steel scaffolding segment holds a substantial market share owing to its unique durability, strength, and high load-bearing capacity. Galvanized steel offers optimal corrosion resistance, increasing its suitability for long-term use in different weather conditions. It is broadly used in large-scale industrial, infrastructure, and commercial projects, where stability, safety, and the ability to handle heavy materials are vital.

Based on application, the global market is segmented into the construction industry, electrical maintenance, temporary stage, and others. The construction industry category holds a leading market share fueled by amplified demand in commercial, residential, and infrastructural projects. Scaffoldings is vital for offering safe access to higher work areas, facilitating materials and workers during construction activities. Large-scale infrastructure investments, mega construction projects, and speedy urbanization across the globe are fueling its leadership.

Scaffolding Market: Regional Analysis

What gives the Asia Pacific a competitive edge in the global Scaffolding Market?

Asia Pacific is likely to sustain its leadership in the scaffolding market due to speedy urbanization and infrastructure growth, government infrastructure investment, and expanding energy and industrial projects. APAC's dominance is attributed to the massive urban development, with the region yearly adding millions to its metropolitan population.

According to UN data, Asia is expected to have 64% of its population living in cities by 2050, driving continuous construction projects. Mega projects like India's smart cities mission and China's high-speed rail expansion need extensive use of scaffolding. Massive public spending on housing, transportation, and industrial infrastructure also propels the demand.

For instance, China’s Belt and Road Initiative and India’s USD 1.4 trillion National Infrastructure Pipeline comprise long-term, scaffold-intensive projects. These commitments promise continuous industry growth in diverse sectors. Additionally, Asia Pacific hosts some of the world's most significant energy and industrial projects, needing scaffolding for construction and maintenance, mainly China’s offshore wind farms, substantially driving the industry demand. The industrial sector alone registers for more than 20% of the total scaffolding use in the region.

Europe continues to secure the second-highest share in the scaffolding industry owing to strong emphasis on restoration and renovation projects, a rise in sustainable and green building construction, and expanding urban infrastructure projects. Historical buildings and aging infrastructure primarily fuel Europe's scaffolding demand. More than 30% of construction output in the European Union is associated with maintenance and repair activities, according to Eurostat. This consistent restoration work sustains long-term scaffolding needs in urban sectors.

Furthermore, Europe leads in sustainable construction, with the green building domain anticipated to progress yearly at 8-10%. Eco-friendly practices usually need specialized scaffolding for installing energy-efficient façades, insulation materials, and solar panels. In addition, key cities like Frankfurt, London, and Paris are experiencing fresh high-rise and mixed-use development, notwithstanding restricted land availability. These projects require suspended and supported scaffolding, which is necessary to maintain steady demand in the commercial construction segment.

Scaffolding Market: Competitive Analysis

The leading players in the global scaffolding market are:

- Layher Holding GmbH & Co. KG

- PERI Group

- Altrad Group

- BrandSafway

- ULMA Construction

- Waco Kwikform

- Instant Upright

- MJ-Gerüst GmbH

- KHK Scaffolding & Formwork

- CETA SPA

- ADTO Group

- Lahyer GmbH

- Sunshine Enterprise

- Safway Services LLC

- Rizhao Fenghua Scaffoldings Co. Ltd.

Scaffolding Market: Key Market Trends

Integration of smart and digital technologies:

IoT-driven scaffolding with load sensors, digital monitoring, and GPS tracking is gaining popularity to improve efficiency and safety. Such systems offer maintenance data and real-time stability alerts, mainly reducing accidents. Adoption is rising in high-value projects in North America, the Asia Pacific, and Europe.

Increased use in offshore projects and renewable energy:

The growth of solar installations, offshore wind farms, and other renewable energy infrastructure is notably demanding specialized scaffolding solutions. These projects require high-load and corrosion-resistant systems that are ideal for challenging environments. Europe and the Asia Pacific are forerunners in adopting these niche scaffolding applications.

The global scaffolding market is segmented as follows:

By Type

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material

- Steel

- Aluminum

- Wood

- Others

By Application

- Construction Industry

- Electrical Maintenance

- Temporary Stage

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Scaffolding is a temporary structure used in repair, maintenance, and construction projects to provide workers with safe access to higher areas. It supports both materials and personnel, assuring safety and stability during tasks such as painting, structural inspection, and building. They are mainly made of aluminum, steel, and reinforced materials for better durability.

The global scaffolding market is projected to grow due to the speedy urbanization of infrastructure development, the adoption of lightweight and modular scaffolding systems, and improvements in scaffolding materials.

According to study, the global scaffolding market size was worth around USD 59.74 billion in 2024 and is predicted to grow to around USD 85.61 billion by 2034.

The CAGR value of the scaffolding market is expected to be around 4.60% during 2025-2034.

Asia Pacific is expected to lead the global scaffolding market during the forecast period.

China is a key contributor to the global scaffolding market, fueled by its large construction sector, which accounts for over 25% of global construction output. Continuous infrastructure expansion, urbanization, and mega-projects sustain its dominant role in global demand.

By 2034, the supported scaffolding segment is expected to lead the market owing to its versatility, strength, and broader use in extensive infrastructure and construction projects worldwide.

The key players profiled in the global scaffolding market include Layher Holding GmbH & Co. KG, PERI Group, Altrad Group, BrandSafway, ULMA Construction, Waco Kwikform, Instant Upright, MJ-Gerüst GmbH, KHK Scaffolding & Formwork, CETA SPA, ADTO Group, Lahyer GmbH, Sunshine Enterprise, Safway Services LLC, and Rizhao Fenghua Scaffoldings Co., Ltd.

The scaffolding market is highly fragmented, with several regional and global players competing on innovation, price, and service. Leading companies focus on safety compliance, product quality, and expanding rental services to maintain market share.

The report examines key aspects of the scaffolding market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed