Global Regulatory Reporting Solutions Market Size, Share, Growth Analysis Report - Forecast 2034

Regulatory Reporting Solutions Market By Industry (Wealth & Asset Management, Banks, Securities & Investments, Insurance), By Application (Regulatory Compliance, Risk Management, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

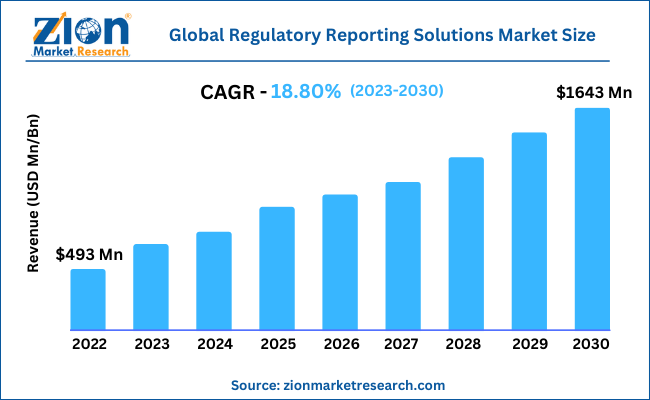

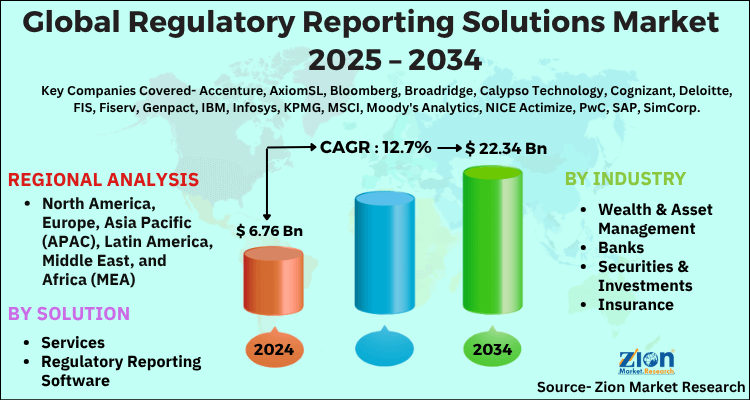

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.76 Billion | USD 22.34 Billion | 12.7% | 2024 |

Global Regulatory Reporting Solutions Market: Industry Perspective

The global regulatory reporting solutions market size was worth around USD 6.76 Billion in 2024 and is predicted to grow to around USD 22.34 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 12.7% between 2025 and 2034. The report analyzes the global regulatory reporting solutions market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the regulatory reporting solutions industry.

The report analyzes the global regulatory reporting solutions market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the regulatory reporting solutions industry.

Global Regulatory Reporting Solutions Market: Overview

The regulatory reporting solutions market is a part of the larger financial technology (FinTech) industry that deals with providing software solutions to financial agencies that ensures compliance with regulatory requirements imposed on the entity. The solutions are responsible for automating the process of data collection, analysis, and submission to the concerned regulatory authority or agencies.

This software is programmed to ensure that financial entities are not at risk of errors or penalties and other legal concerns. The industry includes various software providers along with service-related companies and caters to the needs of units such as banking, insurance, and other financial industries. During the forecast period, the market is expected to grow at a high CAGR mainly due to the rising complexities involved in financial dealings and the dynamic nature of the regulatory measures.

Global Regulatory Reporting Solutions Market: Growth Drivers

Growing regulatory compliance requirements to propel market growth

The global regulatory reporting solutions market is projected to grow owing to the increasing requirements of regulatory compliance across the world. Regional governments and the respective regulatory bodies are getting strict in terms of ensuring that financial companies operating the economy meet all the necessary compliance needs stated by the law. Several countries have initiated implementation programs to ensure that finance companies meet the rules and regulations of the economy they are operational. This is due to the growing complexities in business operations and companies taking certain rules slightly especially in politically weak nations. In addition to this, the growing investment toward technological advancements such as the use of artificial intelligence (AI), machine learning (ML), and big data analytics can assist in improved performance and thus lead to more consumers in the industry.

Restraints:

High complexity of regulatory requirements

In most cases, regulatory requirements are extremely complex. Furthermore, these rules may keep changing as the nation witnesses higher growth and a larger influx of international businesses. This means that companies dealing in developing regulatory reporting solutions may find it difficult to keep up with the dynamic landscape. Furthermore, the implementation and operational cost of such solutions is extremely high as it requires intensive information technology (IT) infrastructure.

Opportunities:

Growing integration with other technologies to provide growth opportunities

The global regulatory reporting solutions market is projected to come across more growth opportunities due to the growing integration of regulatory reporting solutions with other essential technologies such as blockchain. This can drastically improve the overall performance of the program and ensure better safety against cyber-crimes, which is a leading cause of concern in the market. Additionally, the growing research on improving data analytics systems could work in the favor of the market since it will help identify patterns, trends, and insights that can transform business decisions and strategies.

Challenges:

Vendor consolidation to challenge the market expansion

The global regulatory reporting solutions industry is highly competitive due to the recent emergence of multiple smaller players along with the rising number of existing players. This has led to a severe lack of vendor consolidation which can effectively limit the choices available to financial institutions causing a rise in the involved cost. Moreover, constant changes in the regulatory framework could pose an additional roadblock in the industry.

Key Insights

- As per the analysis shared by our research analyst, the global regulatory reporting solutions market is estimated to grow annually at a CAGR of around 12.7% over the forecast period (2025-2034).

- Regarding revenue, the global regulatory reporting solutions market size was valued at around USD 6.76 Billion in 2024 and is projected to reach USD 22.34 Billion by 2034.

- The regulatory reporting solutions market is projected to grow at a significant rate due to Growing complexity of compliance requirements in banking, finance, and healthcare drives demand.

- Based on Industry, the Wealth & Asset Management segment is expected to lead the global market.

- On the basis of Application, the Regulatory Compliance segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Global Regulatory Reporting Solutions Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Regulatory Reporting Solutions Market |

| Market Size in 2024 | USD 6.76 Billion |

| Market Forecast in 2034 | USD 22.34 Billion |

| Growth Rate | CAGR of 12.7% |

| Number of Pages | 212 |

| Key Companies Covered | Accenture, AxiomSL, Bloomberg, Broadridge, Calypso Technology, Cognizant, Deloitte, FIS, Fiserv, Genpact, IBM, Infosys, KPMG, MSCI, Moody's Analytics, NICE Actimize, PwC, SAP, SimCorp, SS&C Technologies, State Street, Synechron, TCS, Temenos, and Wolters Kluwer., and others. |

| Segments Covered | By Industry, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Regulatory Reporting Solutions Market: Segmentation

The global regulatory reporting solutions market is segmented based on industry, solution, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on industry, the global market segments are wealth & asset management, banks, securities & investments, and insurance. The industry witnessed the highest growth in the bank segment as the banking industry is one of the largest consumers of regulatory reporting solutions. Banks, in general, are subject to a wide range of dynamic regulations that requires them to collect data on several aspects of business operations including capital adequacy, liquidity, risk management, and anti-money laundering.

On the basis of Application, the global regulatory reporting solutions market is bifurcated into Regulatory Compliance, Risk Management, Others.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Recent Developments:

- In April 2024, eflow Global, a UK-based regulatory technology company, announced major updates for its regulatory reporting platform called TZTR. The new version will be working along with trade surveillance developed by eflow and its most efficient execution software TZ to provide more holistic solutions to its clients

- In March 2024, ICICI Bank announced the launch of a range of digital solutions for its customers in the capital market along with clients from the custody services sector. These new solutions will allow foreign portfolio investors (FPIs), stock brokers, foreign direct investors, portfolio management service (PMS) providers, and alternative investment funds (AIF) to meet all the necessary banking requirements

Global Regulatory Reporting Solutions Market: Regional Analysis

The Regulatory Reporting Solutions market exhibits strong regional variations driven by differences in financial regulations, technological infrastructure, and market maturity. North America leads the market due to the presence of major financial institutions, stringent compliance requirements from regulators like the SEC and FINRA, and early adoption of advanced reporting technologies. Europe follows closely, with initiatives like MiFID II and GDPR pushing financial firms to invest in robust reporting tools to ensure transparency and data governance. The Asia-Pacific region is experiencing rapid growth, fueled by expanding financial sectors, evolving regulatory landscapes, and increased focus on digital transformation in countries like China, India, and Singapore. Meanwhile, regions such as Latin America and the Middle East are gradually adopting regulatory reporting solutions as financial ecosystems mature and regulatory oversight intensifies, particularly in banking and capital markets.

Global Regulatory Reporting Solutions Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the regulatory reporting solutions market on a global and regional basis.

The global regulatory reporting solutions market is dominated by players like:

- Accenture

- AxiomSL

- Bloomberg

- Broadridge

- Calypso Technology

- Cognizant

- Deloitte

- FIS

- Fiserv

- Genpact

- IBM

- Infosys

- KPMG

- MSCI

- Moody's Analytics

- NICE Actimize

- PwC

- SAP

- SimCorp

- SS&C Technologies

- State Street

- Synechron

- TCS

- Temenos

- Wolters Kluwer.

Global Regulatory Reporting Solutions Market: Segmentation Analysis

The global regulatory reporting solutions market is segmented as follows;

By Industry

- Wealth & Asset Management

- Banks

- Securities & Investments

- Insurance

By Solution

- Services

- Regulatory Reporting Software

Global Regulatory Reporting Solutions Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The regulatory reporting solutions market is a part of the larger financial technology (FinTech) industry that deals with providing software solutions to financial agencies that ensures compliance with regulatory requirements imposed on the entity. The solutions are responsible for automating the process of data collection, analysis, and submission to the concerned regulatory authority or agencies.

The global regulatory reporting solutions market is expected to grow due to Growing complexity of compliance requirements in banking, finance, and healthcare drives demand.

According to a study, the global regulatory reporting solutions market size was worth around USD 6.76 Billion in 2024 and is expected to reach USD 22.34 Billion by 2034.

The global regulatory reporting solutions market is expected to grow at a CAGR of 12.7% during the forecast period.

North America is expected to dominate the regulatory reporting solutions market over the forecast period.

Leading players in the global regulatory reporting solutions market include Accenture, AxiomSL, Bloomberg, Broadridge, Calypso Technology, Cognizant, Deloitte, FIS, Fiserv, Genpact, IBM, Infosys, KPMG, MSCI, Moody's Analytics, NICE Actimize, PwC, SAP, SimCorp, SS&C Technologies, State Street, Synechron, TCS, Temenos, and Wolters Kluwer., among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed