Rodenticides Market Size, Share, Trends, Growth 2032

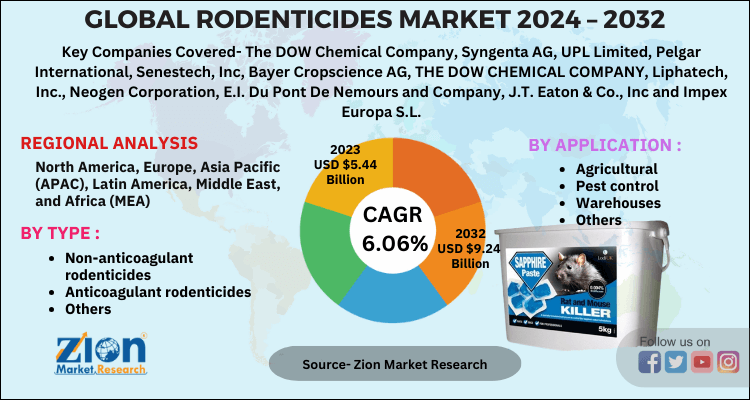

Rodenticides Market By Type (Non-anticoagulant rodenticides, Anticoagulant rodenticides, and others) By Application (Agricultural, Pest control, Warehouses, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

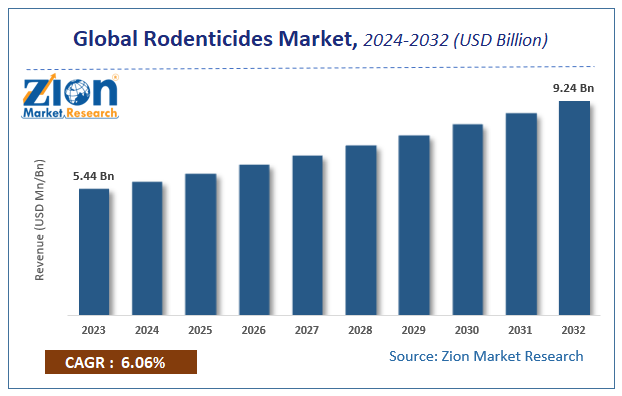

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.44 Billion | USD 9.24 Billion | 6.06% | 2023 |

Rodenticides Market Insights

Zion Market Research has published a report on the global Rodenticides Market, estimating its value at USD 5.44 Billion in 2023, with projections indicating that it will reach USD 9.24 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.06% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Rodenticides Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Rodenticides Market: Overview

Rodenticides are pesticides that kill rodents. They are usually formulated as baits, which are designed to attract animals. Rodent control products are witnessing high demand in most major tier-1 globally. Key players in the market are involved in innovation and development of new products to effectively control rodent population. Increasing number of commercial complexes, restaurants and hotels, and high preference for hygiene standards are expected to propel their demand in the coming years. However, Due to different rules imposed by the governing organizations the companies majorly aim on R&D for eco-friendly 7 innovating rodenticides, boosting the global rodenticides market.

Rodenticides are the chemical pesticides used for killing rodents. Rodents can be rats, mice, squirrels, woodchucks, chipmunks and other animals in some cases. Rodenticides are either anticoagulants or non anticoagulants depending on their function of coagulation. Natural rodenticides are those prepared using natural constituents and are generally environmental friendly.

Rodenticides Market: Growth Factors

Reduction of arable land and ever increasing population are likely to propel the requirement for rodenticides market in the forecast period. The agricultural industry is getting enhanced all over the world. This is expected to show high employment of rodenticides market. Government programs for enhancing the agricultural industry for satisfying the food needs from increasing population help the development of global rodenticides market. On the other hand, the affect of rodenticides on children and even on domestic animals might hamper the rodenticides market. In addition, stringent rules implied by the government on the excess employment of rodenticides in some of the areas might limit the development of the rodenticides market.

There has been the huge rise in the agricultural sector which has led to high consumption of various pesticides to gain high productivity. This factor is likely to assist the high rodenticides market growth. Moreover, high accomplishment from the government to improve the productivity of food to satisfy the requirement from the ever increasing population is likely to spur the growth of the rodenticides market in the coming years. Usage of rodenticides adversely affects domestic animals and children which have resulted into, laws and regulations for the use of rodenticides in definite regions.

This, in turn, may hamper the growth of rodenticides market in the near future. Introduction of natural harmless rodenticides is likely to open new avenues for the growth of rodenticides within the forecast period. In addition, high demand for natural rodenticides is expected to present the market with adequate opportunities in the forecast period.

However, the agricultural industry is flourishing in the up-and-coming nations. This might possibly offer new opportunities for the global rodenticides market. In addition to this, the roll out of natural rodenticides may unlock new opportunities for the development of the global rodenticides market in the years to come.

Moreover, the rising R&D by different academic and government bodies is expected to fuel the development of the rodenticides market. For example, in March 2018, study examining the likelihood of resistance to anticoagulant rodenticides was performed on House mice and Brown Rats (also known as Irish Norway Rats). Resistance to most of the anticoagulant rodenticides in mice and rats has been seen in south-west Scotland and parts of southern & central England, as well as in other European nations in populations of these species. On the other hand, till the research, no info was available on the prevalence of such resistance in Ireland.

Rodenticides Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rodenticides Market |

| Market Size in 2023 | USD 5.44 Billion |

| Market Forecast in 2032 | USD 9.24 Billion |

| Growth Rate | CAGR of 6.06% |

| Number of Pages | 150 |

| Key Companies Covered | The DOW Chemical Company, Syngenta AG, UPL Limited, Pelgar International, Senestech, Inc, Bayer Cropscience AG, THE DOW CHEMICAL COMPANY, Liphatech, Inc., Neogen Corporation, E.I. Du Pont De Nemours and Company, J.T. Eaton & Co., Inc and Impex Europa S.L. |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rodenticides Market: Segment Analysis Preview

On the basis of Type, Rodenticides market has been divided as Non-anticoagulant rodenticides, Anticoagulant rodenticides, and others. Anticoagulant rodenticides segment held the major share in the market.

On the basis of Application, the market is segmented into Agricultural, Pest control, Warehouses, amd Others. Warehouses dominated the Rodenticides industry in 2020, accounting for almost 38.2% of total Rodenticides sales. Thus, the growth potential in warehouses is projected to remain higher than the other application.

Rodenticides Market: Regional Analysis Preview

North America garbed the biggest chunk of share for rodenticides market in 2020. The main cause of the development of the rodenticides market in this area is government supporting for the cultivation of high superiority food, owing to reducing arable land.

Key Market Players & Competitive Landscape

The major players operating Rodenticides market are:

- The DOW Chemical Company

- Syngenta AG

- UPL Limited

- Pelgar International

- Senestech, Inc

- Bayer Cropscience AG

- THE DOW CHEMICAL COMPANY

- Liphatech, Inc.

- Neogen Corporation

- E.I. Du Pont De Nemours and Company

- J.T. Eaton & Co., Inc

- Impex Europa S.L.

The global Rodenticides Market is segmented as follows:

By Type

- Non-anticoagulant rodenticides

- Anticoagulant rodenticides

- Others

By Application

- Agricultural

- Pest control

- Warehouses

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Rodenticides Market was valued at US$ 5.44 Billion in 2023.

The global Rodenticides Market is expected to reach US$ 9.24 Billion by 2032 at a CAGR of about 6.06% from 2024 to 2032.

Some of the key factors driving the global Rodenticides Market growth are government programs for enhancing the agricultural industry for satisfying the food needs from increasing population.

North America garbed the biggest chunk of share for rodenticides market in 2023. The main cause of the development of the rodenticides market in this area is government supporting for the cultivation of high superiority food, owing to reducing arable land.

Some of the major players of global Rodenticides market includes The DOW Chemical Company, Syngenta AG, UPL Limited, Pelgar International, Senestech, Inc, Bayer Cropscience AG, THE DOW CHEMICAL COMPANY, Liphatech, Inc., Neogen Corporation, E.I. Du Pont De Nemours and Company, J.T. Eaton & Co., Inc and Impex Europa S.L.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed