Recruitment And Staffing Market Size, Share, Trends, Growth & Forecast 2034

Recruitment And Staffing Market By Service Type (Permanent Staffing, Temporary Staffing, Executive Search, and Others), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By Industry Vertical (IT & Telecommunications, BFSI, Healthcare, Retail, Manufacturing, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

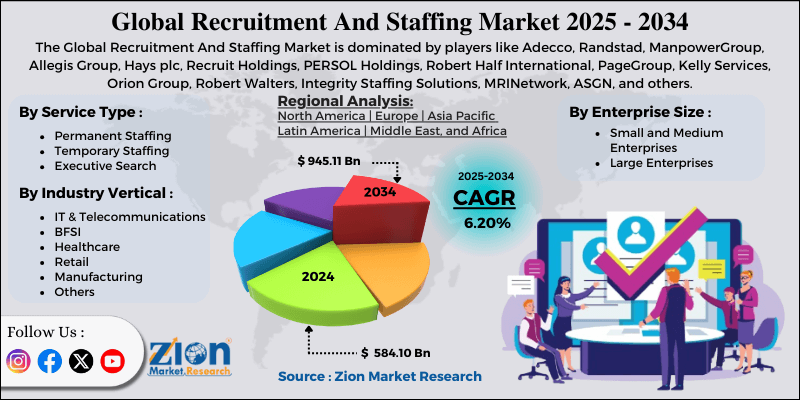

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 584.10 Billion | USD 945.11 Billion | 6.20% | 2024 |

Recruitment And Staffing Industry Perspective:

The global recruitment and staffing market size was around USD 584.10 billion in 2024 and is projected to reach USD 945.11 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global recruitment and staffing market is estimated to grow annually at a CAGR of around 6.20% over the forecast period (2025-2034)

- In terms of revenue, the global recruitment and staffing market size was valued at around USD 584.10 billion in 2024 and is projected to reach USD 945.11 billion by 2034.

- The recruitment and staffing market is projected to grow significantly, driven by the gig and freelance economy, digital transformation, AI in recruitment, and global workforce mobility.

- Based on service type, the permanent staffing segment is expected to lead the market, while the temporary staffing segment is expected to grow considerably.

- Based on enterprise size, the large enterprises segment is the dominating segment, while the small and medium enterprises segment is projected to witness sizeable revenue over the forecast period.

- Based on industry vertical, the IT & telecommunications segment is expected to lead the market, followed by the healthcare segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Asia Pacific.

Recruitment And Staffing Market: Overview

Recruitment and staffing include identifying, attracting, and hiring competent candidates to meet a company’s workforce needs. The process comprises activities such as job posting, sourcing talent, screening candidates, interviewing, and selecting the best fit for each role. The global recruitment and staffing market is likely to expand rapidly, fueled by the growing demand for specialized skills, the growth of the gig economy and flexible work models, and globalization and cross-border hiring. Industries like healthcare, IT, and engineering need niche talent that is hard to find. Staffing companies help bridge this gap by quickly sourcing highly specialized experts. This growing skills shortage drives demand for advanced recruitment services. More workers prefer contract, temporary, and freelance roles, prompting companies to adopt flexible staffing models. Staffing agencies support this shift by supplying on-demand talent for project-based or short-term needs. This trend drives the variety and volume of placements managed by the industry.

Moreover, companies expanding globally need support in recruiting across different regions and regulatory environments. Worldwide staffing companies offer the specialization, local insights, and networks required for cross-border talent acquisition. This makes them crucial partners in the growth of multinational workforces.

Despite growth, the global market is constrained by factors including intense competition, low margins, mismatches between candidates and roles, and quality-control issues. The staffing sector comprises several players offering similar services, leading to aggressive pricing. Intense competition reduces profitability, mainly for smaller companies. This makes long-term growth challenging, as clear differentiation is difficult. Similarly, inaccurate assessments or rushed placements may lead to poor candidate selection. Such mismatches lead to dissatisfaction and turnover among job seekers and clients. Maintaining consistent quality is still a key challenge for agencies.

Nonetheless, the global recruitment and staffing industry stands to gain from several key opportunities, such as specialization in high-demand skill areas and integrated talent management services. Focusing on niche segments like cybersecurity, AI, biotech, or renewable energy enables premium pricing. Specialized recruiters build client loyalty and strong credibility. This differentiation offers a significant competitive advantage.

Additionally, agencies can expand beyond hiring to include onboarding, training, retention, and analytics solutions. This positions them as end-to-end workforce partners rather than transactional vendors. Clients gain added value, creating stronger, long-term relationships.

Recruitment And Staffing Market Dynamics

Growth Drivers

How is the recruitment and staffing market driven by rapid digital transformation and the adoption of recruitment technologies?

Advances such as machine-learning-based candidate matching, AI-powered applicant tracking, and cloud-based recruitment platforms have simplified hiring processes. These technologies reduce time-to-hire, enhance match quality, and reduce administrative pressure. Recruitment agencies that adopt these tools can handle high volumes of hiring and scale operations across geographies. As more companies embrace digital hiring workforces, the industry for tech-enabled staffing services continues to grow. This technological move makes staffing companies more attractive and efficient to employers.

How does the growing trend of outsourcing recruitment and workforce management fuel the recruitment and staffing market?

Companies steadily outsource hiring, onboarding, compliance, and payroll to external staffing or recruitment firms rather than managing these functions in-house. This approach offers faster, cost-effective access to talent and less administrative pressure for employers. As companies focus on their core business, they delegate recruitment functions to specialized companies. This outsourcing trend, including models such as recruitment process outsourcing and contract staffing, drives more business for staffing agencies. Subsequently, staffing companies become strategic partners in corporate workforce management, driving the growth of the recruitment and staffing market.

Restraints

High turnover, candidate attrition, and placement instability negatively impact the market progress

Even when placements are made, high turnover, mainly for temporary or contract roles, damages staffing companies' margins, predictability, and stability. Several new hires leave in a short period, or candidates switch jobs quickly, creating a cycle of constant re-hiring and placement inadequacies. This instability hampers client confidence and raises the cost of maintaining talent pipelines. For staffing companies, frequent attrition requires greater resources and effort for recruiting, replacement, and onboarding, thereby restricting capacity to scale. The unpredictability of retention, hence, remains a significant drag on the industry's growth.

Opportunities

How is the growing demand for flexible, project‑based, and temporary staffing offering advantageous conditions for the recruitment and staffing market development?

Several businesses are preferring contract-based, temporary, or project-oriented hiring over permanent roles to stay agile in uncertain economic settings. This preference fuels the demand for staffing agencies that can speedily supply contingent or contract workforce, impacting the recruitment and staffing industry. For industries with varying workloads, such as logistics, IT, retail, healthcare, and more, the ability to scale up or down through external staffing becomes remarkably attractive. Staffing companies that position themselves as reliable providers of agile workforce solutions are likely to grow as more companies adopt flexible staffing models.

Challenges

Intensified competition and market saturation restrict the market growth

The staffing market is notably crowded, with thousands of small or boutique agencies and global companies competing for business. This saturation reduces margins, particularly in commoditized staffing services, and complicates differentiation. Several companies end up competing on price, thus reducing profitability. Less specialized or smaller agencies usually struggle to survive, especially when demand lessens, or clients become more selective. The competitive pressure undermines long-term stability, especially for companies that do not invest in value-added services or niche specialization.

Recruitment And Staffing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Recruitment And Staffing Market |

| Market Size in 2024 | USD 584.10 Billion |

| Market Forecast in 2034 | USD 945.11 Billion |

| Growth Rate | CAGR of 6.20% |

| Number of Pages | 213 |

| Key Companies Covered | Adecco, Randstad, ManpowerGroup, Allegis Group, Hays plc, Recruit Holdings, PERSOL Holdings, Robert Half International, PageGroup, Kelly Services, Orion Group, Robert Walters, Integrity Staffing Solutions, MRINetwork, ASGN, and others. |

| Segments Covered | By Service Type, By Enterprise Size, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recruitment And Staffing Market: Segmentation

The global recruitment and staffing market is segmented based on service type, enterprise size, industry vertical, and region.

Based on service type, the global recruitment and staffing industry is divided into permanent staffing, temporary staffing, executive search, and others. The permanent staffing segment registers a dominating share of the market. It comprises hiring full-time employees for long-term positions, which form the backbone of a company's workforce. It registers a leading share due to consistent demand across industries. Companies prefer permanent staffing to assure stability, reduce turnover costs, and retain talent. The rising demand for skilled professionals across major sectors worldwide augments its dominance.

Based on enterprise size, the global recruitment and staffing market is segmented into small and medium enterprises and large enterprises. The large enterprises segment holds a substantial market share due to its high-volume hiring and complex workforce requirements. They usually operate across multiple departments and regions, creating continuous demand for skilled talent. Outsourcing recruitment helps organizations manage scale effectively while reducing internal HR pressures. Their structured hiring processes and budget capacity make them the primary clients for staffing services.

Based on industry vertical, the global market is segmented into IT & telecommunications, BFSI, healthcare, retail, manufacturing, and others. The IT & telecommunications segment captures a leading share because of the continuous demand for specialized technical talent. Speedy technological improvements and project-based hiring create a steady need for staffing services. Companies depend on external agencies to quickly source skilled professionals and maintain workforce flexibility. This makes the segment the leading contributor to the industry revenue.

Recruitment And Staffing Market: Regional Analysis

What gives North America a competitive edge in the global Recruitment And Staffing Market?

North America is anticipated to retain its leading role in the global recruitment and staffing market, driven by mature economies and diverse industries, the high adoption of outsourced and flexible staffing models, and advanced HR infrastructure and technology. The region benefits from well-developed economies with a broad range of industries, including BFSI, IT, healthcare, professional services, and manufacturing. These segments continually require skilled professionals, driving ongoing demand for recruitment and staffing solutions. The diversity of industries ensures broad-based, stable reliance on staffing providers.

Moreover, companies in North America rely on external staffing to manage contract, temporary, and project-based roles. A flexible workforce model reduces internal HR pressure while enabling faster hiring to meet fluctuating demand. This creates a significant and recurring client base for staffing and recruitment firms.

Furthermore, North America has a well-established HR infrastructure and professional staffing companies that offer compliant, scalable, and efficient recruitment operations. The region also leads in the adoption of recruitment technologies, data-driven hiring, and automation solutions. These capabilities enhance placement quality, efficiency, and speed, strengthening the regional dominance in the market.

Asia Pacific ranks as the second-largest region in the global recruitment and staffing industry, driven by a significant share of the global market, rapid urbanization, economic growth, and workforce expansion. Asia Pacific accounts for 20-23% of the global staffing and recruitment market, making it the second-largest region. The market value exceeds billions of dollars, underscoring the regional surge in significance in global talent acquisition. This remarkable share indicates robust demand for temporary and permanent staffing solutions across multiple industries.

The region is also experiencing rapid economic growth, urbanization, and industrialization, all of which are fueling substantial demand for workers across diverse sectors. A large, young population entering the labor force further increases the need to recruit for semi-skilled, skilled, and unskilled roles. Expanding industries and urban centers create ongoing opportunities for staffing agencies to supply talent effectively.

Additionally, the region's staffing industry is growing rapidly, indicating strong future potential for recruitment services. This rapid growth has attracted international and regional staffing companies to invest and expand operations in the market. The escalating demand for flexible workforce and skilled professional solutions assures continued expansion opportunities in the region.

Recruitment And Staffing Market: Competitive Analysis

The leading players in the global recruitment and staffing market are:

- Adecco

- Randstad

- ManpowerGroup

- Allegis Group

- Hays plc

- Recruit Holdings

- PERSOL Holdings

- Robert Half International

- PageGroup

- Kelly Services

- Orion Group

- Robert Walters

- Integrity Staffing Solutions

- MRINetwork

- ASGN

Recruitment And Staffing Market: Key Market Trends

Increased use of AI and automation in hiring:

Artificial intelligence, automation tools, and machine learning are progressively used for screening, assessment, matching, and candidate sourcing. This amplifies hiring cycles, lessens manual HR workload, and enhances candidate-job fit. Staffing providers leveraging these solutions are becoming more competitive and efficient.

Focus on Diversity, Equity & Inclusion (DEI) and employer branding:

Companies are placing greater emphasis on building inclusive and diverse workforces and investing in employer branding to attract talent. Staffing companies consistently offer DEI-focused sourcing and unbiased screening practices, helping customers meet diversity goals. This trend augments the role of staffing agencies as strategic talent associates – not only recruiters.

The global recruitment and staffing market is segmented as follows:

By Service Type

- Permanent Staffing

- Temporary Staffing

- Executive Search

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Industry Vertical

- IT & Telecommunications

- BFSI

- Healthcare

- Retail

- Manufacturing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed