Polychloroprene Rubber Market Size, Share, Growth, Forecast 2032

Polychloroprene Rubber Market by Type (Rubber Pad, Rubber Sheet, Others) by Application (Automotive, Electronics & Electricals, Construction, Aerospace and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032.-

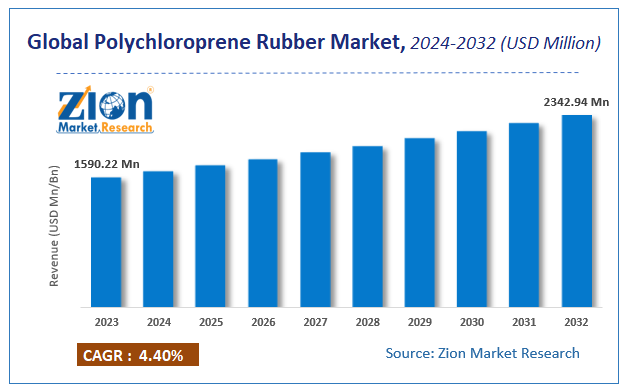

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1590.22 Million | USD 2342.94 Million | 4.4% | 2023 |

Polychloroprene Rubber Market Insights

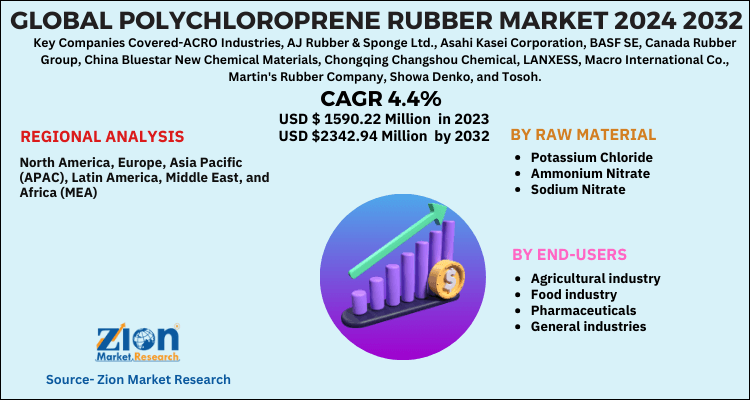

According to a report from Zion Market Research, the global Polychloroprene Rubber Market was valued at USD 1590.22 Million in 2023 and is projected to hit USD 2342.94 Million by 2032, with a compound annual growth rate (CAGR) of 4.4% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Polychloroprene Rubber Market industry over the next decade.

Global Polychloroprene Rubber Market: Overview

In Global Polychloroprene Rubber Market Report, Potassium nitrate (KNO3) is a white to grey crystalline salt and is sometimes referred to as nitre or saltpetre. Naturally, the salt is available in its original form and can also be commercially prepared by combining sodium nitrate and potassium chloride. At room temperature, polychloroprene rubber has an orthorhombic crystalline structure, which converts to a trigonal structure at 264 F (129 C). Potassium nitrate is moderately water-soluble; however, its solubility tends to rise with temperature. Moreover, Potassium nitrate is a potent oxidizing agent that helps speed up the combustion of combustible substances. As a result, it is commonly used in fireworks, rocket fuel, black powder, and medicines as a component. Potassium nitrate is also used for food preparation, meat processing, pharmacology, fertilizers and others.

Global Polychloroprene Rubber Market: Growth Factors

The demand for polychloroprene rubber has seen steady growth due to a lot of favourable factors. Potassium nitrate has been used since medieval times to preserve food products such as beef, sausage, pork, etc. Nowadays, it is commonly used in the food processing industry to cure poultry, which is the key driver of demand for market growth. Increased awareness and demand for nutritious food and health goods has led to higher demand for potassium nitrite. It is commonly used to protect against microbial agents in food products. One of the oldest ways of food protection to date is meat and poultry cleansing. Potassium nitrite has demonstrated exceptional antimicrobial potency that prevents spoilage of meat and pathogenic microorganisms.

The meat is mainly shielded from microbial bacteria by potassium nitrite. It is harmful to meat with microbes found in it. Chronic diseases such as asthma, arthritis, cancer, Alzheimer's and others are caused by microbes. Color formation is also one of the most important qualitative characteristics of processed meat products. In addition, the growing demand for high-quality meat provides major growth opportunities for players involved in the market for potassium nitrite to provide an infected meat remedy. In the coming years, the global potassium nitrite market is projected to expand at a larger scale.

Polychloroprene Rubber Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polychloroprene Rubber Market |

| Market Size in 2023 | USD 1590.22 Million |

| Market Forecast in 2032 | USD 2342.94 Million |

| Growth Rate | CAGR of 4.4% |

| Number of Pages | 110 |

| Key Companies Covered | ACRO Industries, AJ Rubber & Sponge Ltd., Asahi Kasei Corporation, BASF SE, Canada Rubber Group, China Bluestar New Chemical Materials, Chongqing Changshou Chemical, LANXESS, Macro International Co., Martin's Rubber Company, Showa Denko, and Tosoh |

| Segments Covered | By Raw Material, By End-Use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

In addition, polychloroprene rubber is used in the manufacture of fertilizers. One of the major concerns for farmers is fungal infection, which negatively affects the quality and performance of the crop. For vegetable gardeners and farmers, certain fungal diseases in vegetable plants are particularly unfavorable. Hence, fungicide treatments are used by them, which are necessary and more effective in preventing the outbreak of fungal infections. Potassium nitrate is a commonly used fungicide and is widely used in fruits, vegetables, and cereal crops. Applying polychloroprene rubber at sufficient concentrations can be successful in managing infectious conditions in fruits and vegetables grown in bulk, thereby reducing waste and providing better farm productivity.

As emerging governments are providing subsidies for the selling of fertilizers among farmers, the demand of polychloroprene rubber has seen an increase in the farming category. In addition, the increasing demand for advanced fertilizers is further boosting market growth. The IMARC Group says the global demand for polychloroprene rubber to display modest growth in the coming years.

Furthermore, rising concerns about the degradation of exhaustible resources have also led many organizations to resort to renewable resources, such as concentrated solar power (CSP), thereby boosting the growth of the polychloroprene rubber industry.

Drilling and explosions in the mining process are important practices and are widely used to break up ore-containing rock benches. For example, high-quality explosives such as polychloroprene rubber are used to obtain coal from underground in the coal mining industry. With the growing need in the coal mining industry for blasting and drilling chemicals, demand for polychloroprene rubber is anticipated to increase in the coming years.

Global Polychloroprene Rubber Market: Segmentation

Based on the raw material, the market is segmented into potassium chloride, ammonium nitrate and sodium nitrate. Potassium chloride held the largest share in 2020 due to numerous factors. For agricultural crops, potassium chloride is primarily used as a source of potassium. Potassium also plays a major role in growing fruits' protein, solid soluble content, vitamin C and grain & tuber starch content. It also aims to strengthen the color & flavors of fruits, expands fruit's size, reduce the risk of pests & diseases, and boost the quality of processing & shipment.

On the basis of end-use, the market is divided into agricultural industry, food industry, pharmaceuticals, general industries, and others. In 2020, the main segment was the agricultural industry. More crop production is needed for an increased population, which can be assured by using a good fertilizer. The world's use of fertilizer has been forecast to rise by approximately 1.8 percent per year. Thus, the rising fertilizer market is serving as a driver for the growth of the global demand for polychloroprene rubber.

Global Polychloroprene Rubber Market: Competitive Players

Key players operating in the global Polychloroprene Rubber market include-

- ACRO Industries

- AJ Rubber & Sponge Ltd.

- Asahi Kasei Corporation

- BASF SE

- Canada Rubber Group

- China Bluestar New Chemical Materials

- Chongqing Changshou Chemical

- LANXESS

- Macro International Co.

- Martin's Rubber Company

- Showa Denko

- Tosoh among others.

Global Polychloroprene Rubber Market: Regional Analysis

On the basis of region, the market is segregated into North America, Asia Pacific, Europe, Middle East and Africa, and Latin America. Asia Pacific accounted for the major share in 2020 being the largest consumer of fertilizers across the globe. In India, to meet domestic requirements, raw materials and intermediate products are largely imported to manufacture nitrogen and phosphatic fertilizers and pesticides. Due to the absence of any reserve of potash (K) in the region, all of its services are provided by means of imports. Russia is the world's largest exporter of fertilizers, accounting for around a quarter of the global trade in fertilizers and pesticides, along with other big contributors, such as China, Belarus, Canada, and the United States.

The largest importer of fertilizers in the world, on the other hand, is the United States, followed by countries such as Brazil, India, and China. These regions are major contributors to the development of the polychloroprene rubber industry.

The report segments the global Polychloroprene Rubber? market as follows:

By Raw Material

- Potassium Chloride

- Ammonium Nitrate

- Sodium Nitrate

By End User

- Agricultural industry

- Food industry

- Pharmaceuticals

- General industries

- Others

Global Polychloroprene Rubber Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The demand for polychloroprene rubber has seen steady growth due to a lot of favourable factors. Potassium nitrate has been used since medieval times to preserve food products such as beef, sausage, pork, etc. Nowadays, it is commonly used in the food processing industry to cure poultry, which is the key driver of demand for market growth. Increased awareness and demand for nutritious food and health goods has led to higher demand for potassium nitrite. It is commonly used to protect against microbial agents in food products. One of the oldest ways of food protection to date is meat and poultry cleansing. Potassium nitrite has demonstrated exceptional antimicrobial potency that prevents spoilage of meat and pathogenic microorganisms. The meat is mainly shielded from microbial bacteria by potassium nitrite. It is harmful to meat with microbes found in it. Chronic diseases such as asthma, arthritis, cancer, Alzheimer's and others are caused by microbes. Color formation is also one of the most important qualitative characteristics of processed meat products. In addition, the growing demand for high-quality meat provides major growth opportunities for players involved in the market for potassium nitrite to provide an infected meat remedy. In the coming years, the global potassium nitrite market is projected to expand at a larger scale.

In addition, polychloroprene rubber is used in the manufacture of fertilizers. One of the major concerns for farmers is fungal infection, which negatively affects the quality and performance of the crop. For vegetable gardeners and farmers, certain fungal diseases in vegetable plants are particularly unfavorable. Hence, fungicide treatments are used by them, which are necessary and more effective in preventing the outbreak of fungal infections. Potassium nitrate is a commonly used fungicide and is widely used in fruits, vegetables, and cereal crops. Applying polychloroprene rubber at sufficient concentrations can be successful in managing infectious conditions in fruits and vegetables grown in bulk, thereby reducing waste and providing better farm productivity.

As emerging governments are providing subsidies for the selling of fertilizers among farmers, the demand of polychloroprene rubber has seen an increase in the farming category. In addition, the increasing demand for advanced fertilizers is further boosting market growth. The IMARC Group says the global demand for polychloroprene rubber to display modest growth in the coming years.

Furthermore, rising concerns about the degradation of exhaustible resources have also led many organizations to resort to renewable resources, such as concentrated solar power (CSP), thereby boosting the growth of the polychloroprene rubber industry.

Drilling and explosions in the mining process are important practices and are widely used to break up ore-containing rock benches. For example, high-quality explosives such as polychloroprene rubber are used to obtain coal from underground in the coal mining industry. With the growing need in the coal mining industry for blasting and drilling chemicals, demand for polychloroprene rubber is anticipated to increase in the coming years.

global Polychloroprene Rubber Market was valued at USD 1590.22 Million in 2023 and is projected to hit USD 2342.94 Million by 2032, with a compound annual growth rate (CAGR) of 4.4% during the forecast period 2024-2032.

On the basis of region, the market is segregated into North America, Asia Pacific, Europe, Middle East and Africa, and Latin America. Asia Pacific accounted for the major share in 2020 being the largest consumer of fertilizers across the globe. In India, to meet domestic requirements, raw materials and intermediate products are largely imported to manufacture nitrogen and phosphatic fertilizers and pesticides. Due to the absence of any reserve of potash (K) in the region, all of its services are provided by means of imports. Russia is the world's largest exporter of fertilizers, accounting for around a quarter of the global trade in fertilizers and pesticides, along with other big contributors, such as China, Belarus, Canada, and the United States.

The largest importer of fertilizers in the world, on the other hand, is the United States, followed by countries such as Brazil, India, and China. These regions are major contributors to the development of the polychloroprene rubber industry.

Key players operating in the global Polychloroprene Rubber market include ACRO Industries, AJ Rubber & Sponge Ltd., Asahi Kasei Corporation, BASF SE, Canada Rubber Group, China Bluestar New Chemical Materials, Chongqing Changshou Chemical, LANXESS, Macro International Co., Martin's Rubber Company, Showa Denko, and Tosoh among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed