Polysaccharides Products Market Size, Share, Trends, Growth & Forecast 2034

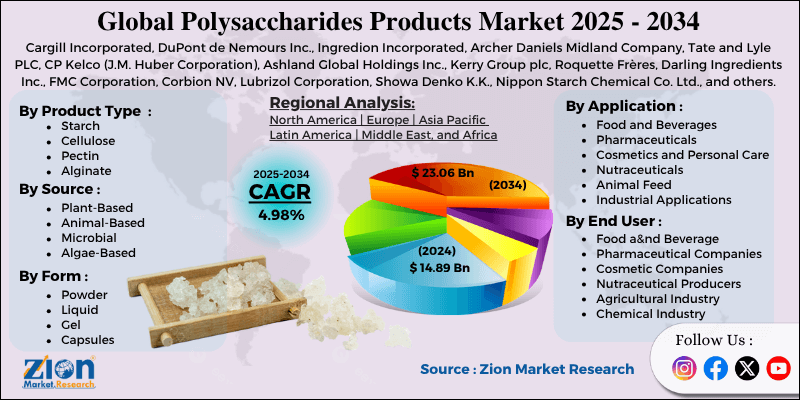

Polysaccharides Products Market By Product Type (Starch, Cellulose, Pectin, Chitin and Chitosan, Alginate, Carrageenan, and Others), By Source (Plant-Based, Animal-Based, Microbial, Algae-Based, Synthetic), By Form (Powder, Liquid, Gel, Capsules), By Application (Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Nutraceuticals, Animal Feed, Industrial Applications), By End-User (Food and Beverage Manufacturers, Pharmaceutical Companies, Cosmetic Companies, Nutraceutical Producers, Agricultural Industry, Chemical Industry), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

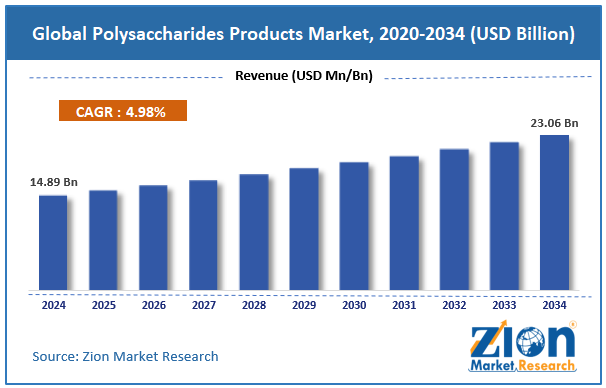

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.89 Billion | USD 23.06 Billion | 4.98% | 2024 |

Polysaccharides Products Industry Perspective:

The global polysaccharides products market size was worth approximately USD 14.89 billion in 2024 and is projected to grow to around USD 23.06 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.98% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global polysaccharides products market is estimated to grow annually at a CAGR of around 4.98% over the forecast period (2025-2034).

- In terms of revenue, the global polysaccharides products market size was valued at approximately USD 14.89 billion in 2024 and is projected to reach USD 23.06 billion by 2034.

- The polysaccharide products market is projected to grow significantly due to increasing demand for natural and functional ingredients, rising health consciousness among consumers, expanding pharmaceutical applications, and growing adoption of plant-based products globally.

- Based on product type, the starch segment is expected to lead the polysaccharides products market, while the chitin and chitosan segment is anticipated to experience significant growth.

- Based on the source, the plant-based segment is expected to lead the polysaccharides products market, while the microbial segment is anticipated to witness notable growth.

- Based on application, the food and beverages segment is the dominating segment, while the pharmaceuticals segment is projected to witness sizeable revenue over the forecast period.

- Based on end user, the food and beverage manufacturers segment is expected to lead the market compared to the agricultural industry segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Polysaccharides Products Market: Overview

Polysaccharide products are complex carbohydrates made of multiple sugar units linked by glycoside bonds and are used widely for their functional benefits in various industries. These natural or modified biopolymers act as thickeners, stabilizers, emulsifiers, and functional ingredients across food, pharmaceutical, cosmetic, and industrial applications. They come from plants, animals, microbes, and marine algae, including starch, cellulose, pectin, chitin, xanthan gum, dextran, carrageenan, and alginate. Their molecular structure influences their specific properties and uses. They are used to improve food quality, support pharmaceutical drug delivery, and enhance cosmetic formulations, offering benefits such as improved texture, extended shelf life, controlled release, and moisturizing effects. Industrial uses include paper manufacturing, textile processing, and biodegradable packaging. Advancements in extraction and modification methods are increasing the functional potential of polysaccharides. Growing clean-label preferences are boosting demand for natural polysaccharide solutions, while biotechnology supports the development of new varieties through fermentation and enzymatic processes.

The growing consumer preference for natural ingredients and expanding applications across multiple industries are expected to drive significant growth in the polysaccharide products market throughout the forecast period.

Polysaccharides Products Market Dynamics

Growth Drivers

How are the expanding health and wellness trends driving the polysaccharides products market growth?

The polysaccharide products market is experiencing strong growth due to increasing consumer interest in health, wellness, and functional foods that offer improved nutritional value and support for disease prevention. Health-focused consumers are choosing products made with natural ingredients offering proven functional benefits beyond basic nutrition. Dietary fiber from polysaccharides supports digestive health, encouraging regular bowel movements and the growth of beneficial gut bacteria. Prebiotic polysaccharides nourish probiotic bacteria, improving intestinal microbiome balance and overall immune function.

Growing scientific research linking polysaccharide intake with reduced risk of chronic diseases is motivating food manufacturers to include these ingredients in their formulations. Increasing awareness of metabolic health is boosting demand for resistant starch and various low-glycemic polysaccharides. Functional beverage companies are using polysaccharides to create drinks designed for specific health benefits. Sports nutrition brands add polysaccharides for sustained energy release and better athletic performance. Weight management products rely on polysaccharides to increase satiety and reduce overall calorie intake.

Rising demand for natural and clean-label ingredients

The global polysaccharides products market is expanding strongly as consumers increasingly prefer clear ingredient lists and natural options instead of synthetic additives. Clean label trends across developed regions are encouraging manufacturers to reformulate products using recognizable, naturally derived ingredients. Regulatory pressure and consumer awareness are lowering the acceptance of artificial stabilizers, thickeners, and emulsifiers in food products. Parents who want healthier choices for children pay close attention to ingredient labels and avoid products with chemical-sounding additives.

Social media discussions raising concerns about synthetic ingredients are influencing purchasing decisions across various age groups. Food manufacturers face reputational challenges when using ingredients considered unnatural or heavily processed. Polysaccharides sourced from familiar ingredients such as corn, potatoes, seaweed, and fruits support clean label requirements. The image of polysaccharides as wholesome, plant-based ingredients appeals to environmentally conscious consumers. Organic and natural food categories are growing quickly, creating opportunities for organic-certified polysaccharide ingredients.

Restraints

Price volatility and raw material availability challenges

A major challenge for the polysaccharides products market is the large price fluctuation and supply inconsistency linked to raw material sourcing. Weather patterns and climate conditions directly influence crop yields for starch sources such as corn, potatoes, and tapioca, creating supply uncertainty. Extreme weather events, droughts, and floods can severely damage harvests, causing sudden price increases and pushing manufacturers to search for alternative raw materials.

Competition for agricultural raw materials across food, fuel, and industrial uses increases pricing pressure during shortage periods. The seasonal availability of several raw materials forces manufacturers to maintain large inventories, thereby locking up working capital. Transportation expenses and logistics issues add further variation to raw material prices, especially for imports from distant regions. Quality variations in natural raw materials require additional processing and strict quality control, increasing overall production costs.

Opportunities

How is innovation in pharmaceutical and biomedical applications creating new opportunities for the polysaccharide products market?

The polysaccharides products industry is experiencing strong growth opportunities as pharmaceutical research continues to recognize the therapeutic value and drug delivery potential of various polysaccharide materials. Pharmaceutical scientists are developing polysaccharide-based nanoparticles for targeted drug delivery, improving treatment effectiveness while reducing side effects. Controlled-release formulations using polysaccharide matrices support sustained medication delivery, improving patient compliance and overall treatment results. Biocompatible and biodegradable qualities make polysaccharides suitable for medical implants and tissue engineering scaffolds.

Wound care products containing chitosan and alginate show faster healing and lower infection rates. Cancer researchers are studying polysaccharides as immunomodulatory agents that strengthen the immune system response against tumors. Vaccine development uses specific polysaccharides as adjuvants, improving immune response and overall vaccine performance. Regenerative medicine applications include polysaccharide hydrogels for cell culture and organ-on-chip systems.

Challenges

How are extraction efficiency and processing complexity creating restraints for the market?

The polysaccharides products industry is facing significant challenges due to technical difficulties in extracting, purifying, and modifying polysaccharides while preserving their functional properties and commercial value. Traditional extraction methods often involve harsh chemicals, high temperatures, or long processing times, which can damage sensitive polysaccharide structures. Purification steps required to remove proteins, lipids, and other impurities add complexity and increase manufacturing costs. Various polysaccharide sources require customized extraction procedures, which reduces production flexibility and increases the need for strong technical expertise.

Scaling extraction methods from laboratory level to commercial production often brings unexpected issues that impact product consistency. Enzymatic modification used to create functional polysaccharides requires precise control of reaction conditions and costly enzyme inputs. Quality control for polysaccharides requires advanced analytical instruments and trained personnel to test molecular weight, purity, and functional characteristics.

Polysaccharides Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polysaccharides Products Market |

| Market Size in 2024 | USD 14.89 Billion |

| Market Forecast in 2034 | USD 23.06 Billion |

| Growth Rate | CAGR of 4.98% |

| Number of Pages | 214 |

| Key Companies Covered | Cargill Incorporated, DuPont de Nemours Inc., Ingredion Incorporated, Archer Daniels Midland Company, Tate and Lyle PLC, CP Kelco (J.M. Huber Corporation), Ashland Global Holdings Inc., Kerry Group plc, Roquette Frères, Darling Ingredients Inc., FMC Corporation, Corbion NV, Lubrizol Corporation, Showa Denko K.K., Nippon Starch Chemical Co. Ltd., and others. |

| Segments Covered | By Product Type, By Source, By Form, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polysaccharides Products Market: Segmentation

The global polysaccharides products market is segmented based on product type, source, form, application, end-user, and region.

Based on product type, the global polysaccharides products industry is segregated into starch, cellulose, pectin, chitin and chitosan, alginate, carrageenan, and others. Starch leads the market due to its widespread availability, low cost, versatile functionality, and extensive use across food, pharmaceutical, and industrial applications.

Based on the source, the industry is segmented into plant-based, animal-based, microbial, algae-based, and synthetic. Plant-based sources lead the market due to abundant agricultural production, consumer preference for plant-derived ingredients, established supply chains, and generally lower production costs compared to other sources.

Based on form, the global polysaccharides products market is divided into powder, liquid, gel, and capsule. Powder form is expected to lead the market during the forecast period due to its stability during storage, ease of transportation, flexibility in dosing, and convenience for manufacturers in various formulation processes.

Based on application, the global market is classified into food and beverages, pharmaceuticals, cosmetics and personal care, nutraceuticals, animal feed, and industrial applications. Food and beverages hold the largest market share due to the essential role of polysaccharides in modifying texture, stabilizing, and preserving various food products.

Based on end-user, the global polysaccharides products market is categorized into food and beverage manufacturers, pharmaceutical companies, cosmetic companies, nutraceutical producers, the agricultural industry, and the chemical industry. Food and beverage manufacturers dominate the market due to high volume consumption and the critical importance of polysaccharides in product formulation and quality.

Polysaccharides Products Market: Regional Analysis

What factors are contributing to North America's dominance in the global polysaccharide products market?

North America leads the polysaccharides products market due to its advanced food processing industry, strong pharmaceutical sector, high consumer awareness of functional ingredients, and substantial research and development investments. The United States is home to major food and beverage companies using large volumes of polysaccharides in product formulation across many categories. The region shows strong consumer demand for natural ingredients, encouraging manufacturers to use plant-based polysaccharides instead of synthetic options.

Well-developed dietary supplement and nutraceutical industries create consistent demand for specialty polysaccharides with health-supporting properties. The pharmaceutical sector applies sophisticated polysaccharide solutions in drug delivery systems and medical devices. Cosmetic and personal care brands incorporate premium polysaccharides to cater to the growing consumer demand for natural beauty products. Agricultural research institutions work on improved crop varieties for starch production and explore new polysaccharide sources.

Regulatory frameworks support the introduction and use of new polysaccharide ingredients after safety evaluation. An innovation-focused business environment promotes investment in new polysaccharide products and applications. Strong distribution networks enable efficient supply chain movement from manufacturers to end users. Growing collaborations between industry, academic institutions, and technology providers are accelerating breakthroughs in polysaccharide extraction, modification, and product development, strengthening the region’s position as a global leader in this market.

Europe is experiencing steady growth.

Europe is experiencing steady growth in the polysaccharides products market as countries focus on sustainable sourcing, natural ingredients, and innovative applications aligned with circular economy principles. The region shows strong leadership in organic food production, increasing demand for organic-certified polysaccharide ingredients. European pharmaceutical companies maintain high-quality standards, driving the need for pharmaceutical-grade polysaccharides. The cosmetics industry in France, Germany, and Italy uses natural polysaccharides to match consumer interest in green beauty products.

Regulatory measures promoting biodegradable materials are expanding industrial use of polysaccharides in packaging and textiles. Research partnerships between universities and industry support the development of new polysaccharide-based materials. The functional food sector is expanding as consumers look for products supporting specific health benefits. Clean label rules and consumer expectations encourage reformulation using natural polysaccharides. Marine biotechnology development in coastal countries explores seaweed-derived polysaccharides for multiple applications.

Agricultural policies supporting local crop cultivation strengthen supply chains for starch and cellulose. Innovation clusters in Scandinavia advance sustainable extraction technologies and processing methods. Health-conscious consumers in Western Europe increase demand for dietary fiber and prebiotic polysaccharides.

Recent Market Developments:

- In February 2025, Layn Natural Ingredients debuted its novel heteropolysaccharide ingredient Galacan, designed via precision fermentation and targeting immune and gut-health benefits in functional foods and supplements.

- In June 2025, Macro Oceans introduced Big Kelp Flex, a seaweed-cellulose-derived polysaccharide ingredient for personal care formulations, engineered to replace synthetic polymers and microplastics in skin and sun-care products.

- In September 2025, Cyvex Nutrition and Vietal Nutrition jointly launched LLP-1, a stimulant-free weight-management ingredient composed of esterified fatty acids combined with highly viscous polysaccharides, clinically studied for appetite control and metabolic support.

Polysaccharides Products Market: Competitive Analysis

The leading players in the global polysaccharides products market are:

- Cargill Incorporated

- DuPont de Nemours Inc.

- Ingredion Incorporated

- Archer Daniels Midland Company

- Tate and Lyle PLC

- CP Kelco (J.M. Huber Corporation)

- Ashland Global Holdings Inc.

- Kerry Group plc

- Roquette Frères

- Darling Ingredients Inc.

- FMC Corporation

- Corbion NV

- Lubrizol Corporation

- Showa Denko K.K.

- Nippon Starch Chemical Co. Ltd.

The global polysaccharides products market is segmented as follows:

By Product Type

- Starch

- Cellulose

- Pectin

- Chitin and Chitosan

- Alginate

- Carrageenan

- Others

By Source

- Plant-Based

- Animal-Based

- Microbial

- Algae-Based

- Synthetic

By Form

- Powder

- Liquid

- Gel

- Capsules

By Application

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Nutraceuticals

- Animal Feed

- Industrial Applications

By End User

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Cosmetic Companies

- Nutraceutical Producers

- Agricultural Industry

- Chemical Industry

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polysaccharide products are complex carbohydrate molecules formed by linking multiple sugar units through glycosidic bonds, serving essential functions across food, pharmaceutical, cosmetic, and industrial sectors.

The global polysaccharides products market is projected to grow due to increasing consumer demand for natural and functional ingredients, expanding pharmaceutical applications, rising health consciousness, growing clean label trends, and innovation in biomedical applications across developed and emerging markets.

According to a study, the global polysaccharides products market size was worth around USD 14.89 billion in 2024 and is predicted to grow to around USD 23.06 billion by 2034.

The CAGR value of the polysaccharides products market is expected to be around 4.98% during 2025-2034.

North America is expected to lead the global polysaccharides products market during the forecast period.

The major players profiled in the global polysaccharides products market include Cargill Incorporated, DuPont de Nemours Inc., Ingredion Incorporated, Archer Daniels Midland Company, Tate and Lyle PLC, CP Kelco (J.M. Huber Corporation), Ashland Global Holdings Inc., Kerry Group plc, Roquette Frères, Darling Ingredients Inc., FMC Corporation, Corbion NV, Lubrizol Corporation, Showa Denko K.K., and Nippon Starch Chemical Co. Ltd.

The report examines key aspects of the polysaccharides products market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

In the polysaccharides products market, emerging trends include the development of improved and modified polysaccharides with better functionality, eco-friendly extraction methods, microbial and fermentation-based production, the use of nanostructured polysaccharide materials, and a growing focus on bioactive polysaccharides for health and wellness applications.

In the polysaccharides products market, growth is strongly shaped by clean label rules, strict food safety regulations, pharmaceutical standards, organic certification requirements, and environmental sustainability policies set by regulatory authorities.

In the global polysaccharides products market, the value chain includes raw material farming or harvesting, extraction and purification, chemical or enzymatic modification, quality testing and product validation, packaging and distribution, marketing and sales, and end-use application development across industries.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed