Global Robotic Cutting, Deburring, and Finishing Market Size, Share - Forecast 2034

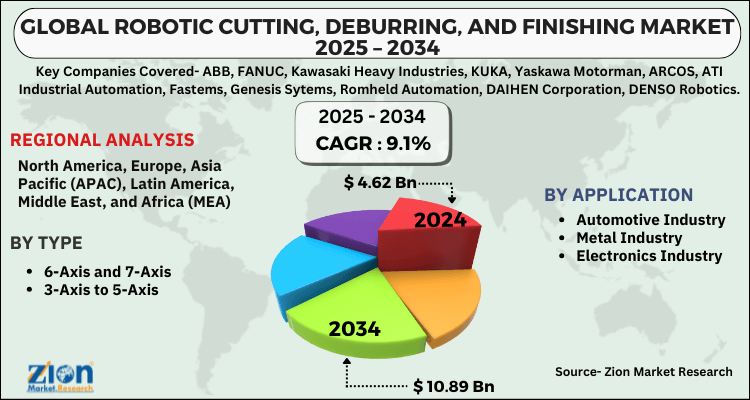

Robotic Cutting, Deburring, and Finishing Market By Type (6-Axis and 7-Axis, 3-Axis to 5-Axis), By Applications (Automotive Industry, Metal Industry, Electronics Industry, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

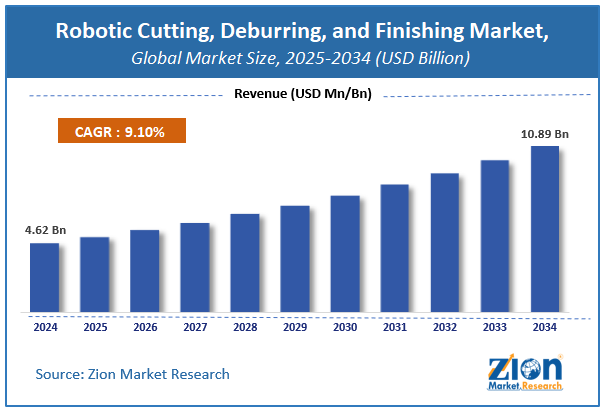

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.62 Billion | USD 10.89 Billion | 9.1% | 2024 |

Robotic Cutting, Deburring, and Finishing Market Size

The global robotic cutting, deburring, and finishing market size was worth around USD 4.62 Billion in 2024 and is predicted to grow to around USD 10.89 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.1% between 2025 and 2034.

The report analyzes the global robotic cutting, deburring, and finishing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the robotic cutting, deburring, and finishing industry.

Robotic Cutting, Deburring, and Finishing Market: Overview

Manufacturing industries eventually began to see the long-term financial and operational advantages of cutting, deburring, and finishing robots over traditional machinery and began to incorporate these robots into their production facilities. The global robotic cutting, deburring, and finishing market began to gain traction as a result of its advantages over traditional cutting, deburring, and finishing instruments. The need for industrial robots is always increasing due to the manufacturing sector's need for high productivity and accuracy over the forecast period. Over traditional manufacturing and production processes, automation and artificial intelligence (AI) boost accuracy, speed, and innovation, which is propelling the market growth.

The introduction of artificial intelligence, machine learning, IIoT, and human-machine interface technology has expanded the Robotics Market with important applications in digitalization industry verticals like healthcare, logistics, manufacturing, defense, entertainment, and others. Growth factors such as increased concern for and development of energy-efficient drive systems, as well as intense competition among industrial verticals to shift toward sophisticated technology and automation, are primarily driving the Robotics Market Growth.

Key Insights

- As per the analysis shared by our research analyst, the global robotic cutting, deburring, and finishing market is estimated to grow annually at a CAGR of around 9.1% over the forecast period (2025-2034).

- Regarding revenue, the global robotic cutting, deburring, and finishing market size was valued at around USD 4.62 Billion in 2024 and is projected to reach USD 10.89 Billion by 2034.

- The robotic cutting, deburring, and finishing market is projected to grow at a significant rate due to increasing demand for automation in manufacturing, advancements in robotics and AI, labor cost reduction, and the need for precision and efficiency in industrial processes.

- Based on Type, the 6-Axis and 7-Axis segment is expected to lead the global market.

- On the basis of Applications, the Automotive Industry segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Robotic Cutting, Deburring, and Finishing Market: Growth

Robotic Cutting, Deburring, and Finishing Market: Driver

The electronics sector is undergoing a period of continuous innovation and sophistication. Due to the trend toward smaller, lighter, and slimmer electronic goods such as smartphones and tablets, the structure of microchips in electronic devices is getting more compact. Components like as integrated circuits, diodes, transistors, and resistors are becoming shrunk at an increasing rate and cannot be accurately perceived with the naked human eye. Since the increased demand for smartphones, gaming consoles, and wearable devices, the electronics industry is expecting greater growth during the projection period. According to the leading electronic component makers, economies of scale and smart factory deployment have considerably reduced production costs.

Robotic Cutting, Deburring, and Finishing Market: Restraint

With the increased usage of robotics, the demand for human labor will reduce significantly as it provides greater accuracy and precision. The increasing usage of CNC machines, as well as the possibility of job loss, are projected to halt the growth of this business in the next years. Technical complexity and greater starting cost price are two market restrictions. These are having a negative effect on market growth. Robot development in R&D necessitates the use of numerous sensors such as gesture, motion, and voice recognition sensors. Since most products are pricey, finding materials at a reasonable price is difficult.

Robotic Cutting, Deburring, and Finishing Market: Segmentation Analysis

The Robotic Cutting, Deburring, and Finishing Market are segregated based on Type, and Applications.

By Applications, the market is classified into Automotive Industry, Metal Industry, Electronics Industry, and Others. During the manufacturing process, automotive assembly lines include industrial robots for a variety of functions including assembly, material handling, material removal, and welding. Cutting, deburring, and finishing robots have enabled the automobile industry to improve the precision of their old manufacturing processes, allowing them to be transformed into more efficient manufacturing methods.

By Type, the market is classified into 6-Axis and 7-Axis, 3-Axis to 5-Axis. The 6-Axis and 7-Axis are expected to dominate the market in the forecast period. As their range of motion is almost equivalent to that of a human arm, six-axis robots are the industry standard for robotic automation. However, as robots have improved, so has the complexity of applications, prompting some manufacturers to automate using high-DOF robots, primarily seven-axis models.

Robotic Cutting, Deburring, and Finishing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Robotic Cutting, Deburring, and Finishing Market |

| Market Size in 2024 | USD 4.62 Billion |

| Market Forecast in 2034 | USD 10.89 Billion |

| Growth Rate | CAGR of 9.1% |

| Number of Pages | 199 |

| Key Companies Covered | ABB, FANUC, Kawasaki Heavy Industries, KUKA, Yaskawa Motorman, ARCOS, ATI Industrial Automation, Fastems, Genesis Sytems, Romheld Automation, DAIHEN Corporation, DENSO Robotics, Staubli International AG, Universal Robots, Comau, and others. |

| Segments Covered | By Type, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In 2021, Kuka AG unveiled the first version of its new operating system, iiQKA.OS, which will greatly simplify robot use. This new operating system serves as the foundation for a whole ecosystem, offering a diverse range of programs, components, apps, equipment, and services.

- In 2021, Kawasaki Heavy Industries, Ltd. announced the completion of the installation of Japan's indigenous automated PCR testing (Polymerase Chain Reaction) system at Fujita Health University in Aichi, using Kawasaki robots.

Robotic Cutting, Deburring, and Finishing Market: Regional Landscape

The Asia Pacific is estimated to be dominant in the global market in the forecast period. The rising population and disposable income of individuals boost consumption of consumer goods and other products, resulting in increased production capacity and market size. As the region's population ages, government institutions in the region intend to rely increasingly on robots than on humans.

The North American Region was an early supporter of industrial robots because of modest manufacturing expansion and industrial automation. The leading country, the United States, is at the top due to a higher rate of robot adoption. The North American regional market is expanding as a result of the rising deployment of robots in industrial and domestic settings. The region's regional market is being driven by the advanced expansion and development of cutting-edge robotics technology.

Robotic Cutting, Deburring, and Finishing Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the robotic cutting, deburring, and finishing market on a global and regional basis.

The global robotic cutting, deburring, and finishing market is dominated by players like:

- ABB

- FANUC

- Kawasaki Heavy Industries

- KUKA

- Yaskawa Motorman

- ARCOS

- ATI Industrial Automation

- Fastems

- Genesis Sytems

- Romheld Automation

- DAIHEN Corporation

- DENSO Robotics

- Staubli International AG

- Universal Robots

- Comau

The global robotic cutting, deburring, and finishing market is segmented as follows;

By Type

- 6-Axis and 7-Axis

- 3-Axis to 5-Axis

By Applications

- Automotive Industry

- Metal Industry

- Electronics Industry

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global robotic cutting, deburring, and finishing market is expected to grow due to rising for high precision and efficiency, increasing automation in manufacturing, advancements in robotics and AI, and growing adoption in automotive, aerospace, and metal industries.

According to a study, the global robotic cutting, deburring, and finishing market size was worth around USD 4.62 Billion in 2024 and is expected to reach USD 10.89 Billion by 2034.

The global robotic cutting, deburring, and finishing market is expected to grow at a CAGR of 9.1% during the forecast period.

Asia-Pacific is expected to dominate the robotic cutting, deburring, and finishing market over the forecast period.

Leading players in the global robotic cutting, deburring, and finishing market include ABB, FANUC, Kawasaki Heavy Industries, KUKA, Yaskawa Motorman, ARCOS, ATI Industrial Automation, Fastems, Genesis Sytems, Romheld Automation, DAIHEN Corporation, DENSO Robotics, Staubli International AG, Universal Robots, Comau, among others.

The report explores crucial aspects of the robotic cutting, deburring, and finishing market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed