Residential Single Family Roofing Market Size & Forecast 2034

Residential Single Family Roofing Market By Type (Asphalt Shingles, Concrete & Clay Tile Roofs, Metal Roofs, Plastic Roofs, and Others), By Application (New Construction, Roof Replacement, Roof Repair & Maintenance, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

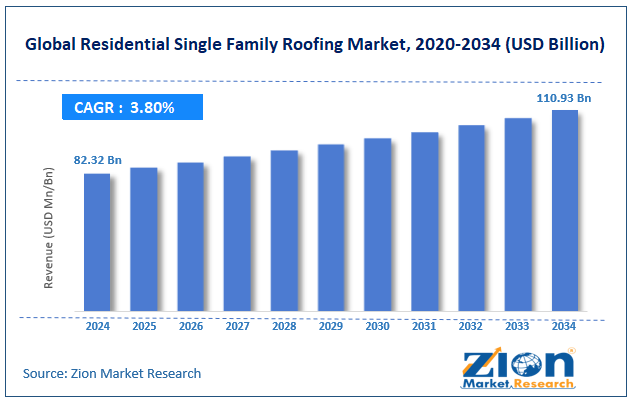

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 82.32 Billion | USD 110.93 Billion | 3.80% | 2024 |

Residential Single Family Roofing Industry Perspective:

The global residential single family roofing market size was worth around USD 82.32 billion in 2024 and is predicted to grow to around USD 110.93 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global residential single family roofing market is estimated to grow annually at a CAGR of around 3.80% over the forecast period (2025-2034)

- In terms of revenue, the global residential single family roofing market size was valued at around USD 82.32 billion in 2024 and is projected to reach USD 110.93 billion by 2034.

- The residential single family roofing market is projected to grow significantly owing to increasing reroofing and roof replacement demand, growth of suburban housing projects, and government incentives for energy-efficient roofing.

- Based on type, the asphalt shingles segment is expected to lead the market, while the metal roofs segment is expected to grow considerably.

- Based on application, the roof replacement segment is the dominating segment, while the new construction segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Residential Single Family Roofing Market: Overview

The residential single family roofing market encompasses roofing installation services and materials for standalone homes, comprising asphalt shingles, clay and concrete tiles, metal roofs, and emerging eco-roofing options like green and solar roofs. The global residential single family roofing market is poised for notable growth owing to the aging roof inventories, storm-induced replacement after disasters, and detached housing growth in emerging countries. Several single family homes are reaching the end of their roof lifespan, triggering regular replacements. Homeowners mostly opt for long-lasting and durable materials to minimize future maintenance. This creates a stable and recurring demand for roofing material suppliers and contractors.

Moreover, severe weather like high winds, storms, and hail often damages roofs, increasing the urgent need for replacements. Insurance claims usually accelerate these replacement and repair decisions. Contractors experience recurring demand in regions prone to harsh weather events. Furthermore, speedy urbanization in the developing markets is raising the construction of single-family homes. Every new home needs a roof installation, generating first-time roofing demand. Developers usually choose materials that balance cost, durability, and aesthetic appeal.

Nevertheless, the global market faces limitations due to factors such as high upfront costs for premium roofs and input price instability for roofing materials. Professional installation and premium roofing materials require a significant investment. Several homeowners delay replacements due to budget restrictions. High costs restrict the adoption of long-lasting and advanced roofing solutions. Similarly, varying costs of asphalt, composite materials, and metals create pricing instability. Contractors may delay projects or adjust quotes to protect margins. This unpredictability may slow the industry's growth.

Still, the global residential single family roofing industry benefits from several favorable factors like impact-resistant and fire-related premium systems, solar-integrated roofing, and cool roof and reflective tile adoption. High-risk areas fuel the demand for fire-rated and impact-resistant roofing. Homeowners are willing to invest in long-term protection and insurance benefits. Contractors can increase their offerings with these high-value solutions. Solar shingles and integrated photovoltaic roofs blend protection with energy generation. They streamline installation and raise property value. This offers a progressing domain for both installers and suppliers. Additionally, heat-reflective and energy-efficient roofing materials are gaining prominence in hot climates. Homeowners value reduced cooling requirements and enhanced comfort. Suppliers and builders benefit from sustained solutions.

Residential Single Family Roofing Market Dynamics

Growth Drivers

How are growing renovation and roof replacement activities driving the residential single family roofing market?

Home renovation and roof replacement activities have increased worldwide because of aging infrastructure and extreme weather events. In North America alone, the roof replacement industry was valued at USD 20.5 billion in 2024, with a yearly growth rate of 4-5%, as per IBISWorld. Recent storms and hurricanes in the United States, including Hurricane Idalia in 2024, caused wider roof damage, triggering urgent replacements. Renovation projects in Australia and Europe also reflect similar trends, with homeowners upgrading to aesthetically appealing and durable roofing. This continuous replacement cycle promises a stable demand for materials like clay tiles, metal, and asphalt shingles.

How are technological improvements in roofing materials fueling the residential single family roofing market?

Advancements in roofing technologies are majorly propelling the growth of the residential single family roofing market. Manufacturers are launching more durable, lighter, and weather-resistant materials like polymer-modified asphalt shingles, recycled plastic roofing, and metal composites.

A 2025 report underscored that metal roofing adoption is surging at a 6.2% CAGR because of enhanced fore resistance and longevity. News from CertinTeed denotes the introduction of hybrid roofing solutions blending solar panels and advanced insulation. These technological improvements enhance roofing lifespan, attract homeowners seeking modern solutions, and reduce maintenance costs, fueling replacement projects and new installations.

Restraints

Competition from alternative roofing solutions adversely impacts the market progress

The growth of alternative roofing solutions like cool roofs and prefabricated roofing panels offers a restriction to conventional materials like clay tiles and asphalt. As per the reports for 2025, the adoption of reflective and green roofing is progressing at a CAGR of 8.3% worldwide, diverting the demand from traditional roofing. News from the Netherlands and Germany signifies elevated municipal mandates for energy-efficient and green roofs in new residential projects. This move reduces the industry share for standard single family roofing materials, compelling traditional manufacturers to face dropping sales or advance products.

Opportunities

How does technological integration with smart homes present favorable prospects for the residential single family roofing market expansion?

The integration with smart home technologies creates new revenue streams. Energy-monitoring systems, IoT-enabled roof maintenance devices, and solar shingles are highly popular. A 2025 report predicts a 9.2% CAGR for smart flooring solutions in the coming five years. News from the United States underscores that Tesla's solar roof adoption is mounting among residential users, creating a standard in the residential single family roofing industry. Leveraging technology allows manufacturers to differentiate products and tap into the premium home industry.

Challenges

Regulatory and compliance pressures restrict the market growth

Compliance with progressing building codes and environmental regulations offers ongoing challenges. The EU Construction Products Regulation and the International Building Code (IBC 2024) mandate stringent performance, energy standards, and safety. News from 2025 underscores project delays because of new eco-compliance approvals for roofing solutions. Promising adherence raises costs and extends project timelines, especially in small-scale manufacturers; regulatory pressures, hence, act as a continuous barrier to speedy industry growth.

Residential Single Family Roofing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Residential Single Family Roofing Market |

| Market Size in 2024 | USD 82.32 Billion |

| Market Forecast in 2034 | USD 110.93 Billion |

| Growth Rate | CAGR of 3.80% |

| Number of Pages | 213 |

| Key Companies Covered | GAF, Owens Corning, CertainTeed (Saint-Gobain), IKO Industries, TAMKO Building Products, Atlas Roofing Corporation, Malarkey Roofing Products, Firestone Building Products, Carlisle Construction Materials, Boral Roofing, Brava Roof Tile, DaVinci Roofscapes, Ludowici Roof Tile, Duro-Last Roofing, PABCO Roofing Products, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Residential Single Family Roofing Market: Segmentation

The global residential single family roofing market is segmented based on type, application, and region.

Based on type, the global residential single family roofing industry is divided into asphalt shingles, concrete & clay tile roofs, metal roofs, plastic roofs, and others. The Asphalt shingles segment held a dominating share of the market because of their cost-effectiveness and easy installation. They offer reliable durability and come in a variety of colors and styles for aesthetic appeal. Contractors and homeowners favor them for both reroofing and construction projects. Their broad availability and versatility make asphalt shingles the dominating segment in the industry.

On the other hand, the metal roofs segment held a second-leading share for their low-maintenance, long lifespan, and better resistance to extreme weather conditions. They offer energy efficiency benefits through reflective coatings and can be installed over existing roofs. The surging preference for sustainable and premium materials fuels their adoption. This ranks metal roofing as the second-dominating segment in the industry.

Based on application, the global residential single family roofing market is segmented into new construction, roof replacement, roof repair & maintenance, and others. The roof replacement is the leading application segment since many homes suffer damage from weather events or reach the end of their roof lifespan. Homeowners prioritize replacement to promise safety, durability, and compliance with building codes. Insurance-driven replacements also add significantly to the industry volume. This surges the dominance of the said segment.

Conversely, the new construction segment holds a second rank since it fuels the demand for first-time roof installations in both emerging and developed regions. Homeowners and developers usually select energy-efficient and durable materials during construction. The steady growth of single-family housing in urbanizing regions backs the segmental prominence. It ranks as the second-leading segment because of continuous residential development.

Residential Single Family Roofing Market: Regional Analysis

Why does North America hold a dominant position in the global Residential single-family roofing Market?

North America is projected to maintain its dominant position in the global residential single family roofing market owing to high homeownership and large existing housing stock, substantial renovation and remodeling culture, and frequent severe weather events. North America holds the leading homeownership rates worldwide, with more than 65% of households owning single-family homes. The large existing housing stock needs frequent replacement and reroofing cycles. This continuous replacement demand sustains the roofing industry throughout the year. Homeowners in Canada and the United States heavily invest in home improvement projects, including roofs.

The United States remodeling industry alone recently surpassed USD 400 billion, with exterior upgrades as a top category. This fuels ongoing demand for premium roofing materials and professional installation. Regions like the Midwest, the U.S. Gulf Coast, and parts of Canada face hail, hurricanes, storms, and high winds regularly. NOAA reports show billions in annual property damage from these events. This fuels urgent insurance-related replacement and reroofing projects.

Europe maintains its position as the second-leading region in the global residential single family roofing industry due to the strong existing housing stock and renovation activity, government regulations and building costs, and weather and climate-related roof replacements. Europe holds a sophisticated residential industry with a large share of single family homes, especially in nations like the UK, France, and Germany. Reroofing and renovation are common, as homes age and need maintenance.

The European home improvement industry is valued at more than Euro 300 billion every year, backing continuous roofing demand. European nations enforce stringent building codes, focusing on energy efficiency, weather resistance, and fire safety. Roof replacements usually need compliance with sustainability standards and insulation. This fuels the adoption of energy-efficient and high-class roofing materials.

Additionally, several regional nations witness heavy rain, storms, and snow, which may negatively impact the lifespan of the roof. Central and Northern Europe usually need durable materials like metal and tiles for long-term protection. Local regulations and insurance motivate timely replacement, sustaining industry demand.

Residential Single Family Roofing Market: Competitive Analysis

The leading players in the global residential single family roofing market are:

- GAF

- Owens Corning

- CertainTeed (Saint-Gobain)

- IKO Industries

- TAMKO Building Products

- Atlas Roofing Corporation

- Malarkey Roofing Products

- Firestone Building Products

- Carlisle Construction Materials

- Boral Roofing

- Brava Roof Tile

- DaVinci Roofscapes

- Ludowici Roof Tile

- Duro-Last Roofing

- PABCO Roofing Products

Residential Single Family Roofing Market: Key Market Trends

Integration of solar and photovoltaic systems:

Rooftops are progressively used to generate electricity through building-integrated photovoltaics (BIPV) and solar shingles. These solutions assimilate energy generation and protection. Government initiatives and rebates are amplifying the adoption.

Digitalization and use of advanced technology:

Contractors are adopting AI-based inspection tools, remote estimating platforms, and drones. This enhances accuracy, speeds up project execution, and reduces labor time. Digital platforms also improve lead generation, overall industry efficiency, and customer engagement.

Rise of premium and durable roofing materials:

Materials like synthetic slate, impact-resistant asphalt, and metal shingles are becoming more prominent. Homeowners prefer low-maintenance and long-lasting solutions that can tolerate extreme weather. This trend is developing the market for high-value roofing products.

The global residential single family roofing market is segmented as follows:

By Type

- Asphalt Shingles

- Concrete & Clay Tile Roofs

- Metal Roofs

- Plastic Roofs

- Others

By Application

- New Construction

- Roof Replacement

- Roof Repair & Maintenance

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The residential single family roofing market encompasses roofing installation services and materials for standalone homes, comprising asphalt shingles, clay and concrete tiles, metal roofs, and emerging eco-roofing options like green and solar roofs.

Which key factors will influence the residential single family roofing market growth over 2025-2034?

The global residential single family roofing market is projected to grow due to rising new single-family home construction, advancements in roofing materials and technologies, increasing disposable incomes, and home improvement spending.

According to study, the global residential single family roofing market size was worth around USD 82.32 billion in 2024 and is predicted to grow to around USD 110.93 billion by 2034.

The CAGR value of the residential single family roofing market is expected to be around 3.80% during 2025-2034.

What are the emerging trends and innovations impacting the residential single family roofing market?

Emerging trends include solar-integrated roofing, energy-efficient cool roofs, digital inspections, premium durable materials, and AI-driven project management.

The value chain includes roofing material manufacturing, raw material production, contractor installation, distribution and wholesale, and post-installation maintenance and services.

Regulatory and environmental factors include energy-efficiency standards, building codes, zoning laws, fire and impact resistance requirements, and sustainability or green roofing incentives.

North America is expected to lead the global residential single family roofing market during the forecast period.

The key players profiled in the global residential single family roofing market include GAF, Owens Corning, CertainTeed (Saint-Gobain), IKO Industries, TAMKO Building Products, Atlas Roofing Corporation, Malarkey Roofing Products, Firestone Building Products, Carlisle Construction Materials, Boral Roofing, Brava Roof Tile, DaVinci Roofscapes, Ludowici Roof Tile, Duro-Last Roofing, and PABCO Roofing Products.

The report examines key aspects of the residential single family roofing market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed